Last month, the US government made one of what will become several monthly payments to households with children, meant to spur spending and reduce economic hardship. In today’s Insight Flash, we take advantage of our unique demographic capability to isolate households with children, and to cross-reference that by income, to evaluate the impact of this payment.

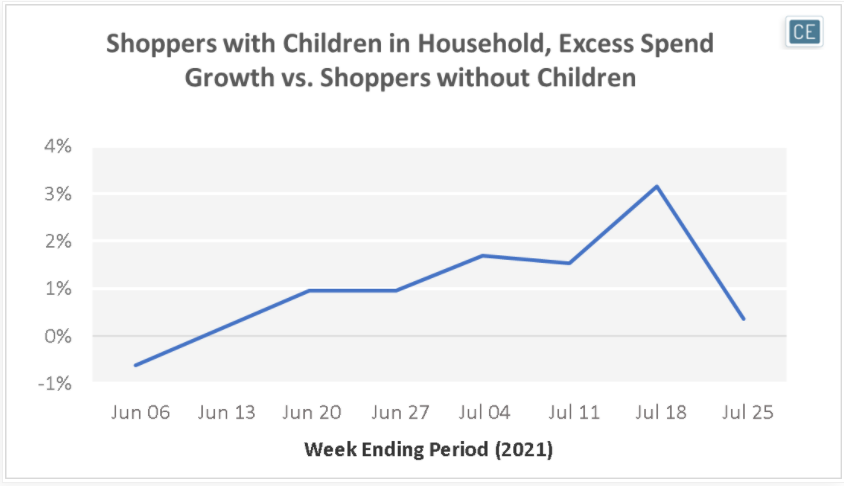

Households with children began ramping spending in advance of the payment, moving from lower spend growth than shoppers without children the week of June 6 to slightly higher growth the weeks ending June 13 – July 11. This ramp spiked the week the actual payment was made, with spend growth among households with children outpacing spend growth among households without children by 3% for the week ending July 18. Interestingly, a lot of this spend appears to have been pulled forward, since the week ending July 25 spend growth among households with and without children was relatively on par.

Spend Lift

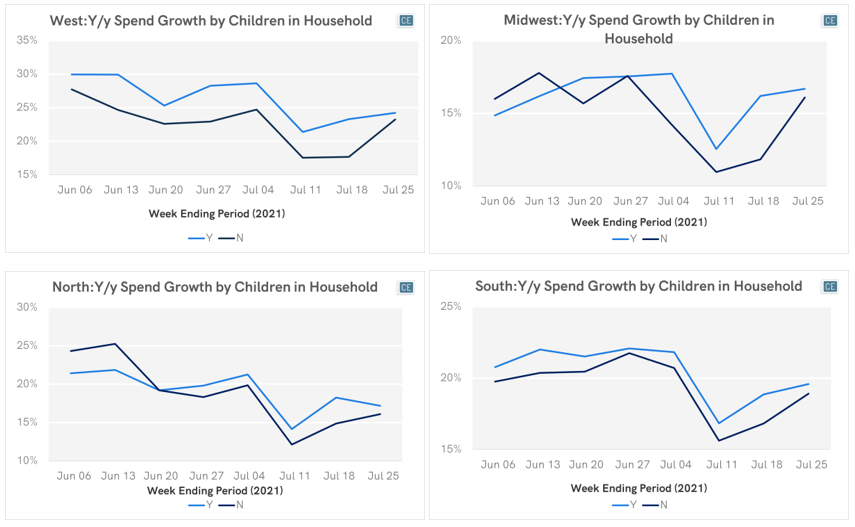

These trends are consistent across regions, with spreads in growth between households with children and those without children widening prior to the tax credit and peaking the week ending July 18, 2021. The spread in that week was widest in the West at 5.6%, followed by 4.4% in the Midwest, 3.4% in the Northeast, and 2.0% in the South.

Regional Trends

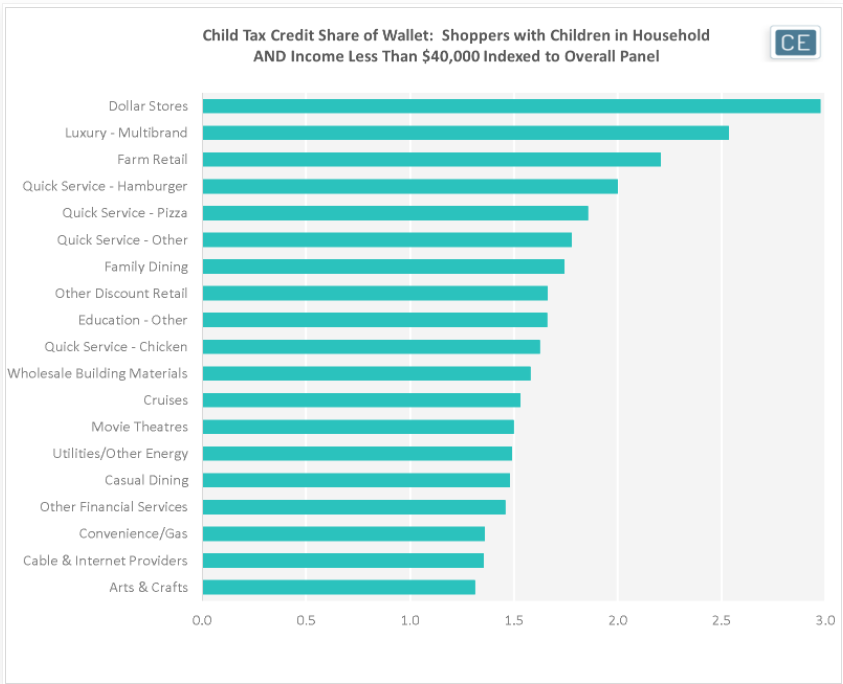

The lowest income shoppers were most likely to have benefitted from the credit. During the week the credit was issued, those who made under $40,000 per year and also have children in their households spent almost three times as much as the overall panel at Dollar Stores on a share of wallet basis. They also spent about two and a half times as much of their wallet share at Multibrand Luxury stores. Other retailers overindexed to these major beneficiaries of the child tax credit appear to have been in Farm Retail, Quick Service Restaurants, and Family Dining.

Subindustry Trends

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.