For many, there’s an inherent thrill that comes with online gambling. The risk, the high stakes, the rewards can be addicting.

And like so many other popular pastimes, gambling has not been impervious to the digital revolution. Think about it, there’s really no need anymore to drive to the local casino or take a trip to Las Vegas to get your fix. Technology has transformed our living rooms into our own personal casino royales filled with Texas Hold ‘Em, Roulette, Blackjack, and more.

With more and more people gambling online, benchmarking your performance against major competitors can give you the insights you need to draw a royal flush.

Using Similarweb’s powerful data and research intelligence, we examined key digital insights from the online gambling industry, including traffic share, audience demographics, marketing channel performance, and more, to give you a better idea of where you stand. Let’s dive right in.

Methodology and the competitive players

In order to give you the most accurate overview of the online gambling industry, we’ll showcase competitive benchmarking for the top 10 gambling websites worldwide, as well as in the U.K. and Germany. A majority of the data analyzed has been collected over the past year (June 2020–June 2021).

Each competitive set consists of the following:

Top 10 gambling websites worldwide:

Top 10 gambling websites in the U.K:

Top 10 gambling websites in Germany:

1. Total visits over time

The online gambling interest is booming and growing in popularity fast. Total visits to the top 10 websites worldwide grew nearly 18% year-over-year (YoY) from 885 million in June 2020 to 1.0 billion in June 2021.

Although responsible for the least amount of traffic, gambling websites in Germany experienced the most impressive boost in total visits, increasing 184% YoY. In the U.K., total visits increased 45% in the same time period.

2. Traffic share split – where do you fit in?

Understanding traffic share split among top competitors in your industry will help you spot opportunities to win customers away from others. Keeping a digital scorecard of your competitive arena gives you a good idea of which websites gamblers prefer, and can also be an important indicator of up-and-coming industry players to watch, as well as those who may be losing popularity.

Take a look at the traffic share split for the top gambling websites worldwide, in the U.K., and Germany. Do you see any opportunities for growth?

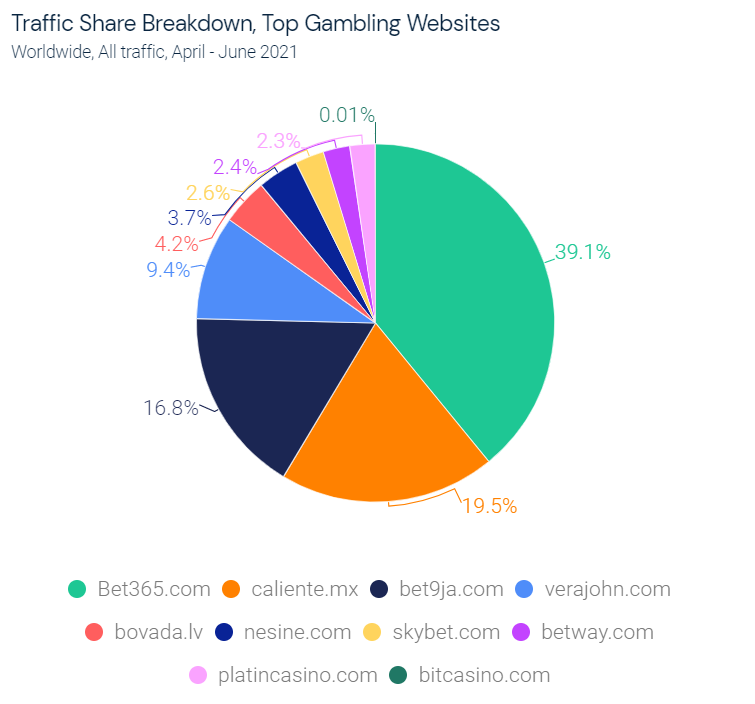

Worldwide

Bet365.com is the most popular gambling site worldwide, with a whopping 39.1% of the traffic share. Caliente.mx comes in second with 19.5%, and bet9ja.com slides into the third spot. with 16.8%.

