Source: https://insights.consumer-edge.com/2021/06/understanding-whether-weather-impacted-tx-grocery/

Winter Storm Uri in February of this year ravaged much of the country, with the strongest impact in states with little snow experience such as Texas. But not all businesses were plowed under by the storm. Grocers actually saw a lift in sales in the days prior as snow-shy shoppers stocked up on essentials in anticipation of rough road conditions and grocery closures. In today’s Insight Flash, we take advantage of our partnership with WeatherOptics and our newly launched WeatherOptics Signal dashboards to dig into which grocers were the most impacted, and how that impact varied across the storm’s trajectory.

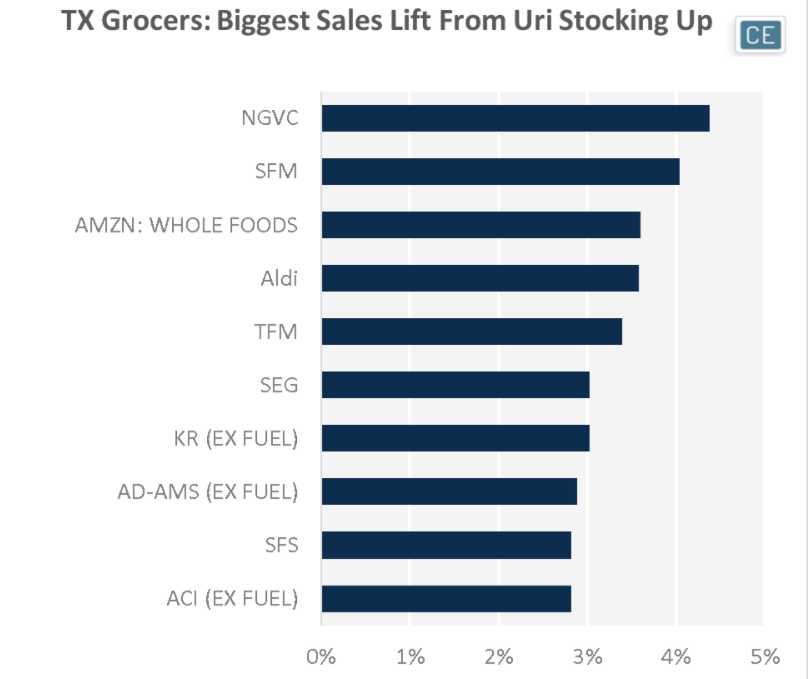

Our data takes the WeatherOptics proprietary business disruption indices and uses them to model the percentage impact that a weather event has on company sales. This data shows that in the three days before the storm hit Texas, February 10-12, grocers saw a big weather-related sales increase. Organic and Natural Specialty grocers saw the most weather-related growth as these typically fill-in trips became a means of stocking up. Natural Grocers by Vitamin Cottage saw the biggest weather impact lift among Texas shoppers at 4.4%, followed by Sprouts at 4.0% and Whole Foods at 3.6%.

