Our latest white paper looks at the indoor and outdoor mall recovery. We chose a representative sample of 100 top performing indoor malls and 100 outdoor shopping centers from across the United States to see how a year of movement and gathering restrictions have affected visit and consumer behavior patterns. We made some adjustments to how we gathered the data to make sure our analysis was based on the most accurate and up-to-date numbers available.

We found that despite the dire predictions, many malls were actually emerging from COVID stronger than ever. Below is a taste of our findings.

Malls Make a Full COVID recovery

Already before the pandemic, numerous analysts talked about malls as a dying breed nearing extinction – and when the pandemic hit, the prognosis got even worse. But it turns out that malls are much more resilient than many expected, and shoppers’ forced separation from these emblems of American retail seems to have rekindled an old flame. Visit recovery patterns also emphasize that the ‘one-size-fits-all’ narrative surrounding malls is fundamentally flawed. Top performing centers are regional retail landmarks, and even if there are cases of ‘over-malled’ landscapes – the leaders are still well positioned for long-term success.

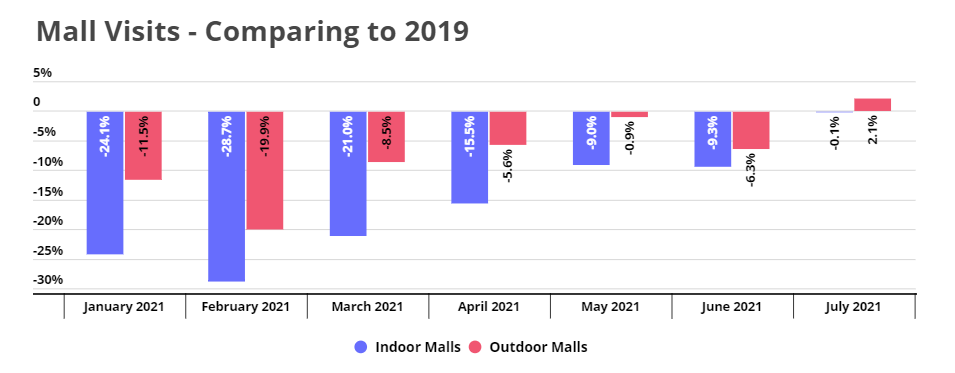

In July, outdoor shopping centers registered a 2.1% increase in monthly visits compared to 2019, while indoor malls narrowed the year-over-two-year visit gap to -0.1% – indicating that both indoor and outdoor malls have essentially fully recovered. The consistency of the recovery also points to the tremendous resiliency of the sector, even in the face of renewed COVID concerns throughout the country.

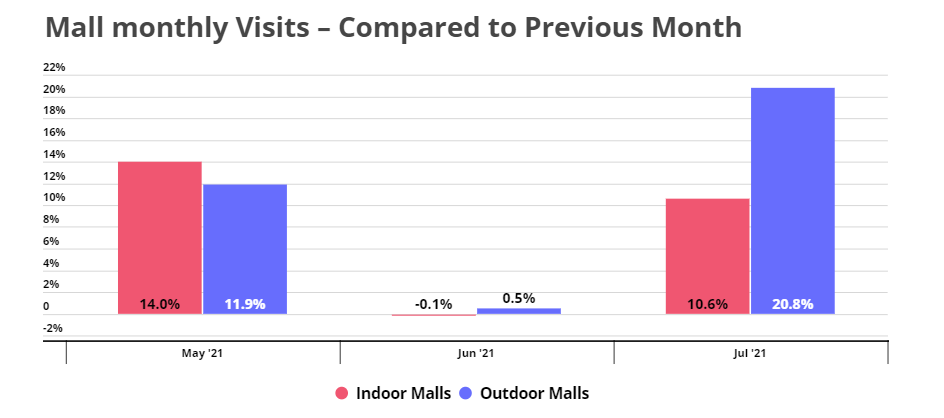

The month-over-month growth in foot traffic data also points to a mall resurgence. Month-over-month visits are either increasing or remaining steady, indicating that the mall recovery is here to stay. July visits to outdoor malls grew by 20.8% relative to June while visits to indoor malls grew by 10.6% – and this is before the Back to School shopping season kicks in fully, which is expected to give malls an additional boost.

