As the cornerstone of many living rooms around the world, the TV set remains a fixture for media consumption. That consumption, however, looks much different than it did a few years ago. Just as it has in the U.S., the market where Netflix was born, connected TV (CTV) adoption and streaming enablement are redefining how global consumers are spending their TV time.

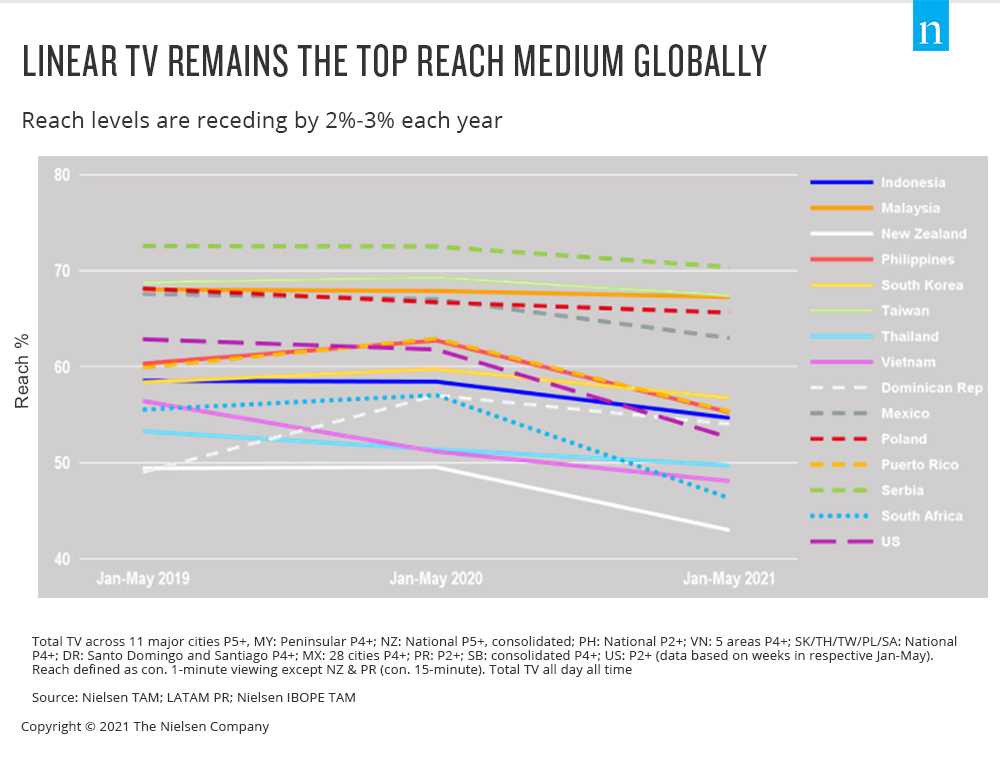

In aggregate, linear television remains the best way to reach mass audiences, but reach levels are dropping between 2% and 3% each year as viewing behaviors fragment across the growing variety of streaming content.

