Last week, Abercrombie & Fitch announced Zappos as its exclusive e-commerce partner in the U.S., with a footwear collaboration on the horizon. In today’s Insight Flash, we dig into the collaboration, comparing growth rates, demographics, and cross-shop to see where the benefits might lie.

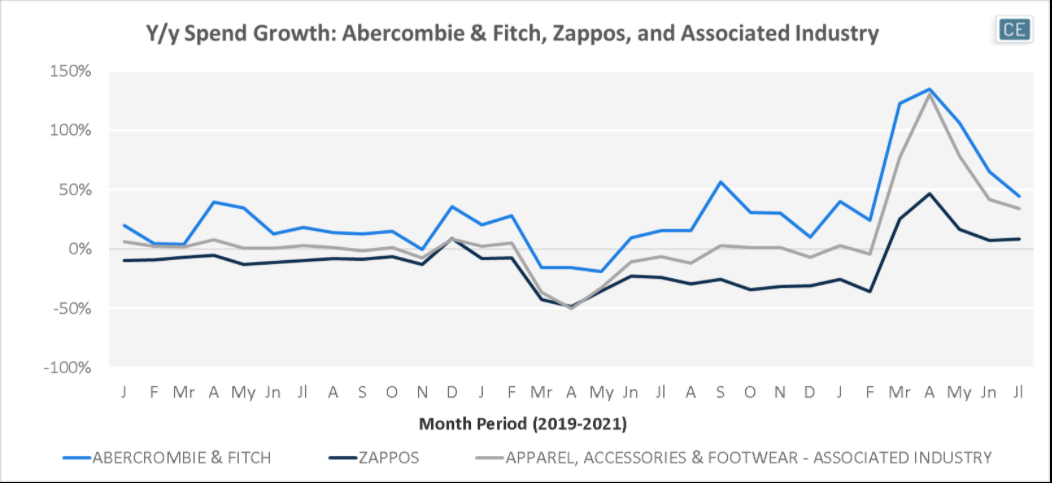

While Abercrombie & Fitch has seen spend growth steadily outperform the Apparel, Accessories & Footwear industry over the last two and a half years, Zappos has consistently underperformed. For Abercrombie, lapping easy compares from store reopenings has led to summer growth in June and July of 65% and 44%, a 10% margin versus the rest of the industry. Meanwhile, Zappos’s online affiliation didn’t give it the boost it should have during the pandemic – April 2020 was the only month spend growth has been inline with industry trends since the beginning of 2020, with spend growth lagging the rest of the time.

