Source: https://secondmeasure.com/datapoints/thanksgiving-black-friday-sales-walmart-target-best-buy/

In 2020, several big-box chains announced that they would close their retail locations on Thanksgiving Day due to the ongoing COVID-19 pandemic. One year later, some of those same companies—including Walmart, Target, and Best Buy—will remain closed again on Thanksgiving. Consumer transaction data reveals that among the three companies, Walmart saw the most significant decrease in year-over-year sales the week of Thanksgiving in 2020. At the same time, Best Buy saw a major shift to online sales during that week while most sales at Walmart and Target still took place through retail channels.

Thanksgiving week sales in 2020 declined compared to the previous two years

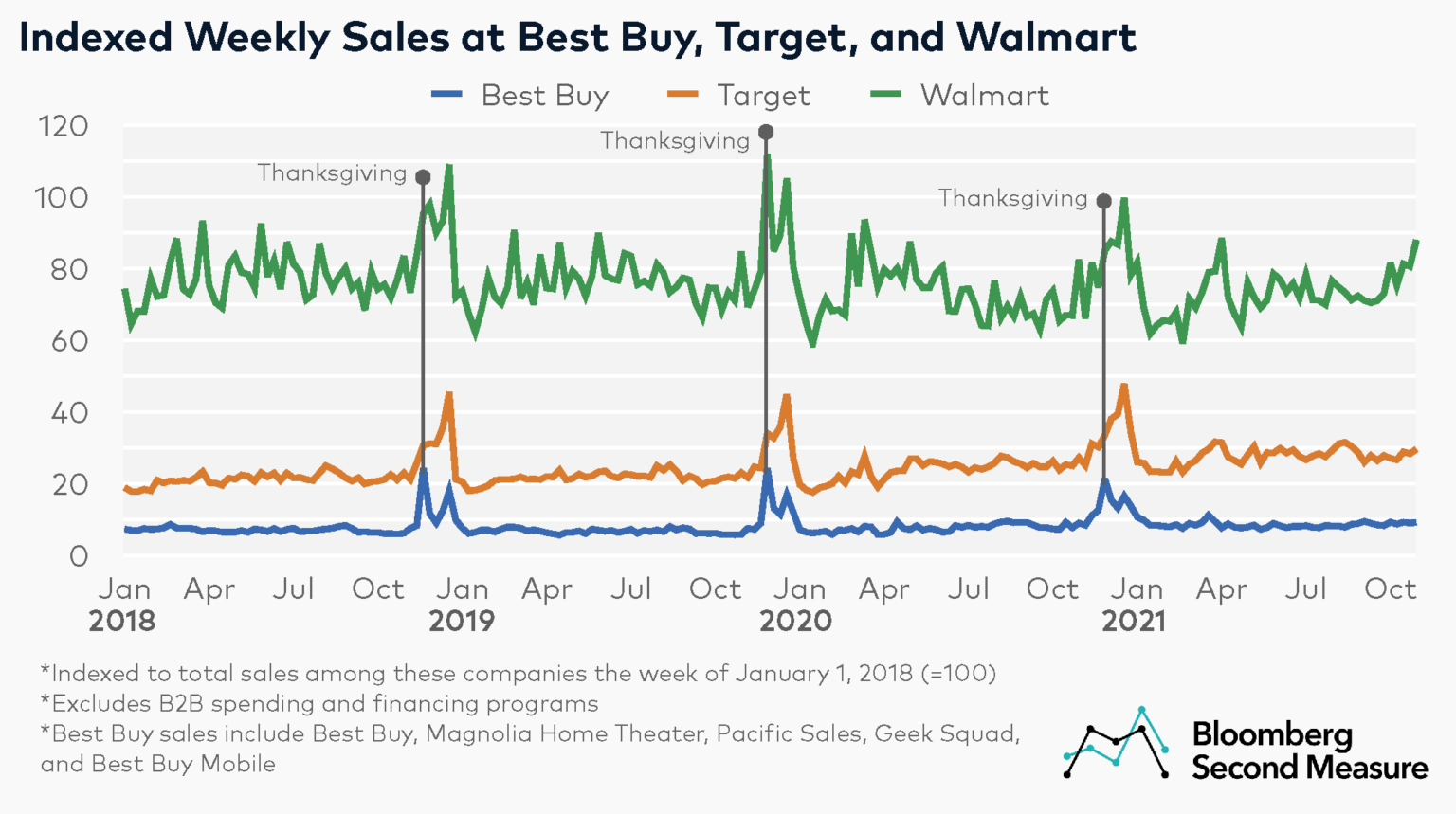

Looking at weekly consumer transaction data going back to 2018, Walmart, Target, and Best Buy all experience a similar sales pattern in November and December. Sales at these retailers skyrocket during Thanksgiving week—corresponding with Black Friday deals—and remain elevated through the end of the year as consumers finish their holiday shopping.

Prior to the pandemic, Thanksgiving week sales were rising year-over-year at these three companies. Compared to Thanksgiving week in 2018, sales during Thanksgiving week in 2019 were about the same at Best Buy, 11 percent higher at Target, and 17 percent higher at Walmart.

However, all three companies experienced a year-over-year decrease in weekly sales between Thanksgiving 2019 and Thanksgiving 2020, when stores were closed on Thanksgiving Day. Walmart and Target also started releasing online holiday deals as early as mid-October (corresponding with Amazon Prime Day that year), which may be a factor in lower sales during Thanksgiving week. Walmart sales during Thanksgiving week in 2020 decreased the most among the three companies, with a 24 percent decrease year-over-year compared to a 12 percent decrease at Best Buy and a 2 percent decrease at Target.

For the past three years, Best Buy saw its highest sales volume take place during the week of Thanksgiving, corresponding with its major Black Friday sales event. By contrast, Walmart and Target generally saw their highest sales volumes in the third week of December, perhaps capturing sales from last-minute Christmas shoppers.

More than half of Best Buy’s U.S. consumer sales during Thanksgiving week in 2020 were from the online channel