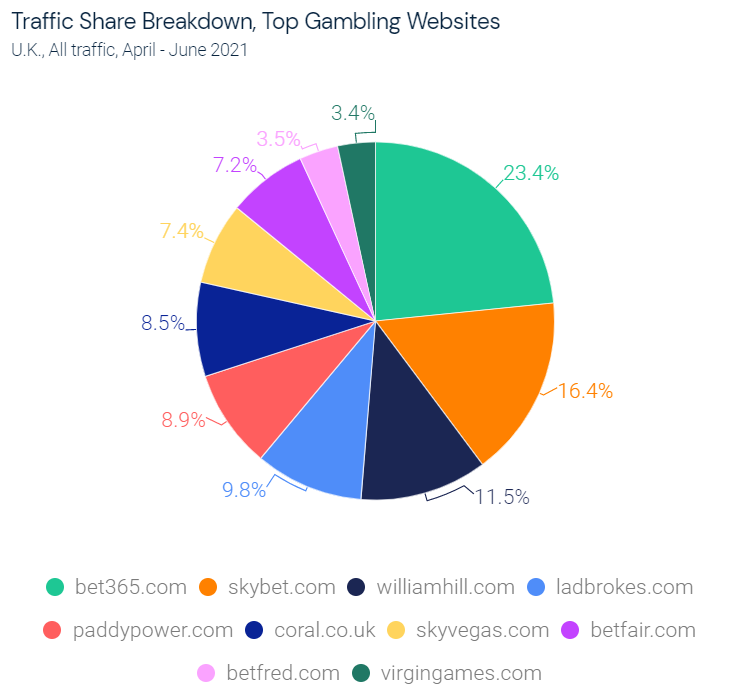

U.K.

Bet365.com comes in first again with 23.4% of the total traffic share for gambling websites in the U.K., followed closely by skybet.com (16.4%) and williamhill.com (11.5%).

Traffic split is divided more evenly among the top ten websites in the U.K. compared to worldwide. This means that there is more competition at a local level, with smaller companies vying against each other to win audience engagement.

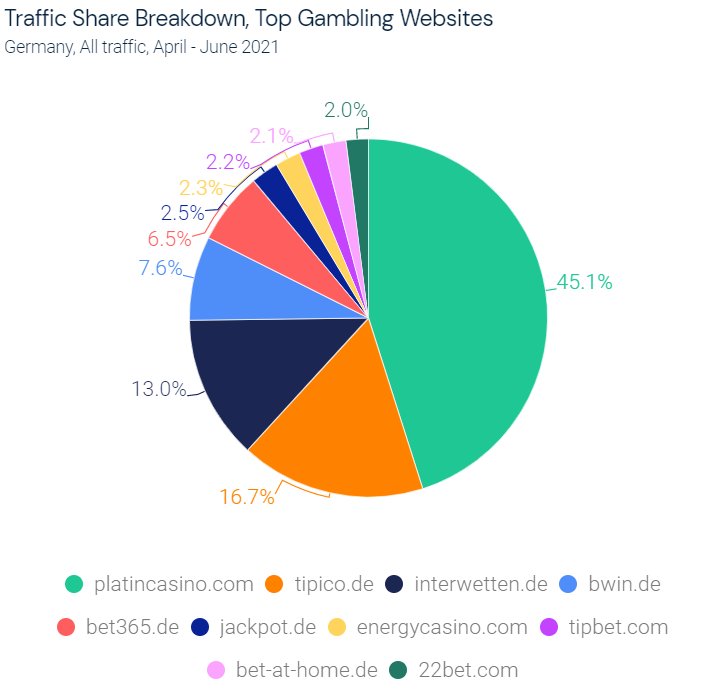

Germany

Platincasino.com has a huge monopoly on the online gambling space in Germany with 45.1% of the traffic share. For comparison, its closest competitors tipico.de and interwetten.de have 16.7% and 13.0% of the traffic share respectively.

