With the help of summer vacation, Mainland China’s overall hotel occupancy rate showed a good upward trend in July, with the second and third week of the month reaching 2019 levels.

Average daily rate (ADR) was even stronger, and when indexed to 2019, remained stable at roughly 110—meaning it was well above 2019 levels. As a result, Mainland China’s revenue per available room (RevPAR) index climbed from 87 at the beginning of the month to 117 by the end.

However, with confirmed COVID-19 cases in Nanjing on 20 July, momentum shifted abruptly. The current outbreak has spread to several provinces and cities across the country, resulting in show cancellations and meetings postponements. The out-of-the-city initiative has put the hotel industry, which had been looking forward to this summer’s summer vacation, back into a winter-type situation and significantly shortened summer vacation season.

As such, national occupancy and RevPAR have shown a certain downward trend since 20 July. At the end of the month, due to the spread of the pandemic, some provinces and cities have repeatedly reported new local cases, and hotel performance has dropped sharply with occupancy at only 60% of the comparable period in 2019.

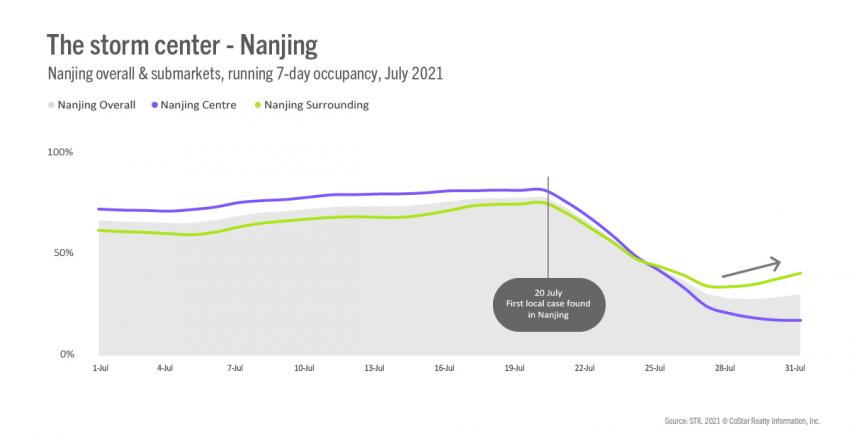

Nanjing deep dive

As the epicenter of this latest outbreak, Nanjing’s hotel market performance has been hit hard. After cases were reported on 20 July, Nanjing’s overall occupancy fell sharply over the next seven days, dropping rapidly from a peak of 78% to a trough of 28%. The city center market, specifically, bottomed out at 17% on the last day of July.

Although the market around Nanjing also experienced a sharp decline on 25 July, the submarket, however, showed a small increase at the end of the month reaching levels of more than 40%. It is believed that the main reason for that higher level is that some surrounding hotels have been temporarily requisitioned as quarantine hotels.

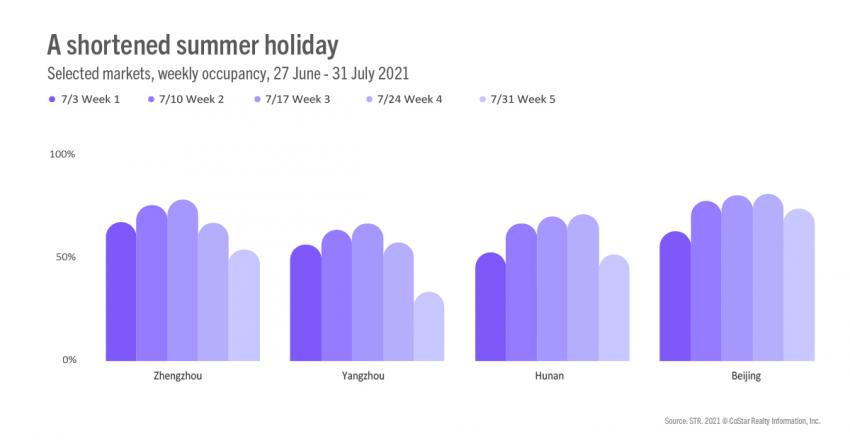

Select market performance

In the past five weeks, Mainland China has shown a trend of up and then down. Occupancy peaked in the third week or fourth week of July and then fell to varying degrees.

On 20 July, the Hunan Province was hit by heavy rains, with serious flooding in Zhengzhou. Occupancy fell from nearly 80% in the week ending with 17 July to 50% in the week ending with 31 July, with a loss of nearly 30%. In addition to the current emergence of local cases in Zhengzhou, the situation is even worse.

Yangzhou, the second-worst city to be affected by the recent outbreak, saw a 33% occupancy rate for the week ending 31 July.

Hunan Province’s occupancy rate, affected by the local outbreak in Zhangjiajie, fell by 20% in the last week of the month.

Beijing is a summer market, with occupancy rates exceeding 80% in the third and fourth weeks of July. But with the spread of this outbreak, the last week of the month showed a downward trend. Sporadic confirmed cases of related cases no doubt cast a shadow on the market.

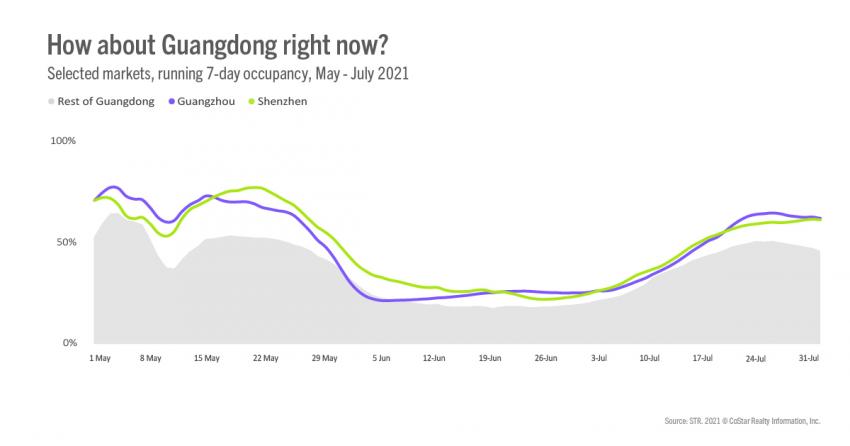

Guangdong recent performance

Over the past three months, Guangdong’s occupancy rate has been on a rollercoaster. The Labor Day holiday rushed to a high point, then fell, and then quickly recovered, while Shenzhen occupancy was as high as 77%. However, due to the emergence of the outbreak in Guangzhou, the market’s occupancy fell off a cliff, dropping to as low as 20%.

After a full month of decreases in June, July began to show a gradual climb, with end-of-month occupancy at 60%. Although the recent domestic outbreak situation is serious, Guangdong hotel market has shown resilience.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.