Source: https://docs.google.com/spreadsheets/d/1VkS2QkRIyipahXXnpnX2v4MT5YOSrOBMIZyarogsr-I/edit#gid=0

The COVID-19 pandemic has led to a shift in beauty and grooming habits, as exemplified by the rise of the quarantine beard and DIY haircuts. Men’s grooming subscription companies—both those that cater to clean-shaven customers and those that offer products for bearded customers—saw a higher percentage of new customers early in the pandemic compared to the same period a year before. In addition, Dollar Shave Club retains the crown for highest customer retention among a selection of DTC companies in the men’s grooming industry, while Bevel has the highest quarterly sales per customer.

How has customer acquisition at grooming subscription companies changed during the pandemic?

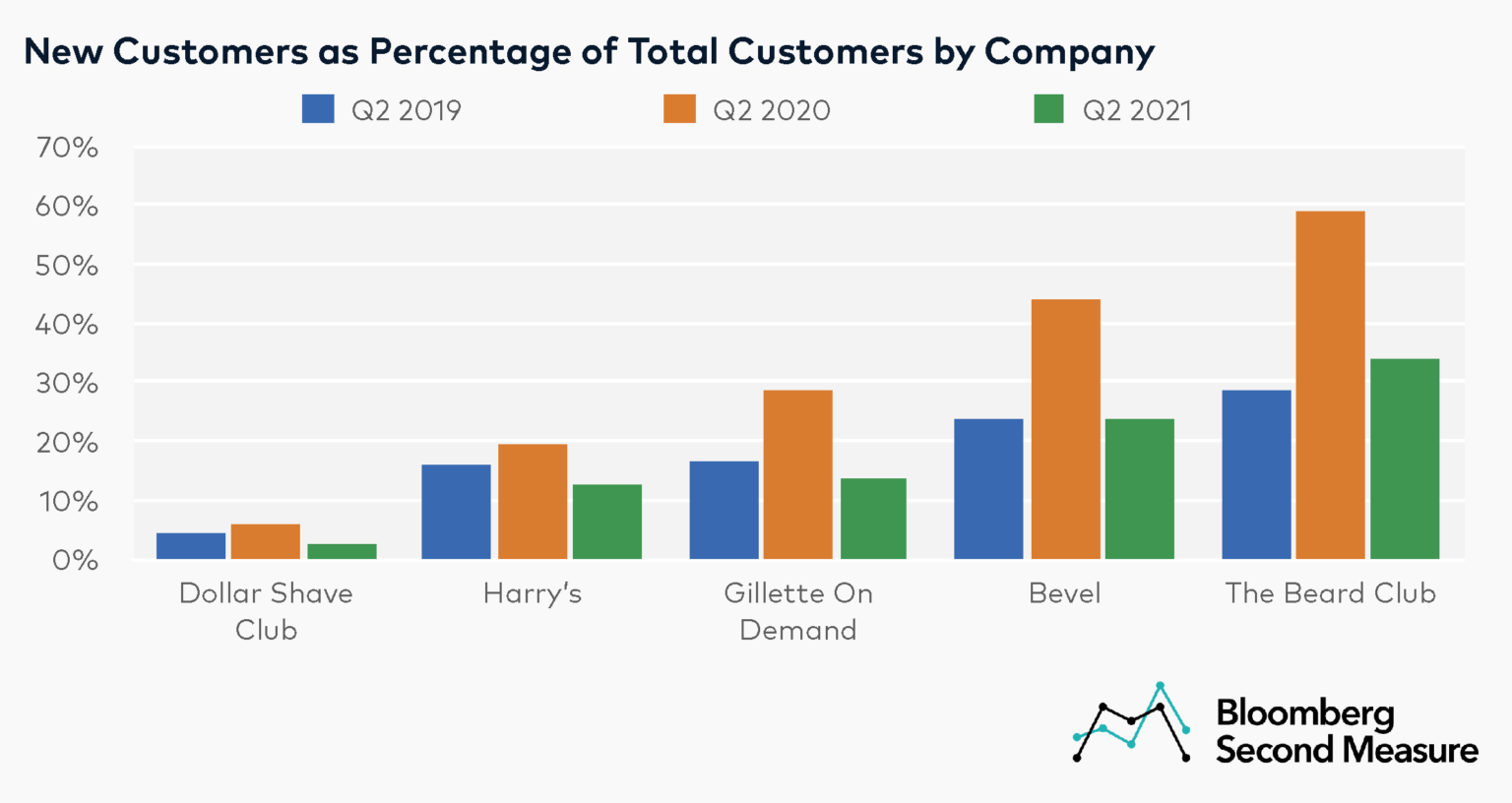

Following the trend of beauty subscription boxes, some men’s grooming subscriptions experienced renewed interest at the start of the pandemic. For each company in our analysis, the second quarter of 2020 had a higher percentage of new customers as a percentage of total customers, compared to the same quarter in 2019 and 2021.

The Beard Club, one of the newer and smaller companies (in terms of sales) in the analysis, had the highest percentage of new customers among these companies early in the pandemic, with 59 percent in Q2 2020. The Beard Club is also the only company in the analysis that had a higher percentage of new customers in Q2 2021 compared to Q2 2019. In Q2 2021, about a third of The Beard Club’s customers were new.

On the other hand, Dollar Shave Club (which was acquired by Unilever in 2016) had the lowest percentage of new customers among these companies in Q2 2019, Q2 2020, and Q2 2021. In Q2 2020, only 6 percent of customers were new. A potential factor is that Dollar Shave Club is the largest (in terms of sales) and oldest company in this group, so it is more likely to attract returning customers than new ones.

Consumers spend the most per quarter at Bevel, but The Beard Club is closing the gap

