A year and a half after the initial lockdowns, we dove into the foot traffic of the fitness sector to see how visits to this hard-hit sector are recovering.

Near-Recovery over the Summer

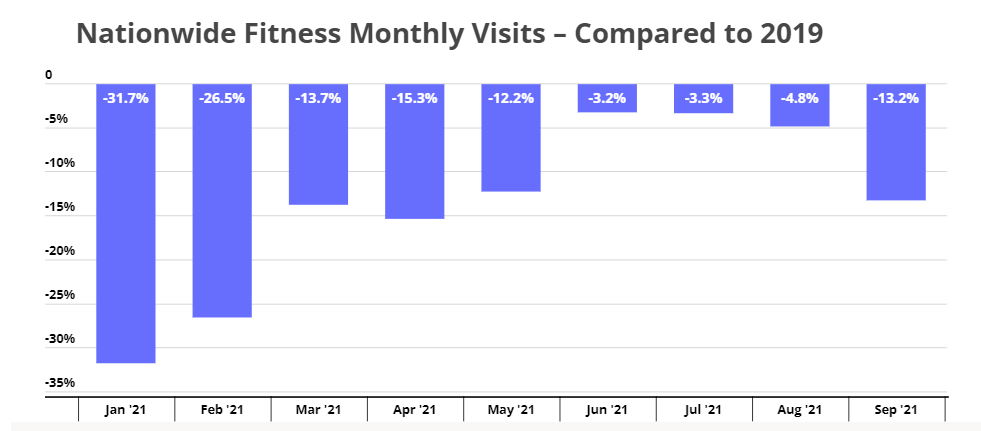

Many gym rats discovered the convenience and cost-effectiveness of home workouts over the pandemic, leading some experts to predict that the COVID closures would mark the beginning of the end of gyms. But by summer, monthly visits were already inching closer to pre-pandemic levels, with year-over-two-year visit declines of just 3.2%, 3.3%, and 4.8% in June, July, and August, respectively.

By September, however, visits had fallen back, and the year-over-two-year visits declined again to 13.2%. The drop in visits may be attributed to seasonality – gym visits rise in the summer with the advent of swimsuit season, and fall again in the autumn as consumers settle into their regular work and home routines once again.

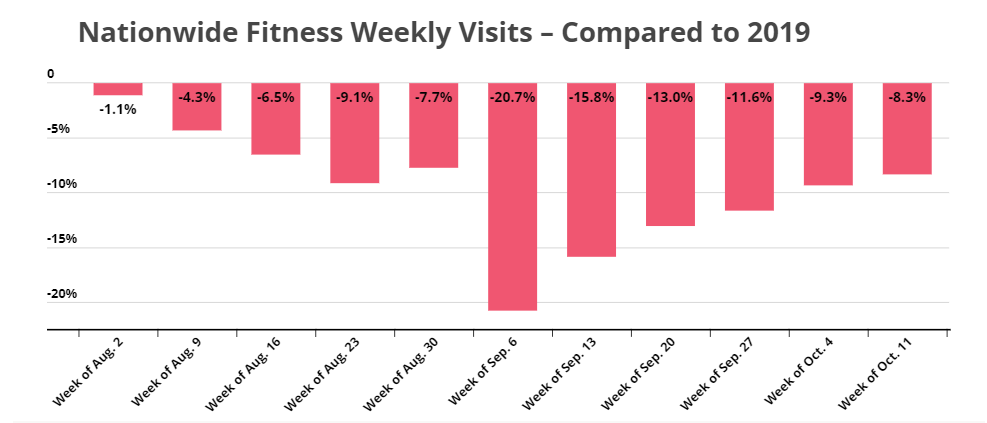

But a key element does appear to be the rise in COVID cases. Looking at weekly visits shows that while year over two year visit gaps grew into September, that gap has been shrinking into October – a very positive trend as the sector closes out 2021 and heads into a crucial Q1.

