For music lovers, Spotify is practically synonymous with music streaming. And for good reason: The streaming giant says it had 172 million paid subscribers and 381 million monthly active users as of October 2021 — more than any other music streaming service.

Its closest competitors, Apple Music and Amazon, are more tight-lipped about their exact subscriber count, but media analyst Midia Research put them at around 79 million and 68 million, respectively.

While Spotify reigns supreme, both Amazon and Apple Music have been making moves to attract new listeners. All three services offer similar size catalogs at the same $10-a-month price point, so let’s see how they’re using digital advertising to square off in the music streaming wars.

Spotify Outspends Amazon Music

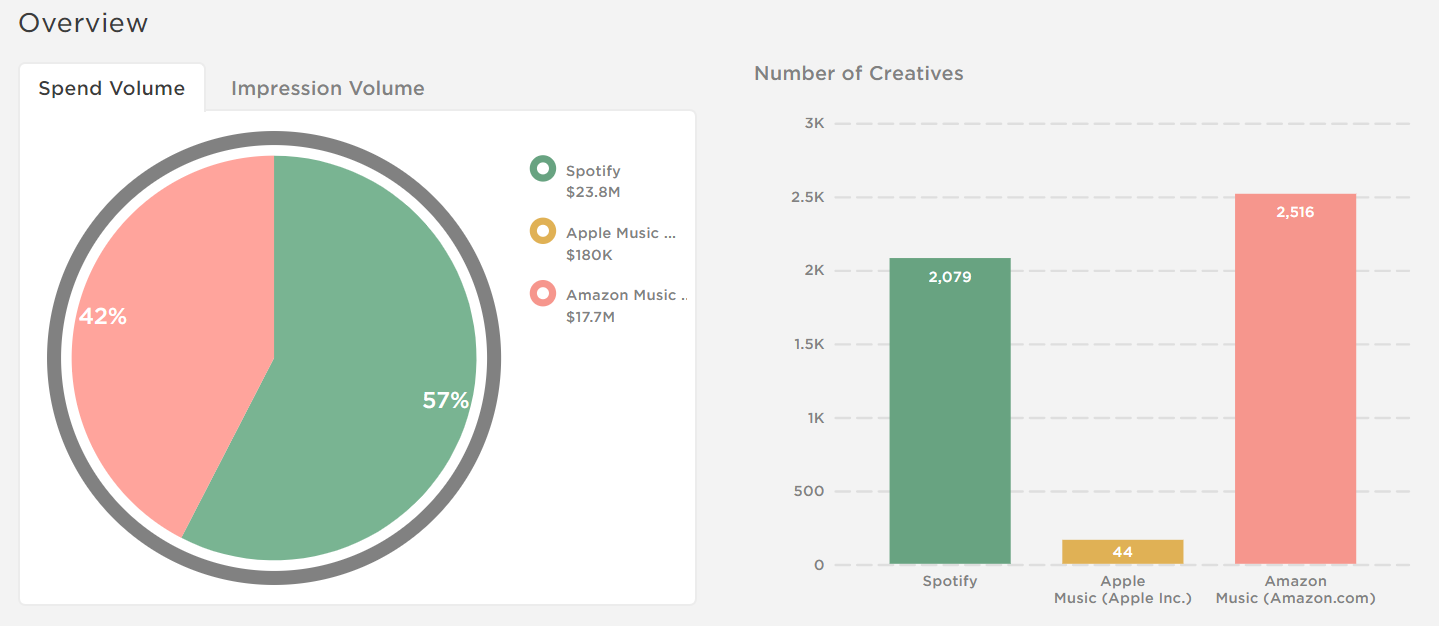

From October 1 to January 20, Spotify has spent $23.8M on digital ads — or around 57% of the overall spend for these three streaming services. By contrast, Amazon Music spent $17.7M, or 42%. This amounts to roughly 3% of Amazon’s $582M digital advertising budget during this time period.

What’s striking is how little Apple is spending by comparison: The brand only invested $180K in digital advertising for its Apple Music brand or 1% of the total spend. Compared to Apple’s $48.2M digital advertising budget, Apple Music feels like an afterthought.

Spotify’s spending has stayed fairly consistent throughout the end of 2021 and beginning of 2022, whereas Amazon Music began ramping up around mid-November with a big spending push in the week leading up to Christmas and a slow taper off throughout the end of the year and into January. This coincided with a holiday campaign offering 3 months of Amazon Music free for new subscribers. Apple Music, on the other hand, pulled back on advertising at the end of the year. October was its lowest month of spending ($35K) since Feb 2021, followed by a slight increase in November ($84K) and another drop in December ($61K).

