With the Back-to-School season in the rearview mirror and the holiday season quickly approaching, we dove into category level analysis to try and understand the wider trends impacting retail.

The Post Summer Dip

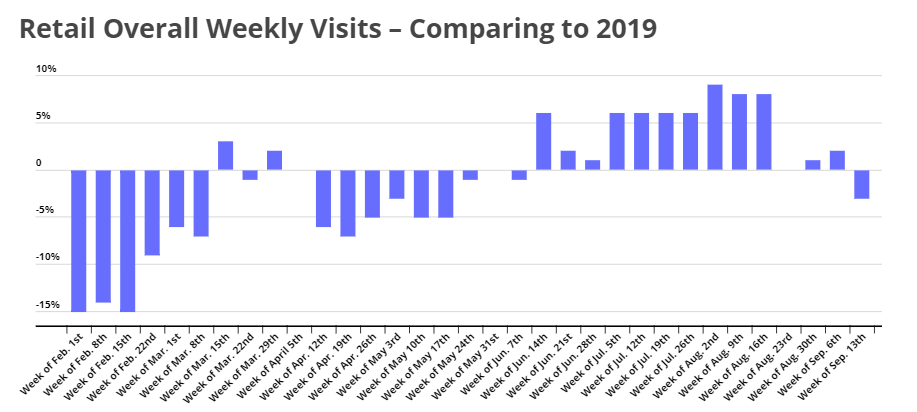

The combination of the wider reopening alongside a key Back-to-School shopping season in the summer drove a significant recovery for many brands and segments. The overall retail category saw significant strength in the summer with the 7-week period beginning the week of July 5th showing average weekly visit growth of 7% when compared to the equivalent weeks in 2019. Further fuel was added to the fire with international travel severely limited and a unique financial situation creating opportunities across the board.

Yet, the period of extended strength did meet an end with the four-week period beginning August 23rd, averaging visits rates that were flat when compared to the equivalent period in 2019 including visits the week beginning September 13th that were down 3%.

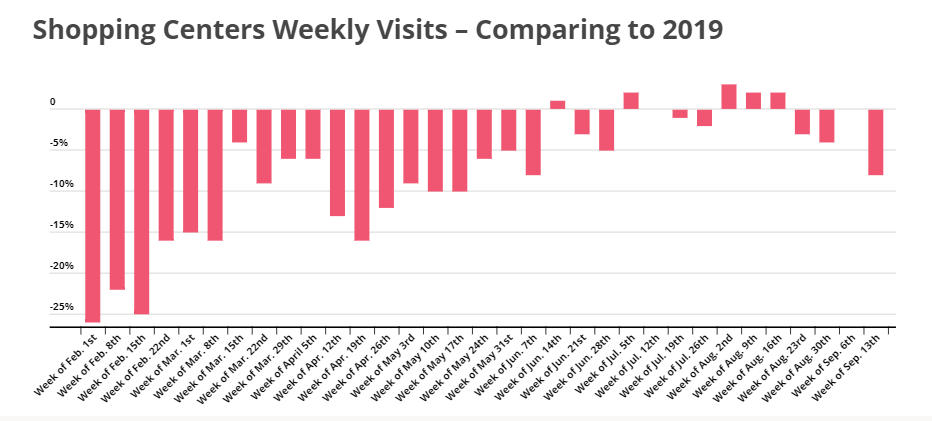

And the effect was seen in overall shopping center visits as well, with the week of September 13th showing an 8% decline compared to the equivalent week in 2019.

