Source: https://www.pathmatics.com/blog/major-league-sports-mount-a-full-court-press-in-the-digital-space

Like so many other industries, major league sports have shifted their advertising strategies to adapt to the ongoing pandemic. During the pandemic, major athletics went through a transformation, with most games canceled, postponed, or held to cardboard cutouts of adoring fans. While this disruption impacted athletes and fans alike, it also posed an even bigger challenge for the leagues’ marketing teams.

We’ll dive into how professional sports leagues pivoted their digital advertising strategies during the pandemic. We’ll also explore ways major league sports can reel in younger audiences and reinforce loyalty with existing fans in a hybrid world and beyond.

NBA Crowns Its Community As The Real MVP

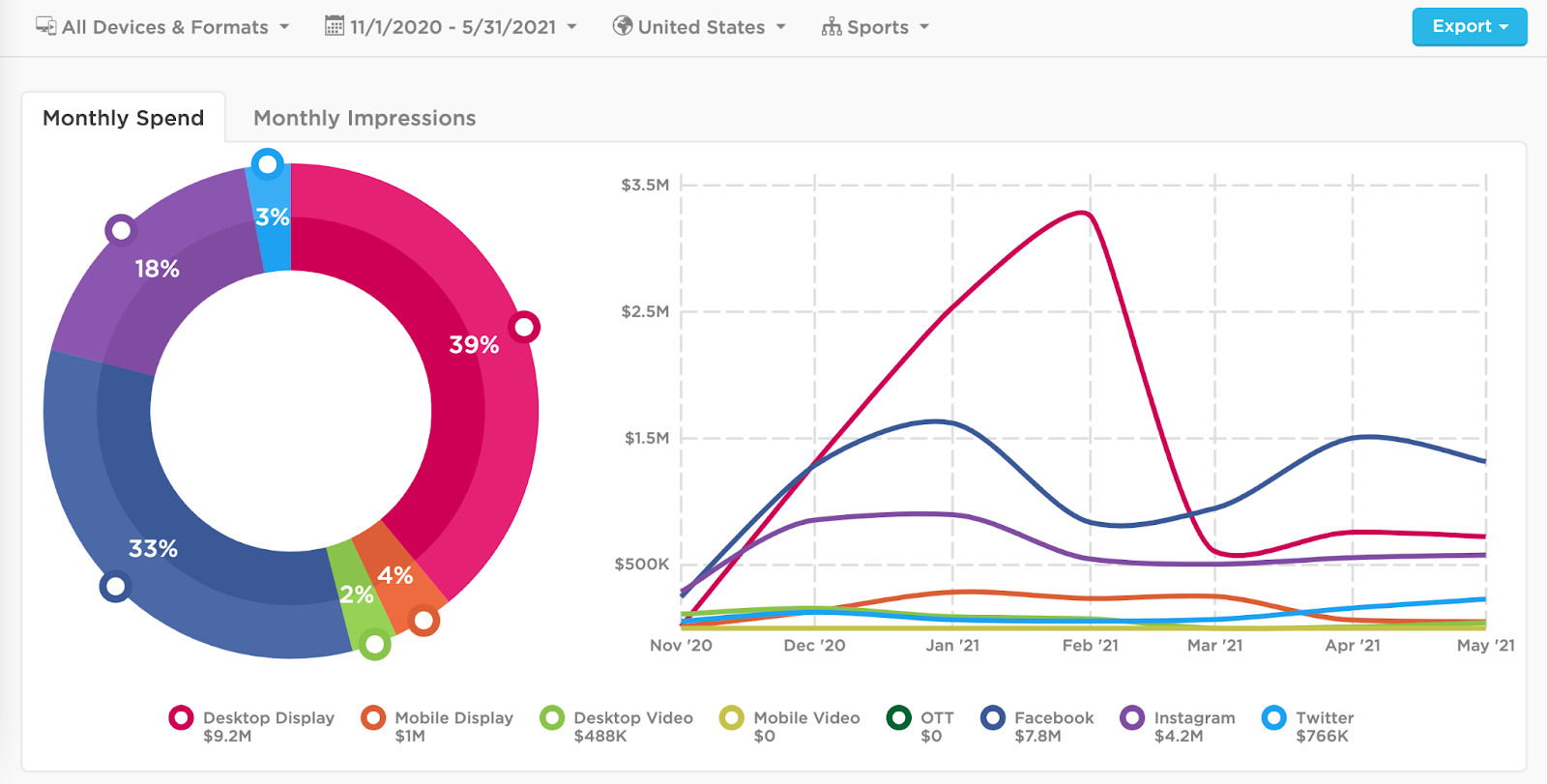

The NBA invested $23.4M in its digital campaigns during the 2020/2021 season between November 2020 and May 2021. This 7-month window offers a snapshot of the league’s strategy between the pre-season and post-championship period.

The NBA’s creative strategy centered on league-sponsored events, giveaways, and partnerships with local news stations to amplify their respective home team’s game coverage.

The NBA maintains a close relationship with its community, so it comes as no surprise their top creative during this period was an ad promoting a public ballot for their 2021 All-Stars game. Empowering fans to have a say in who earns a spot on the All-Star roster is one of the many ways the NBA keeps the consumer top of mind within their marketing mix.

Ad activity ramped up in November 2020 to promote the NBA draft in addition to Black Friday merch sales and Draft watch parties. Spending peaked on channels like Facebook and Instagram in January 2021 and saw another slight increase during the Finals. But it’s Desktop Display campaigns that emerged as the MVP, with channel spend peaking in February to promote All-Stars and claiming 39% of the league’s total spend share during this period.

Comparatively, the WNBA invested $314.8K in its 2021 season, which ran roughly from May through October 2021. Most of the league’s ad spend didn’t ramp up until the climax of its season in September. The lion’s share of the league’s budget was allocated to Instagram with 64% spend share, followed by Twitter at 24% spend share. The WNBA’s creative strategy leaned into promoting single-game ticket sales, drumming up excitement for the start of the season, and driving more online viewership and in-person attendance to their games.

MLB Hopes To Reach New and Younger Fans

Historically, the MLB has struggled to market its game and, more importantly, its star players. Because of the MLB’s 162-game regular season, their players have a limited window to engage with advertising partners. In addition to piecemealed player marketing, the league’s stiff blackout rules, rigid copyright policy limiting content distribution on social media, and lack of domestic and international marketing coordination are hurting the game’s exposure on crucial social media platforms.