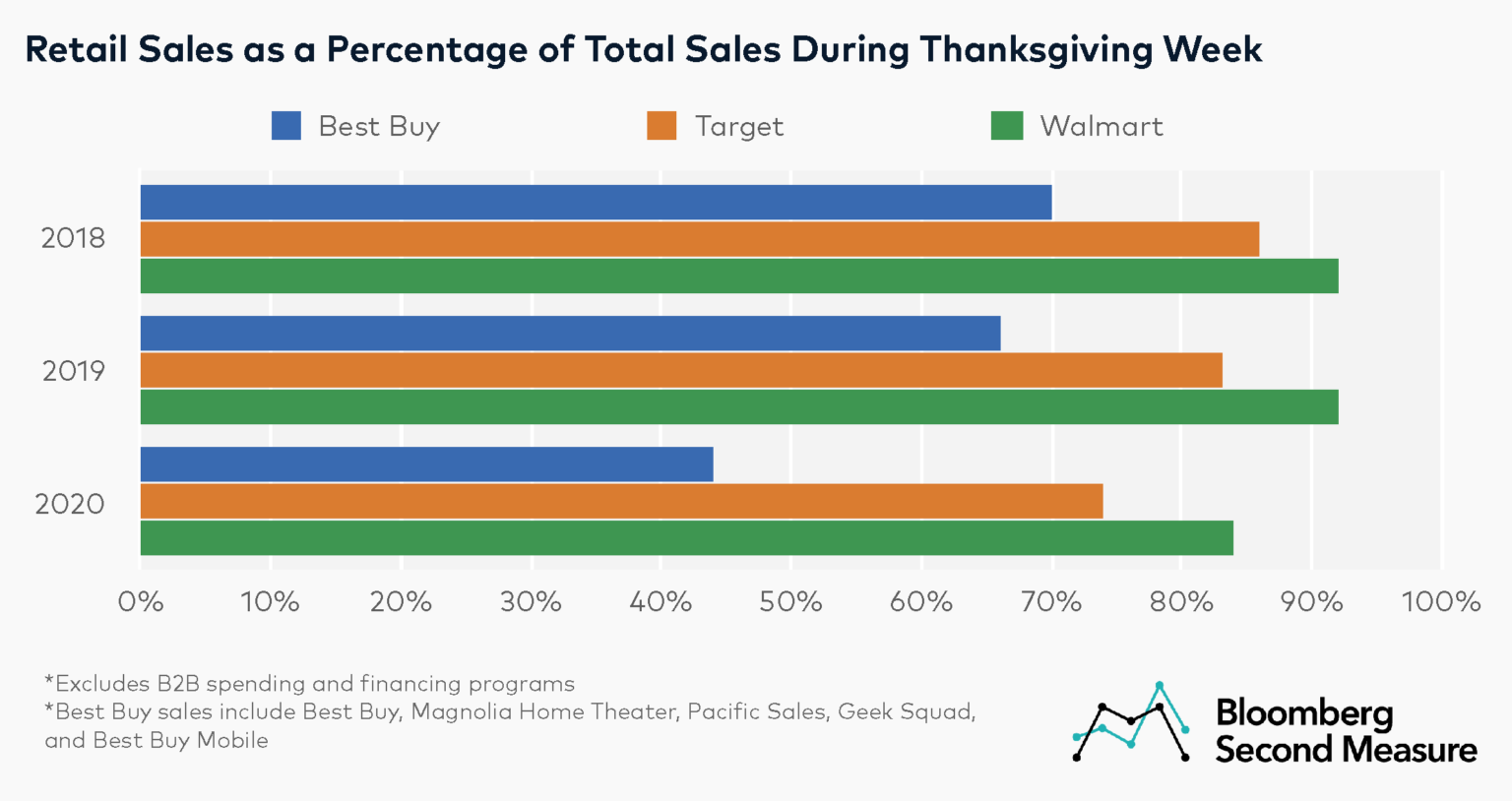

Even when stores were closed on Thanksgiving in 2020, most sales at Target and Walmart still occurred in stores during Thanksgiving week. For Walmart, 92 percent of sales the week of Thanksgiving in 2018 and 2019 took place via retail channels. In 2020, that percentage decreased to 84 percent.

Target has also seen a decreasing percentage of Thanksgiving week sales taking place in stores over the past few years. In 2018, 86 percent of Target’s sales during the week of Thanksgiving were from retail, a percentage that dropped to 83 percent in 2019 and then 74 percent in 2020.

Best Buy had the lowest retail sales as a percentage of total sales during Thanksgiving week. In 2018, 70 percent of Best Buy’s sales during Thanksgiving week came from the retail channel, compared to 66 percent during the same week in 2019. In 2020, 44 percent of Best Buy’s sales during Thanksgiving week took place in stores rather than online.

