The phrase “no place like home” took on new meaning for many at the height of the pandemic, with much of the country pivoting to a new normal of quarantine and remote work. Some of the biggest beneficiaries of this development were the Home Improvement and Home Furnishing sectors as consumers increasingly took on DIY home projects and invested in home offices—to the tune of $420 billion last year.

However, with 60% of adults now vaccinated against the coronavirus, and many employees returning to the office and to urban living, it remains to be seen how long the sector will enjoy this boom. We dug into the current state of home retail to see where and how consumers are shopping, as well as which brands have won new customers during the pandemic.

Key Takeaways

COVID boom for home category sees slowdown

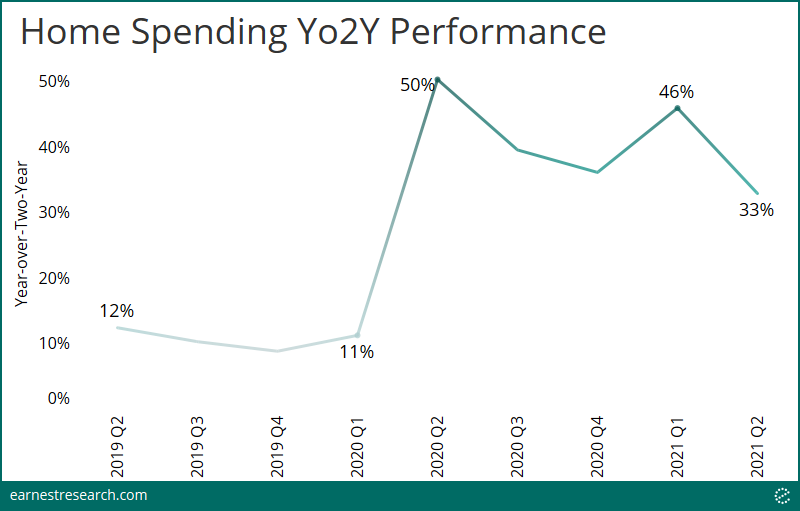

It’s no surprise that stay-at-home behaviors over the past year drove up Home spending to unprecedented levels. The big question is will it persist and for how long?

With growth climbing up five-fold from pre-COVID levels, up to 50% in 2Q20, the most recent quarter saw the start of a meaningful slow down to 33%; though still materially above pre-COVID growth levels of 10% vs. two years prior.

While vaccines continue to roll out, a new surge in cases from the Delta variant is driving the reintroduction of mask mandates and other restrictions, painting an uncertain close to 2021.

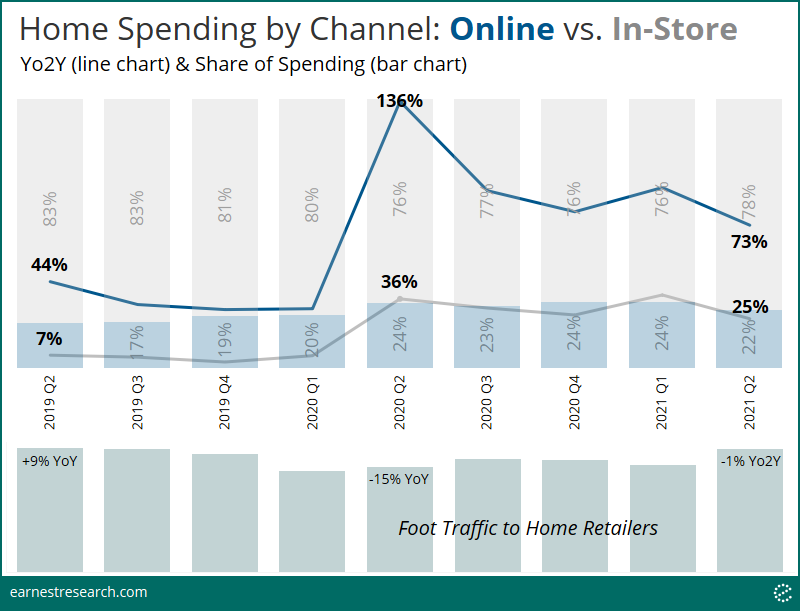

Pandemic shopping shifted more Home purchases online, but most sales still happen in-store

Prior to the pandemic, 80% of all Home purchases happened in-store. Naturally, COVID propelled a shift to online shopping, resulting in the online channel grabbing 5% more share (to just under 25%). At its peak in 2Q20, online spending grew to over 130% relative to 2019.