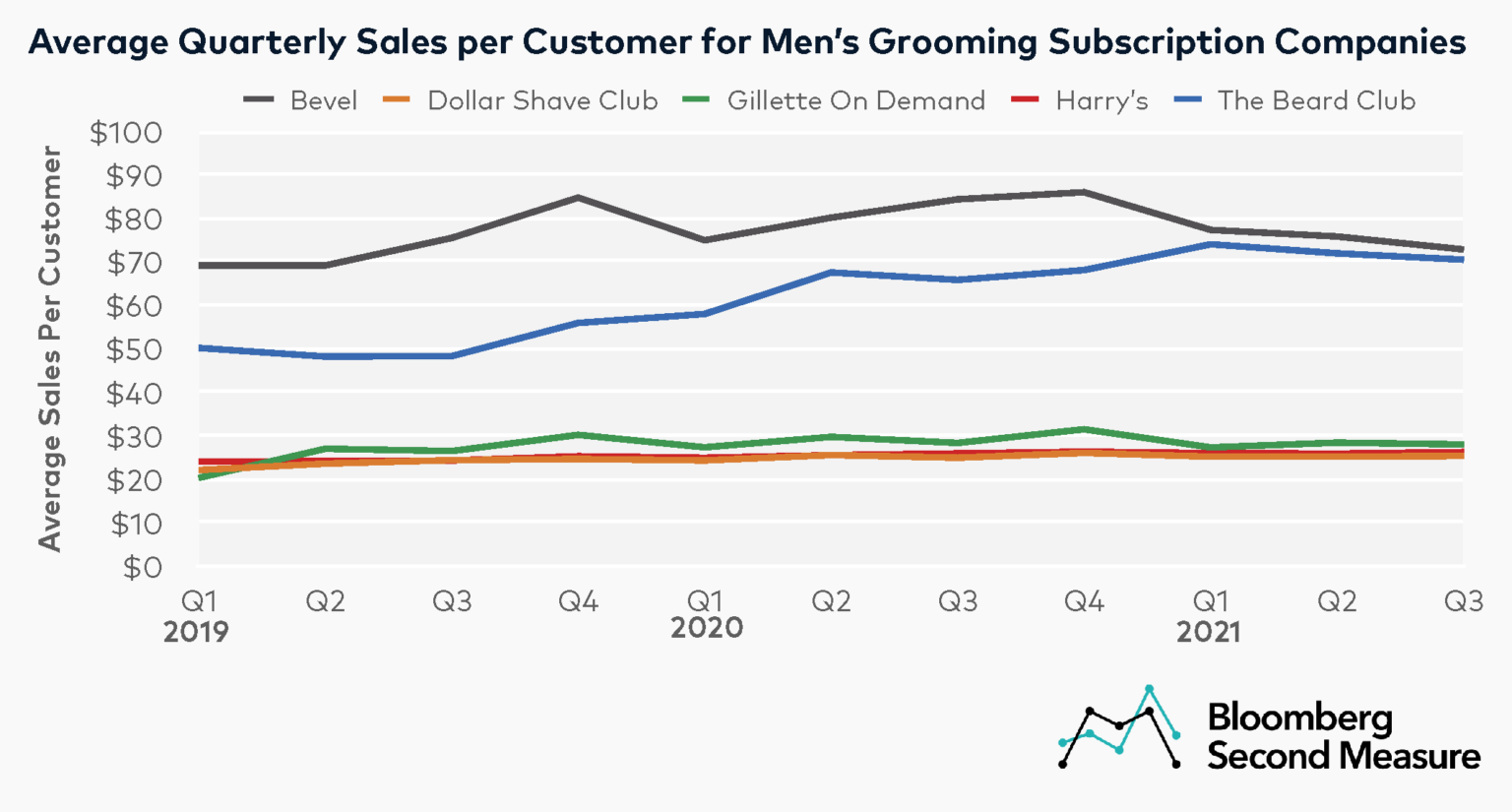

Bevel and The Beard Club had the highest quarterly sales per customer among these men’s grooming subscription companies. In Q3 2021, Bevel customers spent an average of $73, compared to $70 for The Beard Club.

Even though shoppers at Bevel spent the most per quarter, The Beard Club is catching up. In Q3 2021, The Beard Club’s average quarterly sales per customer increased 7 percent year-over-year and 46 percent compared to the same quarter in 2019.

Dollar Shave Club, Harry’s, and Gillette on Demand had a much lower average quarterly sales per customer in Q3 2021, with $25, $26, and $28, respectively. Sales per customer at Harry’s and Dollar Shave Club have held steady over the past three years.

A major reason for the variation in sales per customer is that each company uses a different business model, with varying subscription frequencies, product offerings, and bundling options for one-time purchases. Both Dollar Shave Club and Harry’s originated as subscription services for razors, but have since expanded to include skin care, body care, and hair care products. Now, Dollar Shave Club and Harry’s offer subscriptions as well as one-time purchases. In 2018, Harry’s also launched Flamingo, a sister brand for women. However, Flamingo data is not included in this analysis.

Bevel offers higher-priced bundles of razors and shaving products, as well as hair care, body care, and beard care products that can be purchased on an individual or subscription basis. The Beard Club also allows customers to purchase single products and bundles as a one-time purchase, or sign up for a membership for repeat shipments of products. Unlike the other men’s grooming companies in the analysis, The Beard Club is primarily focused on consumers looking to grow and maintain beards rather than shave. Both Bevel and The Beard Club offer electric razors and trimmers, which could also account for their higher sales per customer.

Gillette on Demand has the fewest options among the competitors, offering a subscription service that ships razor blades and shaving cream at the customer’s desired frequency. Notably, Bloomberg Second Measure data only observes DTC purchases made through this company’s own website or stores.

