As this year draws to a close, we dove into foot traffic trends for Nike, Under Armour, Athleta, and Lululemon to understand where the athletic apparel industry is headed.

Controlling the Distribution

We have written about the current trend of digitally native DTC brands expanding into brick and mortar. But another, no less significant trend is underway – brands with extensive wholesale partnerships reducing the number of third-party distributors to focus on DTC brick and mortar and digital distribution channels. This shift in strategy is particularly apparent in the sportswear category, where legacy athletic apparel brands such as Nike and Under Armour are reducing their wholesale partnerships, while newer sportswear companies such as Lululemon and Athleta have built their brand and cultivated their following by maintaining tight control over distribution.

Slow Offline Recovery for Nike, Faster Recovery for Under Armour

Nike has been shifting its distribution strategy in recent years by focusing on its owned brick and mortar and digital channels and by discontinuing numerous partnerships with online and offline third party retailers. Under Armour has followed suit, and is implementing a strategy that would slash the number of partner stores by 2,000-3,000 by the end of 2022 to allow the brand to gain more control over the distribution of its products.

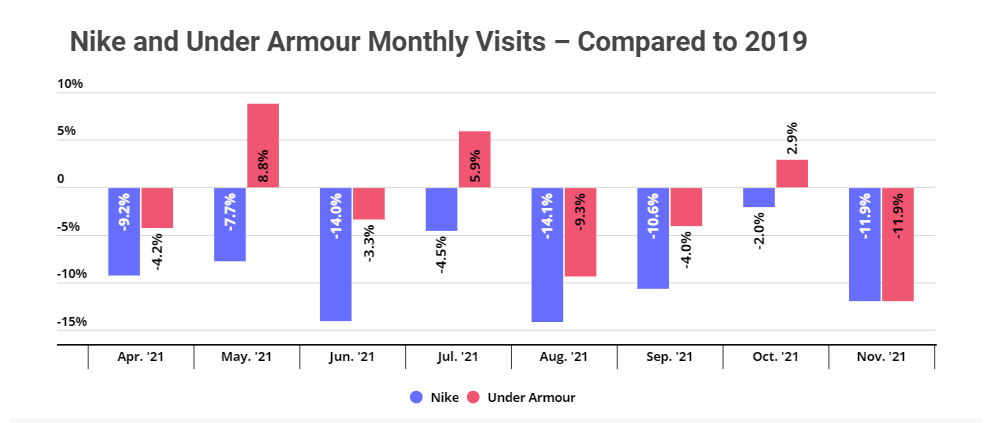

So far, the strategy has yielded mixed offline results for Nike, and slightly better results for Under Armour. From April through November, Nike saw an average of 10.3% decline in visits compared to 2019, while Under Armour saw a 1.8% average Yo2Y decrease for the same period. Both brands saw their foot traffic rise in October as consumers started their holiday shopping early, with Under Armour posting a 2.9% Yo2Y increase while Nike narrowed its Yo2Y visit gap to 2.0%. But in November, visits fell again to 11.9% less than in 2019 for both brands – likely the result of a weaker Black Friday offline performance and Thanksgiving day store closures.

But it would be premature to blame Nike and Under Armour’s mixed offline performance on their strategy, since both brands have been plagued by severe supply chain challenges. This could be causing inventory issues in the brands’ brick-and-mortar stores, which may be leading consumers to shop online where they can see what’s in stock and what’s not from the comfort of their couch.

Visit Growth for Athleta and Lululemon

Meanwhile, Athleta has been going the opposite route and scaling up its distribution through third-party retailers by expanding its existing partnership with REI. Athleta apparel and accessories will now be sold in 135 REI stores nationwide, on top of the five stores that already distribute the Athleta brand. And Lululemon has an equally discerning wholesale strategy of partnering with select gyms and yoga studios as opposed to larger third-party retailers so that it can focus on its DTC distribution channels in owned stores and online. Rather than expanding its distribution channels, the yoga-focussed company is diversifying its brand-building and marketing avenues – the brand recently purchased at-home fitness company Mirror, and plans to have Mirror instructors wear Lululemon apparel while teaching.

