Both Warby Parker and First Watch have been aggressively growing their offline presence. So, we dove into the foot traffic data to find out how the brick and mortar expansions are affecting visit patterns.

Warby Parker’s Offline Expansion

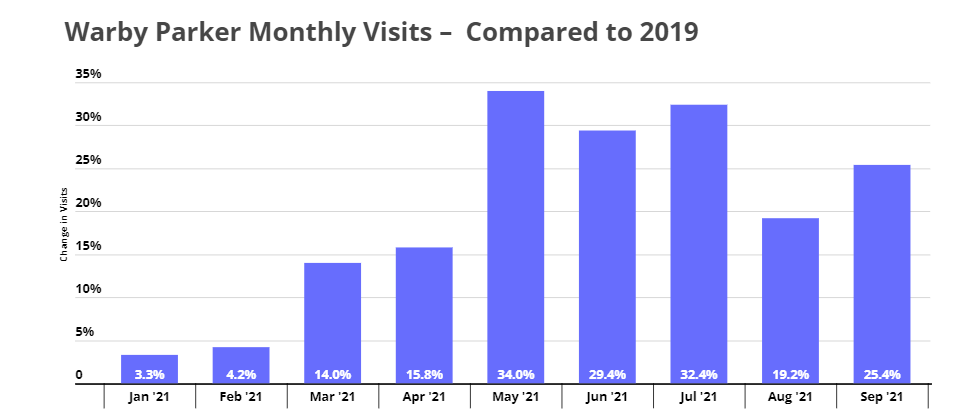

Much has been written about Warby Parker’s brick and mortar expansion. The eyeglasses disrupter opened its first offline store in 2013 and now operates over 140 stores throughout the United States. And the growth in stores has led to a massive increase in foot traffic. Although 2021 was a tough year for many retailers, Warby Parker saw its year-over-two-year visits rise by 32.4%, 19.2%, and 25.4% in July, August, and September, respectively – largely because of this expansion.

The hike in locations and visits in what are still pandemic-impacted times is all the more impressive considering Warby Parker’s origins. The brand began as an online-only DTC retailer and has continued to scale its online retail capacities during the pandemic. The fact that consumers continue to flock to the brand’s brick and mortar stores is a testament not only to Warby Parker’s strategy, but also to the enduring pull of offline retail channels.

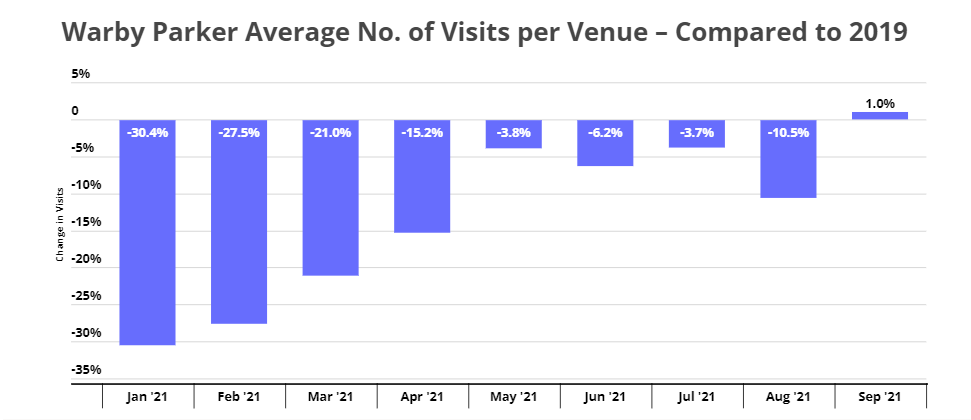

But how much of Warby Parker’s foot traffic is due to the opening of new stores, and how much is due to an increase in the volume of visits per location? Diving into the average number of visits per venue for the chain provides a partial answer. Although overall monthly visits for the brand have been consistently higher than in 2019, the average number of visits per venue has actually decreased during most months of the year so far. While the average number of visits per venue came close to 2019 figures this summer – during sunglasses season – the metric fell again in August when the average number of visits per venue was 10.5% lower than it was in 2019.

The drop in visits per store is obviously highly connected to the current situation and the spectre of COVID. After all, trying on glasses that have been tried on by an unknown number of customers before you loses some of its appeal during a pandemic. And in states where indoor mask requirements have remained, customers may be less motivated to go to the store to try on frames over their masks. Not to mention the impact that COVID has on major cities – areas where Warby Parker has focused early on in their brick and mortar expansion. But since Warby Parker’s brick and mortar stores are also meant to serve a logistical purpose, having more stores that can serve customers over a greater area still serves an essential business need, even with the drop in average visits per venue.