Dollar Shave Club has the highest quarterly customer retention

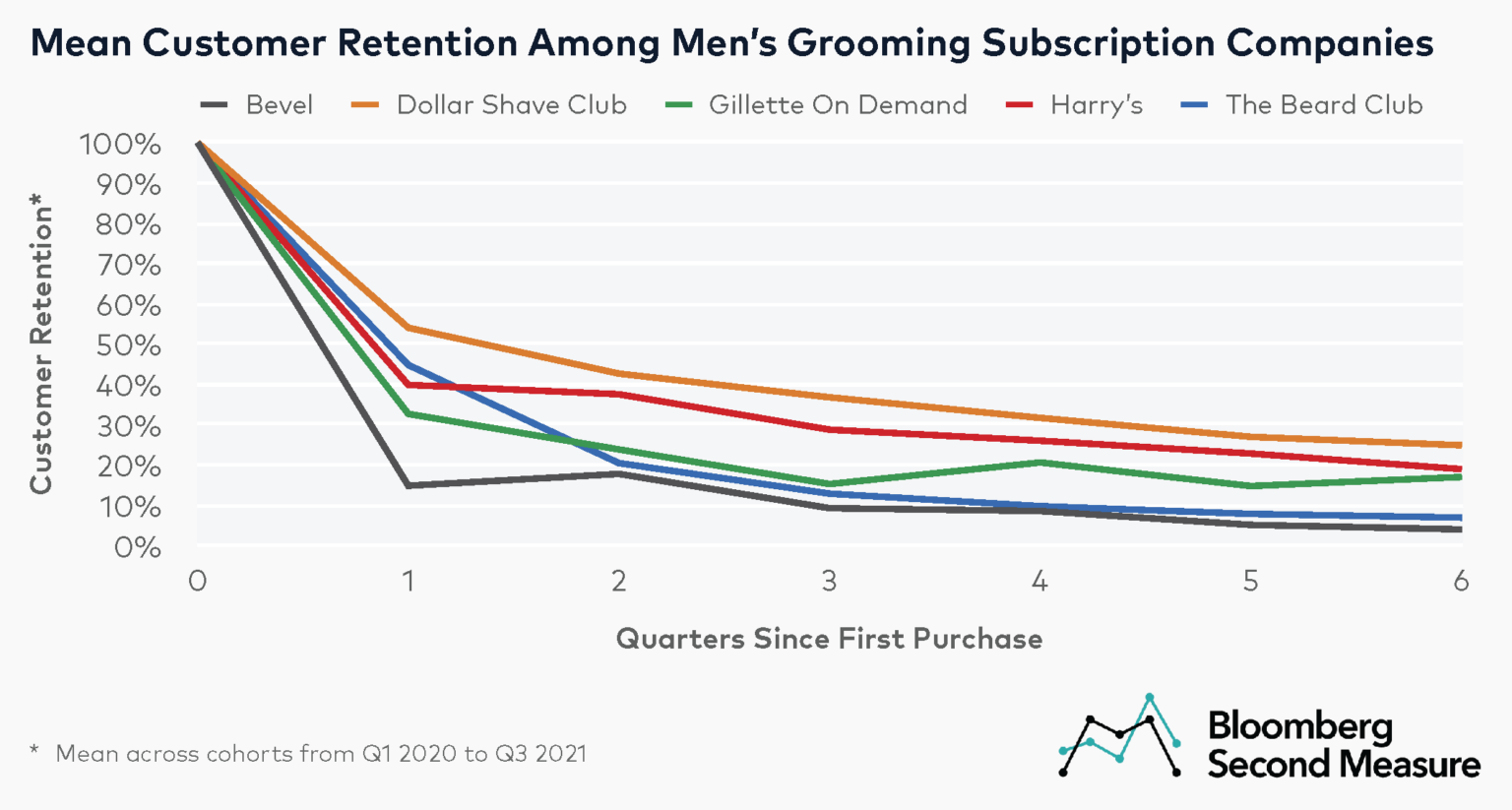

Among the quarterly cohorts that made their initial purchase during the pandemic (the first quarter of 2020 onward), an average of 54 percent of customers at Dollar Shave Club made another purchase the following quarter, compared to 45 percent for The Beard Club and 40 percent for Harry’s.

After six quarters, an average of 25 percent of Dollar Shave Club customers were retained. Bevel had the lowest customer retention, with only 4 percent of customers making another purchase after six quarters. A likely factor is that the companies with higher customer retention rates—Dollar Shave Club, Harry’s, and Gillette on Demand—offer shaving products that need to be replaced more often and therefore function more as subscription businesses, while the companies with lower customer retention—Bevel and The Beard Club—offer electric products and higher-priced starter kits with products that do not need to be replaced as often.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.