In some ways, the U.S. agriculture and farming sector is thriving.

Agricultural export values are setting new records: they reached $59 billion over the first four months of 2021. With increased foreign demand for products like corn, soybean, sorghum, wheat and animal products, farmers have been able to sell their products at competitive prices abroad.

But the industry does face significant challenges—chiefly labor shortages and drought.

The U.S. is navigating new agricultural amendments to overcome these challenges and others. In the meantime, how are advertising buying behaviors looking?

Export values are up, but so is the heat

The overall picture of the agricultural sector is mixed.

On one hand some crops are doing great. The U.S. government upped its initial corn harvest forecast even though much of the country is facing dry conditions or drought. According to Ken Schroeder, extension agriculture agent from Portage County, Wisconsin, it was like the “the faucet got turned on,” allowing the crops to grow.

This is good news as corn is one of the hottest commodities in agricultural exports. Last year, the corn export value was up 20%, with strong demand coming from Mexico, Japan and China.

But not all regions or crops are faring so well.

California, which provides two-thirds of the nations’ fruits and nuts and more than a third of its vegetables, according to The New York Times, is struggling. Though the state has faced severe drought in the past, this year is exceptionally dry.

This year’s drought is forcing farmers to reconsider which crops to grow, and some are asking if they want to keep on farming altogether.

Adding to the weather problems is a lack of labor. There has been a shortage of agricultural workers for years, but it has only become a bigger problem since the pandemic. Farm owners need more employees than the government gives out visas and it’s hard to find American-born individuals willing to do intensive agricultural labor.

The Agricultural Workforce Coalition (AWC) and 300 other unions worked together to request reform immigration policies from the Senate. Last week, the House Committee on Appropriations introduced a bipartisan act that would expand the H-2A temporary agricultural guestworker program, which was quickly approved by voice vote.

As the agricultural sector worries about weather patterns and labor shortages, we’re seeing a slight dip in advertising buying.

MediaRadar Insights

The Senate is working on multiple initiatives to support farm owners and will likely need to expand their efforts if droughts become more severe. But fortunately, demand for food is global and the American farming industry performance is looking promising overall.

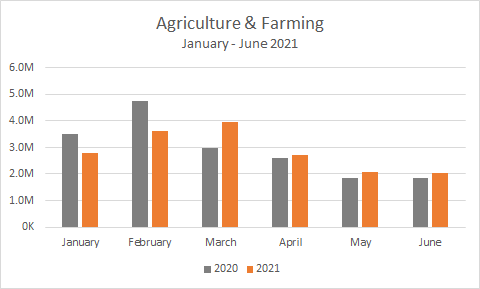

When it comes to advertising spending, the agriculture and farming industry is down 2% YoY. There was $17.2mm spent in January – June this year compared to $17.6mm in the same period in 2020.

March – June saw an overall increase of 16% YoY in advertising spend, but that is when spending decreased last year due to the pandemic. Advertising spend in 2021 has not exceeded that of February 2020 yet.

Compared to other industries, ad spend is still heavily invested in print. However, this is changing.

Between January and April, only 2% of this industry’s ad spend was in digital. In May and June, we started to see this climb. By June, it was up to 16%—which is still low compared to other industries, but a big jump from 2% at the beginning of the year.

Even though this industry may be one of the last to move from print to digital, it is happening. And as the Senate makes amendments to shift visa allowances and support agricultural unions, it seems that ad buying is remaining stable compared to 2020 for now.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.