The home improvement sector was a clear retail winner throughout the pandemic, but by late 2020 home goods brands like At Home and Floor & Decor were seeing similarly impressive levels of strength. The sector surged by riding a similar wave as a homebound audience was pushed to look for ways to improve their increasingly central surroundings and greater migration drove a need for new furnishings.

And like the home improvement sector, home furnishings leaders saw that strength continue into 2021. But as retail increasingly reopens and normalcy increasingly returns, the big question of whether the peaks are sustainable, and which brands might be best positioned arises.

Picking Up Where They Left Off

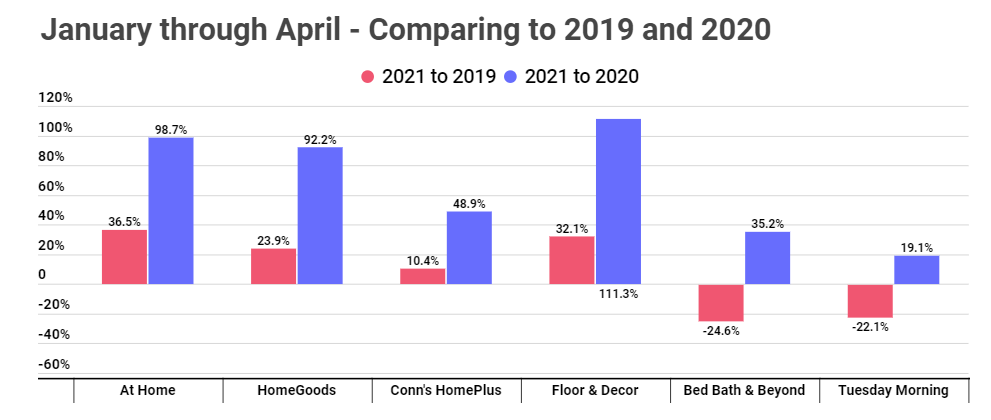

As expected, the home furnishings sector kicked off 2021 with continued strength. Analyzing the first four months of the year compared to the equivalent periods in 2020 and 2019 showed the unique pull of the segment. At Home and HomeGoods saw year-over-year visits up 98.7% and 92.2% in the period. And while this was clearly influenced by March and April closures in 2020, the comparison with 2019 yielded impressive visit growth of 36.5% and 23.9% for At Home and HomeGoods respectively.

Bed Bath & Beyond and Tuesday Morning, two brands with the unique potential to surprise this year, saw strong year-over-year visit growth and shrinking gaps with 2019 levels in early 2021.

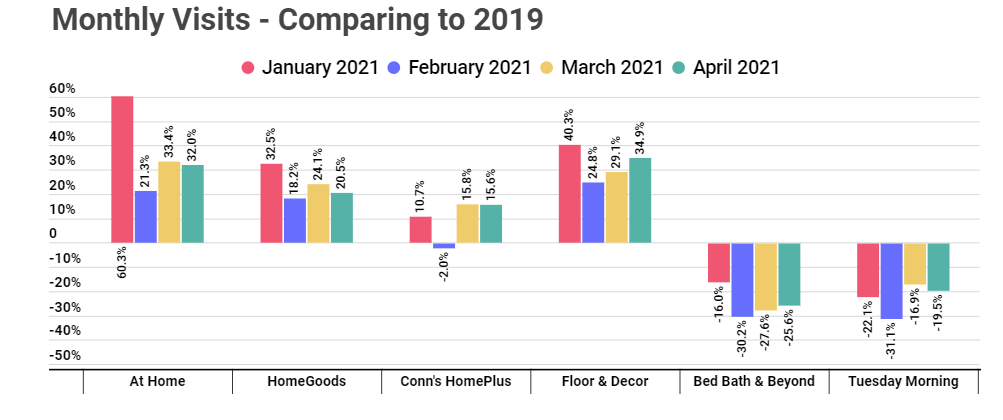

Diving into the monthly breakdown for greater granularity shows the importance of seasonality in this sector. December surges appear to drive increased interest in January as well, with returns likely driving part of this bump. From that point, all the brands saw significant improvements each month as retail increasingly opened up. With several key states still facing limitations, that pace could actually improve early in the summer.

This is especially exciting, because many of the brands measured including Bed Bath & Beyond do see a major seasonal peak in July and August. Should that pattern hold, the timing could position the brands for a strong return to visit normalcy by late summer.

A Big Test Ahead

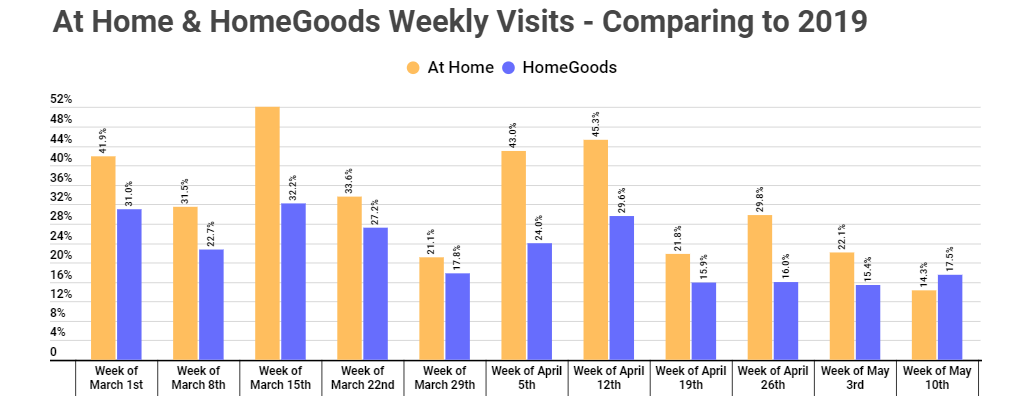

However, the biggest test may be facing two of the brands that have outperformed. At Home and HomeGoods have seen exceptionally strong results throughout the pandemic and there’s real reason to believe that this strength will continue. HomeGoods is very well aligned with both migration and a wider environment of economic uncertainty, while At Home will likely benefit heavily from the latter. Critically, while the impressive surges experienced in late 2020 and early 2021 are heavily driven by the comparisons to periods of normalcy or weakness, the coming months won’t provide that luxury.

If the brands are able to sustain growth in a year-over-year perspective in the coming weeks and months, the result should be even greater bullishness. Essentially, should they prove capable of maintaining any growth over periods of massive growth, the takeaway should center around the unique capacity of these brands to turn their ‘lightning in a bottle’ moment into something more significant and long term.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.