Source: https://www.advan.us/blog.php

As theaters have started opening back up to the public, the blockbuster movie season is slowly making its way back into audience’s summer traditions. After a year of closures, many wondered if theaters would be able to recover, especially with the recent popularity of streaming services and home premieres. The latest foot traffic data compiled by Advan Research suggests that the blockbuster movie season is back and is possibly on track to reach the heights of past years. The box office is also in agreement as studios have started releasing their long-delayed movies for the public to see, a strategy that has seemingly paid off.

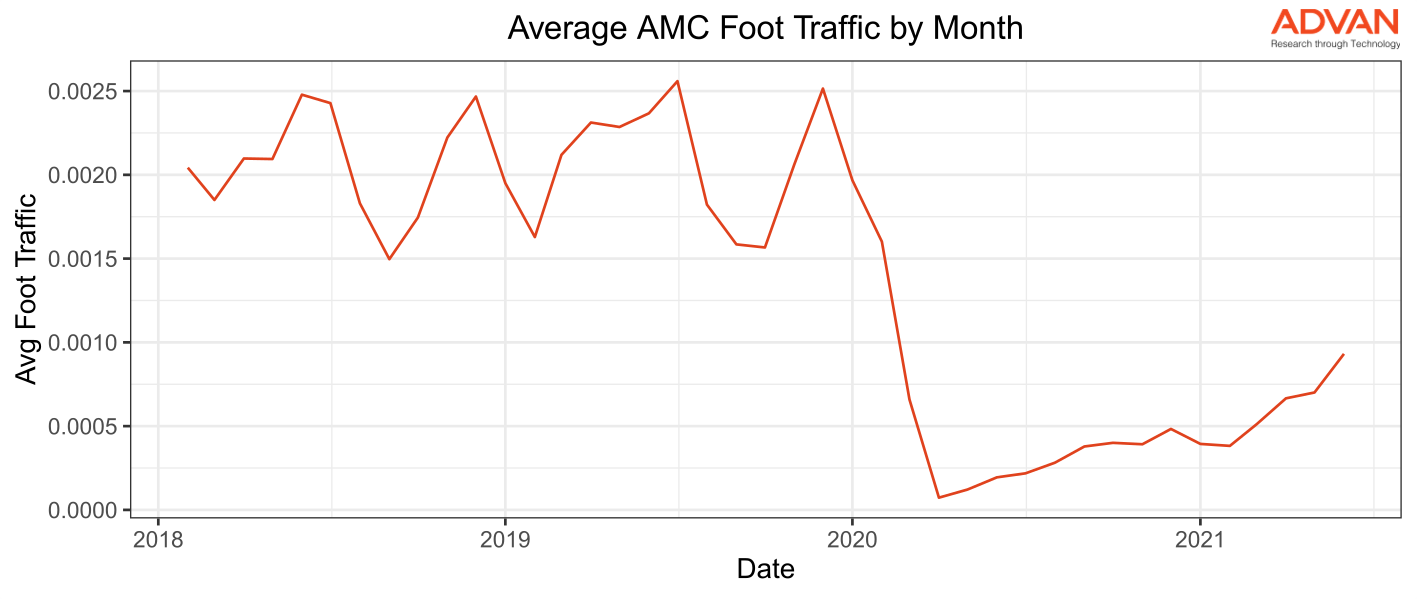

The graph above shows the average foot traffic for AMC Movie theatres over the past 4 years. The peaks of theater foot traffic are found during the summers as blockbuster films are released. One of the highest peaks can be seen in 2019 when ‘Avengers: Endgame’ was released. The film had the biggest opening weekend of all time, and the foot traffic shows it. The steep drop in foot traffic from the pandemic slowly starts to pick up in late 2020 and has a quick spike in June of 2021, just as hit movies like ‘Cruella’ and the newest Fast and Furious film (‘F9’) were released in theaters. This past weekend with the release of ‘F9’ the box office saw a $70 Million opening weekend. Advan’s foot traffic also tracked the highest foot traffic to AMC theaters so far this summer, concurrent with the high box office earnings, and a good indication that summer blockbusters are back. The high foot traffic also has a strong correlation to AMC KPI of 0.954, furthermore showing the relationship between foot traffic and sales for theater chains.

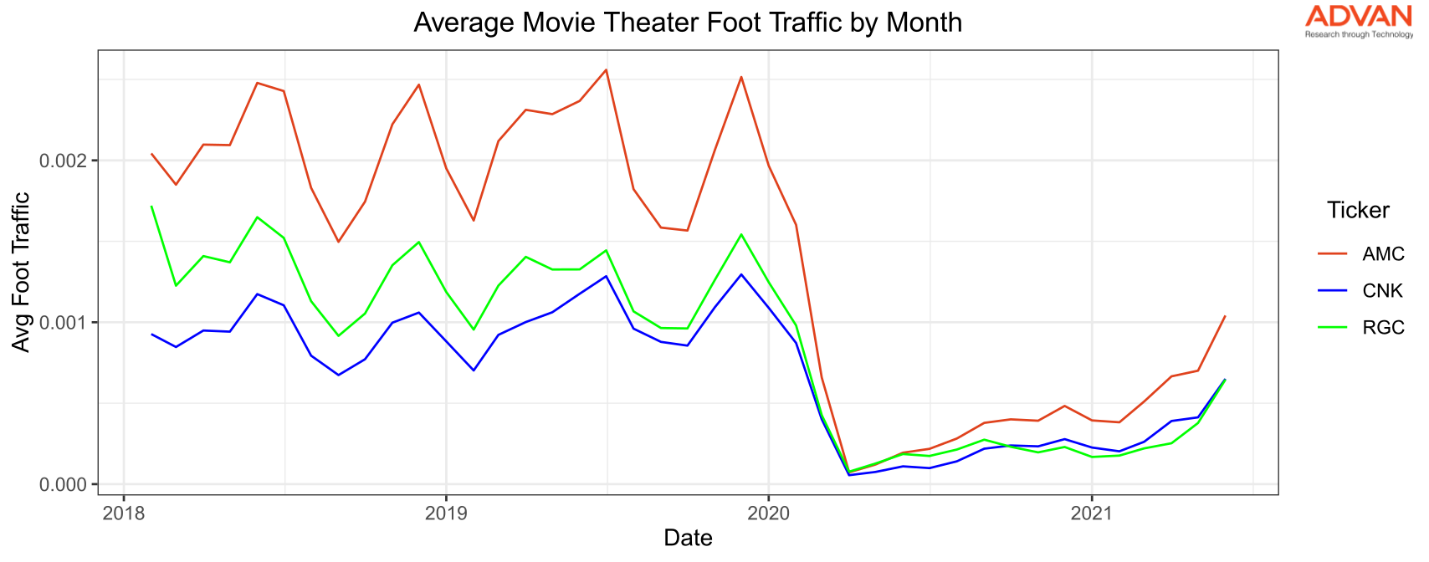

AMC is a well-known theater chain both for its size as well as its place in the news. Within the last year AMC made headlines due to its status as a “meme-stock”. Since then, CEO Adam Aron has announced a strategy to purchase existing movie theaters and expand their brand. While the plans are only to purchase one-off deals, it is important to note AMC’s status amongst its competitors. The Advan foot traffic at AMC compared to the Cinemark and Regal theater chains displays the difference in size between the three chains, with the same general trends. AMC’s strategy to purchase more theaters is contingent on moviegoers showing interest in making the trip to theaters once again, and foot traffic seems to suggest that the overall trend is returning, regardless of brand popularity.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.