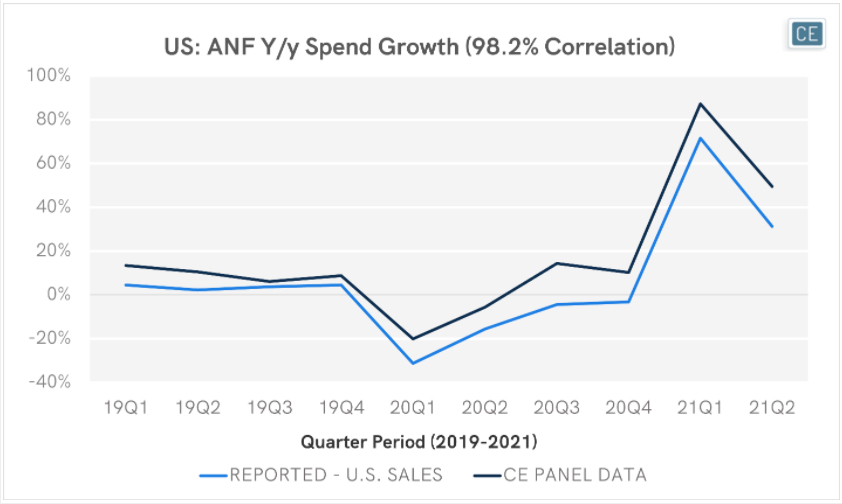

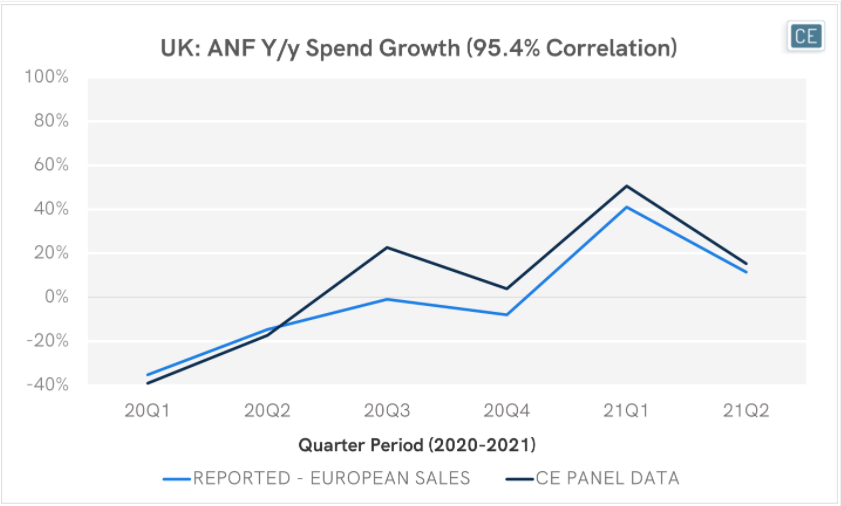

Company performance often differs across geographies. Often, more than one data source is needed to get a complete view. CE Transact provides this view in both the US and the UK. For a company like Abercrombie & Fitch, the data has been highly predictive in both markets. In today’s Insight Flash, we compare channel trends and brand growth across the two geographies.

