Source: https://public.railinc.com/about-railinc/blog/eots-im-flats-intermodal-lead-q3-umler-index-gains

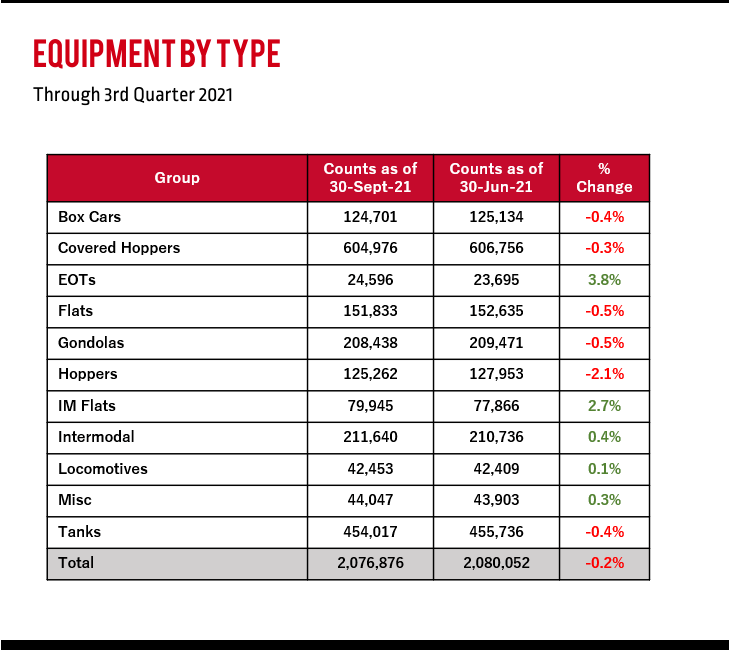

The North American rail equipment fleet decreased in total size during the third quarter of 2021. The total equipment count was 2,076,876 for a change of 0.2 percent.

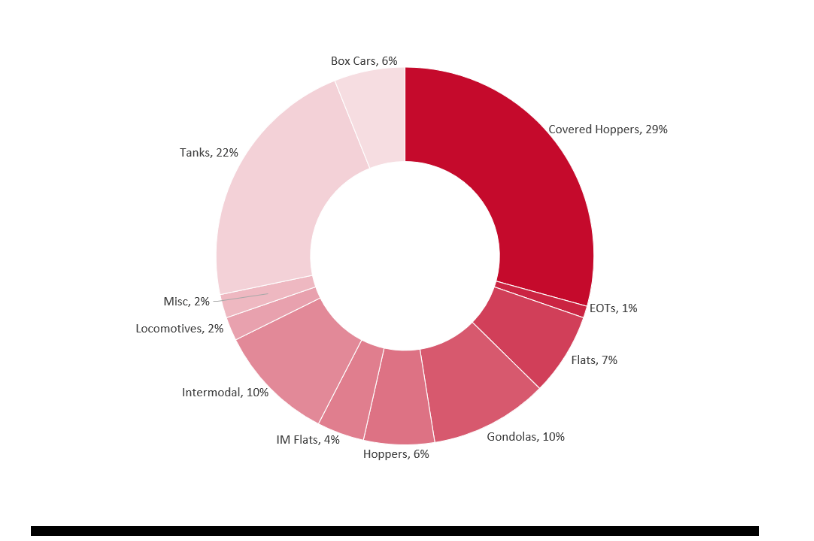

The four largest segments during the quarter were Covered Hoppers (29 percent), Tank Cars (22 percent) and Gondolas and Intermodal (10 percent).

Five equipment groups increased from the last quarter, led by EOTs, up 3.8 percent, and IM Flats and Intermodal, up 2.7 and 0.4 percent, respectively. Hoppers and Flats led declines, down 2.1 percent and 0.5 percent, respectively.

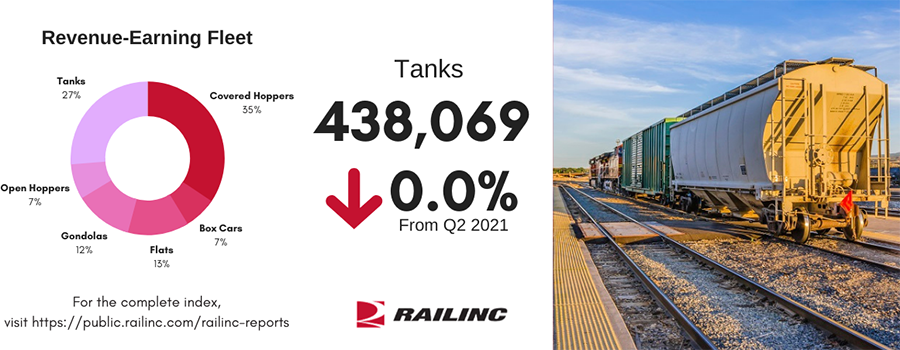

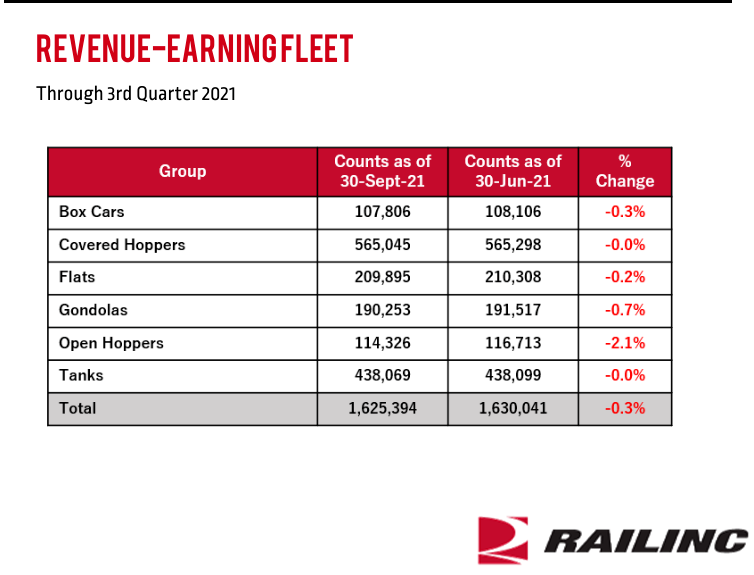

The total count of equipment in the revenue-earning fleet currently stands at about 1.63 million, down by 0.5 percent from the previous quarter. All equipment groups were down, with Open Hoppers and Gondolas decreasing the most, down 1.5 and 1.2 percent, respectively.

The revenue-earning fleet is a subset of the North American rail fleet that is largely composed of freight cars that can be used in interchange service and against which an interline waybill can be placed. The revenue-earning fleet of freight cars is made up of six sub-fleets: box cars, covered hoppers, flats, gondolas, open hoppers and tank cars. It excludes locomotives, intermodal trailers and containers, maintenance-of-way equipment and end-of-train devices.

To learn more about the data behind this article and what Railinc has to offer, visit https://public.railinc.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.