As formerly unknown TikTok influencers become bigger drivers of brand sales, do old school celebrities with careers in music and acting have as much sway? In today’s Insight Flash, we look into performance of celebrity brands in both the US and UK, seeing how spend and average ticket trend versus industry averages as well as what celebrity brand demographics are like in the US.

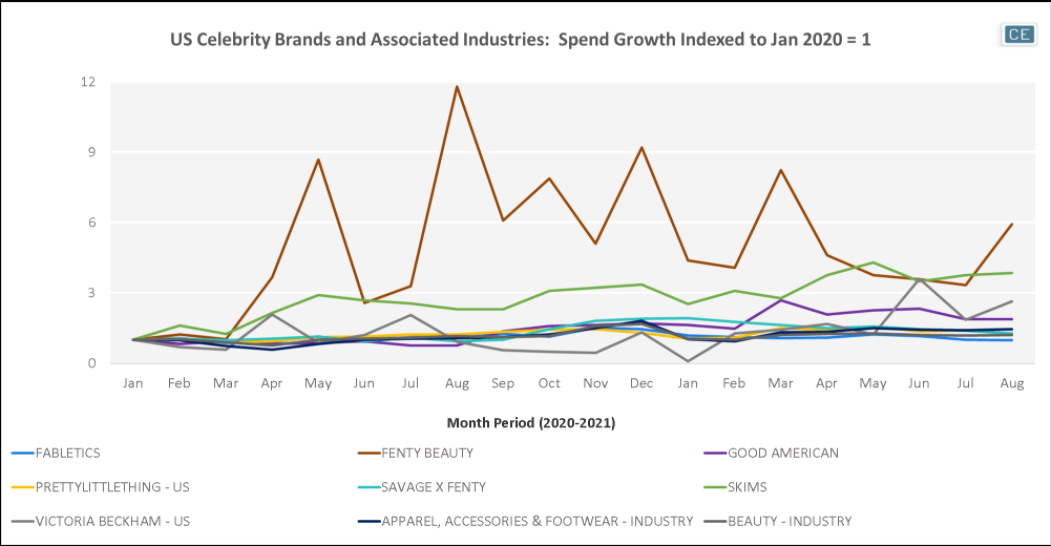

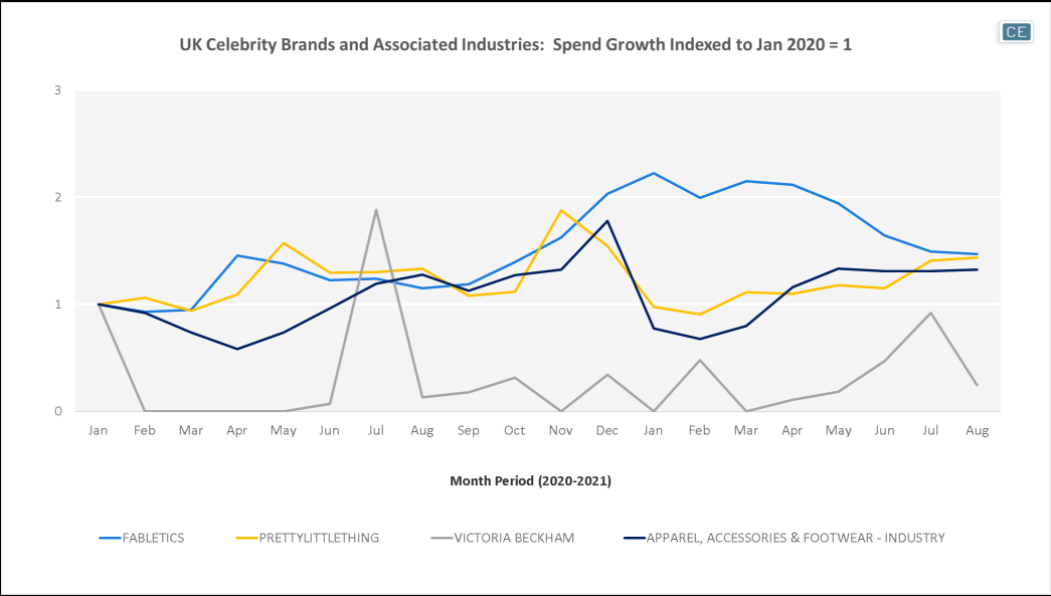

In both the US and UK, the cult of celebrity is still strong. Rihanna’s Fenty Beauty and Kim Kardashian’s SKIMS have shown particularly strong spend growth versus their respective industries in the US, while Kate Hudson’s Fabletics is a popular brand in the UK. However, celebrity doesn’t guarantee success. Fabletics has been a recent underperformer in the US, and Victoria Beckham has seen underperformance in both geographies for part of last year, though US trends have more recently improved.

