More than any other industry, travel feels like a large pendulum pulled to one extreme that is now quickly returning the other way. Perhaps too quickly.

Airline employees and Transportation Security Administration (TSA) agents are tasked with managing heavily booked flights, crowded airports, and passengers who’ve forgotten how to behave while traveling. Passengers are experiencing extremely long check-in and security lines, terminals with closed shops and restaurants, and multiple flight cancellations.

And yet, with the craziness, there is optimism among industry leaders.

Customer-facing airline and cruise employees might be in the thick of it all—but what about travel marketing teams? How does ad spending and messaging reflect the rapid shifts of the industry.

Airlines are confidently back in business, but the cruise industry will return slower

It wasn’t a surprise that people would be eager to travel once vaccinated. But leaders didn’t know flyers would come back this quickly. Airlines and the TSA haven’t been able to hire staff fast enough.

Even without the return of significant international and business travel, TSA has screened more than 2 million people some days. This level of activity hasn’t happened since March 2020.

Though it may feel chaotic in airports for the time being, this is good news for airlines and their employees. Federal assistance is set to end on October 1st, but due to this surging activity, travel companies have told employees that they don’t need to fear furloughs.

United Airlines told 40,000 employees this month that they could count on keeping their jobs this fall, while other U.S. airlines have said they’ll resume hiring pilots.

“This news provides great relief to many of our flying partners who were facing an uncertain future,” wrote John Slater, senior vice president of inflight services.

This good news brings comfort to thousands of families who rely on the industry’s rebound.

When it comes to cruises, it’s more complicated

The cruise industry was the first industry to make major pandemic headlines as ships became the initial super-spreader locations in the States.

With the country becoming increasingly vaccinated, the CDC recently eased its recommendations for the industry. The caveat was that only vaccinated people should go on board because ships are high risk environments for unvaccinated individuals.

However, there was squabbling between Florida politicians, cruise lines, and the CDC about how to navigate these new recommendations. Florida passed a law that prohibits cruise lines from requiring vaccinations.

On top of political and business disputes, cruise lines have had incidents of employees getting COVID, further causing delays. Royal Caribbean pushed back the sailing of Odyssey of the Seas from July 3rd to July 31st because 8 crew members tested positive for Covid.

While ships may be slower to set sail than planes taking off, recovery is underway. And we can see it in the advertising.

MediaRadar Insights

Overall, airline and cruise ad spending is building, but is far from 2019 levels.

Spending is down 58% in 2021 compared to 2019. But it is returning from its lowest point during the pandemic. Q2 2021 spending climbed 53% compared to the same period last year.

To be more specific, in Q2 2021, there were 261 companies spending $65.9mm. In 2020, we saw 260 companies spending $43.2mm. In 2019 there were 390 companies spending $155.7mm on print, digital, and television formats.

The significant drop in the number of airline and cruise line advertisers indicate that though numbers stabilized between 2020 and 2021, as a direct result of the pandemic, the smaller companies that may fly local and operate local pleasure tours are no longer advertising on a national level, if at all.

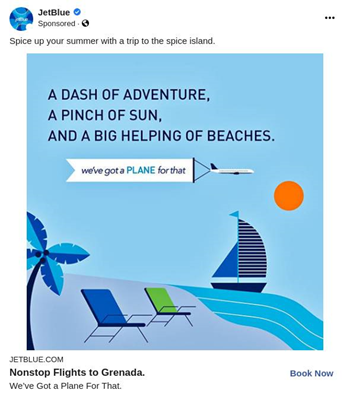

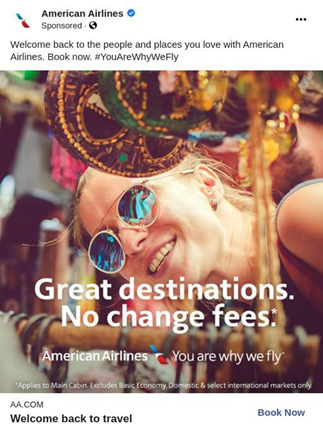

Looking at the creative messaging from travel companies, we noticed:

The travel industry is still figuring out the best way to move forward. As leaders face high demand, staff shortages and a variety of safety standards to maintain, it’s not so simple as turning a time machine back to 2019.

Spending isn’t anywhere close to ‘normal’ yet, but messaging is moving in that direction as we see less hints of the pandemic and more emphasis on adventure and relaxation.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.