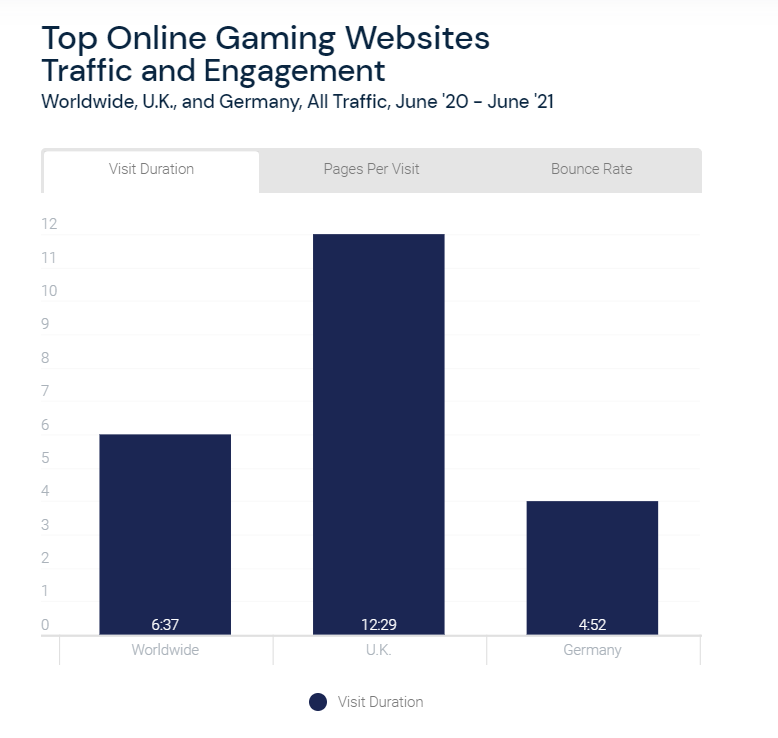

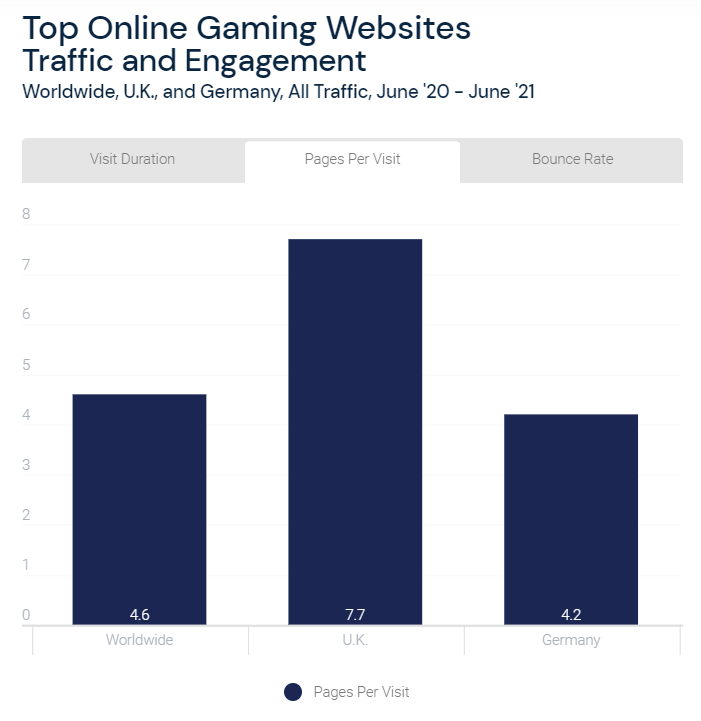

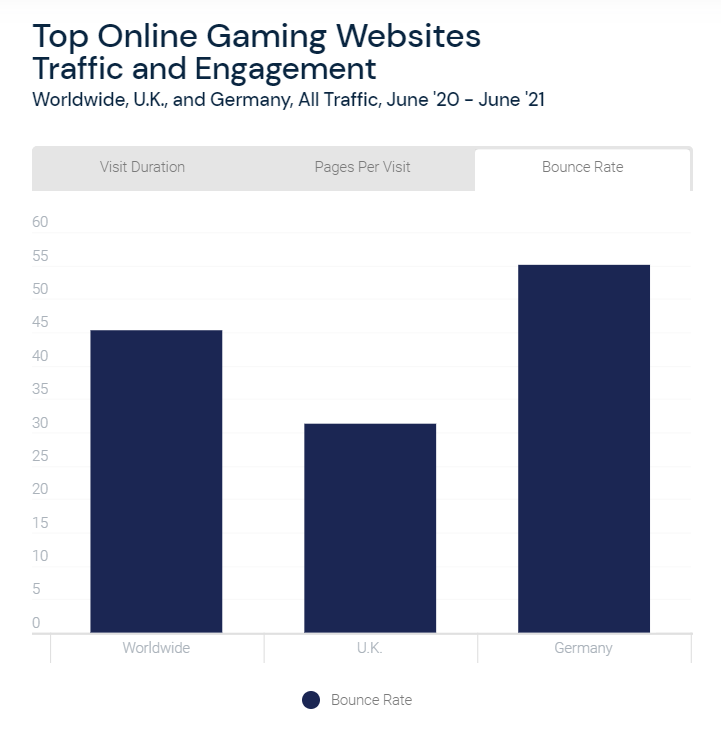

3. Measuring user engagement

For online gambling websites, visitors’ on-site user experiences are crucial for success. Benchmarking metrics such as bounce rate, click-through rate, page views and more gives you an idea of how much your users engage with your content compared to your competitors. You can also predict how well certain ads will perform. More time spent on a page means more opportunities to click.

Below are engagement metric benchmarks worldwide, in the U.K, and Germany, from June 2020 to June 2021.

Top 10 gambling websites worldwide

Top 10 gambling websites in the U.K.

Top 10 gambling websites in Germany

Gambling websites in the U.K. have the best user experience overall, with considerably higher visit duration and page views when compared to Germany and the rest of the world. There is also a much lower bounce rate in the U.K., which means that gamblers there are browsing through multiple pages of a website before leaving.

