As the pandemic’s retail impact was initially being felt, there were some retailers and segments that were better positioned than others, and some that actually looked better positioned than ever.

Home Improvement leaders not only saw the benefit of strong alignment with key trends, but essential retail status early in the pandemic provided a unique opportunity for exceptional growth. Grocery and off-price retail were well-positioned sectors that managed to take full advantage of this opportunity. The result was a combination of relative strength during the pandemic and extended strength as the recovery took shape.

Yet, one sector that seems to have missed out on a big opportunity is the office supplies sector.

The (Missed) Opportunity

As consumers were making their way to home improvement chains across the country, the work-from-home trend offered a powerful opportunity to reinvigorate a challenged office supply ecosystem. The rise of Amazon and other eCommerce competitors, and a struggle to clearly differentiate against retail giants like Walmart and Target, limited the success of players like Office Depot and Staples.

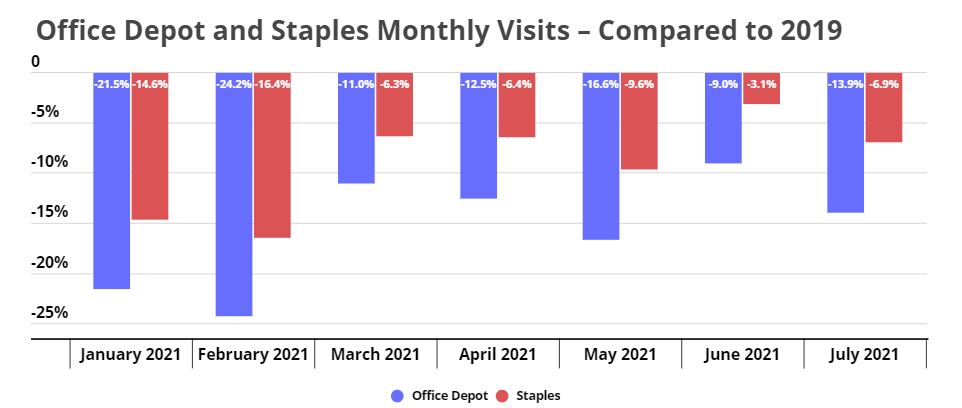

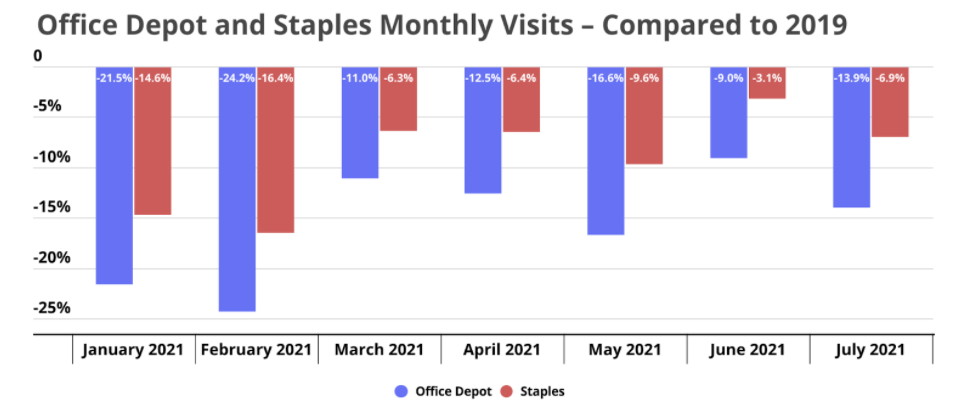

Yet, there were signs that the office supply leaders were trying to take advantage of the opportunity. 2021 showed a consistent decrease in monthly visit gaps compared to 2019 with June visits to Staples down just 3.1% and Office Depot visits down just 9.0% – the best marks in 2021 for both chains. But July marked a step back as visit gaps increased.

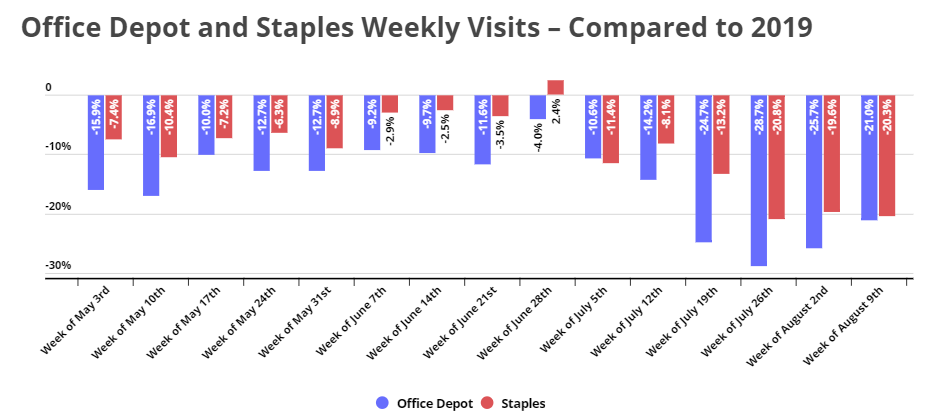

While a certain degree of up and down was to be expected in any sector, the increasing visits gaps are coming during the office supply sector’s critical Back to School period – and the gaps only increased as the season continued. Visits the weeks beginning August 2nd and 9th were down an average of 23.4% for Office Depot and 19.9% for Staples compared to the equivalent weeks in 2019.

Meanwhile, brands like Target and Walmart are seeing significant growth compared to their equally strong 2019 Back-to-School seasons.

The Silver Lining

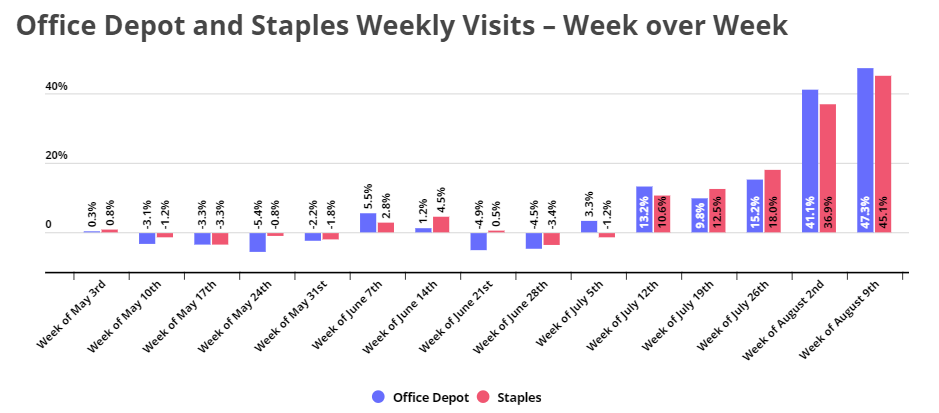

Yet, there are still reasons for optimism. Though visit gaps compared to 2019 increased in July and will likely grow again significantly in August, normal seasonality has remained. Both chains are seeing peaks in July and August relative to the rest of the year, indicating that many consumers still recognize these two players as a key piece of the Back-to-School and office puzzle.

There’s also the staying power of work from home that may contribute to demand. Whether it is a Geek Squad-esque approach modeled on Best Buy or a model that brings a home improvement style lens to the home office with a combination of business focused and DIY elements, there’s still a lingering demand.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.