In this Placer Bytes, we dive into two classic brands – Dutch Bros. Coffee and Crocs – that have been experiencing a major pandemic boost.

Dutch Bros. Coffee: A Pandemic Success Story

Although the dining industry is still struggling to reach its 2019 foot traffic level, Dutch Bros. Coffee has been on an incredible growth streak for more than a year. In the wake of the brand’s recent IPO, we took the opportunity to dive into one of the most impressive success stories of the pandemic.

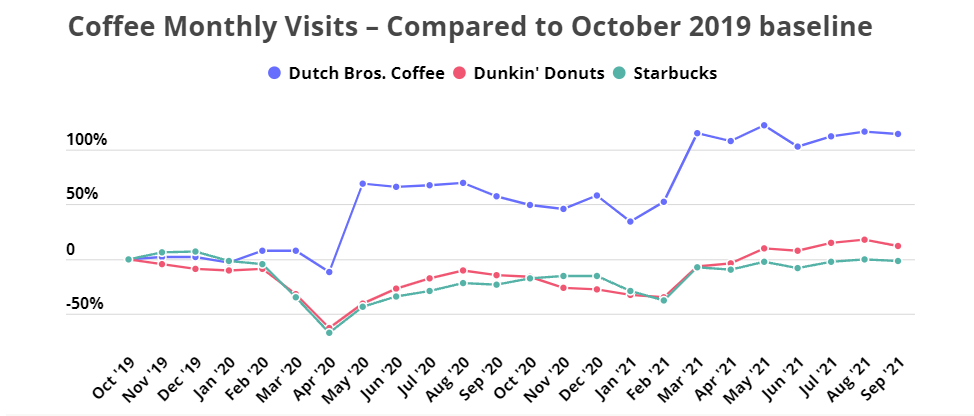

During the months leading up to the pandemic, visits to Dutch Bros. Coffee, Dunkin’, and Starbucks remained more or less stable. But Dutch Bros. Coffee differentiated itself from its competitors already in April 2020, when visits to Starbucks and Dunkin’ fell by more than 60% compared to the October 2019 baseline – while visits to Dutch Bros. took a mere 11.4% dip.

And in May 2020, when visits to Starbucks and Dunkin’ were still more than -40% below what they had been before COVID, visits to Dutch Bros. had increased by 68.9%. As of September 2021, Dutch Bros. received 113.8% more visits than it had in October 2019, compared with an 11.9% increase for Dunkin’ and a 1.8% decrease for Starbucks.

A major factor of Dutch Bros. early pandemic success could have been its drive-thru design, which let customers get their coffee fix without risking too much exposure. But the Dutch Bros. star continued to rise even once other leading coffee chains reopened their walk-up locations.

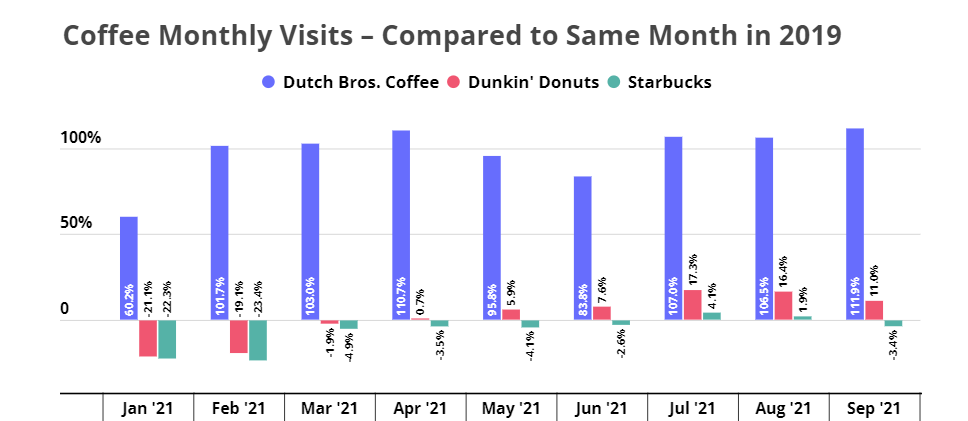

Comparing monthly visit performance in 2021 to 2019 confirms Dutch Bros. remarkable ascent. Dunkin’, which is also experiencing a strong recovery – though the data is not nearly as impressive – saw visits rise by 16.4% and 11.0% in August and September, respectively. Visits to Starbucks rose by only 1.9% in August, only to fall by -3.4% in September.

Meanwhile, monthly visits to Dutch Bros. in August and September were up 106.5% and 111.9%, respectively, when compared to the same months in 2019.

More Locations, More Loyalty, and More Visits per Location

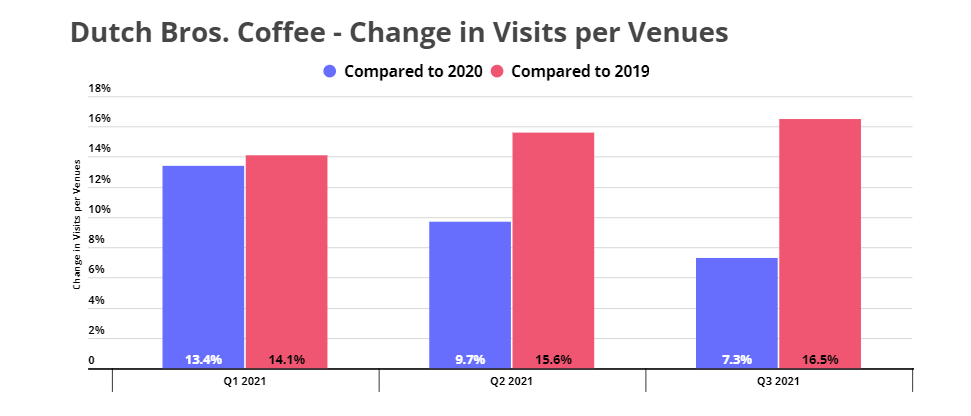

The astronomical rise in visits to Dutch Bros. can be partially attributed to the chain’s significant offline expansion. The chain opened its first Texas location in early 2021, with plans to have around 100 locations in the state by the end of 2023. The company has also been expanding its presence across other western states, from California to Oklahoma.

