The wider Home Improvement category was one of the retail bright spots early on in the pandemic, with brands like Home Depot and Lowe’s showing a unique level of strength. Yet, one of the more interesting storylines was the rise of Tractor Supply – a brand that also outperformed over the last 18 months. Home furnishings leaders were also among the better performers over the last year as key trends aligned to give an added boost to their specific offerings.

With the retail recovery well on its way, we dove back into leaders from both sectors to check in on the continuation of their unique levels of strength.

Value in the Home Goods Space

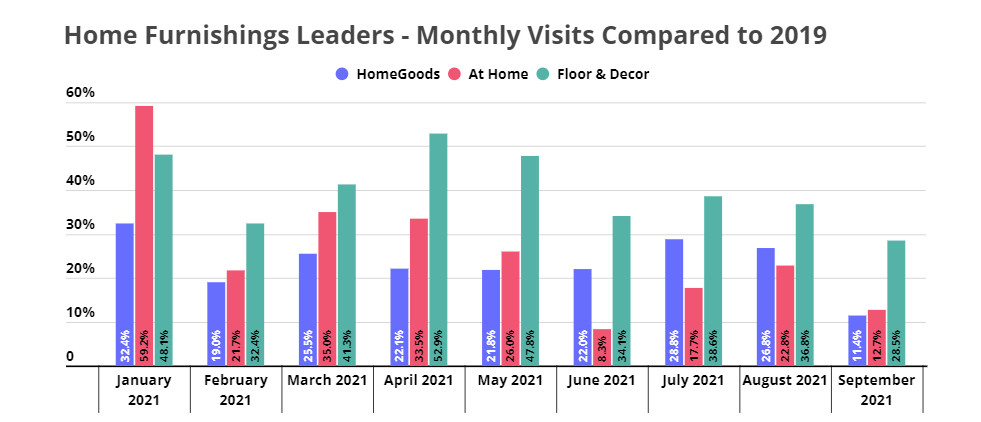

By the summer of 2020, brands like HomeGoods, At Home, and Floor & Decor were already seeing exceptional visit metrics. The renewed focus on home upgrades amid limitations on movement positioned these chains especially well to drive visits and sales. Yet, while the initial wave could have been expected, the sustained strength of the sector has been exceptional.

During August, visits to HomeGoods, At Home and Floor & Decor were up 26.8%, 22.8%, and 36.8%, respectively, when compared to August 2019. And while this was during a wider retail surge driven by the combination of pent up demand, the wider reopening, and the Back-to-School shopping season, the strength sustained even in September when much of retail was seeing declines.

In September, At Home and Floor & Decor saw visits up 12.7% and 28.5% respectively compared to the same month in 2019. However, not all surges were created equal. At Home clearly saw a massive boost by the pandemic. When looking at the period from July through September 2021, average monthly visits were actually down 7.4% compared to the same period last year, during the height of the home furnishings surge. Though this should not diminish the heightened strength of At Home and the ability of the brand to take advantage of its ‘lightning in a bottle’ moment, it does give added weight to HomeGoods. The value-oriented home furnishings leader saw visits up compared to 2019, but also saw a 16.8% jump in average monthly visits from July to September 2021 looking at year-over-year metrics. The jump speaks to the unique staying power of the brand’s surge and the foundation it is creating for longer term success.

The Third Home Improvement Wheel

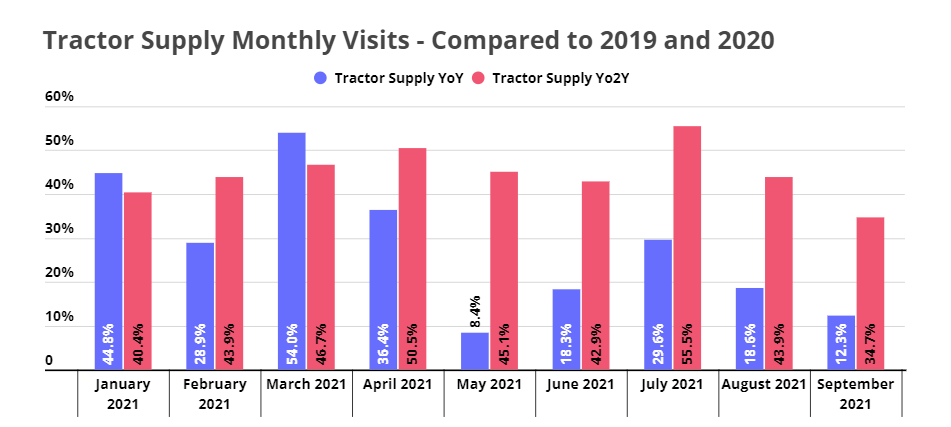

Tractor Supply has been among the most impressive retail performers throughout the pandemic period, with visits up significantly every month in 2021 compared to both 2020 and 2019. And this strength is unlikely to dissipate with the brand’s aggressive expansion plan launching alongside a wider acquisition.

But the real question may be what these moves mean for the chain’s positioning compared to sector giants Home Depot and Lowe’s.

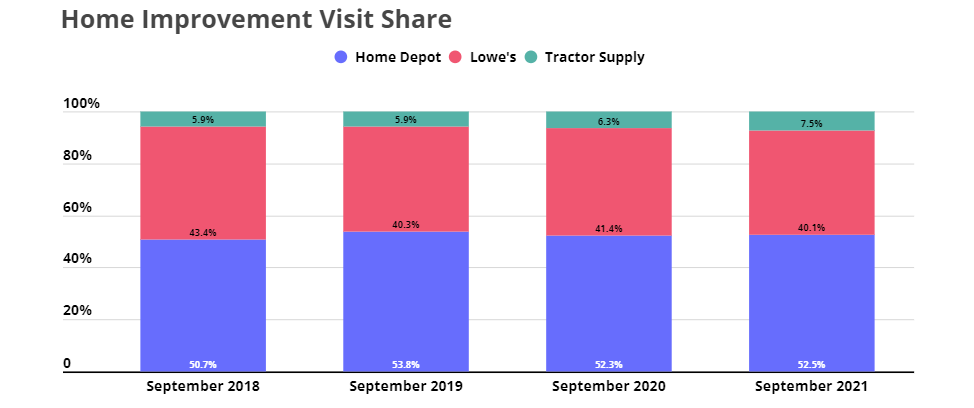

Looking at overall visit share tells a very clear story. Impressively, Tractor Supply visits share has been growing consistently since September 2019. In September 2019, Tractor Supply had 5.9% of the visits for the three brands combined, a number that rose to 6.3% in September of 2020 and to 7.5% by September of 2021. Yet, there is clearly a long way to go to reach the levels set by Home Depot and Lowe’s. Home Depot has maintained their strong position with 52.5% of overall visits in 2021 compared to 40.1% for Lowe’s.

Could the competitive landscape in this space become increasingly interesting? Certainly. However, Home Depot and Lowe’s look to have done enough to make any significant shift unlikely in the near term.

Will HomeGoods continue to dominate? Can Tractor Supply continue to establish a greater visit share?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.