US Celebrity Brand Spend

UK Celebrity Brand Spend

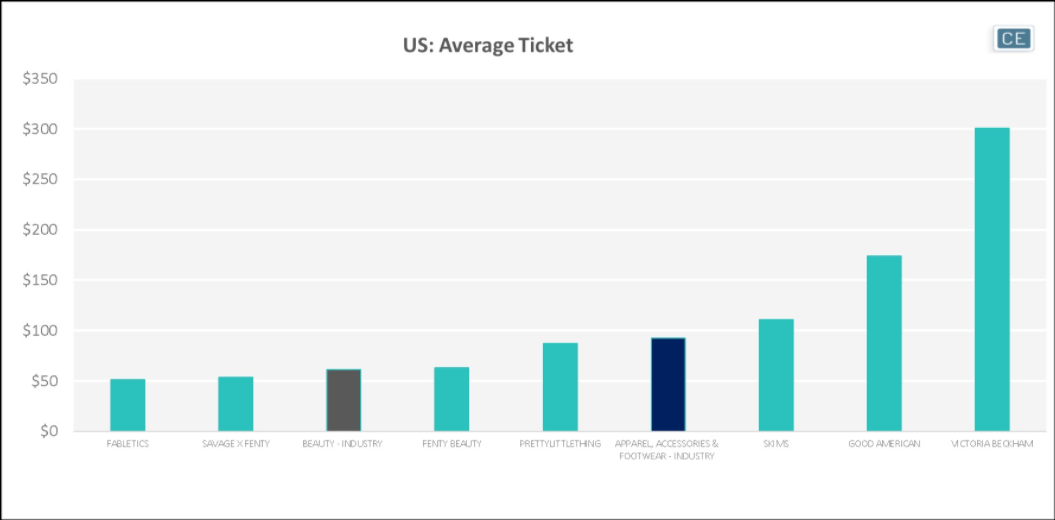

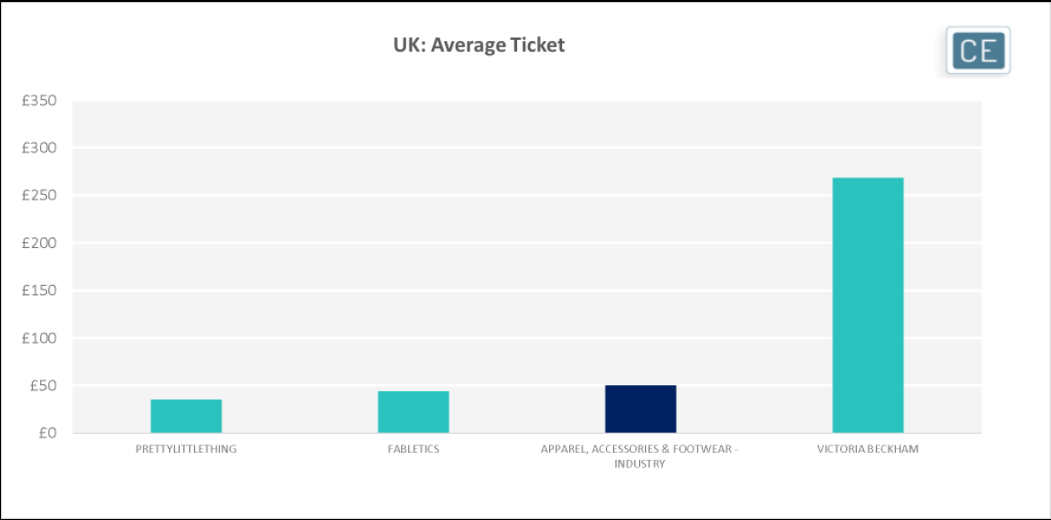

One would think celebrity endorsement would garner higher spend per transaction. However, in the US there were about as many celebrity brands with average ticket above the industry overall as there were brands with average ticket below. In the UK, where fewer brands are tracked, Victoria Beckham average ticket was above the industry average, while Fableticsand PrettyLittleThing were below.