But the massive growth does not come from new stores alone. But the massive growth does not come from new stores alone. The number of visits per location has increased dramatically in the past two years. Between July and September, the average number of visits per Dutch Bros. location rose by 7.3% compared to Q3 2020 and by 16.5% compared to Q3 2019. This points to a strong demand for Dutch Bros. products and bodes well for the chain’s expansion plans. If the current trends continue, the chain could soon be a real threat to the established coffee leaders.

Crocs Are Back

The pandemic caused a deep shift in fashion, leading many consumers to rediscover the joys of comfortable, functional apparel – and the iconic Crocs brand was well positioned to benefit from the current trend. We dove into the company’s foot traffic data to understand how the change in taste has affected in-store visits.

Rise in Monthly Visits

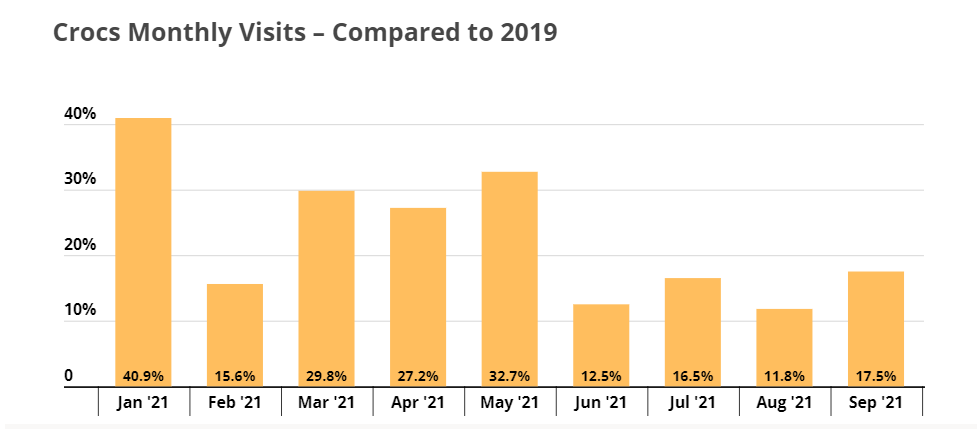

Overall, nationwide Crocs stores have seen double-digit increases in monthly visits every month this year when compared to 2019. While the apparel sector as a whole took a hit in August and September, visits to Crocs stores rose by 11.8% and 17.5%, respectively, when compared to two years ago. But will the growth streak last?

Pandemic Shopping Patterns Persisting

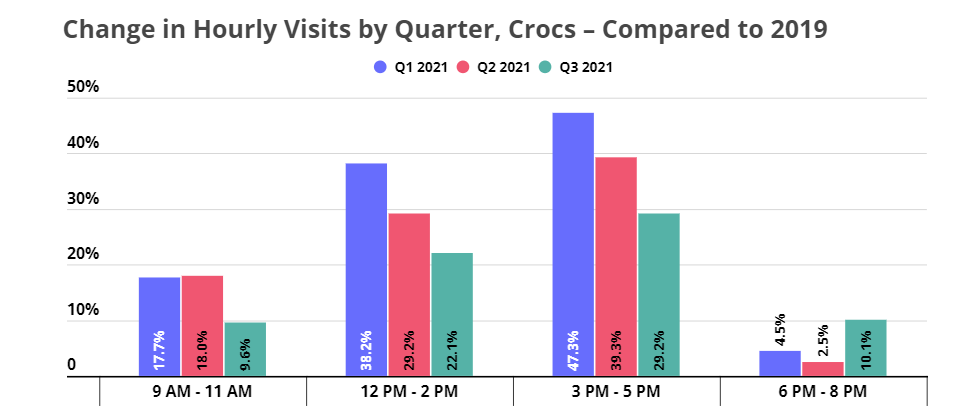

Analyzing hourly foot traffic data reveals that many of the additional store visits are taking place during daytime hours. The year-over-two year change in evening visits (between 6-8 PM) was limited to 4.5% and 2.5% in Q1 and Q2, respectively – but midday visits (between the hours of 12-5 PM) skyrocketed. Early afternoon visits increased by 38.2% in Q1 and by 29.2% in Q2, while mid-afternoon visits increased by 47.3% and 39.3% in Q1 and Q2, respectively, when compared to 2019.

But shopping times appear to be heading back to pre-pandemic norms: the increase in mid-day visits tapered off between Q1 and Q2 and once again between Q2 and Q3. And more people return to the office and fill up their schedules, even fewer consumers will have time for midday shopping trips. But Q3 also saw the greatest increase in evening visits that the brand has seen all year – indicating that many consumers are still making time to stop by their local Crocs store.

Will the Crocs comeback continue as Americans transition out of their COVID schedules and wardrobes? Will Dutch Bros. continue its meteoric rise?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.