In 2Q21, online growth slowed down to 70% and in-store growth to 25% relative to 2019; and the overall channel mix began trending back to normal levels. Importantly, though, even if online growth supercharges again, the majority of Home sales remain in traditional brick-and-mortar, highlighting the sector’s reliance on consumer foot traffic.

Indeed, Earnest foot traffic data shows that consumer foot traffic to Home retailers reached just below the levels they were at this time two years ago, at -1% Yo2Y, up from its 15% YoY decline when the pandemic began.

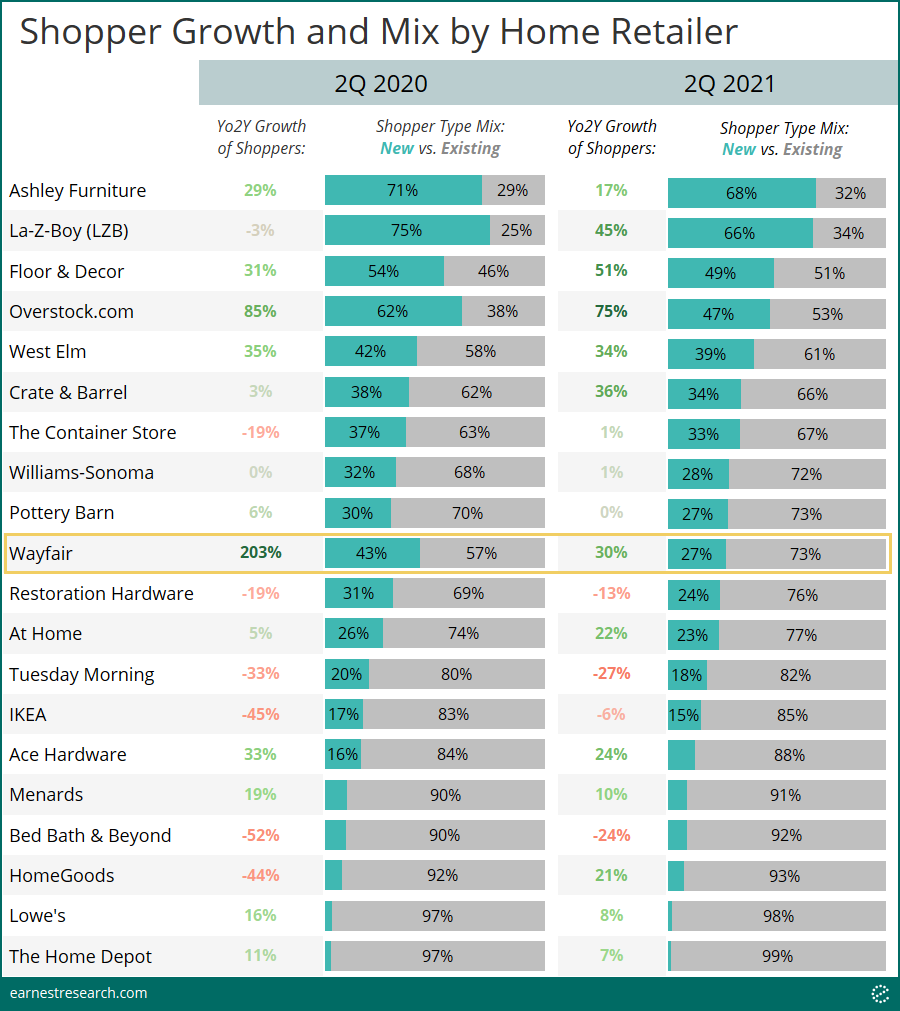

Home Furnishing retailers West Elm, Overstock.com, Floor & Decor, and Ashley Furniture find new shoppers

Was the post-lockdown growth in the Home category driven by new or existing shoppers? Looking at the growth of the number of shoppers in 2Q21 and 2Q20 relative to two years prior, we analyzed its mix of new vs. existing shoppers to assess the main drivers of growth.