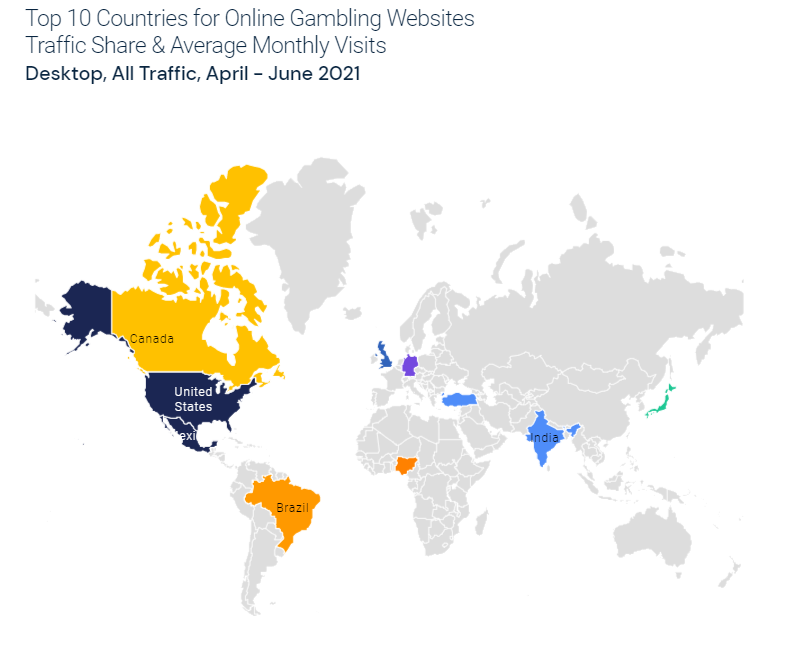

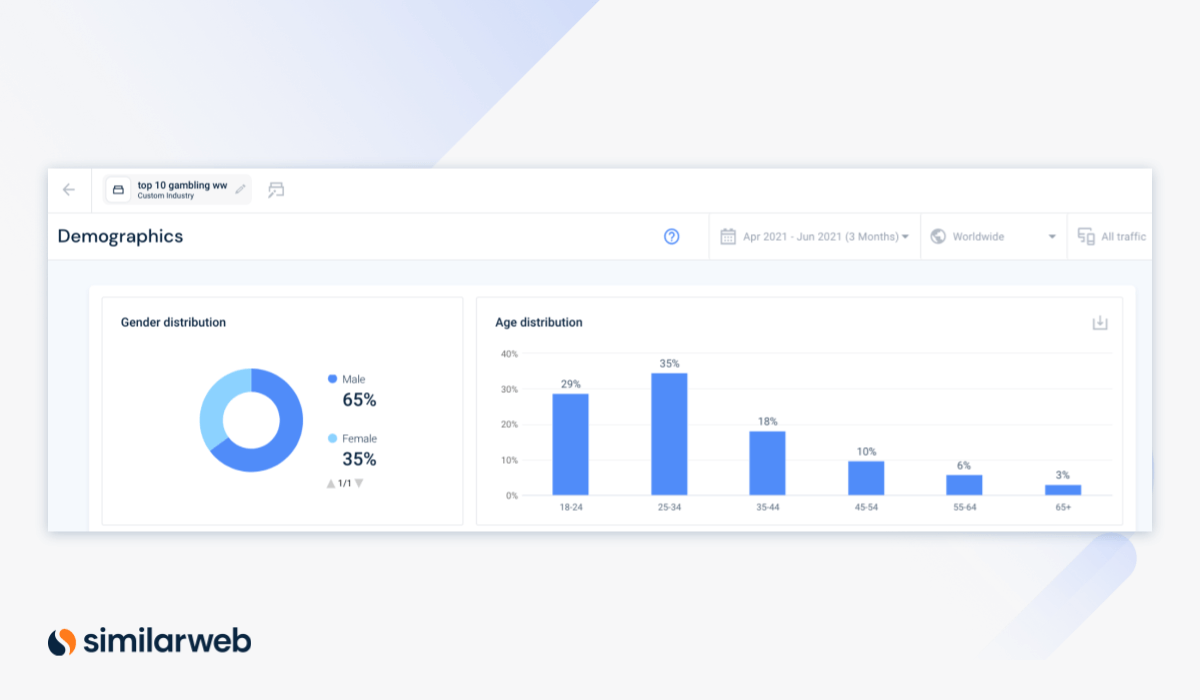

4.Defining your audience

Understanding your target audience is key to smart content production, marketing campaigns, and website engagement. You can analyze the demographics of your main competitors to see who your customers most likely are.

Ten countries make up approximately 80% of the total market share for the top 10 gambling websites worldwide. Brazil brings in the most users with 18.6% of the traffic share, or 92.3 million visits in three months. Japan and Nigeria come in a close second and third respectively.

Worldwide, males are nearly twice as likely to visit gambling websites than females. Age distribution for this industry skews younger globally, with 64% of the audience falling between 18–34 years old, and 37% 35+ years old.