Data Correlations

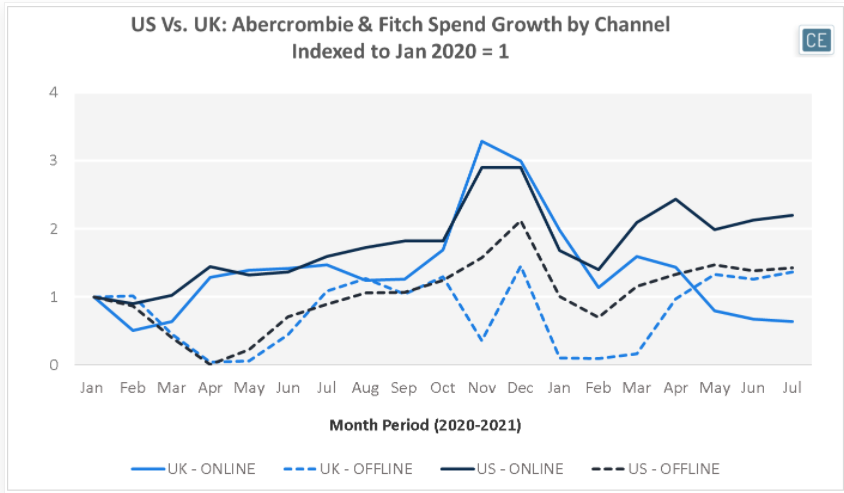

For the most part, online spend growth has surpassed offline spend growth for Abercrombie & Fitch in both the US and the UK since January 2020. However, in the UK this appears to be largely due to store closures as offline growth was stronger both at the beginning of 2020 and in the most recent months of 2021. In the US, online spend growth has been more consistently strong regardless of store closures. Interestingly, US online growth has for the most part been stronger than UK online growth, except during the holiday season. With different reopening cadences a likely factor, UK online spend growth for ANF was higher than US online spend growth in November and December of 2020. In the US, offline growth peaked in December, higher even than March and April’s lapping of 2020 store closures.

Channel Trends

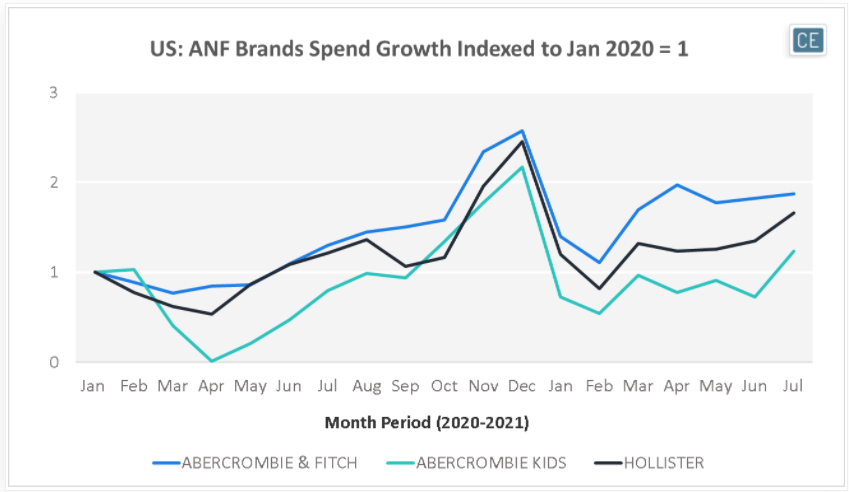

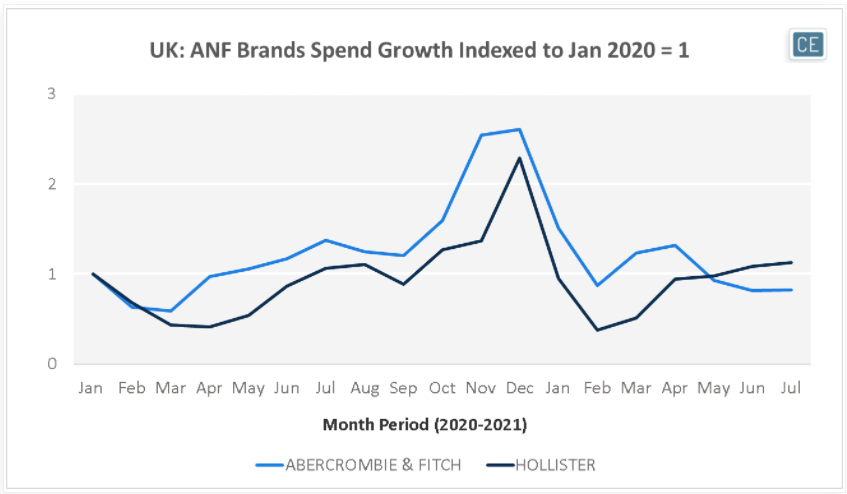

In the US, the core Abercrombie & Fitch brand has led growth throughout almost all of 2020, with outperformance versus Hollister widening in recent months. Growth for sales captured as Abercrombie Kids has consistently lagged the other brands. In the UK, Abercrombie & Fitch spend growth outperformed Hollister’s spend growth from March 2020 through April 2021, but Hollister began to see stronger growth in May 2021.

Brand Growth

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.