Our latest white paper looks at recent mall performance from a location analytics perspective. Consumer behavior trends indicate that shopping behavior is stabilizing, and foot traffic data shows that visits are bouncing back, with some months in 2021 even exceeding 2019 visit levels.

The Mall Deep Dive – 2021 Yearly Review white paper looks at top tier indoor malls, outlet malls, and open-air shopping centers to evaluate nationwide and regional foot traffic trends, analyze the correlation between online searches and mall visits, understand the impact of out-of-the-box tenants, and assess the current state of mall consumer behavior. Below is a taste of our findings. For the full report, download the free white paper.

Recapping 2021 Mall Foot Traffic

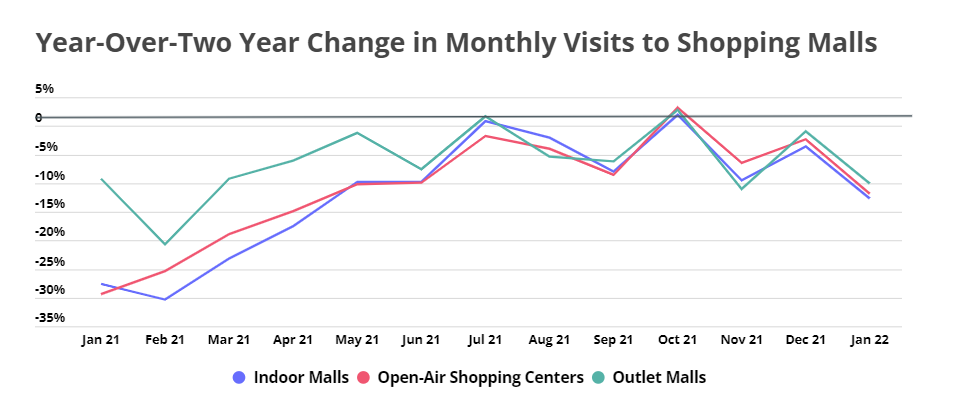

Consumers affected by the economic uncertainty started 2021 with a clear preference for outdoor, bargain-focussed outlet malls. Non-outlet open air shopping centers also outperformed indoor malls as consumers avoided enclosed spaces and due to the lingering impact of restrictions in certain areas.

But as the year progressed, vaccination rates climbed, and unemployment rates fell, shoppers felt more comfortable spending extended amounts of time indoors with others. By June, indoor malls had caught up, and the different mall types saw very similar foot traffic trends throughout much of the summer.

The Delta wave did set the mall recovery back slightly, with year-over-two-year (Yo2Y) visits dipping between mid-August and the beginning of October. But the extended holiday shopping season brought visits right back up, and the push towards earlier holiday shopping was so successful that October ended as the only month of 2021 where visits to all three mall types exceeded 2019 levels. And while visits dipped again in November – likely due to the decline of Black Friday – Yo2Y visits climbed back up in December, serving as a further testament to malls’ resilience.

Getting Creative with Empty Mall Space

The rightsizing of store fleets combined with the empty storefronts still leftover from shops that didn’t weather the lockdowns meant that malls need to think outside the box to fill all the open spaces. Early in the pandemic, many mall operators simply cut rental rates, since a high share of empty stores can affect a mall’s attractiveness – and therefore profitability – more than a temporary rent discount.

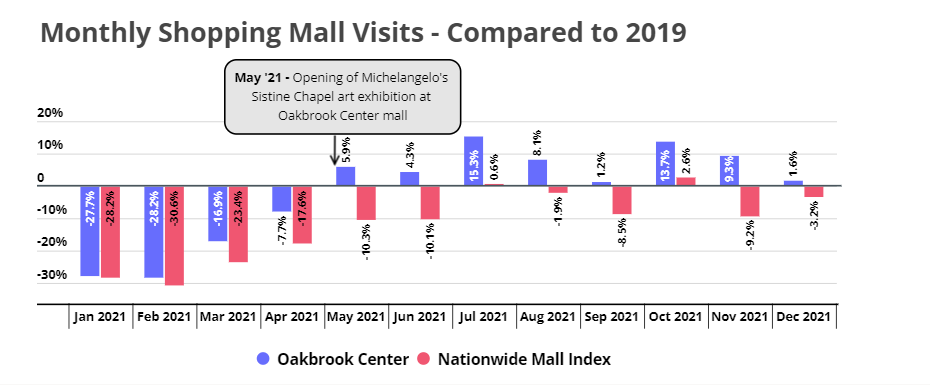

But as 2020 turned to 2021, and then 2022, malls were forced to get more creative – literally – to occupy the newly empty spaces. Brookfield Properties, for example, filled a space at its Oakbrook Center near Chicago that Sears occupied before its bankruptcy with a traveling exhibition about the Sistine Chapel. Such events “draw people from miles away,” said Katie Kurtz, Brookfield’s senior vice president for retail business development.

The result was an increased ability to leverage the space to boost overall interest in a mall visit. And while the concept of a mall-based “event” is nothing new, the ability to manufacture interest could play even more value in the coming years as more top tier shift their focus and increasingly privilege experiences.

Pop-Up Stores

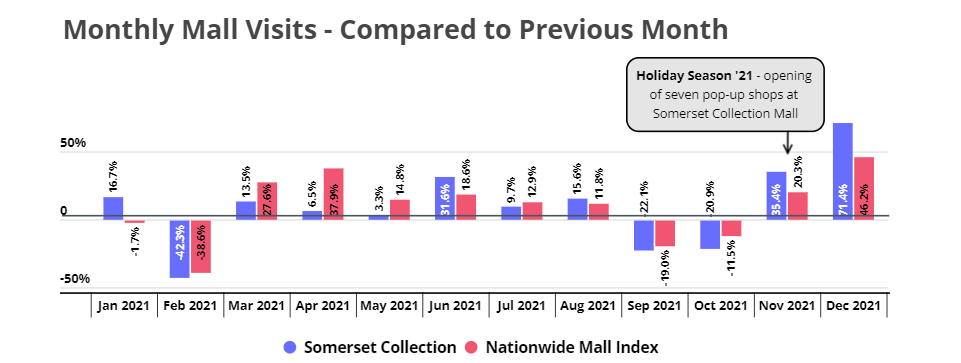

Pop-up stores were another popular option for filling empty mall space. Landlords like pop-ups because they can limit risks on new, untested concepts, while pop-up tenants appreciate the opportunity to test out new markets and store layouts without making a long-term commitment to something that may not work or may only have short term value.

In late November and early December, the Somerset Collection mall near Detroit opened seven pop-up stores for the 2021 holiday season – and month-over-month (MoM) visit data indicate that this seems to have given the mall a visit boost. Most of the stores opened on Black Friday, and the mall’s November foot traffic increase compared to the previous month was almost a third larger than the national mall average. And in December, when all the pop-up stores were up and running, the mall saw a MoM visit hike of 71.4% – compared to the 46.2% average MoM increase for indoor malls nationwide.

The ability to effectively leverage “empty” space and to create timely activations that drive urgency will be a critical element for mall owners in the coming years.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.