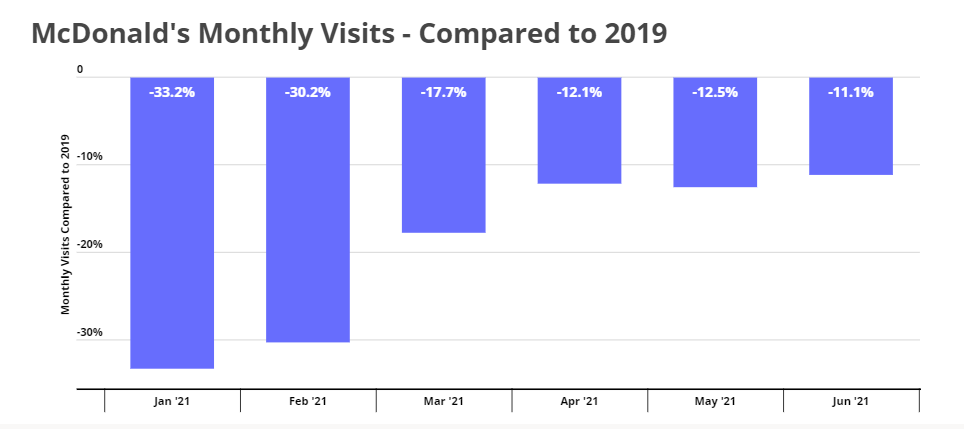

Visits to McDonald’s took a hit over the pandemic, but since February the brand seems to be on an accelerated path to a full offline recovery. Visits in April, May and June were down -12.1%, -12.5% and -11.1% respectively – an impressive result considering the existing strength in delivery and drive thru, and the lingering COVID effects on ‘normal’ routines.

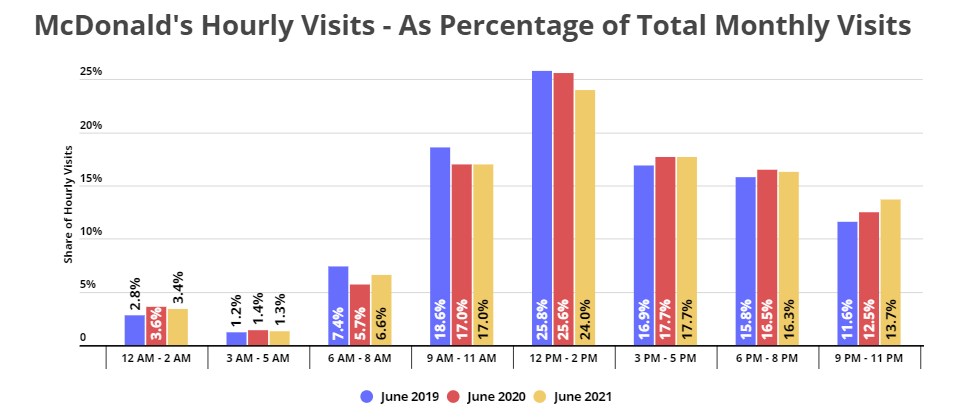

Visits Still Shorter, Later in the Day

One of the factors limiting a full visit return for McDonald’s this past quarter was patrons’ slow return to their pre-pandemic dining patterns. In June 2019, 39.8% of visits were before noon, compared with just 36.9% and 37.0% of morning visits in June 2020 and 2021, respectively.

Throughout Q2, the median visit length also remained around 10% lower than in 2019, meaning that people were not only visiting McDonald’s less often – they were also spending less time in the restaurant on each visit. The likely indication is that there is a tight correlation between normal routines and normal McDonalds visit patterns.

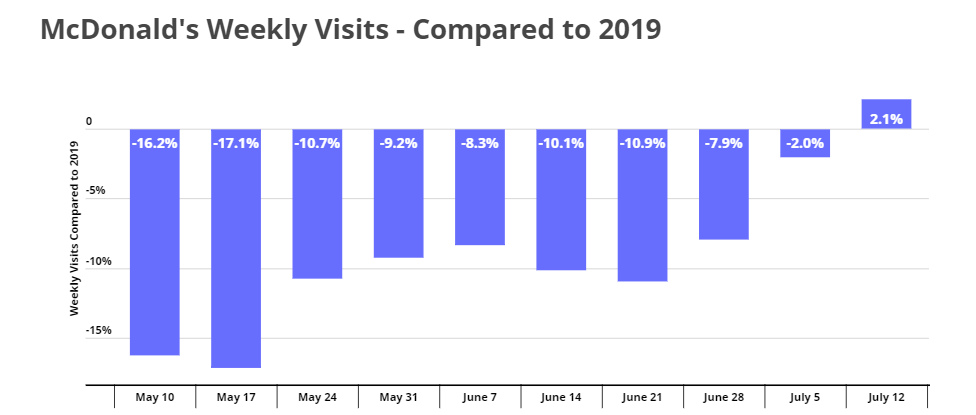

Visit Numbers Return to Pre-Pandemic Levels Mid-July

But despite its somewhat slow Q2, McDonald’s is still one of the strongest brands in the QSR industry. And since June, the fast-food giant has made impressive strides. The week beginning July 12th marked McDonald’s first week of year-over-two year visit growth since the start of the pandemic, with the visit gap moving from -10.9% to 2.1% in just four short weeks.

The gap in median visit length also narrowed to -6.9% when comparing the first two full weeks of July 2021 to the first two full weeks of July 2019. With longer, more frequent visits, McDonald’s Q3 is off to an exceptionally strong start.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.