Off-price foot traffic has been outperforming the apparel average for all through 2021, and recent data shows that visits across the sector are still strong. To better understand the sector, we analyzed overall visit performance and consumer behavior patterns for T.J. Maxx, Marshalls, Burlington, and Ross Dress for Less to see how these off-price leaders capped off 2021 and to understand what lies ahead for the sector in 2022.

Visit Performance Overview

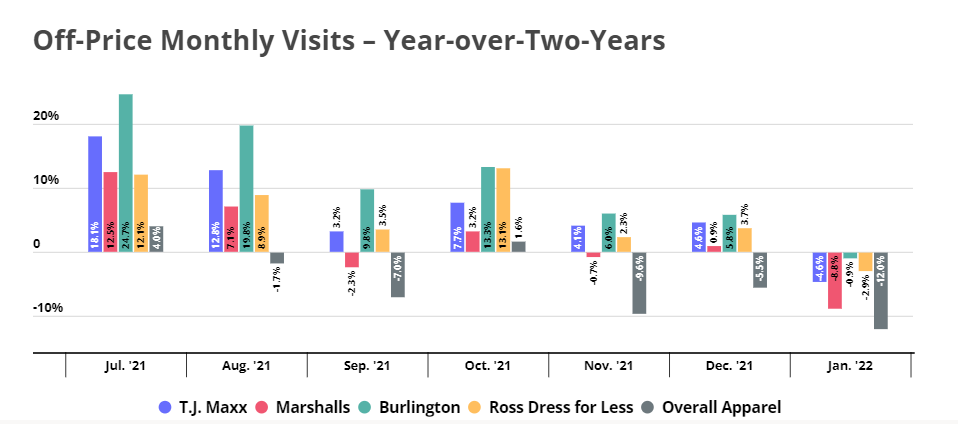

Most off-price retailers reached a full visit recovery towards the end of 2020, quickly bouncing back from COVID-induced restrictions. While overall nationwide apparel visits struggled to consistently exceed – or even reach – their 2019 visit levels, the leading off-price retailers continued posting strong visit performances throughout 2021 – in spite of or perhaps as a result of their brick and mortar focus.

And despite the concerns that supply chain challenges and rising freight costs would impact off-price inventory, the sector finished the year on a high note. December Yo2Y visits increased by 4.5%, 5.9%, 3.7%, and 0.9%, for T.J. Maxx, Marshalls, Burlington, and Ross Dress for Less, respectively. And although foot traffic slowed down in January – likely as a result of surging COVID cases – all four off-price leaders continued to outperform the apparel category – a testimony to the enduring appeal of the off-price model.

Sky High Consumer Loyalty

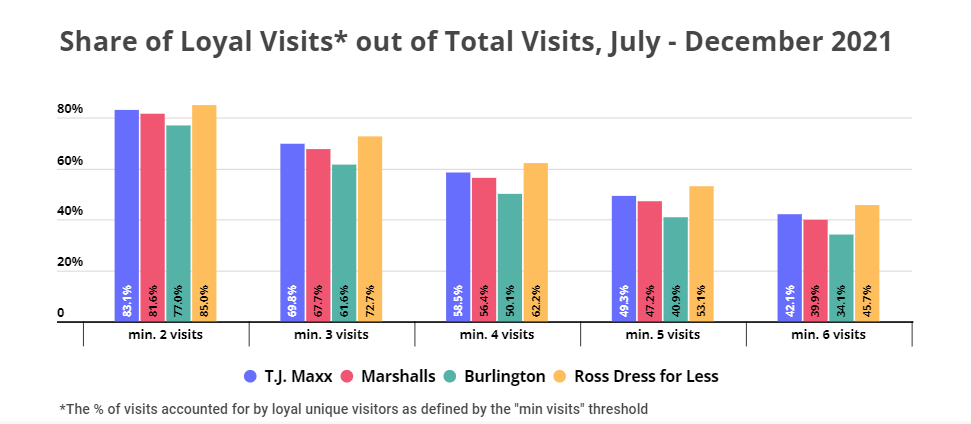

Another promising sign for the long-term prospects of the sector is that the high visit numbers are not coming from one-off visitors: off-price consumers have proved to be extremely loyal. Ross has the highest loyalty score, with 85.0% of visits in July to December 2021 coming from customers who have visited Ross stores at least twice in that period.

T.J. Maxx and Marshalls were not far behind – in the second half of 2021, 83.1% and 81.6%, of visits, respectively, were from loyal customers. And customer loyalty to Burlington was also quite high, with 77.0% of visits between Q3 and Q4 2021 attributed to loyal customers – a number that many also be slightly lower because of the brands surging overall visits and growing customer base.

The graph below shows just how successful off-price brands have been at cultivating a loyal clientele. Over a third of visits to each of the four leading off-price retailers between July and December 2021 were from customers who visited the chain at least six times in those six months – a rarity for apparel brands. This means that the treasure-hunt experience, value orientation and frequent inventory turnover is motivating them to make frequent visits to the store to check out the latest arrivals.

Off-Price Pie Expanding – Cross-Shopping on the Rise

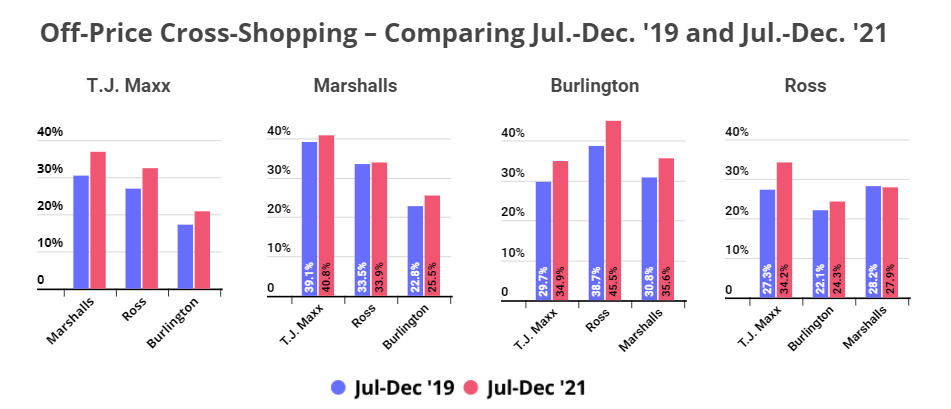

Lastly, cross-shopping – the share of customers of one brand that also shop at another brand – has increased since 2019. The increase in cross-shopping was greatest for T.J. Maxx and Burlington customers – meaning that more T.J. Maxx and Burlington customers also shopped at the other off-price brands in July to December 2021 compared to the same period in 2021, and cross-shopping increased the least among Marshalls customers. Still, the trend towards more off-price shopping is undeniable.

Given the context of high foot traffic and strong loyalty, the increase in cross-shopping can only mean one thing – the demand for off-price apparel is on the rise. The combination of bargain pricing and treasure-hunt experience has proved attractive enough to not only withstand the challenges of 2021, but to actually thrive despite the difficult retail conditions.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.