After a sharp decline early in the pandemic, the DTC clothing rental market is experiencing a resurgence. Many consumers are signing up for DTC clothing rental subscriptions as they return to the office and begin attending in-person events such as weddings again. As a Rent the Runway IPO approaches, consumer transaction data reveals how customer counts are rebounding for top clothing rental companies. Additionally, while returning customers represent the majority of these companies’ customer bases, some competitors are seeing an increase in their percentage of new customers.

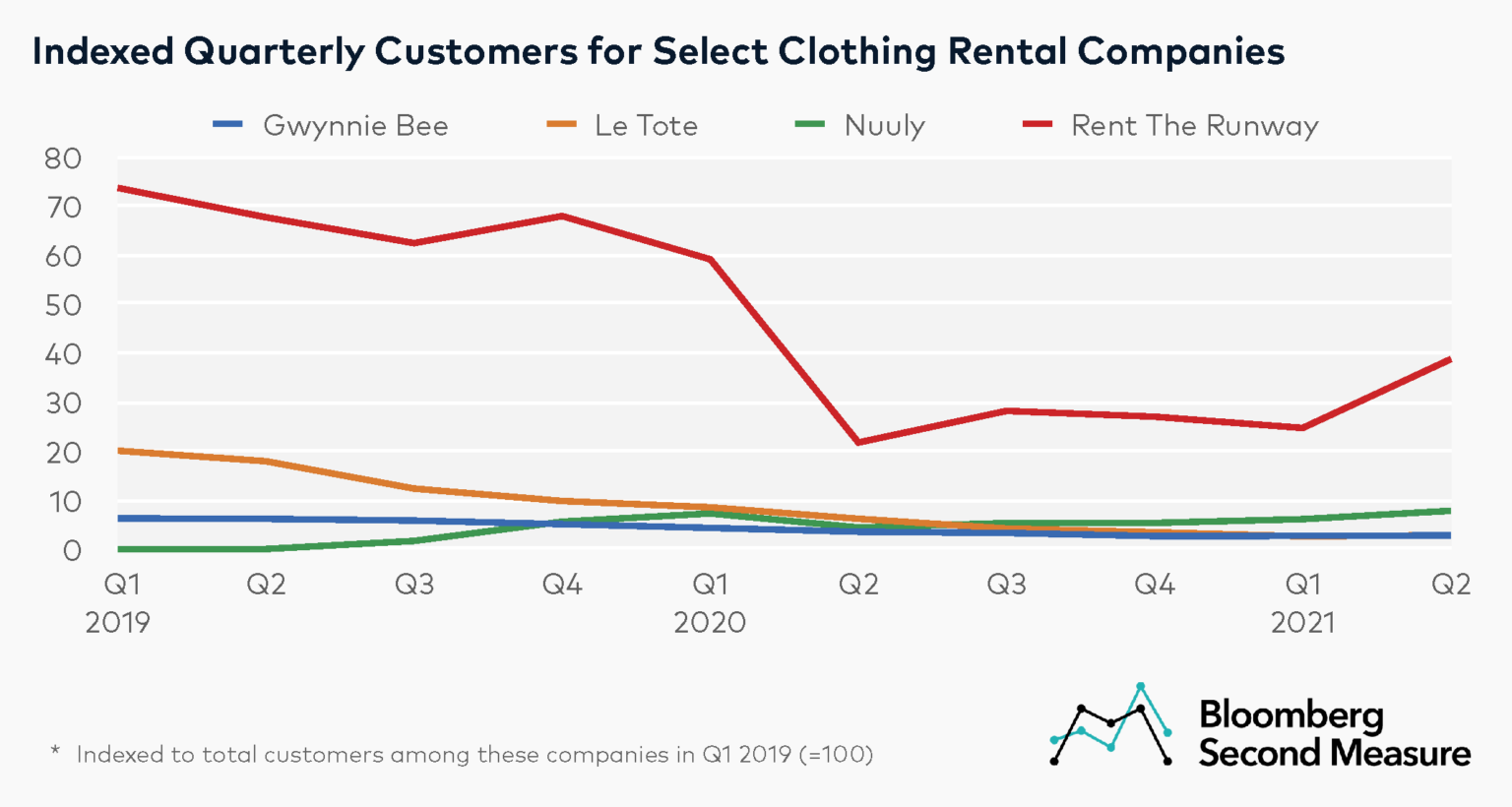

Between Q1 2020 and Q2 2020, customer counts for a select set of clothing rental companies (Rent the Runway, Nuuly, Gwynnie Bee, and Le Tote) declined 55 percent. After remaining low through early 2021, customer counts for clothing rental companies began to recover in the second quarter of 2021. In Q2 2021, combined customer counts among the competitive set increased 44 percent quarter-over-quarter and 45 percent year-over-year.

The highest year-over-year customer growth rates in Q2 2021 came from Rent the Runway and Nuuly, which both grew 78 percent year-over-year. With the exception of Nuuly, whose customer counts have fully recovered, customer counts for the clothing rental companies in the analysis are still well below pre-pandemic levels.

Rent the Runway, which confidentially filed for an IPO last month, had the most customers among the selected set in the second quarter of 2021. Nuuly, the clothing rental subscription launched by URBN in July 2019, had the second-highest number of customers. Gwynnie Bee and Le Tote had the lowest customer counts. It is worth noting that Le Tote acquired Lord & Taylor in late 2019; however, Lord & Taylor data is excluded from this analysis.

The percentage of new customers at Rent the Runway and Nuuly is approaching pre-pandemic levels