Average transaction values have been on the rise, especially at Best Buy

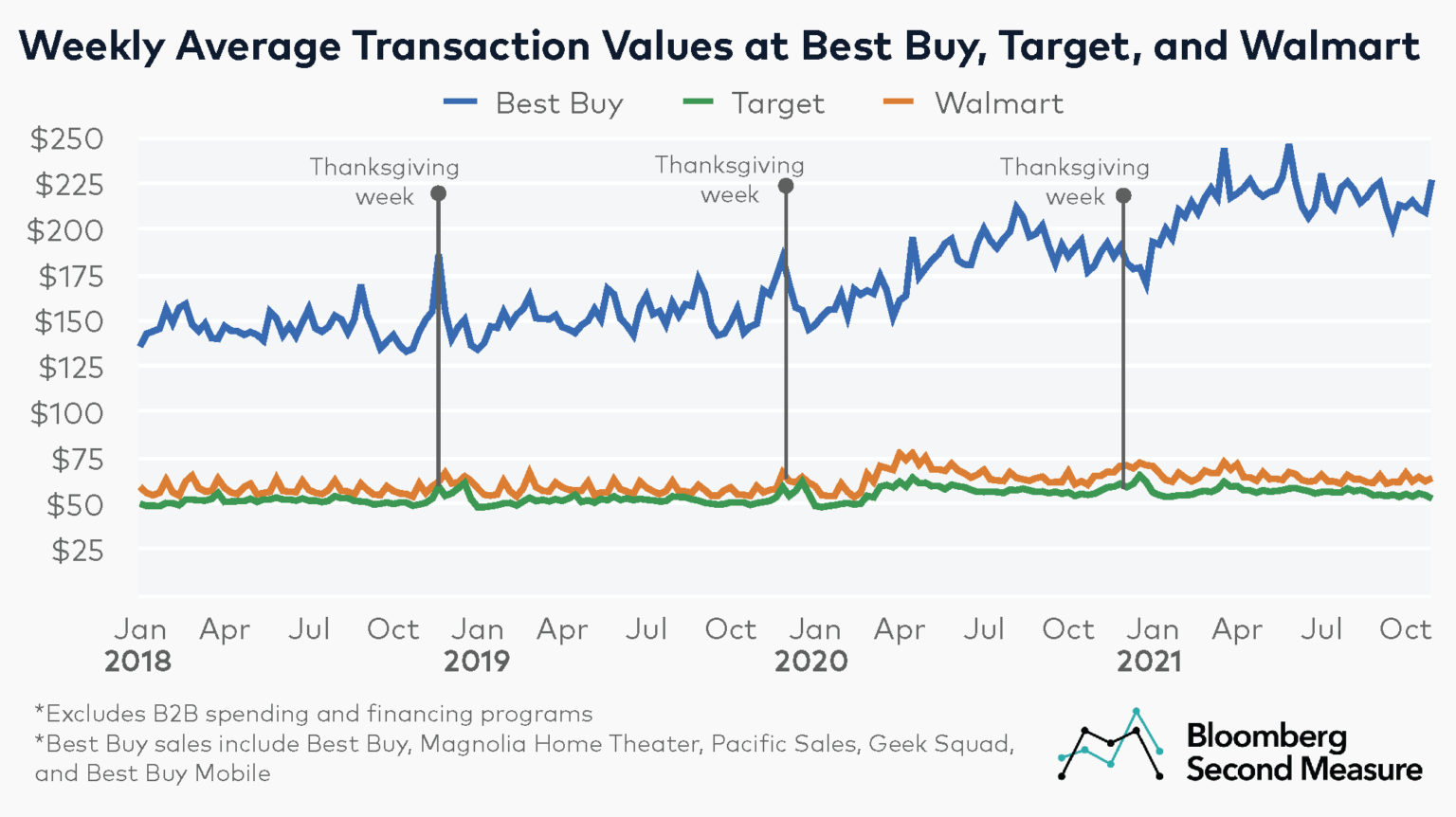

All three companies in our analysis experienced a bump in average transaction value during the week of Thanksgiving. In 2020, these week-over-week average transaction value increases for Walmart, Target, and Best Buy were 3 percent, 3 percent, and 5 percent, respectively.

Best Buy—which primarily sells electronics and home appliances—had the highest average transaction value among the companies in the analysis. During Thanksgiving week in 2020, Best Buy’s average transaction value was $190, compared to $61 for Target and $71 for Walmart.

The average transaction value at Best Buy is continuing to rise in 2021. In the last week of October 2021, Best Buy’s average transaction value was 26 percent higher than the same week in 2020. Some possible factors affecting strong average transaction value growth at Best Buy over the past two years include demand for electronics during the pandemic as many consumers worked and entertained themselves at home, demand for home appliances or new entertainment systems in a hot housing market, and supply chain shortages that could lead to higher prices for electronic devices.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.