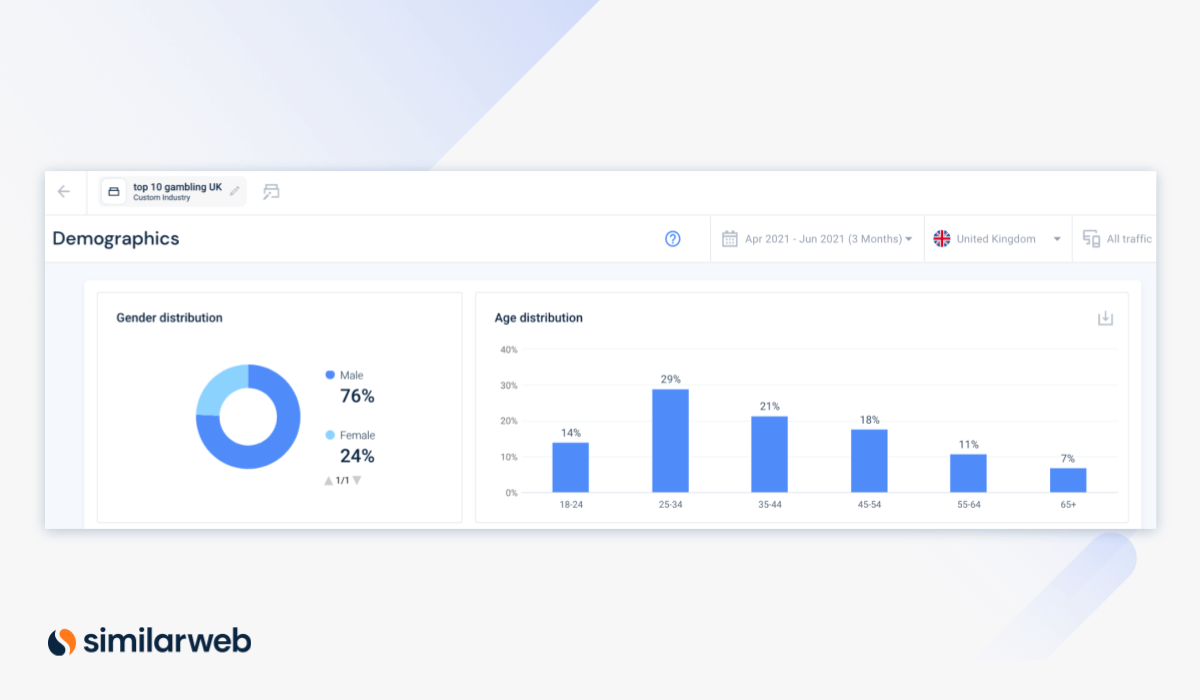

The gender split is even more apparent in the U.K where 76% of the visits to gambling sites are male, while only 24% are female. And the audience skews slightly older compared to the worldwide benchmark.

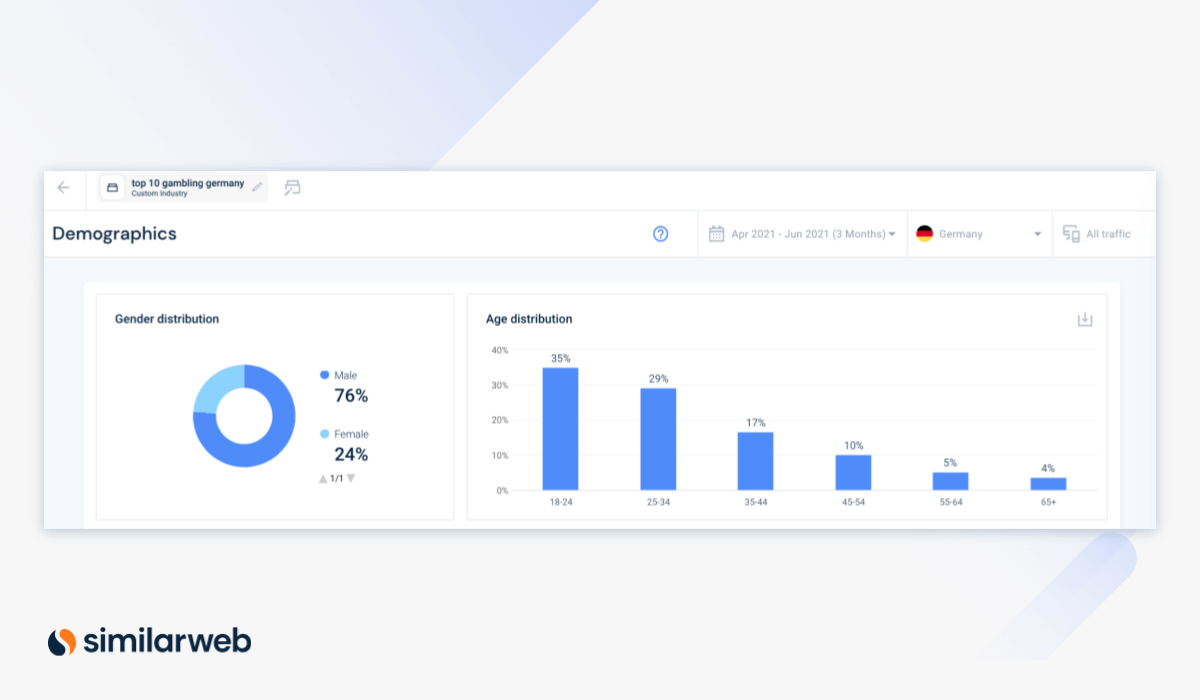

Lastly, when looking at Germany, gender split follows the same trend as the U.K., with considerably more male visitors. Age distribution in Germany aligns with patterns we see worldwide.

