Last year was a public reminder of how important our health is—and a reckoning of how vulnerable our healthcare system can be.

And we’re not out of the pandemic yet.

Partially due to the presence of the highly contagious delta variant, COVID cases are surging. There has been a 109% increase of cases over the last fourteen days. (Though, hospitalizations and deaths are significantly down from the beginning of the year.)

With this reality, public attention is still on our healthcare system, its holes, and what can be done to improve it in the future.

American confidence in the healthcare system is down

In March 2020, when COVID-19 was just becoming a reality in the U.S. a Pew survey found that “71 percent of adults felt as though the healthcare system in their area could adequately handle those who fell severely ill after contracting the coronavirus.”

Nearly a year and a half later, American confidence in their healthcare system is not as high. Only 55% of Americans believe we could sufficiently handle another pandemic.

It will take a real effort to restore trust in the healthcare system and the way the government handles public health crises.

But for right now, we’re still in this pandemic. With the surging COVID cases among those who are unvaccinated, individuals need access to alternative solutions, including telemedicine technologies, robots, chatbots that can collect health data, treat patients, and supply vaccinations.

Last year we saw healthcare companies increase their spending. At the beginning of 2021, digital spending from pharmaceutical companies was up 41% year-over-year. How’s it looking now that we’re half way through the year?

MediaRadar Insights

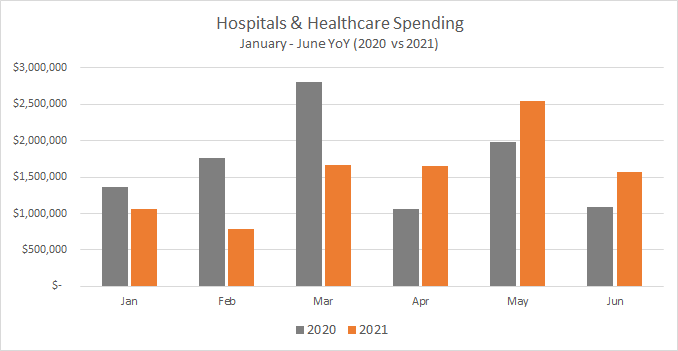

When examining Health Insurance, Hospitals, Life Insurance, and Workers Comp Insurance advertising trends in the first two quarters of the year, we found that spending decreased as we moved into the next phase of the pandemic. (Note: this specific sample doesn’t include pharmaceuticals.)

In the first half of 2021, spending from health insurance companies and hospitals in the B2B space was down 8% YoY. There were 426 companies spending $9.2mm in 2021 to date. Between January and June of 2020, we saw 389 companies spending $10mm.

Last year we saw a dramatic drop in print advertising across most industries. Professional magazines simply weren’t being delivered to offices. Many industries, including healthcare, shifted their advertising into digital.

In 2020 digital accounted for 56% of all advertising spend and that portion size has remained stable. In 2021, digital spending from healthcare only slightly increased to 57%.

The top spending advertisers in hospital systems and health insurance companies in 2021 are:

Their spend accounts for 40% of all spending in this category year-to-date.

The pandemic put a spotlight on how necessary good healthcare is and our need to improve our system. As medical supply chains, hospitals, and health insurance companies navigate new territory, we’ll continue to monitor how much they spend on advertising and if we see any major shifts in creative messaging.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.