There was a location data report published last month called ‘Malls Rise Once Again’ that caught people’s attention. It claimed that malls have made a ‘full COVID recovery’ and have as many visitors as in 2019. We at Advan live and breathe location data, so our intuitive response was ‘no way, how have we missed this… ’.

The reality is, while mall traffic has certainly been improving, it is still down 22% versus 2019. If the visitation estimates for such big, and therefore easier to measure, properties are so off from reality, one could imagine how misleading similar reports could be for the actual retailers residing in these malls. The smaller the property measured, the harder it becomes to estimate the visitation counts for various reasons that we will analyze in a future blogpost.

The analysis:

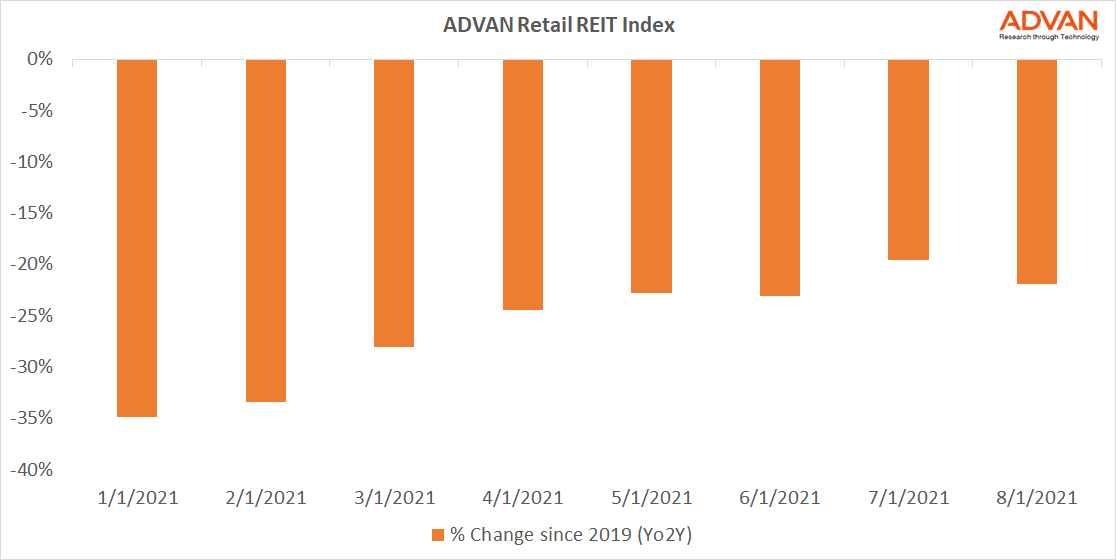

Using as a proxy the ‘Advan Retail REIT’ index that we have been monitoring closely since 2015, we confirmed what most people very well knew was the case, that by no means the malls nationwide have made a ‘full COVID recovery’.

We looked at our data one way, looked at them another way, we analyzed different regions, different malls, different time periods, different data sources and different normalizations but the results were mostly the same. Malls in aggregate have been performing consistently better but are not yet at their 2019 levels. The most optimistic of views has the malls currently standing at a -22% change from August 2021 to 2019 (this is the “Yo2Y”, i.e., change from 2 years ago).