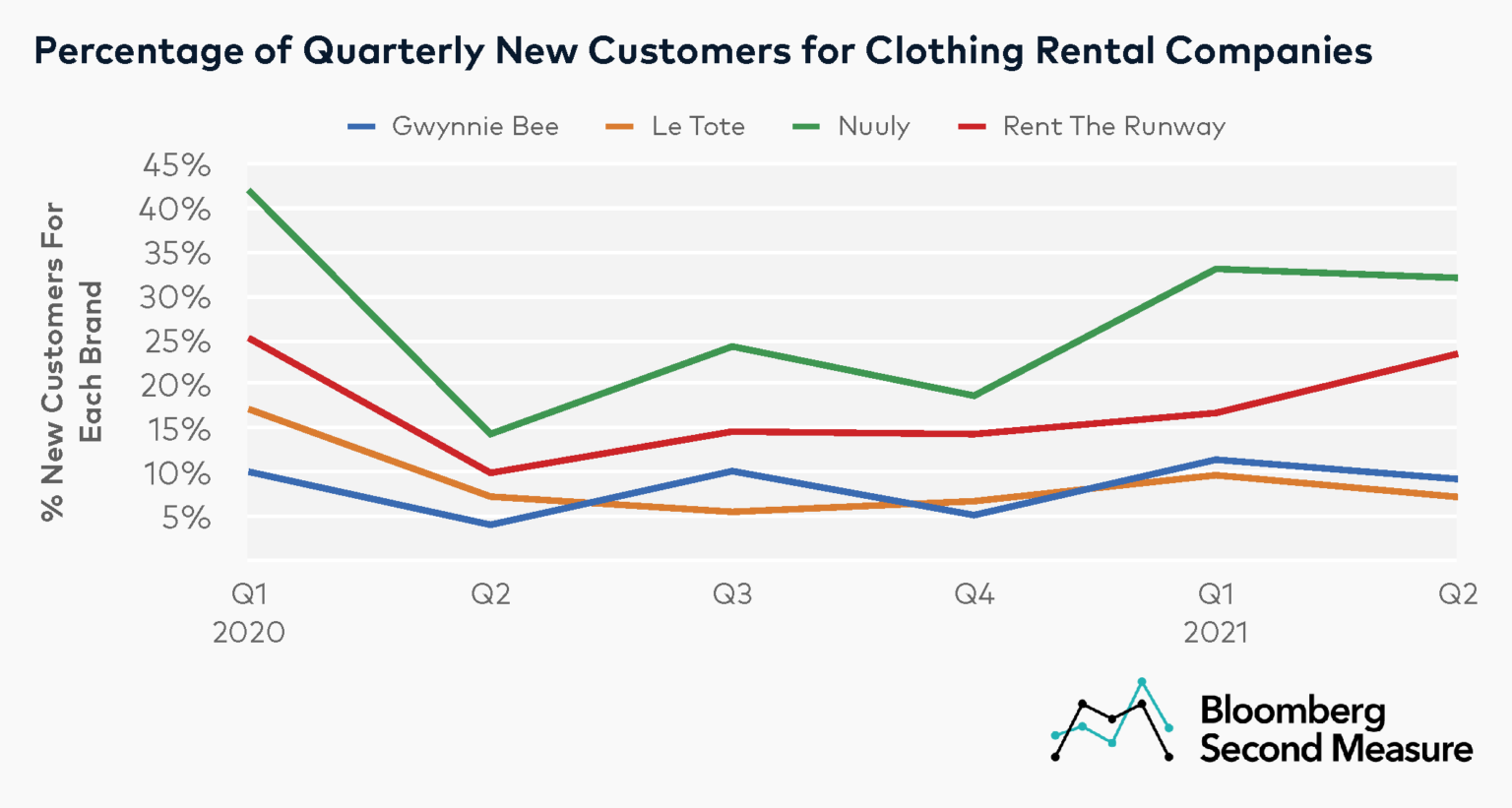

Returning customers comprise the largest share of clothing rental companies’ customer bases. However, a growing percentage of customers at Rent the Runway and Nuuly were categorized as new in the first and second quarters of 2021.

In Q1 2020, 42 percent of Nuuly’s customers were new. This share dipped to 14 percent in Q2 2020, at the height of shelter-in-place orders, but has since increased to 32 percent as of Q2 2021. One potential reason that Nuuly experienced a higher percentage of new customers than its competitors is that the company was launched more recently than the other competitors.

Similarly, 25 percent of Rent the Runway’s customers were new in Q1 2020, but this percentage decreased to 10 percent the following quarter. Rent the Runway’s share of new customers has gradually increased since then, reaching 23 percent in Q2 2021. On the other hand, the percentage of new customers at Gwynnie Bee and Le Tote is significantly smaller, at 9 percent and 7 percent, respectively, in Q2 2021.

