The travel industry was one of the hardest hit over COVID, but foot traffic trends indicate that the sector has been gradually rebounding since the beginning of the year. With August in full swing, we dove into the data for some of the nation’s major hotels chains and airports to get a sense of where the travel recovery stands today.

Air Travel in the Time of Corona

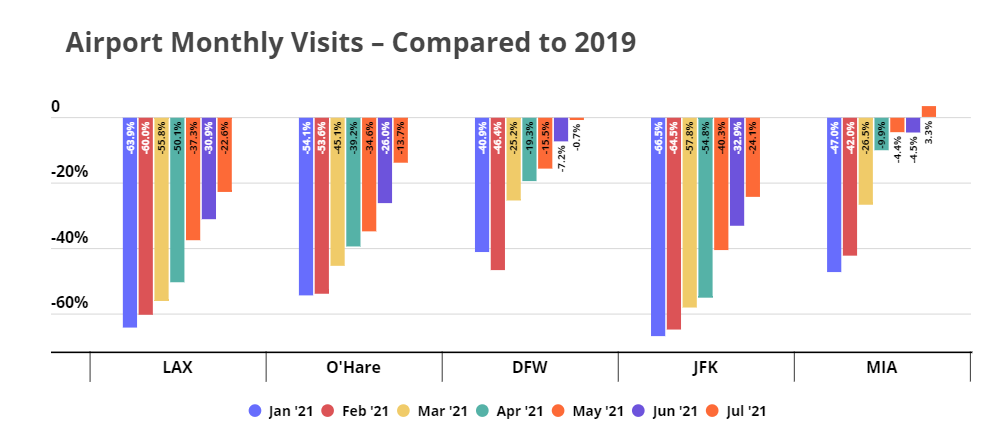

Air travel is still very much complicated by COVID, with safety precautions still causing flying to be much more burdensome than it was pre-pandemic. Still, despite the difficulties, airport visits are slowly climbing back up. Miami and Dallas Fort Worth International Airports are now fully back in action, with July visits up 3.3% and down only -0.7%, respectively, compared to 2019.

LAX, Chicago O’Hare, and JFK are recovering more slowly, with a drop in monthly visits of 22.6%, 13.7%, and 24.1%, respectively when comparing July 2021 to July 2019. But Lax, O’Hare, and JFK have also been consistently narrowing their visit gaps over the past few months, so these airports should be well on their way to recovery – even if it takes them a little longer to get there.

Uncertain Future

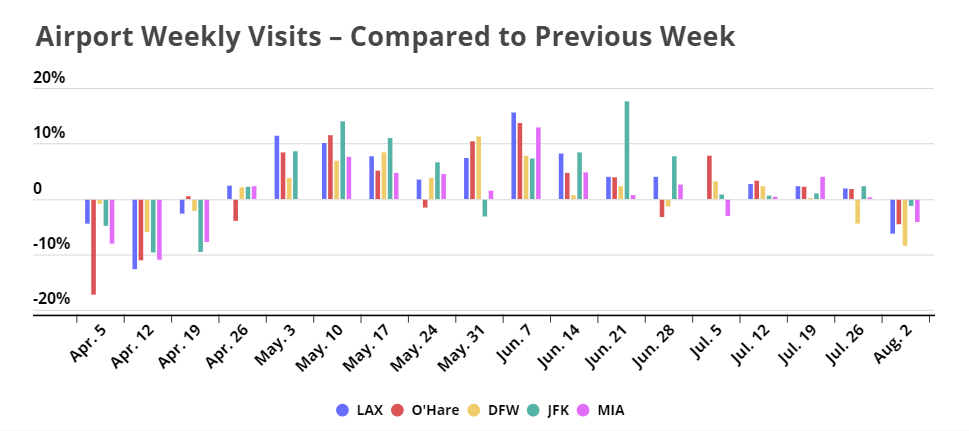

Most of the locations analyzed exhibited a weekly increase in visits compared to the previous week for almost each full week in May through July, For example, visits the week of July 19th grew by 2.3%, 2.2%, 0.2%, 1.0%, and 4.0% at LAX, O’Hare, DFW, JFK, and MIA, respectively, compared to the previous week.

But now, the travel recovery may be stalling. The week of August 2nd showed week-over-week visits to LAX, O’Hare, DFW, JFK, and MIA, fell by -6.1%, -4.4%, -8.3%, -1.1%, and -4.0%, respectively – the first time since April that week-over-week visits were down for each chain. The next couple of weeks will be critical in assessing whether the contraction in visits is a mere glitch or reflective of a larger trend.

