The coffee comeback is continuing with Starbucks, Panera Bread and Dunkin’ all seeing visit comparisons to 2019 levels improve.

Are these recoveries a sign that the new ‘normal’ has been reached or is even more growth ahead?

Coffee Visits Rising

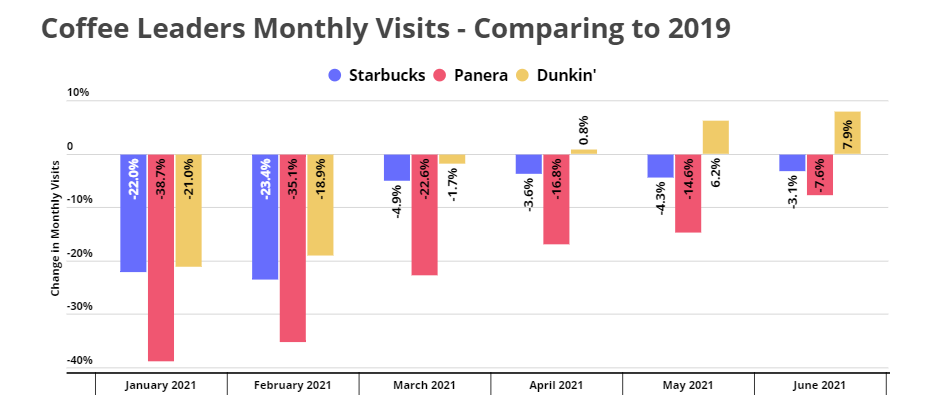

Since the start of 2021, Starbucks, Panera Bread, and Dunkin’ have seen a steady and significant recovery each month. By June, visits for Starbucks and Panera were down just 3.1% and 7.6% respectively compared to June 2019, the best mark for both brands since the start of the pandemic’s retail impact. Dunkin’ had remarkably already returned to visit growth by April, with May and June seeing major visits increases of 6.2% and 7.9% respectively.

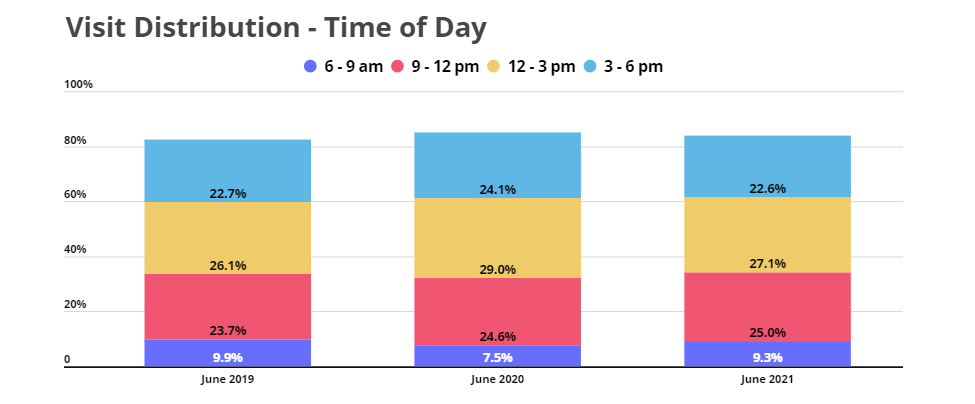

The impressive rebound for these brands is being driven by a few key factors. First, the wider retail recovery is clearly being felt across industries, with restaurant chains and coffee brands feeling the resurgence. Second, the return of work and school routines is giving a boost to players that fit within those routines – and few sectors fit that description as well as breakfast oriented chains. Visits between 6 and 9 AM made up 9.9% of nationwide visits in June 2019, a number that dropped to 7.5% in 2020 and has already returned to 9.3% in June 2021.

And this isn’t the only ‘routine’ factor driving the return. Median visit duration dropped 20.6% in June 2020 compared to June 2019, and while June 2021 is still lagging behind the 2019 standard, the gap has decreased to just 14.7%. In addition, visits per visitor were down just 0.6% in June 2021 compared to June 2019. The takeaway is that normal patterns are returning and repeat visits and visit durations are on the rise, all of which is fueling a powerful recovery.

The Calm Before the Surge?

But the situation might get even better.

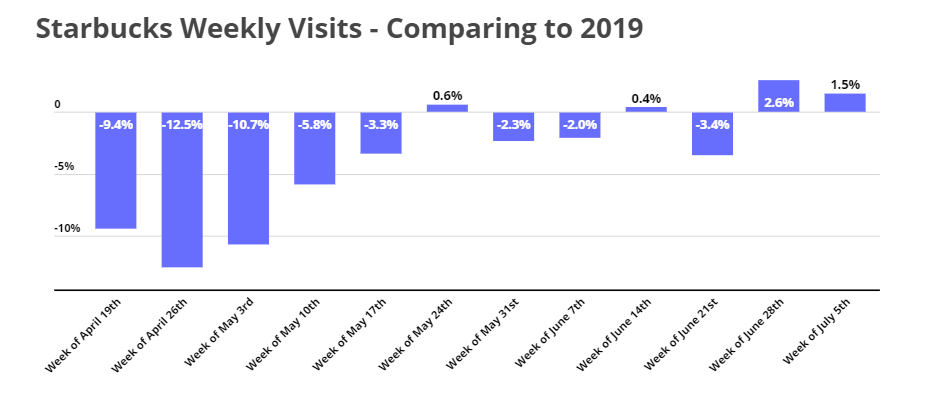

Looking at weekly visits to Starbucks locations shows growth of 2.6% and 1.5% respectively the weeks beginning June 28th and July 5th. These are the strongest comparative weekly metrics since the start of the pandemic and show that not only are visits recovering – the pace of recovery appears to be improving as well.

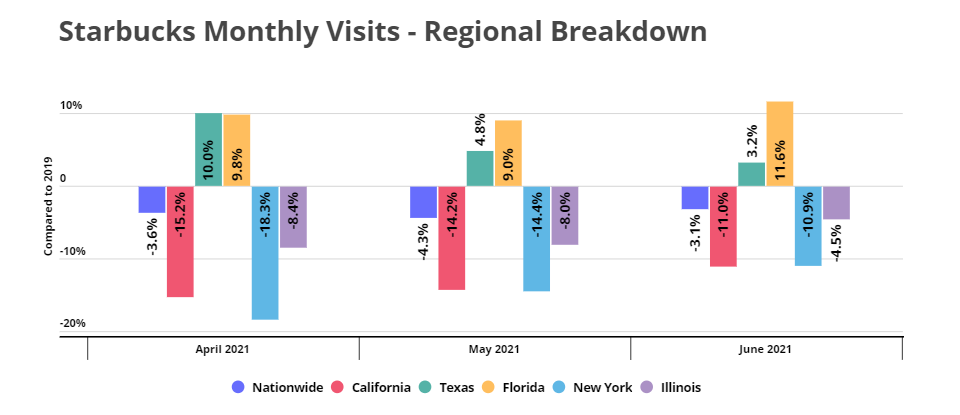

And there may be even more opportunities coming soon. California and New York, two states with some of the highest number of overall locations, are still lagging behind the nationwide recovery standard. As these areas continue to recover, expect brands like Starbucks to see an even greater boost in visit rates.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.