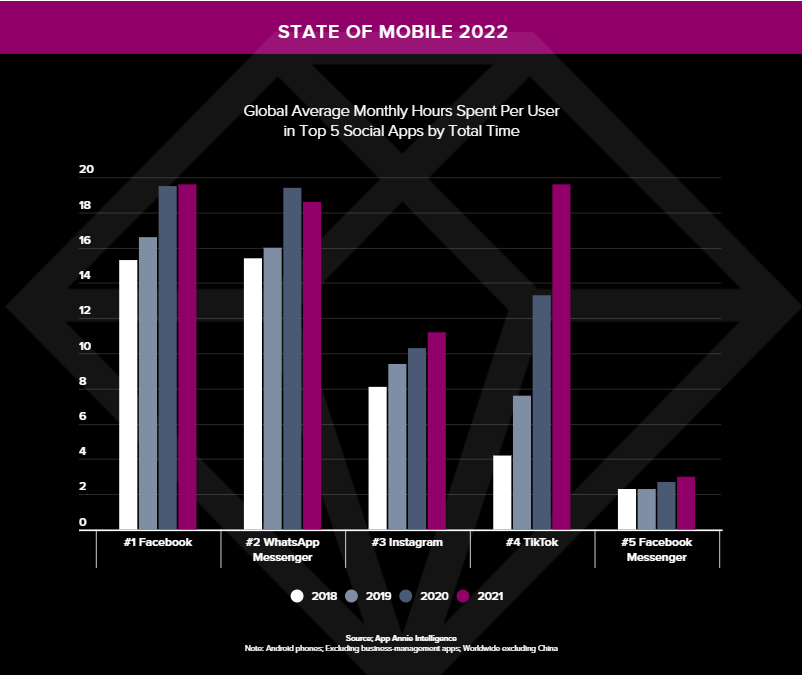

Social apps have never exerted more influence on the app economy than they did in 2021. Video is the main reason, with TikTok the big winner. Users spent 19.6 hours a month in the app – up 4.7x in four years.

When the mobile phone first emerged, it was a communication tool. People used phones to talk. Later, they texted. Then, around 2006, industry insiders started re-positioning the phone as a multimedia computer you could carry around in your pocket. They were right, of course. The smartphone did become a tool for information-gathering, shopping, banking — touching virtually every facet of our lives. It changed mobile behavior forever.

But not completely. Today, nearly two decades on, the phone is undoubtedly a mini-computer. But in terms of time spent, social and communication activity still rules.

This is confirmed in one of the headline stats from App Annie’s State of Mobile 2022 report. It’s this:

In 2021, 7 of every 10 minutes on mobile was spent in Social and Photo & Video apps.

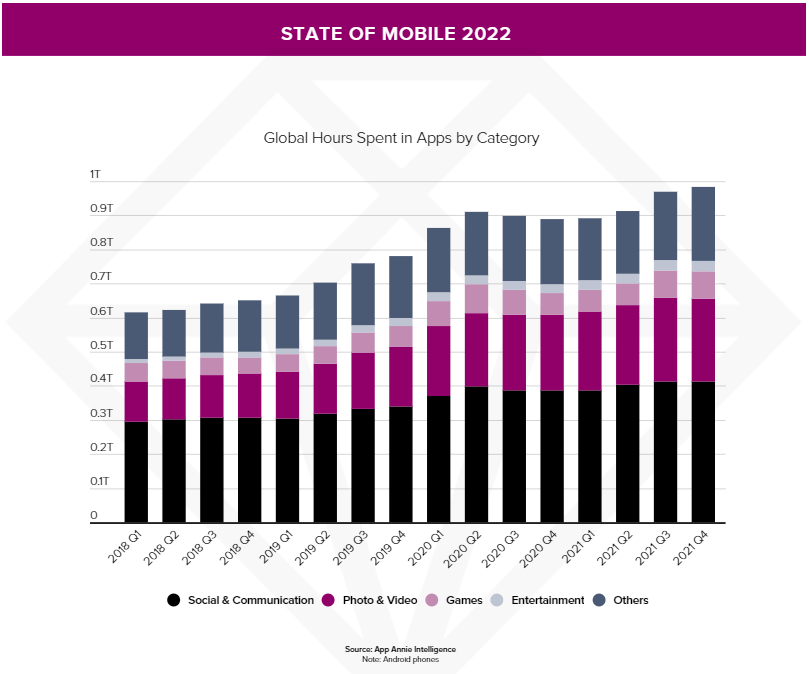

More precisely, the figures for Q4 2021 showed that consumers collectively spent around 950 billion hours on Android phones worldwide. Within that total, they spent around 650 billion hours in social/communication and photo/video products.

By comparison, the comparable total for Q4 2018 was 435 billion — equivalent to a 50% increase.

Time Spent in Social and Photo and Video Apps Nearly Doubles in Three Years

The driving force behind the dominance of social is, without doubt, the rise of apps that put photo and video at the center of the user experience. According to our State of Mobile 2022 data, global time spent in Social apps increased by 35% from Q4 2018 to Q4 2021 (306 billion hours to 412 billion hours). But in the same period, hours spent in Photo & Video apps lept by 90% (129 billion hours to 244 billion hours).

There are no prizes for discerning the main protagonist of this change.

TikTok was the standout winner in user engagement across 2021. The average TikTok user now spends 19.6 hours a month in the app globally excluding China. That’s equal to Facebook (the #1 Social app by time spent globally in 2021) and well above WhatsApp and Instagram. The big difference for TikTok is the trajectory of its growth, which is up 4.7x in four years. In 2018, its average monthly engagement was just 4.2 hours.