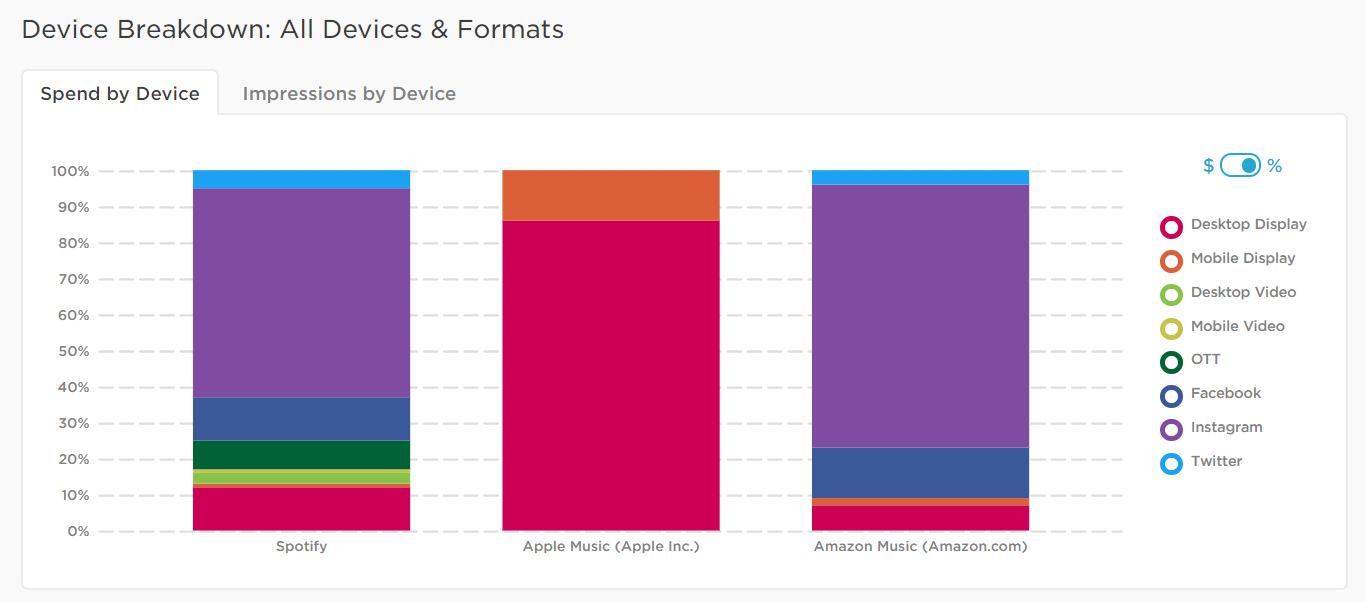

Spotify and Amazon advertise on social media, while Apple Music March to A Different Beat

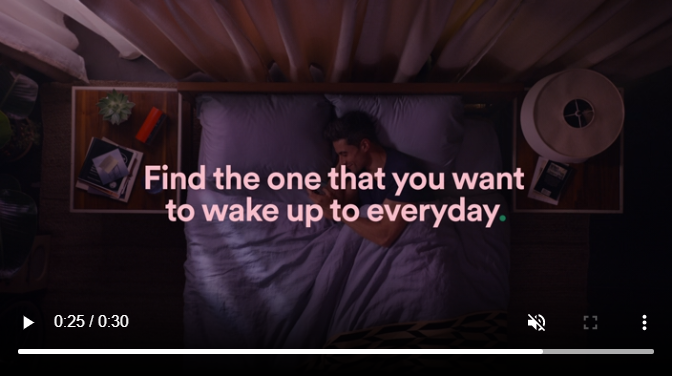

Spotify has been investing heavily in podcasts over the last few years, and in October it became the #1 podcast platform in the U.S. Knowing this, it makes sense that six of its top ten creatives were for podcasts on Spotify. To promote this service, Spotify opted for a big push on social media, with 59% of its spend on Instagram and 83% across social channels. Another 8% went toward OTT, making Spotify the only one of the three advertisers we looked at to use this format. 98% of Spotify’s $676K OTT budget was spent on Hulu.

Apple Music went the opposite direction and sidestepped social media advertising altogether. Instead, 100% of its advertising budget went toward display ads, with 86% on desktop display and 14% on mobile. This is also the complete opposite of parent company Apple’s overall strategy, which is dominated by OTT at desktop video. It’s hard to say why Apple Music isn’t running video ads, but we do know that historically the brand has spent around 15% of its budget on desktop video, and that it stopped advertising on that channel back in March 2021.