Hotels Make a Comeback

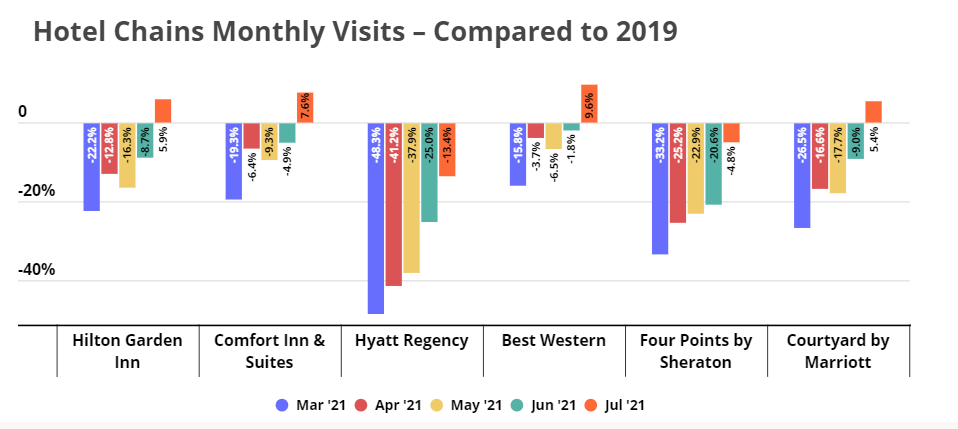

The hotel recovery appears to be pulling ahead of the airport recovery. Hilton Garden Inn, Comfort Inn & Suites, Best Western, and Courtyard by Marriott all saw a year-over-two-year growth in July visits, with an increase in monthly visits of 5.9%, 7.6%, 9.6%, and 5.4%, respectively.

And while July visits to Hyatt Regency and Four Points by Sheraton were still down compared to July 2019, these hotels managed to close their visit gap significantly: Hyatt Regency narrowed its year-over-two-year visit gap from -25.0% in June to -13.4% in July, while Four Points by the Sheraton shrunk its visit gap from -20.6% in June to -4.8% in July.

Rate of Recovery Slowing Down?

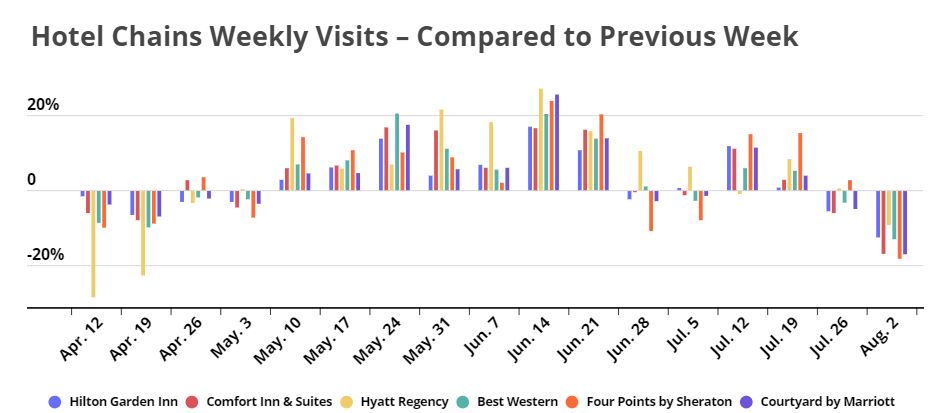

But while the week-over-week growth in hotel visits has been more significant than the growth in airport foot traffic, the arc of the two recovery journeys has been similar, with visits consistently rising week over week pretty across the board. And just like with the airport visits, the weekly rate of growth in hotel foot traffic appears to be dropping.

Visits during the week of August 2nd to Hilton Garden Inn, Comfort Inn & Suites, Hyatt Regency, Best Western, Four Points by Sheraton, and Courtyard by Mariott were down -12.4%, -16.8%, -9.1%, -12.9, -18.1% , and -16.9%, respectively, compared to the previous week. Like for airports, the first full week of August marked the first time that all four exhibited a week-over-week drop in visits after showing consistent week-over-week gains for much of the spring and summer.

It looks like August will mark a key turning point for the travel industry. After particularly strong July visit numbers at both airports and hotels, the growth rate appears to be slowing. The drop in the pace of recovery could be attributed to the recent rise in new COVID cases and renewed consumer concern surrounding the safety of flying, or it could just be a natural contrast to the initial summer surge. Keeping an eye on airport and hotel visits over the next couple of months will determine if the travel industry has recovered from the pandemic’s impact or whether the dwindling visit growth is a sign of the challenges still facing the sector.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.