US Celebrity Brand AverageTicket

UK Celebrity Brand Average Ticket

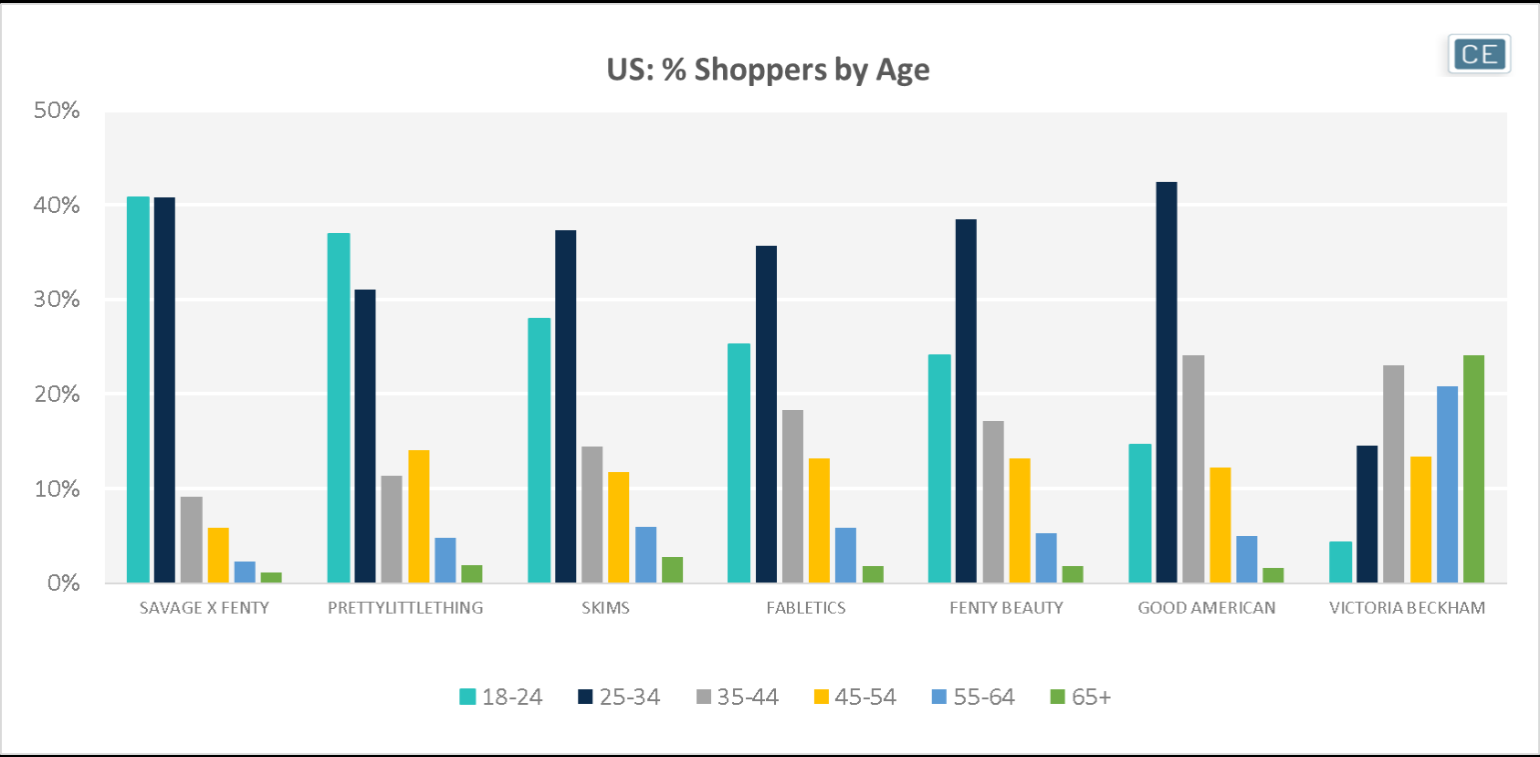

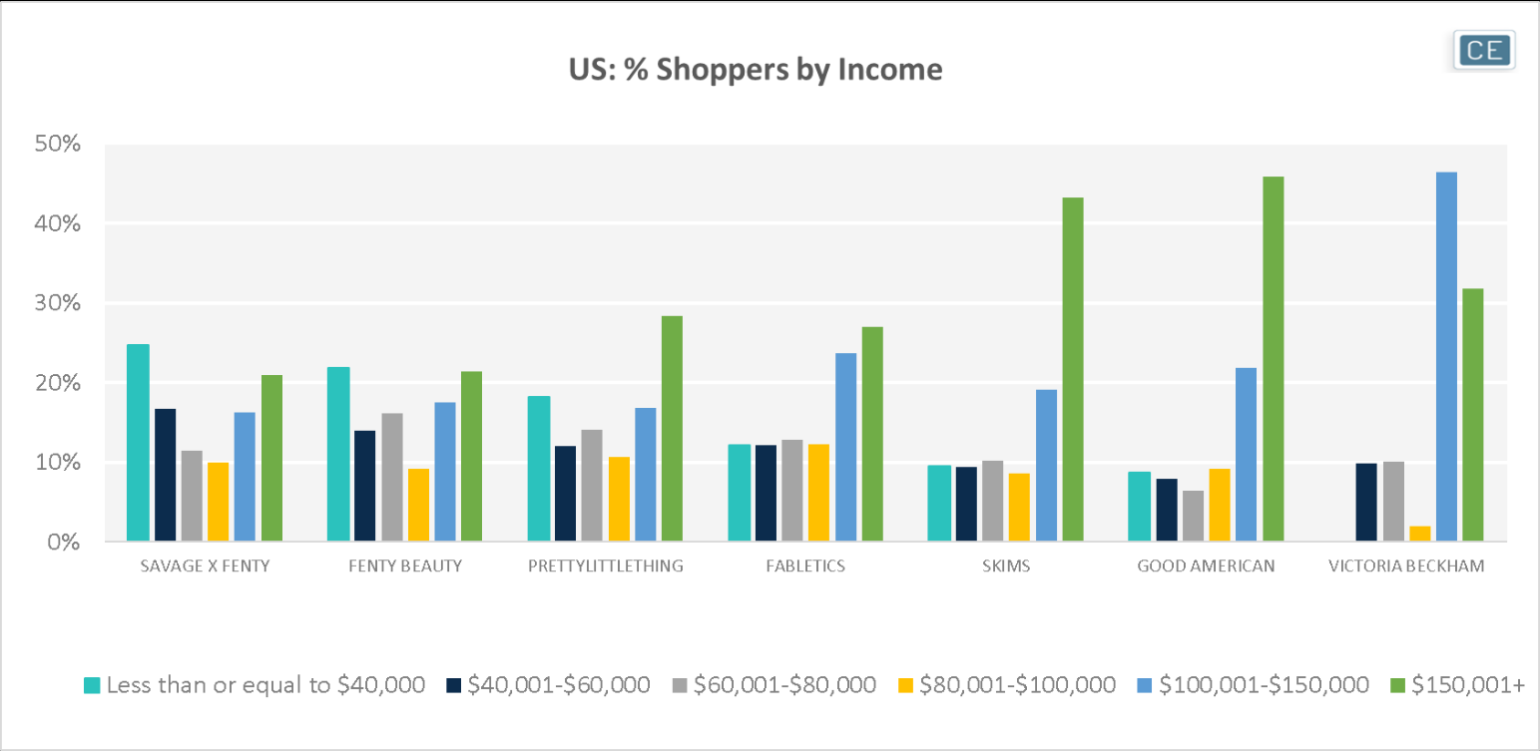

Most Celebrity Brands skew young in our US demographic data, with Savage X Fenty and PrettyLittleThing both seeing a particularly large share of customers in the 18-24 age range. Victoria Beckham’s older skew may have something to do with how long ago she was in the spotlight as Posh Spice. Both Fenty Brands are the most likely to be purchased by low income shoppers, while Victoria Beckham’s older demographic is also higher income, as befits the “posh” image.

US Celebrity Brand Demographics

US Celebrity Brand Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.