And, perhaps even most importantly, in September, the visits per venue metric reached 2019 levels for the first time all year, even exceeding September 2019 average visits per venue by 1.0% – despite the ongoing Delta wave. This is great news for Warby Parker as it shows that the brand’s energetic offline expansion is bringing the desired customers and validates their plans to open even more stores this year. If average visits per venue continue to hit 2019 levels despite the substantial increase in locations, Warby is well positioned to maximize this ongoing offline expansion.

First Watch’s Pandemic Jump

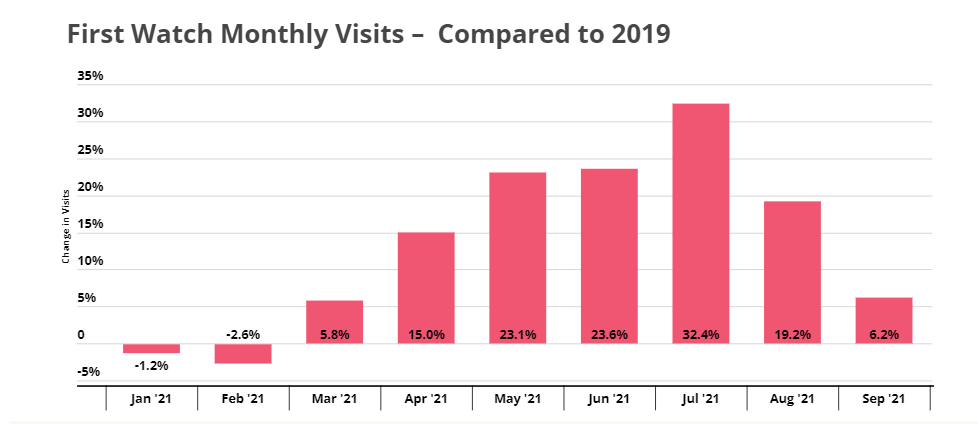

Like Warby Parker, First Watch has gone on a store opening spree since the start of the pandemic, with 42 new restaurants openings in fiscal 2020 and 18 more in the first half of 2021. And like Warby Parker, First Watch has seen an impressive rise in foot traffic over the past year. Summer visits rose by 23.6%, 32.4%, and 19.2% in June, July, and August when compared to the same months in 2019. And even in September, despite the overall dining downturn, year-over-two-year visits were still up by 6.2%.

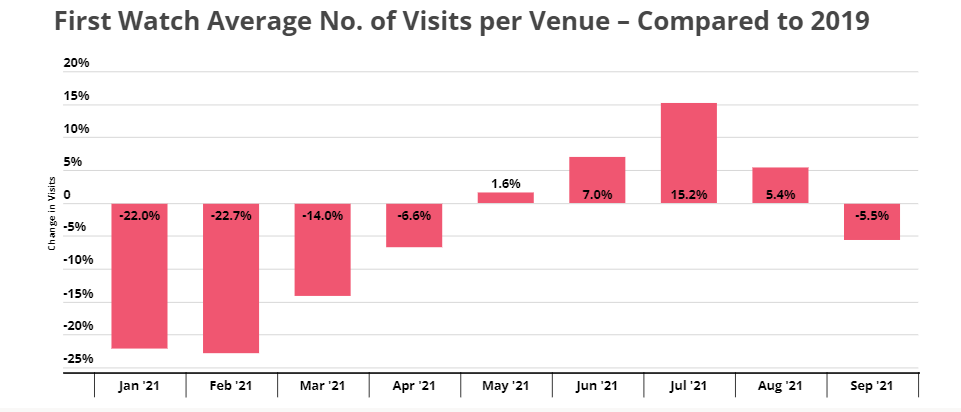

And while some of the increase in foot traffic can be attributed to new store openings, that’s only part of the story. The major jumps in visits coincided with an increase in average visits per venue, indicating that the increase in stores is meeting a ready demand.

Over the pandemic, the breakfast, lunch, and brunch chain invested in digital solutions to manage the wait for dine-in and curbside pickup. These investments seem to have paid off, with the average number of visits per venue rising by 7.0%, 15.2%, and 5.4% compared to 2019. And although that metric fell slightly in September amids the overall dining downturn, the September decline shouldn’t be read too much into given the perspective of the chain’s strong summer performance. This is especially true considering the growing role that ‘third place’ companies should play in a work environment that is increasingly affected by work from home.

Will Warby Parker maintain its edge over 2019 visits per venue? Will visits to First Watch keep rising?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.