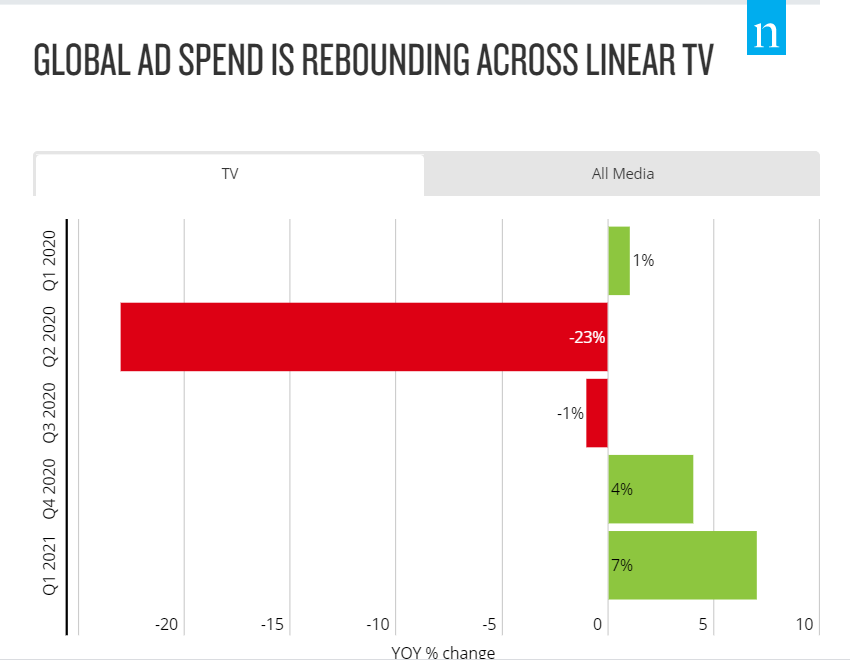

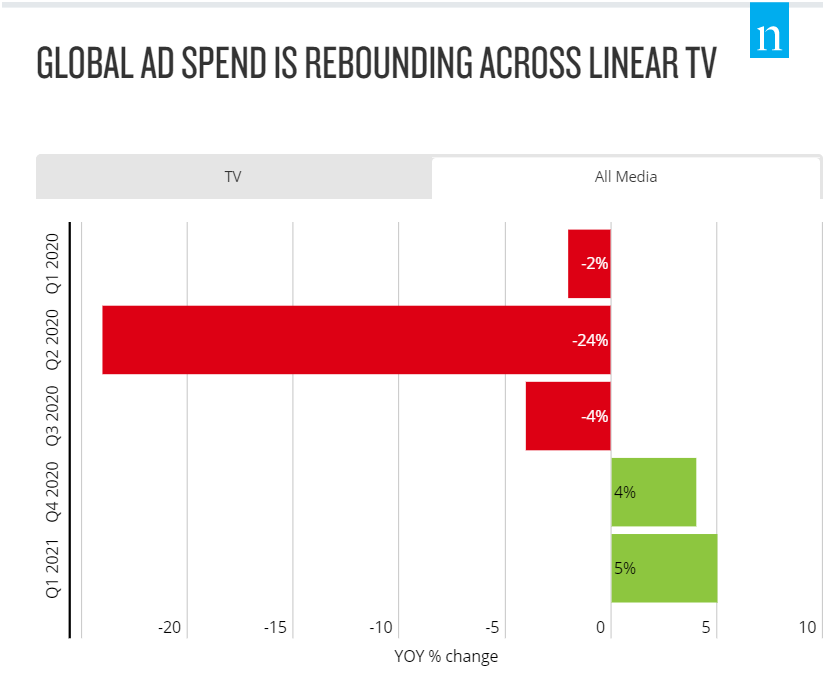

Despite fragmenting viewership, and in contrast to what many marketers say about their planned spending, global ad spend on linear TV has bounced back stronger than spending across all media following the global ad pullback last year. The revitalized commitment speaks to the enduring influence of linear TV, even though the pandemic viewing gains of last year have receded.

Outside of traditional TV programming, platforms like Netflix, YouTube, Facebook, Amazon Prime, Tencent Video, TVING and Nordic Entertainment have established streaming footholds in an array of established global markets, including Mexico, Poland, Sweden, South Korea and Hong Kong. As these players grow their libraries and seek increased engagement, there’s no question that the TV screen will remain the most valuable media real estate in the household, with rapidly expanding content options. In the U.S., for example, streaming video accounted for 27% of viewers’ total TV time in June 2021.