July Turnaround

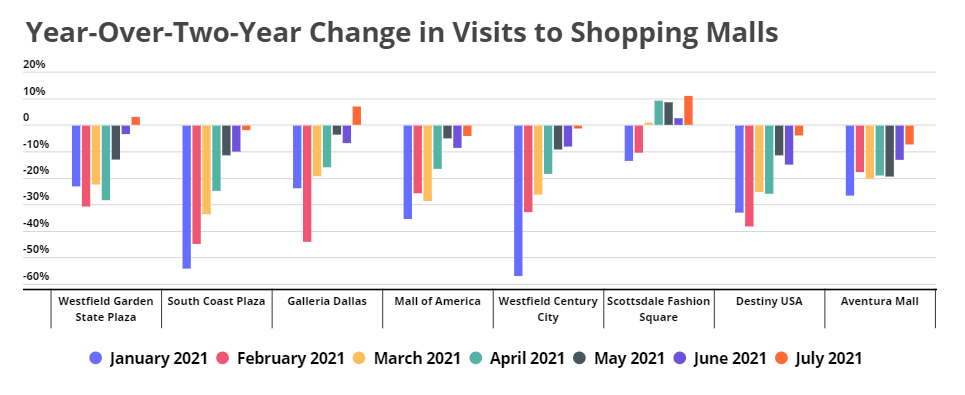

Some malls have already more than recovered in July and are showing an increase in monthly visits compared to 2019. The Westfield Garden State Plaza in New Jersey, the Galleria in Texas, and the Scottsdale Fashion Square Mall in Arizona have recorded impressive increases in July visits compared to two years ago of 3.0%, 6.9%, and 15.9%, respectively.

And while the Scottsdale Fashion Square Mall in Arizona has been on a growth streak for the past four months, July marked a turning point for other malls that had been struggling to return to 2019 foot traffic levels over the first half of 2021. The next few months will tell whether these malls can maintain their strength and continue to attract shoppers in even greater numbers than before the pandemic. Clearly, much of this is driven by differences in regional recoveries, but the fact that the overall trend is taking place across the country is an incredibly positive sign.

Growth in Trade Area Size

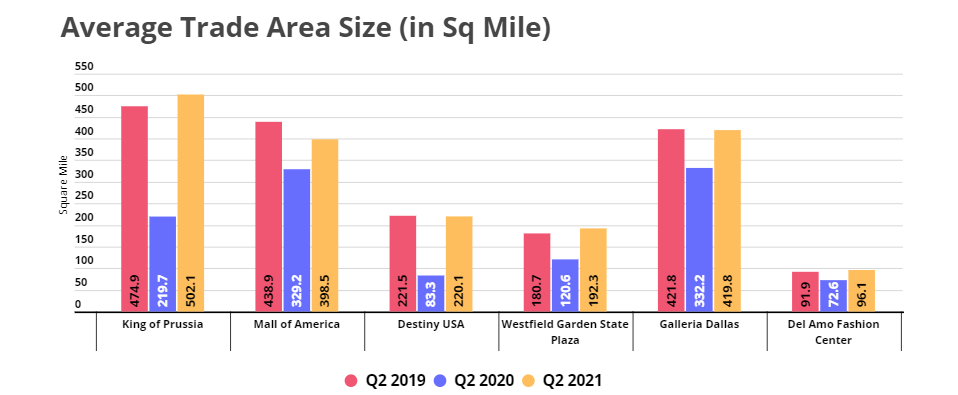

True Trade Area size measures how far consumers are willing to travel to visit a certain venue. Over the pandemic, True Trade Areas for malls shrunks as consumers minimized their shopping trips and made do with the mall closest to home. Now, True Trade Areas are once again increasing to pre-pandemic dimensions – and sometimes even beyond.

In June 2019, the average True Trade Area for the 100 malls we analyzed was 160 Sq miles, but in June 2020, at the height of the pandemic, the average size dropped to 146 Sq miles. By June 2021, the average True Trade Area had returned to become 159 Sq miles.

For some malls, True Trade Area has increased since the pandemic, indicating that customers are willing to travel further than they were before the pandemic to visit these malls. For example, King of Prussia Mall outside of Philadelphia saw its TTA increase from 474.9 sq. mi. to 502.1 sq. mi.; Westfield Garden State Plaza in Paramus, NJ, saw its TTA increase from 180.7 sq. mi. to 192.3 sq. mi; and Del Amo Fashion Center outside of Los Angeles saw its TTA increase from 91.9 sq. mi. to 96.1 sq mi.

The increase in TTA also hints to the growing competition in this space. As customers are willing to drive further if it means visiting a “better” shopping centers, malls will need to step up their offerings if they wish to stay in the game and continue to attract customers who are increasing expecting their malls to provide not just shopping, but also a diverse array of dining options, entertainment choices, and services.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.