Nuuly has the highest average lifetime sales per customer among 2021 cohorts

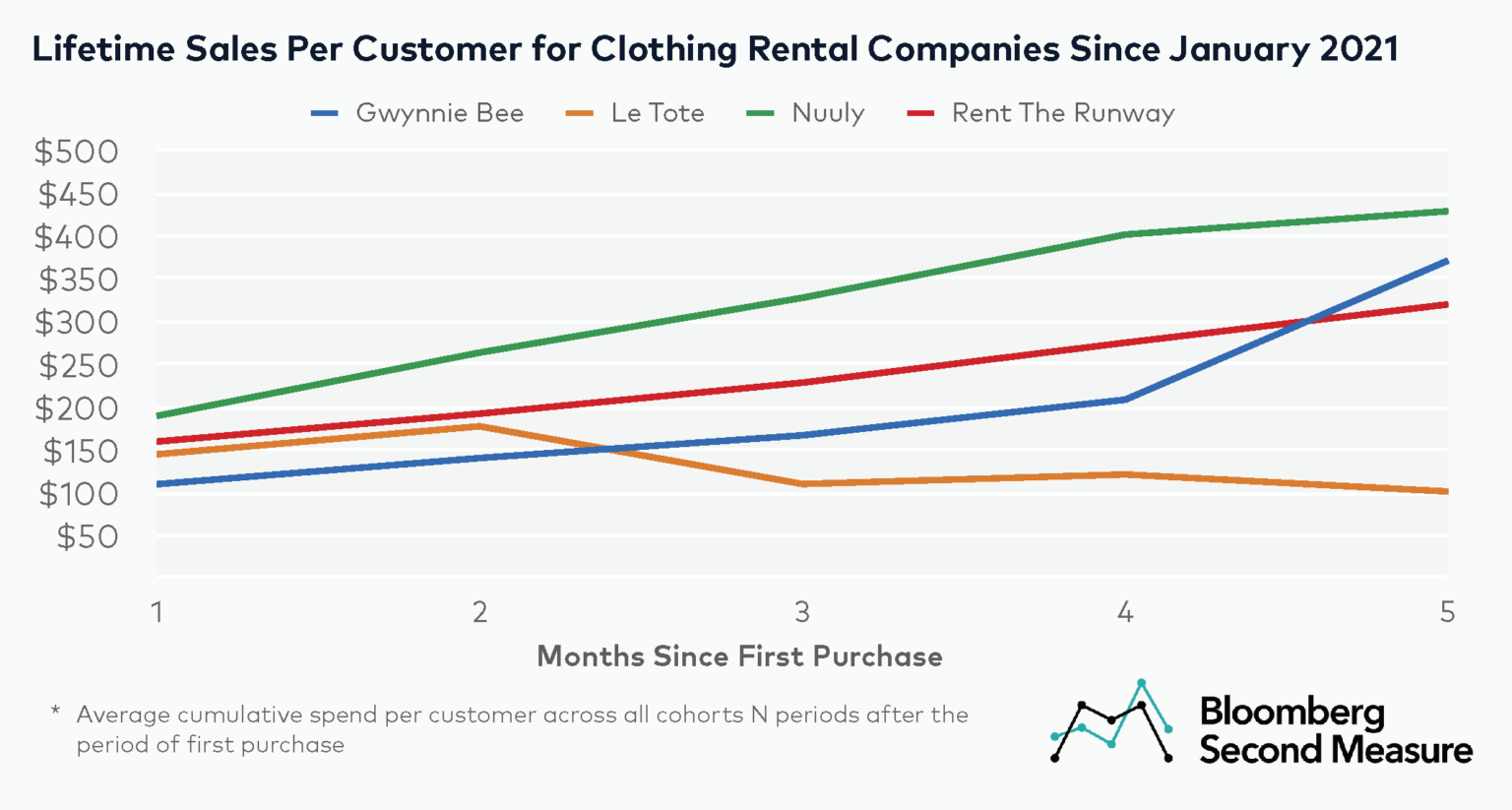

Despite being a relative newcomer to the clothing rental market, Nuuly had the highest average lifetime sales per customer during the first six months of 2021. For cohorts that made their first purchase in or after January 2021, the average lifetime sales per customer at Nuuly was $429, compared to $372 for Gwynnie Bee and $320 for Rent the Runway. Le Tote had the lowest average lifetime sales per customer in this time frame, at $101.

Each of these fashion rental companies has different subscription tiers and a la carte offerings. Rent the Runway recently revamped its subscription model, getting rid of the unlimited membership option and closing its five brick-and-mortar stores. Rent the Runway has also started a fashion resale program, enabling consumers to shop for pre-owned clothing items online without signing up for a subscription. Conversely, the other companies in our analysis have subscription plans, but only offer current subscribers the option to buy any of their rented items, without a separate marketplace.

Established retailers are also introducing clothing rental services

A growing number of retailers and fashion brands are launching rental services of their own. These include Infinitely LOFT, Vince Unfold, Banana Republic Style Passport, New York and Company Closet, My List at Bloomingdale’s, and Eloquii Unlimited. With both new and established companies entering the clothing rental market, consumers have a variety of options for updating their wardrobes.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.