5. Why device split matters

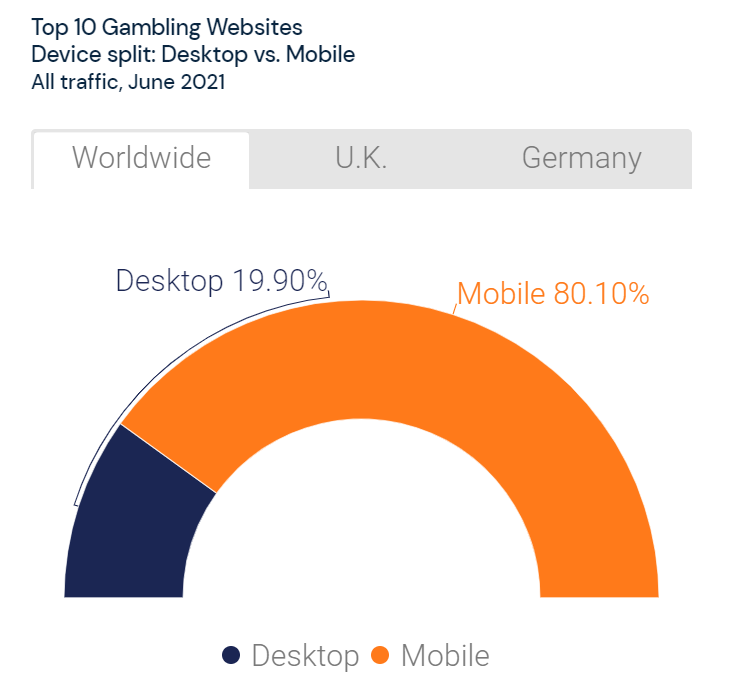

Benchmarks for device split offer an understanding of where you need to focus your marketing efforts when it comes to content creation, user experience, and ad spend.

For the top gambling websites across the globe, we see that most traffic comes from mobile web. Make sure your website has a good user experience across all different types of mobile devices and mimics the same layout or user flow as your desktop version. If you aren’t already doing so, consider offering an app version of your website to increase user engagement.

Top 10 websites worldwide

Top 10 websites in the U.K.

Top 10 websites in Germany:

6. Benchmarking acquisition sources

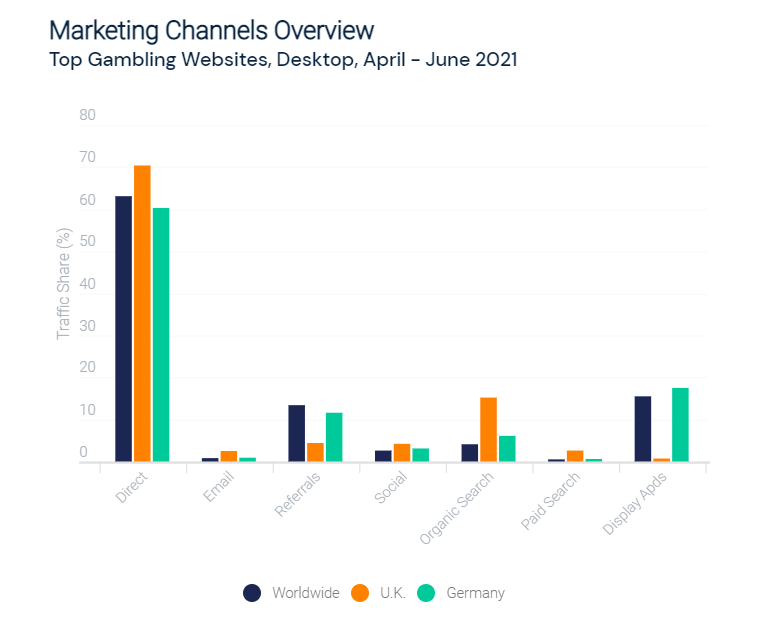

Compare the performance benchmarks for your marketing channels and acquisition sources to see where you might be lagging compared to your competitors. You can also look at shifts over time to see how you can update your content strategy based on new consumer trends or interests.

Direct (63.1%) is the main source of traffic to the top gambling websites worldwide, followed by display ads (15.5%) and referrals (13.4%) This is proof of the importance of having both a loyal fanbase and strong brand awareness, as well as a smart paid acquisition strategy.

Unlike in Germany, which mimics the global performance of marketing channels, gambling websites in the U.K. rely much more on organic and paid search. This information is useful when informing the marketing strategies for new product launches or entering a new market.

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.