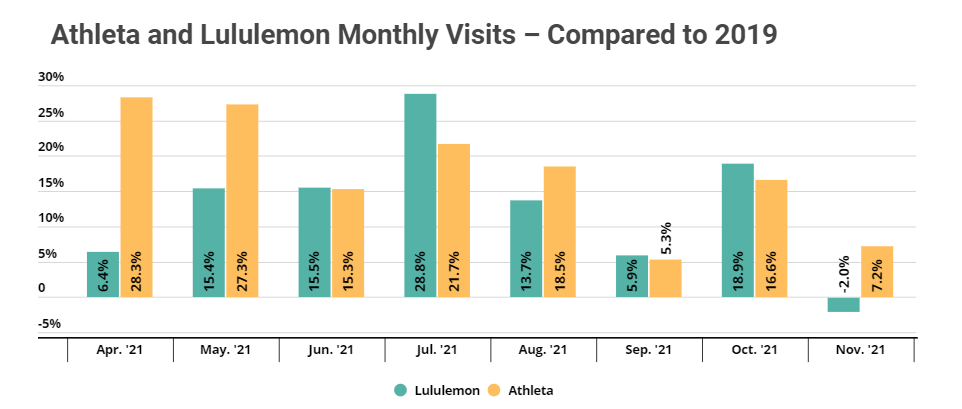

And foot traffic data shows that, with fewer third-party retailers carrying Athleta and Lululemon products, customers are flocking to the brands’ owned stores. Yo2Y visits were up every month this year for the Gap’s showrunner Athleta, with October and November seeing respective visit increases of 16.6% and 7.2%. Lululemon has also been seeing some major Yo2Y foot traffic increases, with October visits up by a whopping 18.9%. And although November visits to Lululemon did fall slightly compared to 2019, the dip is most likely due to weaker Black Friday performance rather than to any real decrease in demand.

Zooming into Black Friday

The holiday season opened early this year, driven by retailers worried about supply chain challenges and consumers brimming with pent-up demand. The extension of the 2021 holiday season, which has boosted visits in October and early November, seems to have also translated into a weaker Black Friday weekend for many retailers across the country – including in the sportswear category.

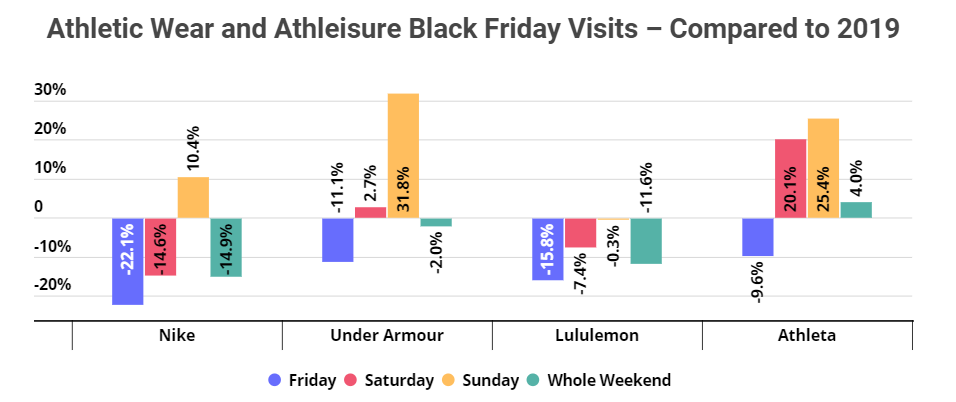

All the brands we analyzed saw Yo2Y visit declines on Black Friday itself, with Nike, Under Armour, Lululemon, and Athleta seeing a Yo2Y decrease of 22.1%, 11.1%, 15.8%, and 9.6%, respectively. But the Yo2Y daily visit gap narrowed throughout the weekend, and by Sunday most of these brands were posting impressive visit gains. Yo2Y daily visits to Nike, Under Armour, and Athleta rose by 10.4%, 31.8%, and 25.4%, respectively, and Lululemon narrowed its visit deficit to only 0.3%.

These brands’ weaker offline Black Friday weekend performance is not just due to the extended holiday season, which led some shoppers to complete their holiday shopping before Thanksgiving. The Yo2Y decline of Black Friday visits this year offers another indication that sector-wide retail events are becoming less significant, while brand-owned retail holidays are gaining momentum. Visits on Memorial Day Monday this year were also significantly lower than in 2019, while retailer-specific events such as Target Deal Days drove significant traffic to Target stores during what is usually a slower retail season.

So while sector-wide retail holidays still drive traffic, the visit peaks seem to be lower than they were in the past. And the success of brand-specific retail events shows that strong brands can create their own sales events to drive visits when it makes sense for them, instead of aligning themselves with sector-wide retail holidays whether the timing of these holidays works with the brand’s strategy and inventory or not – yet another reason why brands such as Nike and Under Armour are increasing control over their distribution channels.

Will Nike and Under Armour’s DTC push lead to an increase in visits? Will Athleta and Lululemon continue to shine in 2022?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.