Several Home Furnishing retailers, including Ashley Furniture, Floor & Decor, Overstock.com, and West Elm saw healthy shopper growth this year and last, where impressively ~40% to 70% of purchases were made by new shoppers (“new” defined as shoppers who have not patronized that particular retailer since Jan. 1, 2016).

Bed Bath, IKEA, Tuesday Morning, and Restoration Hardware saw the total number of shoppers decline, of which 10% to 30% were new shoppers.

Home Improvement retailers like Home Depot, Lowe’s, Menards, and Ace continue to see healthy shopper growth of ~7% to 20%, albeit slower than last year’s 10% to 35% pace. The sector’s main drivers continue to be retaining existing customers vs. acquiring new ones.

Online-only furnishing leader Wayfair has slowed considerably from its 200%+ growth pop last year, where 43% of shoppers were new. Wayfair is now growing 30% vs. 2019, of which [just] 27% are new shoppers.

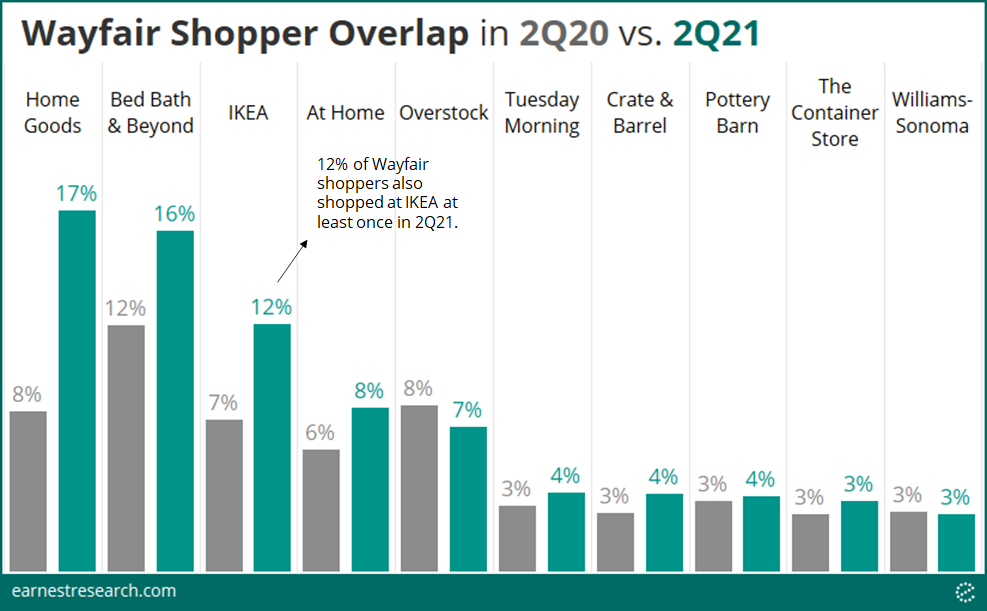

About 15% of Wayfair Customers Also Shop at HomeGoods, Bed Bath, and IKEA, up from 10%.

Given Wayfair’s extreme swings in performance over the past year, we looked at where else Wayfair customers shopped in 2021.

In 2Q21, 17% of Wayfair customers also shopped at HomeGoods, 16% at Bed Bath, and 12% at IKEA; importantly, all up from the 8%, 12%, and 7% overlapping figures, respectively, last year.

Additional retailers in this analysis like Crate & Barrel, Pottery Barn, and The Container Store have the same level of overlap as they did in 2Q20, although the majority only constitute 4% or less of Wayfair shoppers.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.