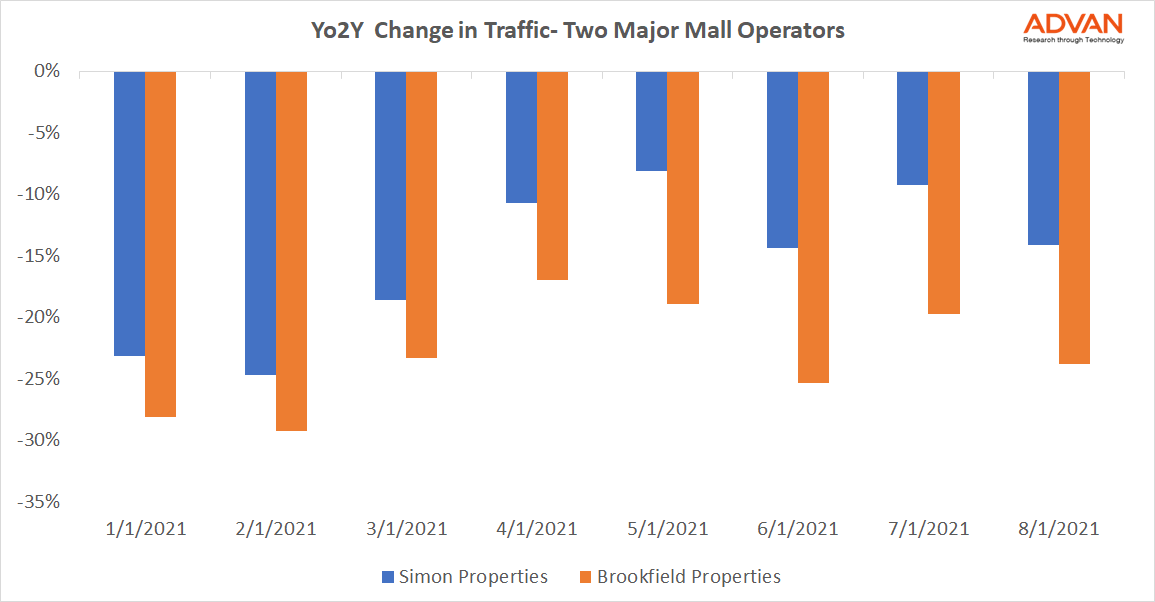

Along with the ‘Advan Retail REIT’ index we also looked at the footfall on two prominent publicly trading mall owners, Simon and Brookfield properties. These results too were pointing at the same direction, no full recovery to be seen. The August Yo2Y change was at -14% and -24% respectively.

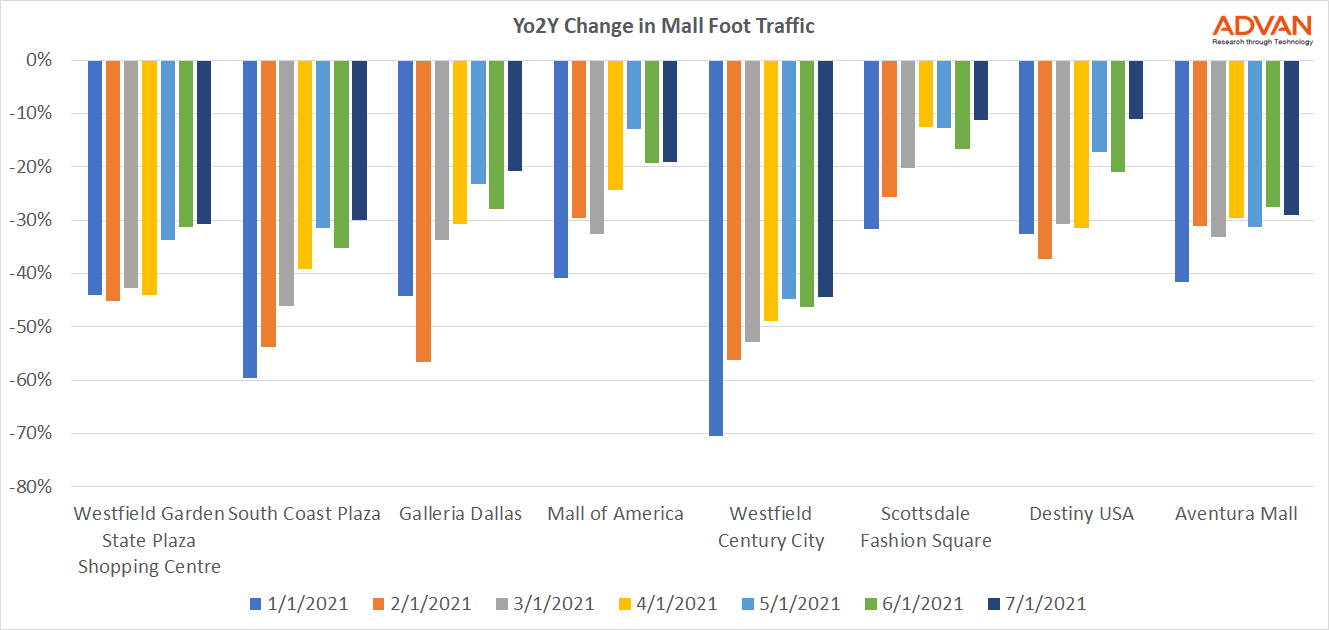

Investigating one level deeper into the actual mall locations, the deviation could not be more apparent. On eight popular mall properties throughout the country the results showed improvement over time but at no given point during this year any of these properties have reached pre-pandemic visitation levels, let along surpass them. The picture looks gloomier if we incorporate the month of August where we observe worsening performance on the whole sector including these properties.

The location dataspace is an exciting, fast growing industry that can provide powerful insights. We at Advan always advise our clients and the public to not believe everything they read without confirming how the analysis was performed and how the data was sourced. Consider placing more weight on analytics performed by the experts in crunching and normalizing location data for financial performance. Data is good; but incorrect and misleading data is worse than no data.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.