Diving Into Individual Chains

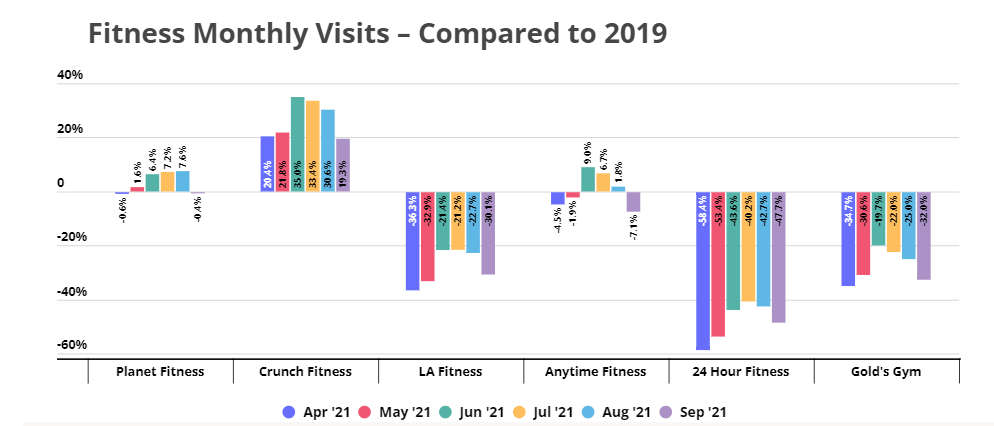

The drop in gym visits was felt across many – but not all – major fitness brands. Most notably, Crunch Fitness has been on a growth streak, with September visits up by 19.3% compared to 2019. Visits to Planet Fitness have also been comparatively high – the fitness leader only saw a year-over-two-year visit drop of 0.4% in September, despite the heavy visits losses at other leading chains. Anytime Fitness also outperformed the sector standard, with September visits only down 7.1% compared to 2019.

Meanwhile, significant visit gaps remain for LA Fitness, 24 Hour Fitness, and Gold’s Gym, with September foot traffic down by 30.1%, 47.7%, and 32.0%, respectively – a likely combination of location closures and lower foot traffic to city-based branches.

Filling Out the Picture

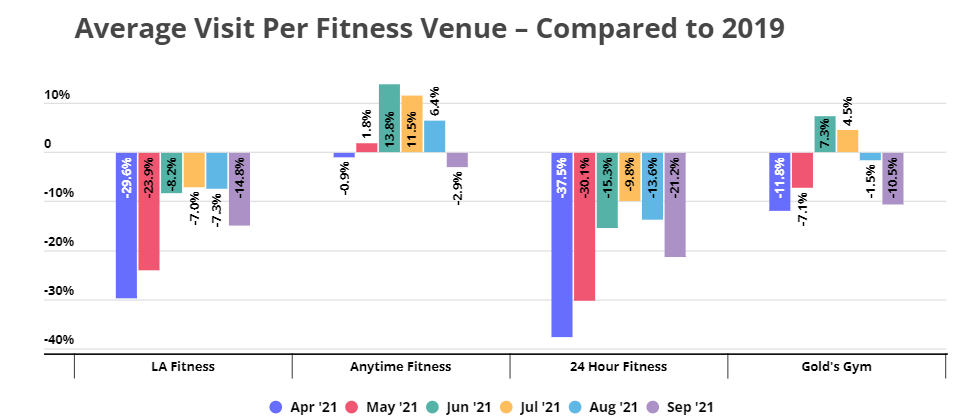

The clear effect of location closures can be seen when diving into visits per location numbers, which show that some of the heavily-impacted chains are actually doing better than their year-over-two-year visit numbers indicate. While visits to LA Fitness, Anytime Fitness, 24 Hour Fitness, and Gold’s Gym were still down compared to 2019, the chains’ respective year-over-two year drops in average visits per venue figures are much smaller – less than half – the year-over-two year visit gap.

So, while many brands are getting less visits overall, the drop in visits speaks more of a shrinking overall reach and not necessarily from the pull of well positioned locations.

Gyms Still Have a Dedicated Consumer Base

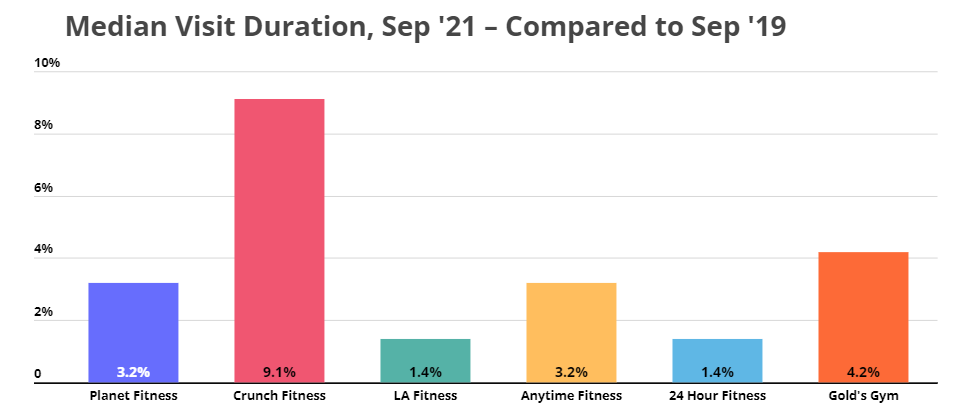

Surprisingly, the drop in fitness visits does not seem to have affected the median visit duration for those who chose to continue hitting the gym. In fact, the median visit duration actually grew for all the brands analyzed when compared to pre-pandemic visit length. September median visit lengths to Planet Fitness, Crunch Fitness, LA Fitness, Anytime Fitness, 24 Hour Fitness, and Gold’s Gym increased by 3.2%, 9.1%, 1.4%, 3.2%, 1.4%, and 4.2%, respectively, when compared to the median visit length in September 2019.

One possible explanation could be that the return of more committed and enthusiastic gym-goers has already been seen, with the shift in focus returning back to attracting newer or less engaged audiences.

Will the fitness visits return to pre-pandemic levels? Will the increase in median visit duration stick?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.