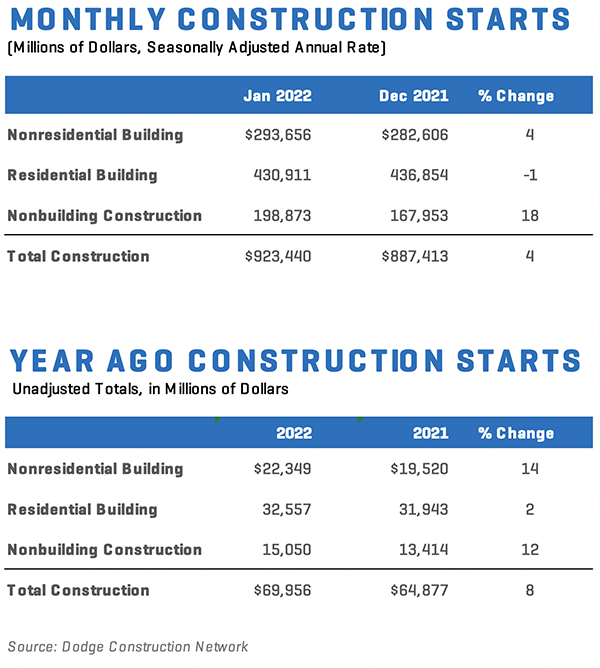

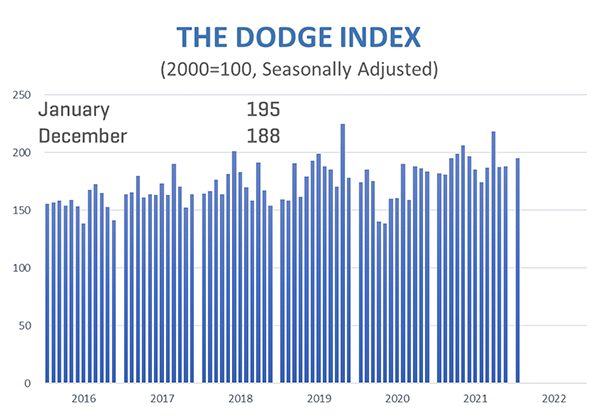

Total construction starts increased 4% in January to a seasonally adjusted annual rate of $923.4 billion, according to Dodge Construction Network. Nonresidential building starts increased 4%, and nonbuilding starts rose 18%. Residential starts fell 1%.

Compared to one year ago, total construction was 8% higher in January 2022 than in January 2021. Nonresidential building starts were up 14%, nonbuilding starts rose 12% and residential starts gained 2%. For the 12 months ending January 2022, total construction starts were 13% above the 12 months ending January 2021. Nonresidential starts were 14% higher, residential starts gained 19%, and nonbuilding starts were up 3%.

“Construction starts continue to climb, mostly unimpeded by rising materials prices and shortages of labor and key materials,” stated Richard Branch, chief economist for Dodge Construction Network. “The number of projects in the planning pipeline suggests that the rising trend in construction should continue for the time being and will be spread across more sectors than last year. While the outlook is positive, the many challenges facing the sector will limit upside potential.”

Below is the breakdown for construction starts:

Nonbuilding construction starts rose 18% in January to a seasonally adjusted annual rate of $198.9 billion. Highway and bridge starts rose 33%, and utility/gas plant starts more than doubled. However, environmental public works starts lost 9%, and miscellaneous nonbuilding starts fell 5%.

For the 12 months ending January 2022, total nonbuilding starts were 3% higher than the 12 months ending January 2021. Environmental public works starts were up 22%, and utility/gas plant starts rose 4%. Highway and bridge starts were 1% lower on a 12-month rolling sum basis, and miscellaneous nonbuilding starts were 16% lower.

The largest nonbuilding projects to break ground in January were the $1.6 billion Amtrak Gateway Portal Bridge Enhancement project in Secaucus, NJ, the $477 million US 183 North mobility corridor in Austin, TX, and a $463 million LA1 paving project in Golden Meadow, CA.

Nonresidential building starts rose 4% in January to a seasonally adjusted annual rate of $293.7 billion. The commercial sector moved 8% higher due to an increase in retail, office and warehouse starts. Institutional building starts gained 10% on gains in healthcare, transportation and recreation starts. Manufacturing starts fell 42%.

For the 12 months ending January 2022 nonresidential building starts were 14% higher than in the 12 months ending January 2021. Commerical starts were up 11%, institutional starts rose 8%, and manufacturing starts gained 82% on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in January were the $1.5 billion JFK Terminal 4 expansion in Queens, NY, the $647 million Rutgers Cancer Institute in New Brunswick, NJ, and the $550 million JM Smucker Uncrustables manufacturing facility in McCalla, AL.

Residential building starts fell 1% in January to a seasonally adjusted annual rate of $430.9 billion. Single family starts moved 2% higher, but multifamily starts fell 10%.

For the 12 months ending January 2022, residential starts improved 19% from the 12 months ending January 2021. Single family starts were 2% lower, while multifamily starts were 26% stronger on a 12-month rolling sum basis.

The largest multifamily structures to break ground in January were the $370 million Seattle House mixed-use building in Seattle, WA, the $300 million Broad & Washington mixed-use building in Philadelphia, PA, and the $275 million Gateway II development in White Plains, NY.

Regionally, total construction starts in January rose in the Northeast, South Central and West, but fell in the Midwest and South Atlantic.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.