Top Impacted Grocers

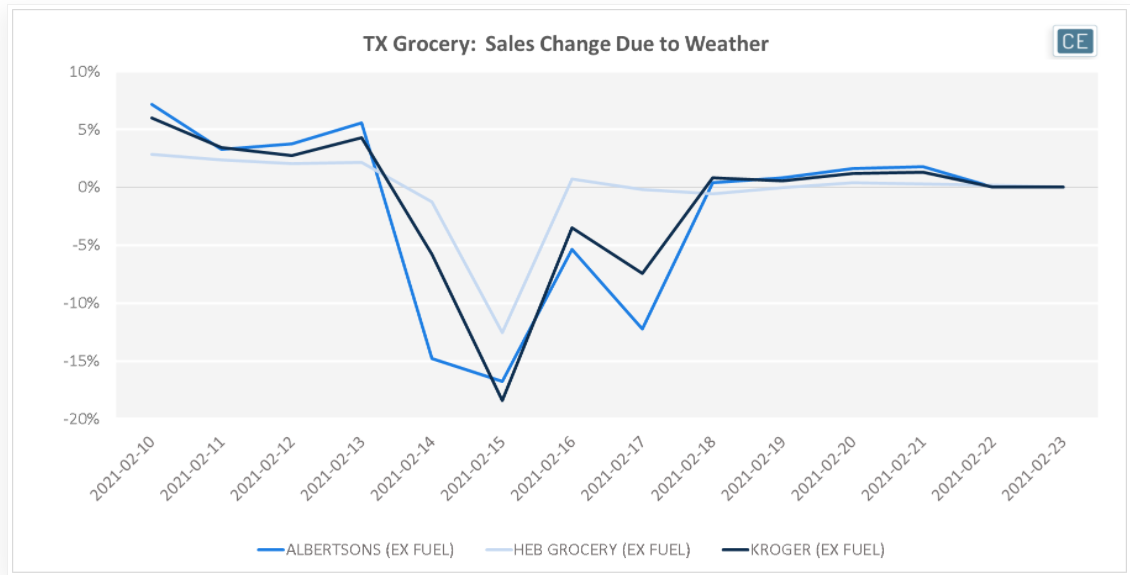

However, the initial pop due to the storm didn’t last long. Among the non-fuel checkouts at three of the largest grocers in the state, Albertsons, HEB, and Kroger all saw sharp negative weather impacts beginning on the fourteenth of February and continuing for the next two to three days. Local grocer HEB was the least impacted, seeing the smallest weather-driven lift in sales prior to the storm, but also seeing the smallest decline during the storm and recovering the fastest after.

Weather Impact Comparison

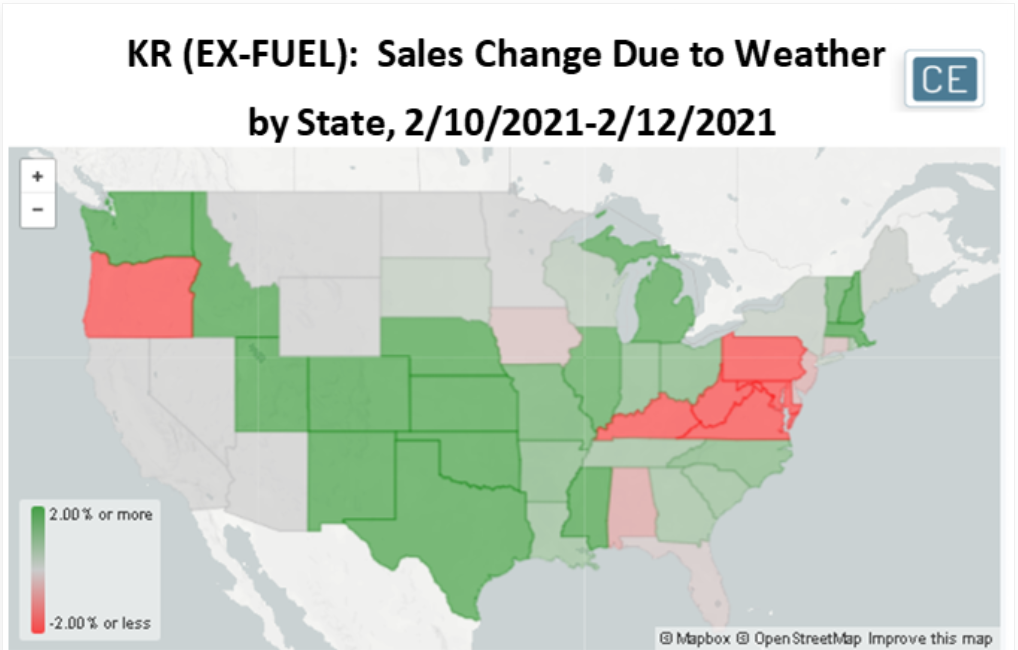

For a big chain like the Kroger parent company (KR), the same weather event may have different impacts in different locations at different times, or competing weather events may cause different effects in different locations. For instance, during the stockup in Texas prior to Winter Storm Uri (February 10-12, 2021), the affected states of Oklahoma, Utah, and Texas all saw a weather impact gain much higher than other states (4.7%, 4.1%, and 3.7%, respectively). At the same time, however, Kroger’s business in the Mid-Atlantic was having weather woes with steep weather impact declines in West Virginia, Washington, D.C., and Maryland (-4.9%, -4.5%, and -4.0%, respectively).

Weather Impact Deep Dive Map

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.