Industry Trends

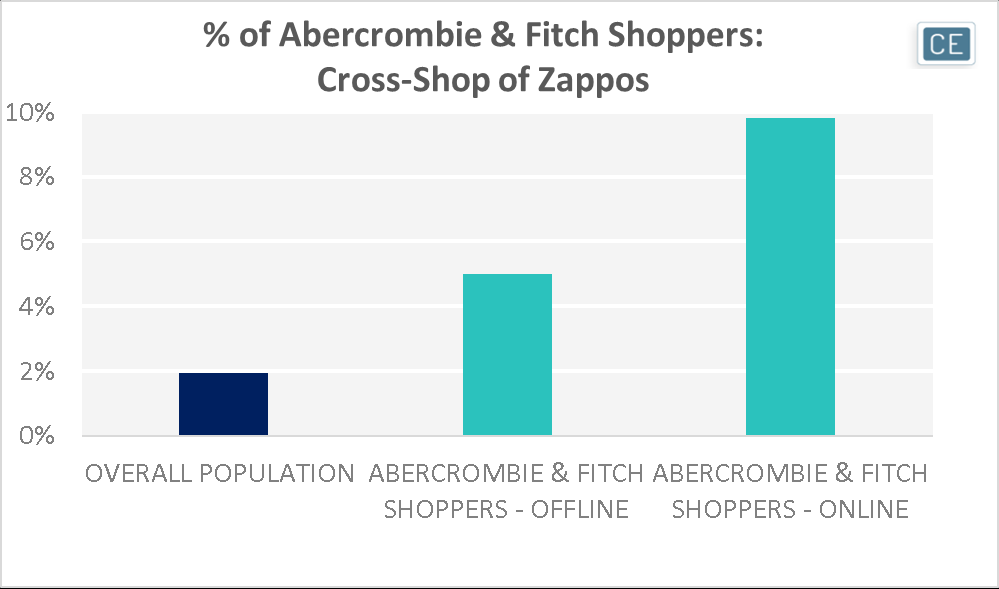

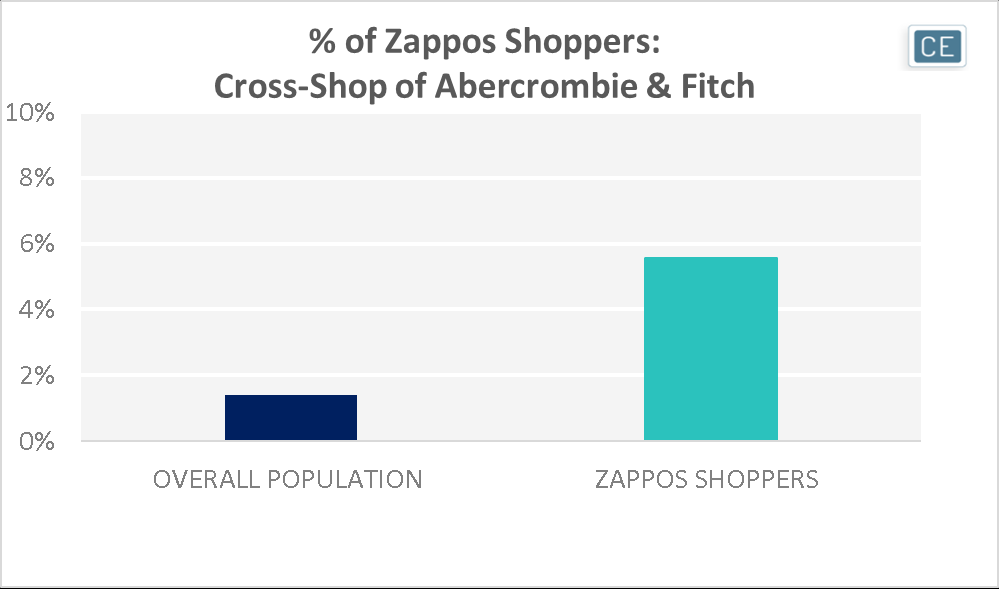

Our data allows users to segment shoppers by online versus offline behaviors. One interesting thing to note is that while all Abercrombie & Fitch shoppers are more likely to shop Zappos than the overall population, those who shop the brand online are twice as likely to shop Zappos as those who shop offline. Conversely, Zappos shoppers are four times as likely as the overall population to shop Abercrombie & Fitch. This means that there are likely to be strong synergies for both parties from the collaboration, linking brands that have high affinities among their shared shoppers.

