As more and more of the healthcare industry shifts to e-commerce solutions, Smile Direct Club and Byte have chomped away at the dental market with their online offerings. In today’s Insight Flash, find out where these companies are making the strongest inroads and what cross-shop behavior says about the overall customer appetite for online healthcare.

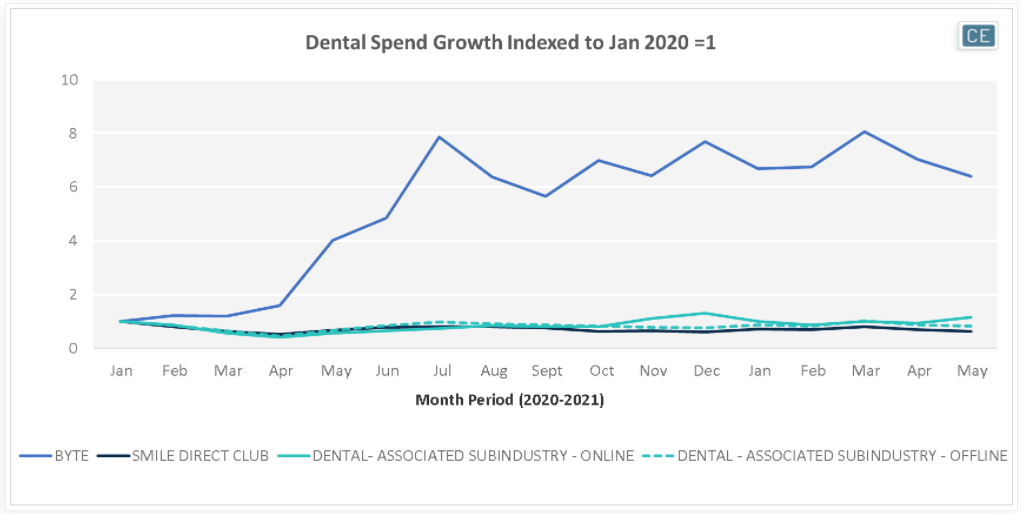

Byte has seen very rapid growth in the last year and a half, with sales in March 2021 peaking at eight times the level of January 2020. Meanwhile, the DTC portion of Smile Direct Club has actually seen diminished spend, with sales in the last two months only around two-thirds the level of January 2020. Recent slowdowns in both are in contrast to online dental services in general, which saw May spend 15% higher than January 2020, the second-highest level in the last sixteen months. Spend at offline dental services (the data does not include individual offices) has trailed at only 80% of January 2020 spend.

Brand Growth vs. Channel

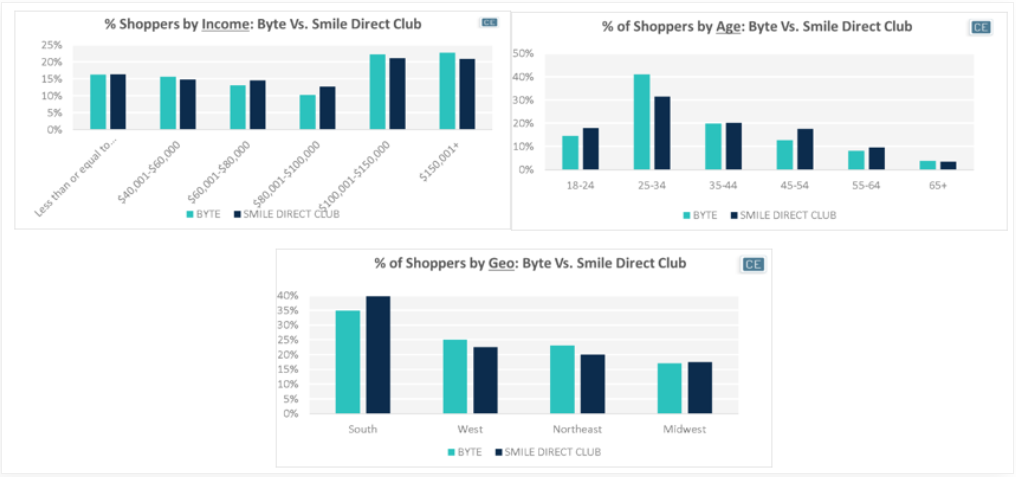

Byte and Smile Direct Club’s DTC business are both more likely to see high income shoppers, with over 40% of purchasers making over $100K per year. Of the two, Byte skews slightly higher income. Additionally, both services are concentrated in the 25-34 age range, though Smile Direct Club is more likely to see younger shoppers aged 18-24 as well. Smile Direct Club is more popular than Byte in the South, while Byte sees more coastal adoption in the Northeast and West.

Demographics

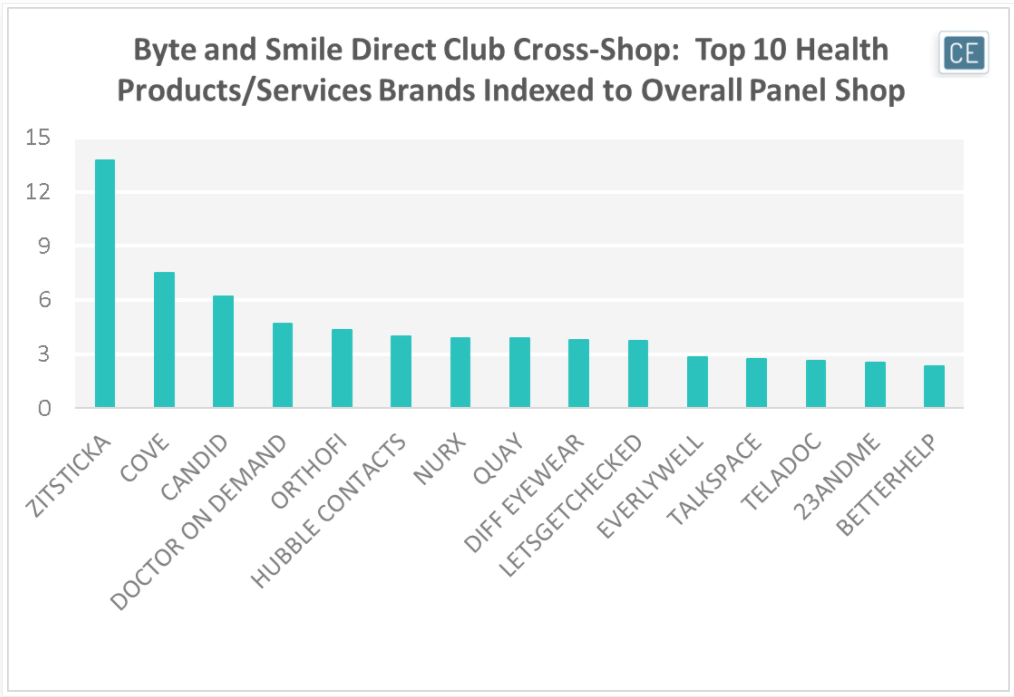

The demographics are reflected in cross-shop behavior. Looking at share of wallet for those who made a purchase at either Byte or Smile Direct Club, these shoppers spent almost fourteen times as much as the overall panel at ZitSticka, and almost eight times as much at Cove. They were also more likely to cross-shop other dental brands like Candid and OrthoFi. These high rates present opportunities for partnerships and acquisitions, or for a mutual parent to build a portfolio of healthcare brands.

Cross-Shop

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.