Workplace Recovery Continues

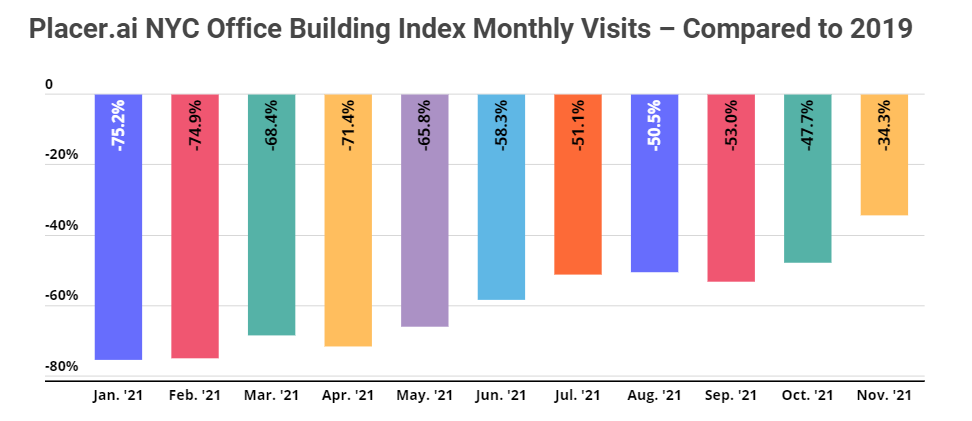

The workplace recovery, which suffered a brief setback in September as the fourth COVID wave swept through the United States, is continuing apace. October visits were down by 47.7% Yo2Y, and the November visit gap shrunk even further to 34.3% – a major leap given that the Yo2Y visit gap had been hovering at around 50% for the previous four months.

The fact that office foot traffic bounced back so quickly after this fourth COVID wave indicates that Americans are ready to return to their workplace. While office attendance may have dropped as the risk of infection rose, it seems that the novelty of 100% work-from-home has worn off, and people didn’t waste time going back to the office – at least partially – once the risk subsided.

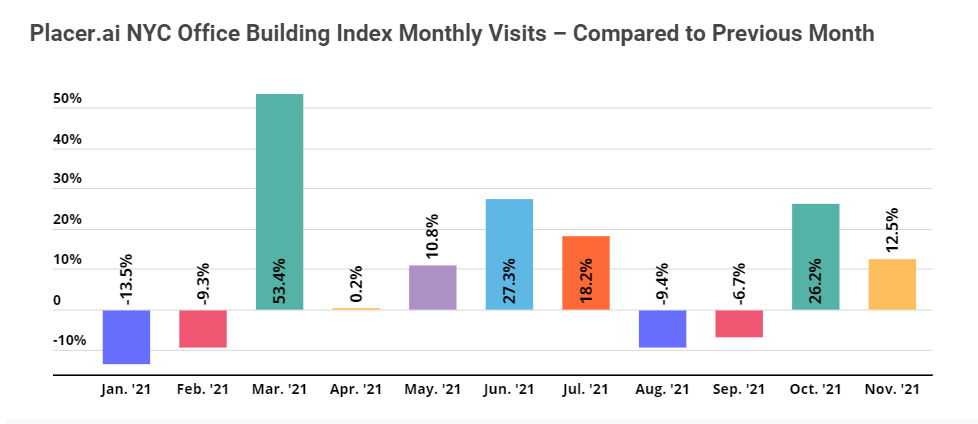

The month-over-month foot traffic growth confirms the consistency of the recovery. Office visits have increased almost every month since March compared to the month before, with the only major exceptions in August and September – at the height of the fourth COVID wave.

The office recovery took off in March, as office visits in NYC rose by 53% compared to February. Growth leveled off in April, but visits took off again in May, June, and July, as Month over Month foot traffic rose by 10.8%, 27.3%, and 18.2%, respectively. And following the dips in August and September, visits took off again in October and November, with 26.2% and 12.5% MoM growth, respectively.

The increase in office foot traffic reveals the transition underway from a work-from-home model towards a more hybrid model. While many workers may not be returning to the office every day, the office foot traffic increase is significant enough to bode well for the future of office buildings.

What’s Next for the Office Recovery?

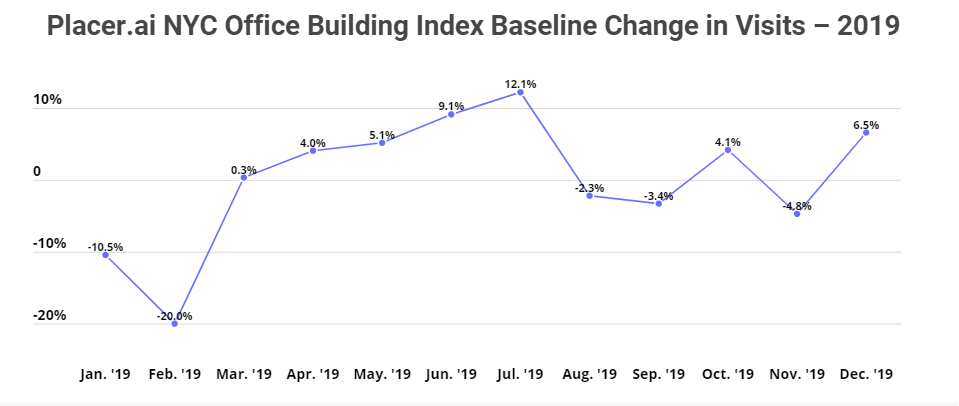

It is always tough to predict the future based on past trends, and it is even tougher to do so after a global pandemic turned the world upside down. Nevertheless, looking at the monthly baseline change in NYC office building occupancy in 2019 can give us a sense of where the office recovery may be headed in 2022.

In the past, March through July have been the strongest month for office foot traffic, with the sector getting another bump in visits in late fall/early winter. The March through July bump of 2019 is consistent with this year’s pattern of MoM increases in March – July, and the increase in visits in October also seems in line with this year’s visit patterns. So while this year’s MoM increase in November may have been higher than usual – perhaps due to the overall lower office occupancy this year and the fact that people are still coming back to their workplace – it seems that the visit trend of 2019 is pretty close to the visit trend of 2021, and is likely to continue in 2022.

This means that we can expect office visits to continue rising in December, but the recovery may stall a bit in January and February 2022 as the cold weather sets in and people accustomed to working from home stay in their comfort zone. Come March, however, office visits will likely rise once more, and office buildings may make a full recovery by July 2022.

Will NYC office building foot traffic continue to rise?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.