Cross-Shop

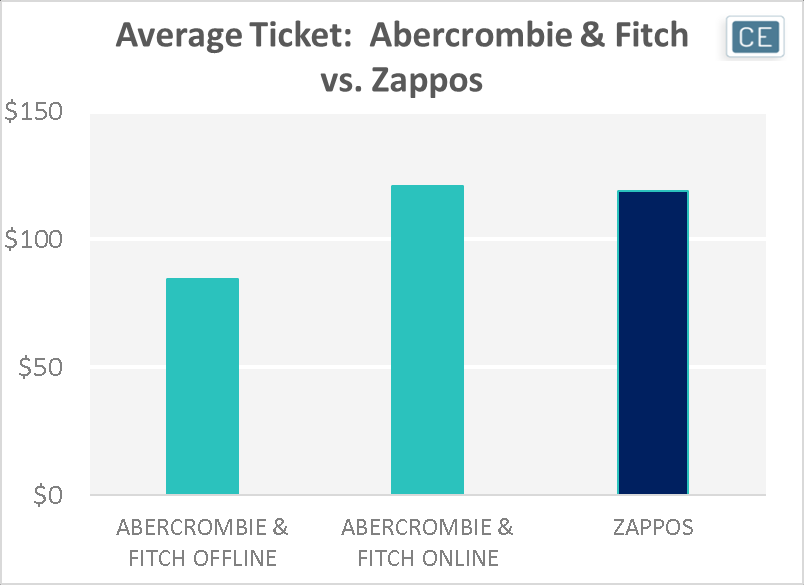

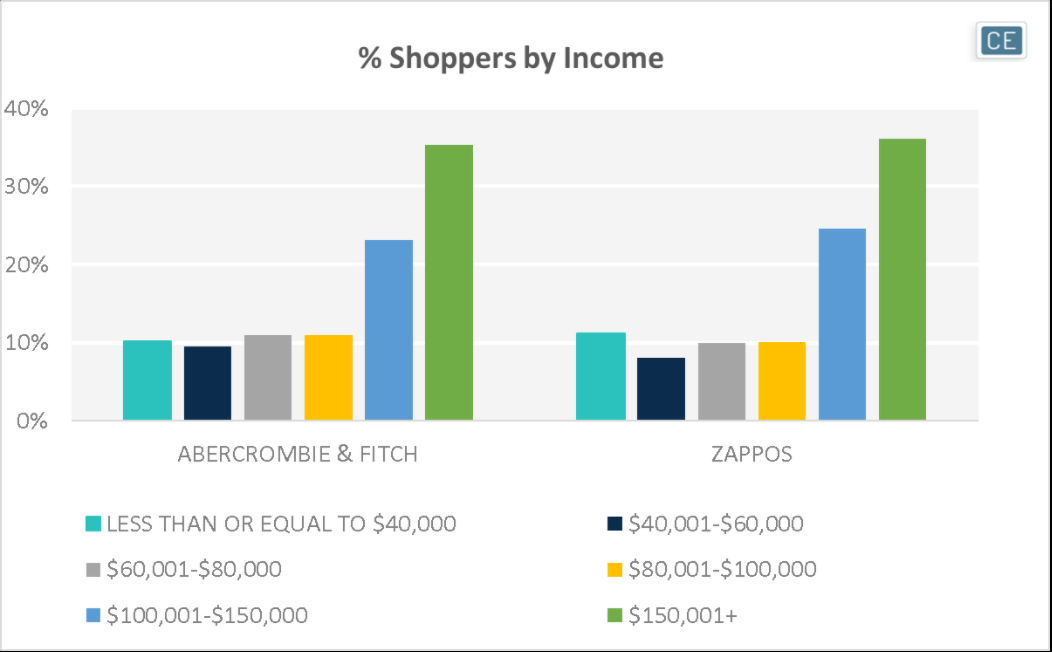

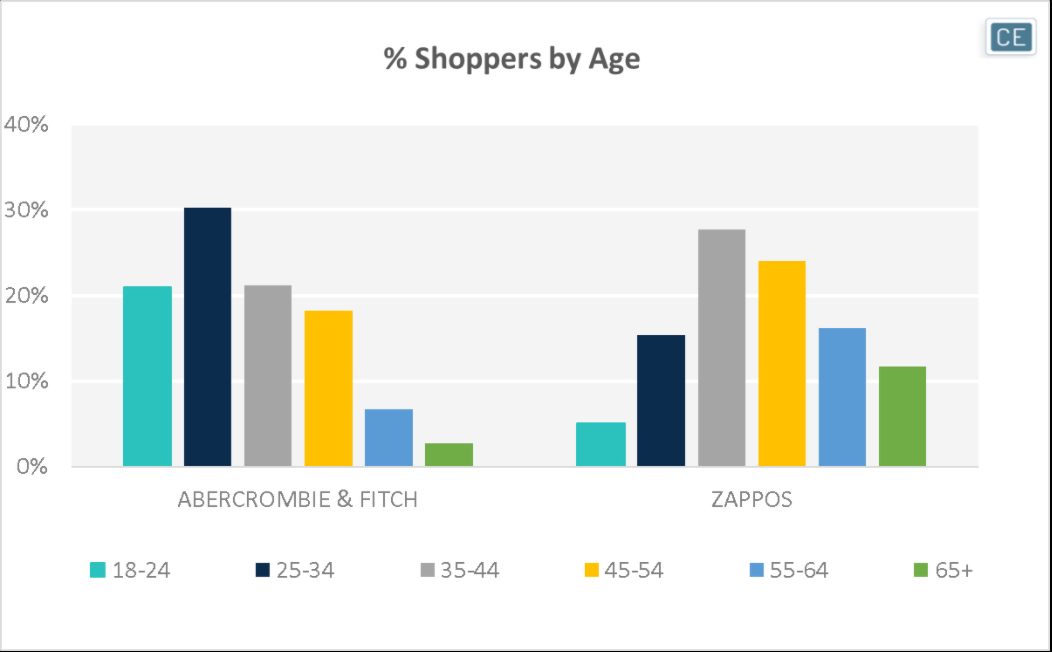

Abercrombie & Fitch and Zappos also have synergies in capturing customers at a similar spend level. The average Abercrombie & Fitch transaction over the last year was $85 offline and $121 online. The online spend per transaction was almost exactly the same as Zappos’s at $119. Some of this may be due to the fact that the companies attract shoppers with similar income levels. But, Abercrombie reaches a much younger audience and can potentially bring those consumer to the Zappos platform. Meanwhile, Zappos’s older shopper base could be converted to Abercrombie purchases as they’re browsing the site.

Pricing and Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.