In what many considered as a very bold move at the height of COVID-19 in 2020, Haidilao expanded massively — reaching a total of 1597 stores by June 2021. Unfortunately this delivered a disappointing blow to Haidilao’s bottomline. Stock price dropped continually at a staggering 74% from its peak on Feb 17 to Nov 8 this year. As an attempt to stop the bleeding, Haidilao announced shut down of 300+ stores by Dec 31, 2021. Sandalwood weekly sales data saw this coming, because data consistently showed weakness throughout 2Q21.

The negative momentum continued into the third quarter. With the opening of 84 stores in 3Q21 mostly in Tier 2 and 3 cities, Haidilao increased ~50% number of restaurants compared to October 2020, totaling 386 new store openings since December last year. The rapid store expansion, however, did not bring about matching sales performance. Sandalwood data showed the company’s total sales in September was lower than the same period last year, despite slight recovery around mid-autumn festival. Figures during the Golden Week in early October at -17% y/y did not look optimistic either.

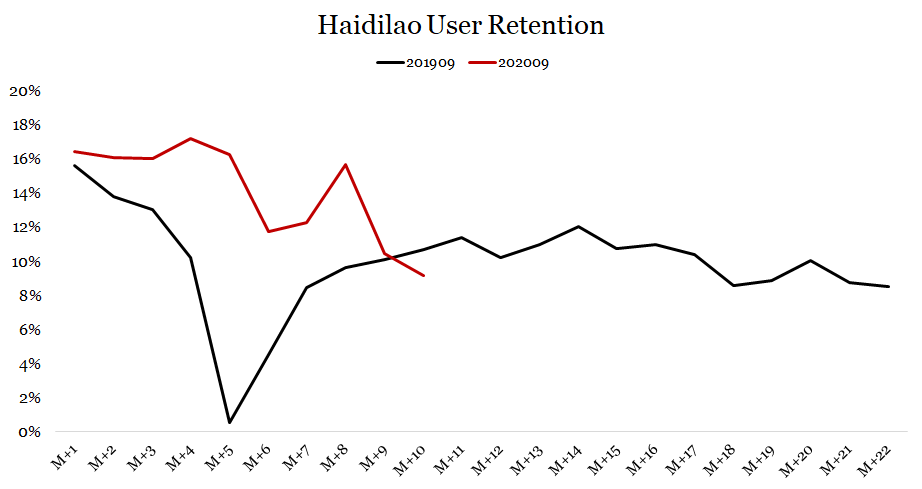

Haidilao’s per store sales were also underperforming throughout the third quarter compared to 2020 across all city tiers, while user retention rate saw further decline since May.

Multiple factors contributed to the continuous slow down. The unexpected Delta variant outbreak and regional lock down in China resulted in a negative shock on the dine-in restaurant industry at large.

Merely focusing on expansion without considering strategic location choices led to mounting labour cost and lower turnover rate, thus diminishing profit margin. Inefficient management also halted revenue gain. To make matters worse, Haidilao has been facing increasing customer complaints on poorer dine-in experience — higher price, service decline, lower-quality food, and rising food safety issues.

Along with store closure and suspension, Haidilao launched the “Woodpecker” initiative spearheaded by its deputy CEO, Lijuan Yang. The initiative aims to boost operational efficiency and enhance company brand image. The hot pot industry in China though, has long become a red ocean with ultra-high competition where customers have massive choices, posing challenges for Haidilao to differentiate itself from other major players. Can Haidilao be saved from further losses? Would the “Woodpecker” initiative be enough to build its competitiveness in the long run?

To learn more about the data behind this article and what Sandalwood has to offer, visit http://www.sandalwoodadvisors.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.