The home furnishing sector got a boost in 2020 as the excessive amounts of time spent indoors pushed people to upgrade their living space. Since then, the country has opened back up, but home furnishing foot traffic is still booming. To better understand this category, we dove into foot traffic patterns for Tuesday Morning, At Home, HomeGoods, and Floor & Decor to see how these visit leaders performed in 2021 and find out where the sector is headed in 2022.

At Home, HomeGoods, and Floor & Decor Remain Strong

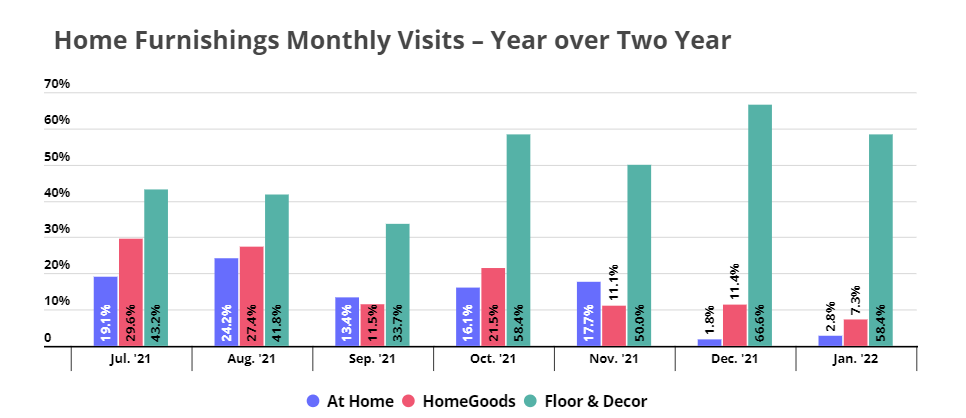

Home furnishing brands were on an extended roll throughout 2021. Visits to Home, HomeGoods, and Floor & Decor saw growth every month of 2021 on a year-over-two-year (Yo2Y) basis, and their strength continued into 2022: In January ‘22, Yo2Y visits rose by 2.8%, 7.3%, and 58.4% for At Home, HomeGoods, and Floor & Decor, respectively.

The three brands focus on different products and operate different types of stores. At Home venues average just over 100,000 sq. ft, compared to 28,000 feet for the average HomeGoods store and 78,000 sq. ft. for the average Floor & Decor stores. The success of all three brands indicates that there is space for all different types of players in the home furnishing space.

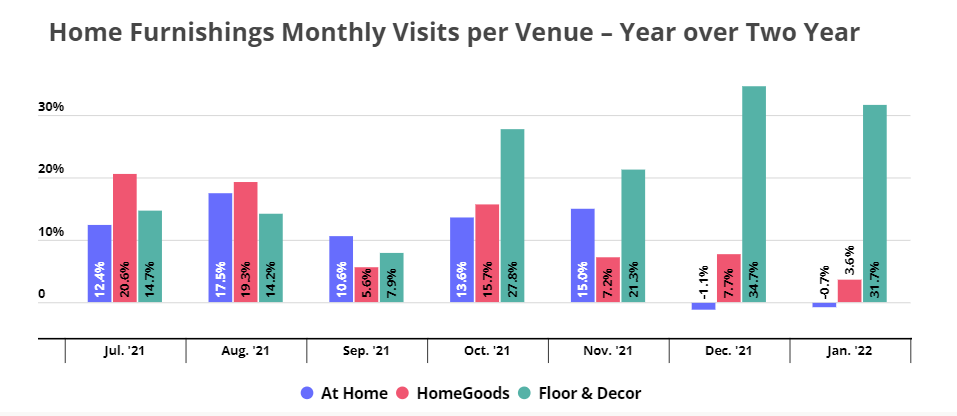

The visits per venue increases further confirm the increased demand for home furnishing products. Floor & Decor’s rise is particularly noteworthy – the brand’s impressive growth in visits per venue numbers indicates that its growing store fleet is being met with high levels of consumer interest.

The Yo2Y visit growth in the second half of 2021 and into 2022 – even though the light at the end of the pandemic tunnel is already faintly visible – reflects the fact that COVID transformed consumers’ relationships with their living space. The persistence of remote and hybrid work has imposed new requirements on homes, and the many hours spent indoors have made people appreciate the importance of investing in comfortable and practical surroundings. At Home, HomeGoods, and Floor & Decor are well positioned to benefit from this long-term rise in home goods demand.

Tuesday Morning’s Comeback

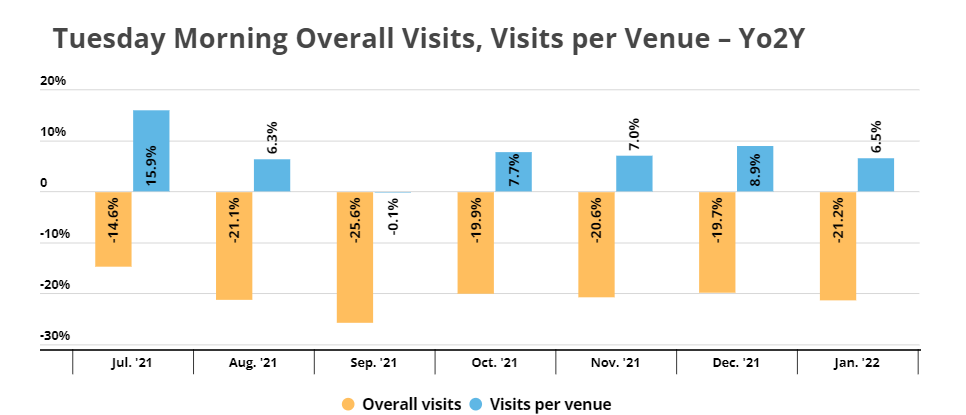

Tuesday Morning was one of the earliest COVID retail casualties. The furniture and home decor retailer filed for bankruptcy in May 2020 citing the “immense impact” of store closures. In January 2021, the brand exited bankruptcy after permanently shuttering almost 200 locations. It is not surprising, then, that overall visits were down compared to 2019 and early 2020 – the company has been operating with almost 30% fewer venues.

Since “right-sizing”, however, Tuesday Morning’s visits per venue have increased significantly. So while the company now has less stores, it is serving more customers out of each one.

This data shows how closing underperforming stores can sometimes breathe new life into retailers by enabling them to maximize the impact of every brick and mortar investment. Tuesday Morning’s success should serve as an example for other brands looking to optimize their store fleet and offers a reminder that right-sizing is not necessarily a step along the way towards extinction.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.