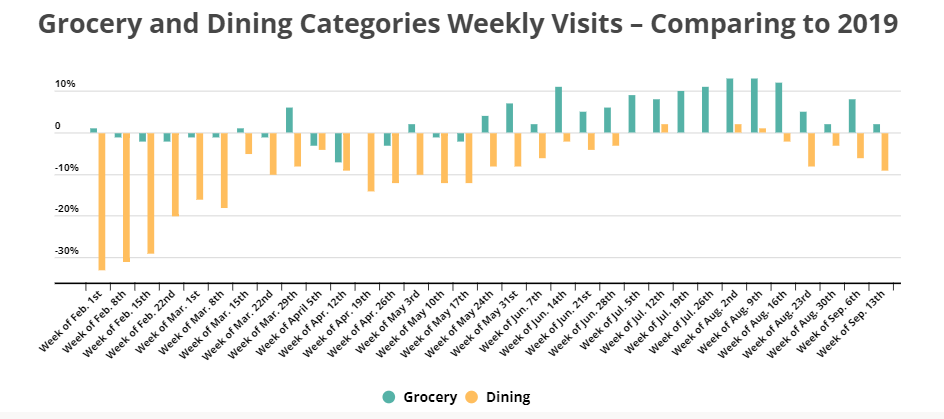

Other categories also saw a similar pattern with grocery and dining both going from mid-summer peaks to declining returns in early September.

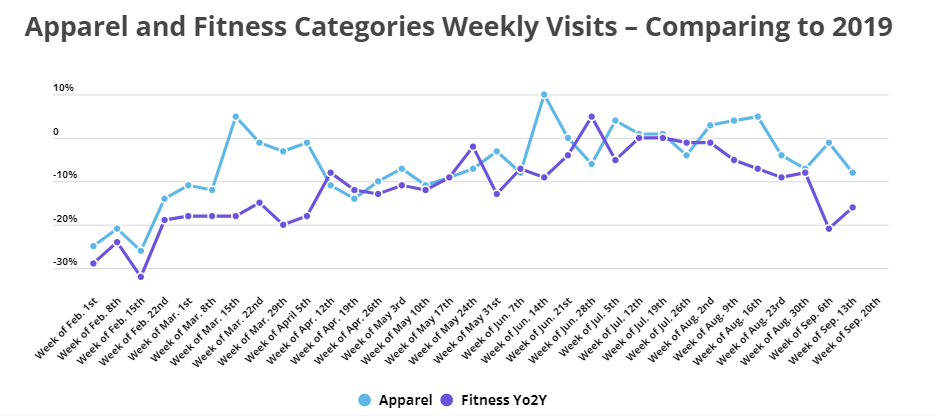

The fitness and apparel categories also saw similar situations with weeks that were near or above 2019 levels quickly reverting back to comparative declines as August came to a close.

The Why – An Optimistic and Pessimistic View

Yet, the important question here is rooted in the why.

An optimist’s perspective would focus on the power of the recovery itself in midsummer. Even in the face of rising COVID cases and as major cities were still being limited by the ongoing disruptions to work, school, and travel – retail saw strength. Categories like dining, apparel and fitness – expected to see slower recoveries – saw many brands with growth when compared to 2019, and all this alongside the ongoing strength seen in Home Improvement, Grocery, and Superstores like Target and Walmart. All in all, the swift and widespread nature of the recovery proved how resilient consumer demand remained for brick-and-mortar locations, deepening the confidence of the central role they continue to play in retail ongoing evolution.

The late summer declines, from this viewpoint, are the result of a rise in COVID cases and the natural effect of an especially strong Back-to-School season. The strength of the visit surges in July and early August lead naturally into deeper declines in September and October where the urgency of retail holidays and the wider recovery excitement are removed. The key takeaway here being that key retail seasons retained their strength – and while COVID concerns linger, the potential exists for a better than expected holiday period. Even more, even as retail recovered, the benefits were widespread across segments showing the power of the recovery to increase the wider pie.

Yet, a more pessimistic view is also possible. Perhaps retail saw a recovery because of a unique set of circumstances that drove short term strength. Then, when COVID returned, so did the relative declines compared to 2019. From this perspective, while the short term spikes were positive, they don’t indicate a fundamental change to a wider situation that will continue to limit retail visits – especially under the lingering effects of COVID. These realities will only be exacerbated by supply chain challenges, rising retail costs, and the removal of short term capital infusions driven by government action.

The ultimate reality will likely be somewhere in between. Though my personal belief is that, barring an extreme upswing of COVID, the holidays should prove to be particularly powerful for retail visits, it is impossible to ignore the challenges facing the sector. After a very strong Back-to-School season, September and October present a step back.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.