While our latest Coffee Deep Dive broke down the unique opportunity in the coffee and breakfast segment of the wider dining space, there was a specific need to call out the strength displayed by Starbucks in 2021.

The Expanded Power of Starbucks

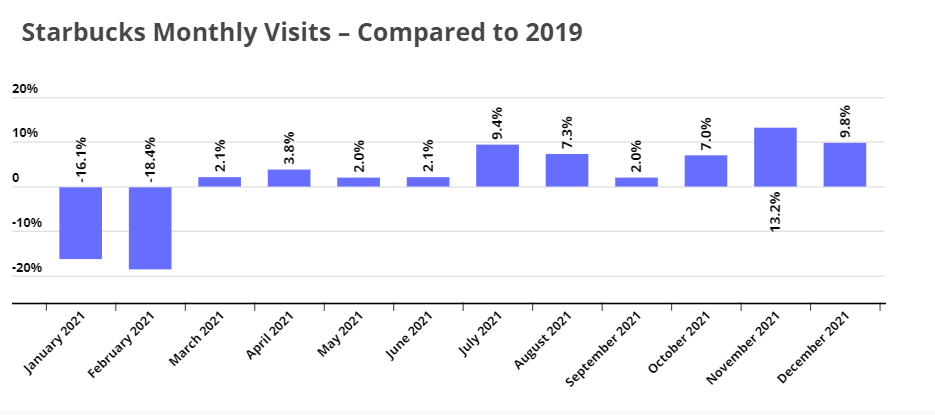

Considering the wider impacts of COVID on shopping and work behavior, it would have been fair to assume that visits would remain below normal levels throughout the year. And that is exactly how 2021 began, with visits down 16.1% and 18.4% in January and February, respectively, compared to the same months in 2019. Yet, by March, visits had returned to growth and remained that way throughout the rest of the year.

Visits peaked in the summer with the Back-to-School shopping season driving ample opportunities to drop by a Starbucks. And though this period performed well, it would have been fair to expect visit rates to decline in the fall, considering the comparison to November and December months that consistently mark the annual traffic peaks for the brand. However, visits did just the opposite, with Q4 marking visit increases of 7.0%, 13.2%, and 9.8% respectively in October, November, and December compared to the same months in 2019 – an especially strong performance considering the heights hit during this period in the past.

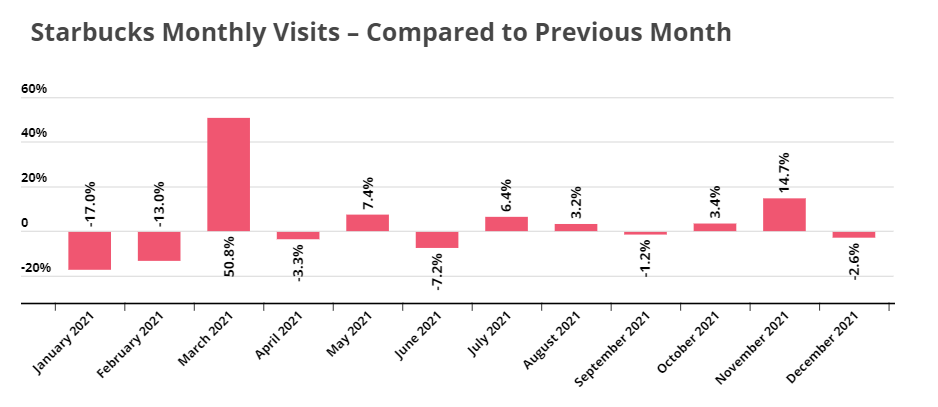

And the month over month comparisons confirm that, while behaviors have changed and shifted over the past two years, the brand has maintained its normal seasonality. October visits were up 3.4% and November visits were up 14.7% compared to the previous month, showcasing Starbucks’ ability to successfully drive a yearly fall visit surge.

Why?

The holiday season was particularly interesting for Starbucks because there was real reason for concern. The brand normally sees some of its strongest performances on major retail holidays, and the extended shopping season did threaten to diminish the heights reached on any given day. Instead, Starbucks saw five of its best visit days since the start of 2017 take place during the 2021 holiday season. Essentially, as the holiday shopping season extended earlier and more to off-peak days, shoppers continued to prioritize a visit to a Starbucks to refuel as part of the shopping trip.

Impressively, this also happened as visit length dropped over 18% compared to the same quarter in 2019. So although visits were shorter, the number of visits actually grew as the holiday retail period shifted. The success is critical as it shows that Starbucks will adapt to the patterns dictated by the wider retail and work environment.

What Does It Mean Moving Forward?

Starbucks is still operating in a strange and challenging environment where office visits have yet to normalize. As more people return to the office, the drop-in numbers at Starbucks should increase. At the same time, the new balance in favor of remote and hybrid work should create an added incentive to visit nearby Starbucks locations and utilize the café space as a place to work away from home.

This new balance should help Starbucks thrive through its unique combination of wide reach and multichannel approach that enables it to give its customers what they want – whether it is a convenient cup of coffee on the go or a more extended stay in a location. Combine this with a proven ability to succeed in a shifting retail environment and the reasons for Starbucks optimism in 2022 expand.

How will Starbucks perform in 2022?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.