The app also dominates the download chart in most territories. In 2021, it was the top product in 8 North American and Latam markets, 5 APAC markets and 3 European markets — among select markets analyzed in the report.

Top 25 Live Video Streaming Apps Supported a $3.8 Billion Economy in 2021

Another significant influence on the social app space has been the transition from video sharing to live video streaming.

It’s another area in which TikTok leads, but in some regions new entrants are challenging the big incumbents. A good example is Singapore’s Bigo LIVE, which ranked #1 for global consumer spend in Social apps for 2021.

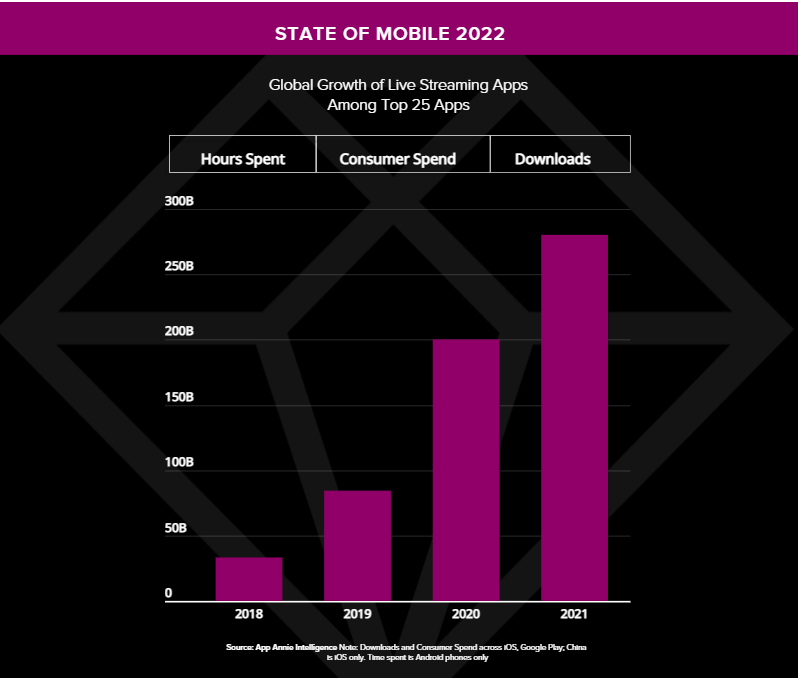

In 2021, growth in time spent in the top 25 live streaming apps outpaced the social market overall by a factor of 9 — a YoY rise of 40% compared to social apps at 5%. This has been accompanied by a similar rise in consumer spend as consumers look to compensate their favorite streamers — offering monetization pathways for content creators in the creator economy.

Live streaming is now creating a new economy – providing opportunities for live shopping and direct creator compensation. According to our data consumer spend in the top 25 live streaming apps grew from $2.4 billion in 2020 to $3.8 billion in 2021. That’s a year-over-year increase of 57%.

The Next Big Social App Evolution: Avatars and Metaverse?

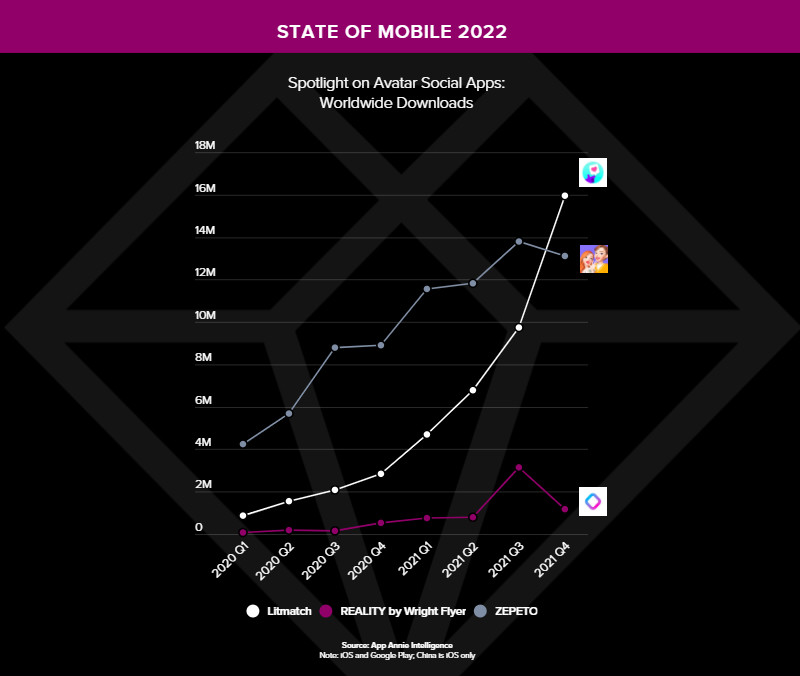

Does the public interest in live streaming provide an indication of which way the social market might go next? Yes. Live streaming incorporates creativity, self-expression, user generated content and online socializing. Which is why, in the State of Mobile 2022 report, we report on the rise of avatar social apps. These apps combine creative self-expression, user generated content and online communities often with the world building components of metaverses. Increased interest in metaverse games has led to a spike in avatar-based social apps. In fact, we expect metaverse games to grow to over $3.1 billion in annual app store consumer spend in 2022.

There has always been a demand for online worlds in which people interact not as themselves but as avatars. Think Habbo Hotel or even The Sims, both founded nearly 22 years ago in 2000. Now, with so much hype around the potential of the metaverse, a new generation of apps is rebooting these virtual worlds for the TikTok generation. We identified three – Litmatch, REALITY by Wright Flyer and ZEPETO – whose combined global downloads grew 160% YoY in 2021. ZEPETO is even creating a new generation of virtual influencers, who have the ability to sell digital items that other users can use to personalise their avatars.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.