Q2 Quarterly Index – The Return of Normal

Home Improvement received a major boost as Americans sheltering in place focused their time and energy on improving their living space. In contrast, Fitness took what some predicted would be a fatal blow as many Americans discovered cheaper, more time-effective ways to work out at home.

Now, it seems that gyms are making a comeback – while home improvement giants continue to hold onto their gains. And the driving force for both seems to be a strong return to ‘normal’ shopping behaviors. We dove into our Q2 Quarterly Index to find out more.

Fitness – Quarterly Visits Rise for Fourth Straight Quarter

Visits to fitness venues continue to increase for the fourth straight quarter in Q2, indicating that visitors are steadily returning to gyms. Visits were up by 17.4% from last quarter, and visits in Q2 2021 were only 12.3% lower than visits in Q2 2019 – half the visit gap seen in Q1.

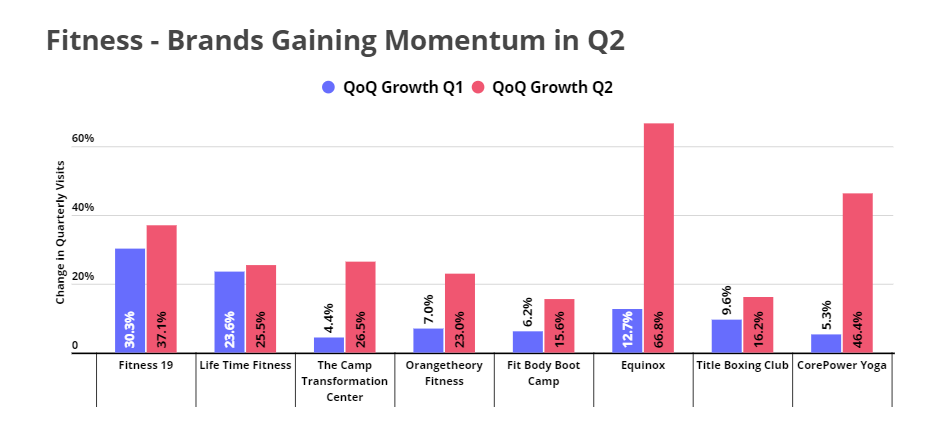

Fitness Brands Experiencing Q2 Jumps

Gyms have been reopened – or partially reopened – for a while, but many brands only started seeing major increases in visits in Q2. Most notably, visits at Equinox and CorePower Yoga skyrocketed by 66.8% and 46.4%, respectively, after a slower Q1 during which visits increased by only 12.7% and 5.3% in the prior quarter, respectively. This means that although some gyms have been open since Q3 of last year, many customers are only now returning to their pre-pandemic fitness habits.

The rise is a significant testament to the pull of brick and mortar fitness and the role it will play moving forward. As restrictions lift fully and people settle into new – or not so new – routines, the next couple of months will be critical to the sector. If quarterly visits continue to grow, the sector can recover much sooner than expected.

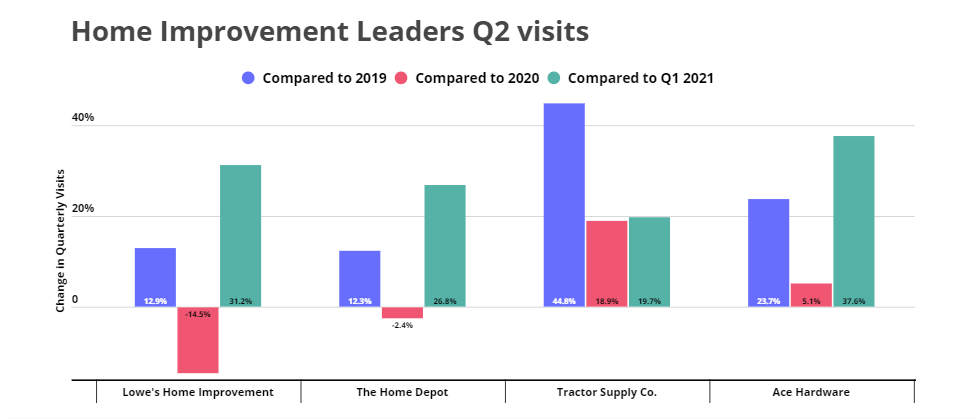

Home Improvement Sector Still Strong

The worst of the lock-downs may be behind us, but that doesn’t mean people are losing interest in sprucing up their homes. While some brands such as Lowe’s and Home Depot may have trouble reaching Q2 2020 visit levels again, the strength gained over the pandemic is having a lasting impact – both brands are still showing a double-digit gain in visits compared to Q2 pre-pandemic.

If these brands manage to hold onto the new customers acquired over the pandemic as they return to cater to their core audience of building professionals, the sector’s 2020 success might be just the beginning.

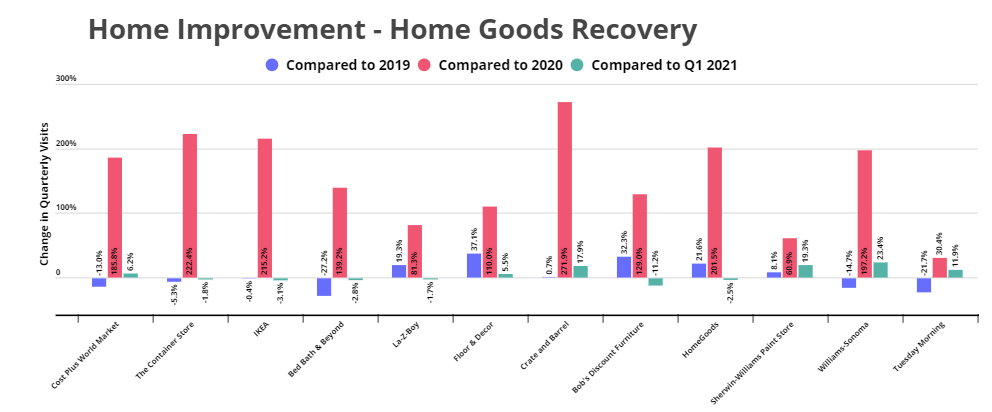

Furniture Making a Comeback

Many home furnishings retailers are making a comeback after closing partially or fully over the pandemic. La-Z-Boy, Floor & Decor, Bob’s Discount Furniture, and HomeGoods are all showing a double-digit increase in visits compared to Q2 2019, with Floor & Decor and Bob’s Discount Furniture leading the pack with a 37.1% and 32.3% increase in visits, respectively.

Of course, some brands are still struggling to recover. But a decline in visits does not necessarily mean a retailer is having trouble – some home furnishing brands such as Williams-Sonoma and Bed Bath and Beyond are closing stores as part of a strategic focus on digital channels following successful e-commerce pushes over the pandemic.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.