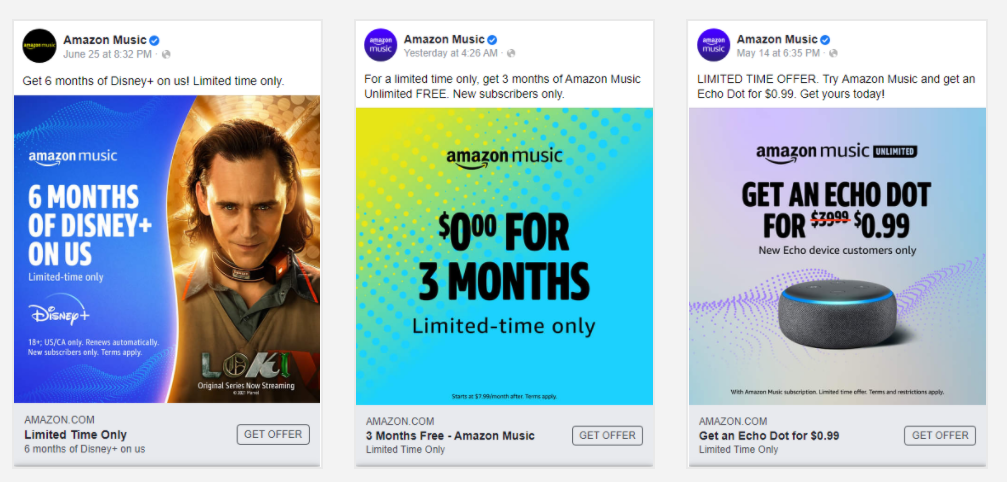

Meanwhile, Amazon Music seems to be singing from the same song sheet as Spotify, with Instagram being its top platform to advertise on (74%), followed by Facebook (15%), desktop display (6%), and Twitter (4%). Amazon Music’s top creatives touted deals aimed at attracting new subscribers, like “6 months of Disney+ on us” and a bundle offer where customers could get an Echo Dot speaker for $0.99 when they sign up for Amazon Music Unlimited.

In The Background

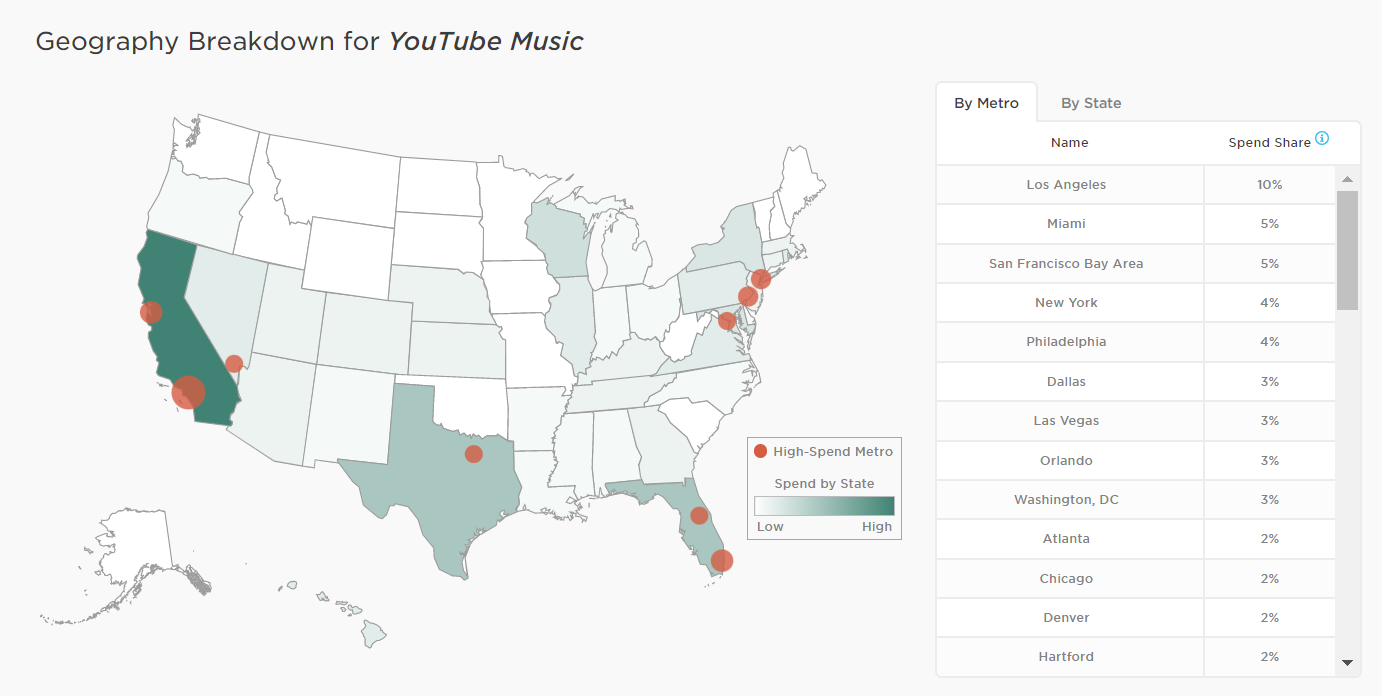

While Spotify, Amazon, and Apple Music are dominating the music streaming wars, YouTube Music is rising up the charts with 42 million subscribers. The brand, which is owned by Google, spent $232K from October through January — outspending Apple Music by $52K. Nearly 99% of YouTube Music’s ads appeared on Instagram. Ads targeted California, with high spend in the Los Angeles area.

It appears this strategy is working: Midia Research reports that YouTube Music grew by over 50% in 12 months, while Spotify’s market share has been steadily decreasing from 34% in Q2 2019 to 31% in Q2 2021.

It’s unlikely that any of these services will be able to unseat Spotify as the king of streaming, but Amazon Music’s aggressive advertising push has led to the brand outperforming Spotify over the last several quarters. So far, Apple seems unconcerned with what its competitors are doing — but YouTube Music’s moves could have them singing a different tune.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.