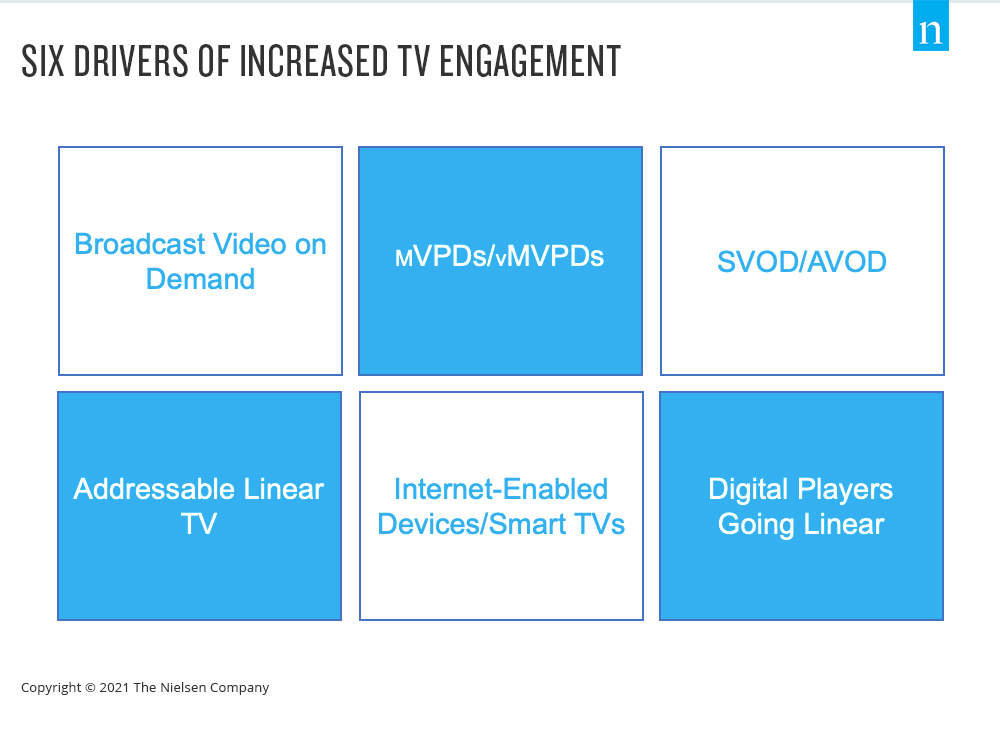

And just as we’ve seen in the U.S., large media companies with established footholds in the global TV space are innovating to build broadcast video-on-demand (BVOD) libraries to give audiences the opportunity to view premium content at their convenience and drive incremental ad sales. Media companies are also experimenting with dynamic ad insertion to provide addressability and personalized messaging within their linear TV programming.

Multichannel video programming distributors (MVPDs) and virtual MVPDs (vMVPDs), many of which are operated by traditional TV companies, are also gaining traction among viewers, as they offer viewers tailored content flexibility without a commitment to a cable or satellite subscription. In the U.S., Nielsen Streaming data shows that ad-supported video-on-demand (AVOD), multichannel video programming distributors (MVPDs) and virtual MVPDs (vMVPDs) accounted for 36% of the total minutes streamed in June 2021.

In total, six key trends are driving increased TV time in ways that linear programming could not do alone. This is what the evolution of TV viewing looks like, and these trends present the industry with the next big battle: the quest for consumers’ share of TV time.

Importantly, the fragmenting video viewing landscape places a new emphasis on understanding audiences, and not just who they are. As channels, platforms and content options increase, consumers will engage with the options that are most appealing to them, and that will continue to affect traditional TV viewing trends. CTV, which facilitates everything from streaming video to addressable advertising to skinny TV bundles, is transforming the viewing experience—and opening new advertising opportunities in the process.

In Europe, recent IAB research found that more than 50% of advertisers and nearly 100% of agencies cite CTV/addressable as a key growth area for digital video over the next 12 months. That growth expectation is backed by growing consumer demand, with the IAB citing eMarketer forecasts that over-the-top (OTT) subscribers in Western Europe will increase from 133 million in 2019 to 159 million by 2023. Just last year, 50% of the CTV audience in Europe watched streaming content daily, according to Statista survey findings.

The increasing diversity of content is a boon for consumers. It also illustrates the ever-growing evolution of TV viewing—something that all parties will need to stay in tune with in order to know where the eyeballs are, as well as which options will best engage them.

To learn more about the data behind this article and what Nielsen has to offer, visit https://www.nielsen.com/us/en/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.