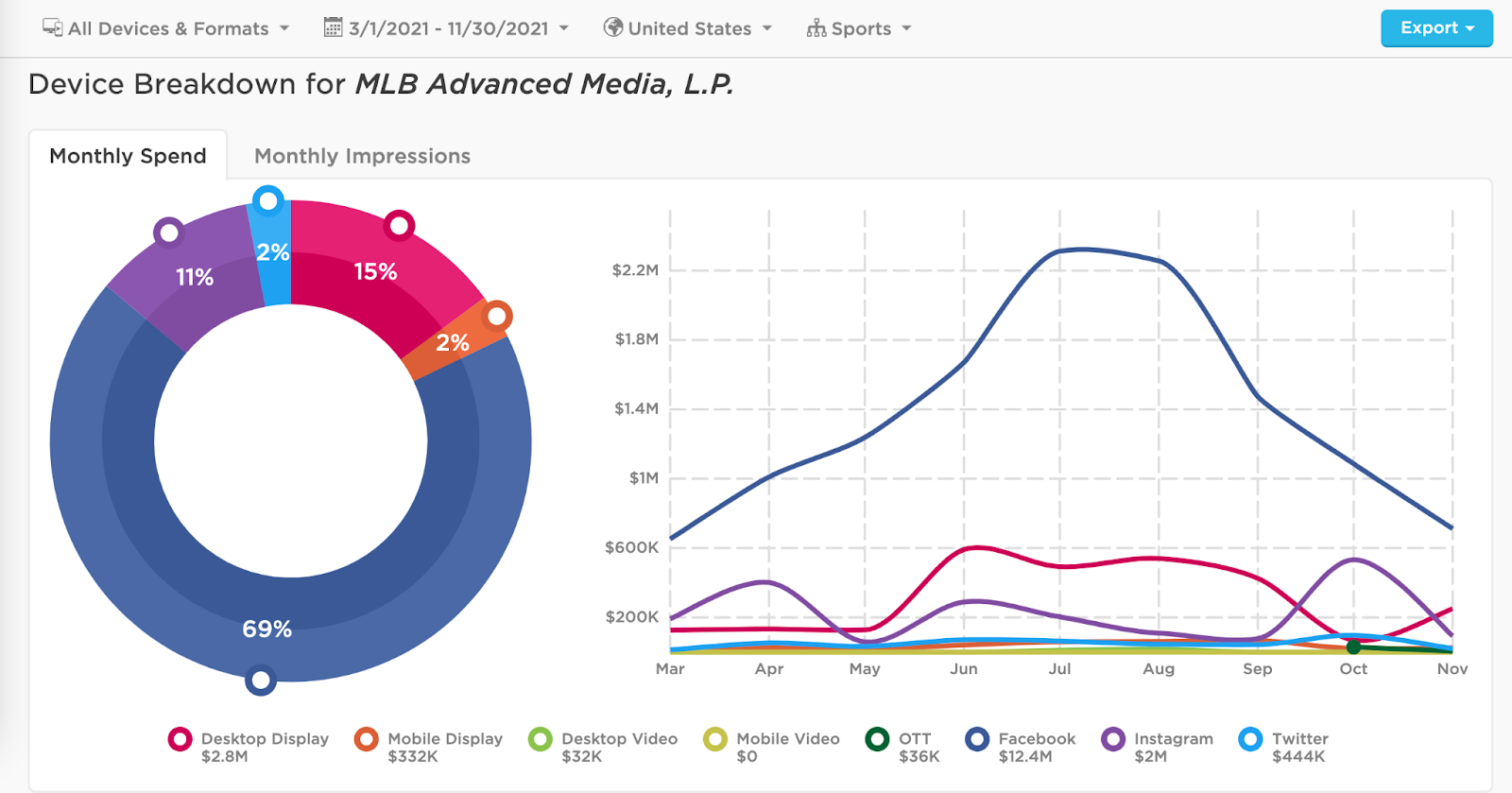

Even so, the league funneled $17.9M into its digital ad campaigns during its 2021 season, raking in over 1.9B paid impressions.

Like other major sports leagues, the MLB is trying to expand its online reach by breaking out into streaming platforms. Its top creative during this period promoted YouTube TV as a game viewing option for fans. Outside of YouTubeTV, casual fans have limited game viewing access on other streaming platforms like SlingTV, ESPN+, and fuboTV. Additionally, the league is prioritizing initiatives to attract younger viewers to the game. A Facebook ad offering free membership to MLB.tv to all college students was a clear nod to this effort.

Spending across Facebook and Desktop Display increased from pre-season until peak season before declining into the league playoffs and World Series in the fall. This spending trend may have something to do with the fact that game attendance goes up during the summer months and stadiums were eager to recoup their pandemic losses.

NFL Rallies Behind Its Social Justice Campaign

The latest broadcasting and viewership ratings from the NFL are showing promise. The league announced an extension of rights fees for CBS, ESPN/ABC, Fox, and NBC, and a new contract with Amazon Prime Video will have exclusivity for Thursday Night Football beginning with the 2022 season, replacing Fox. Could this lead to an increase in OTT spending in the coming year? We’ll keep tabs on it.

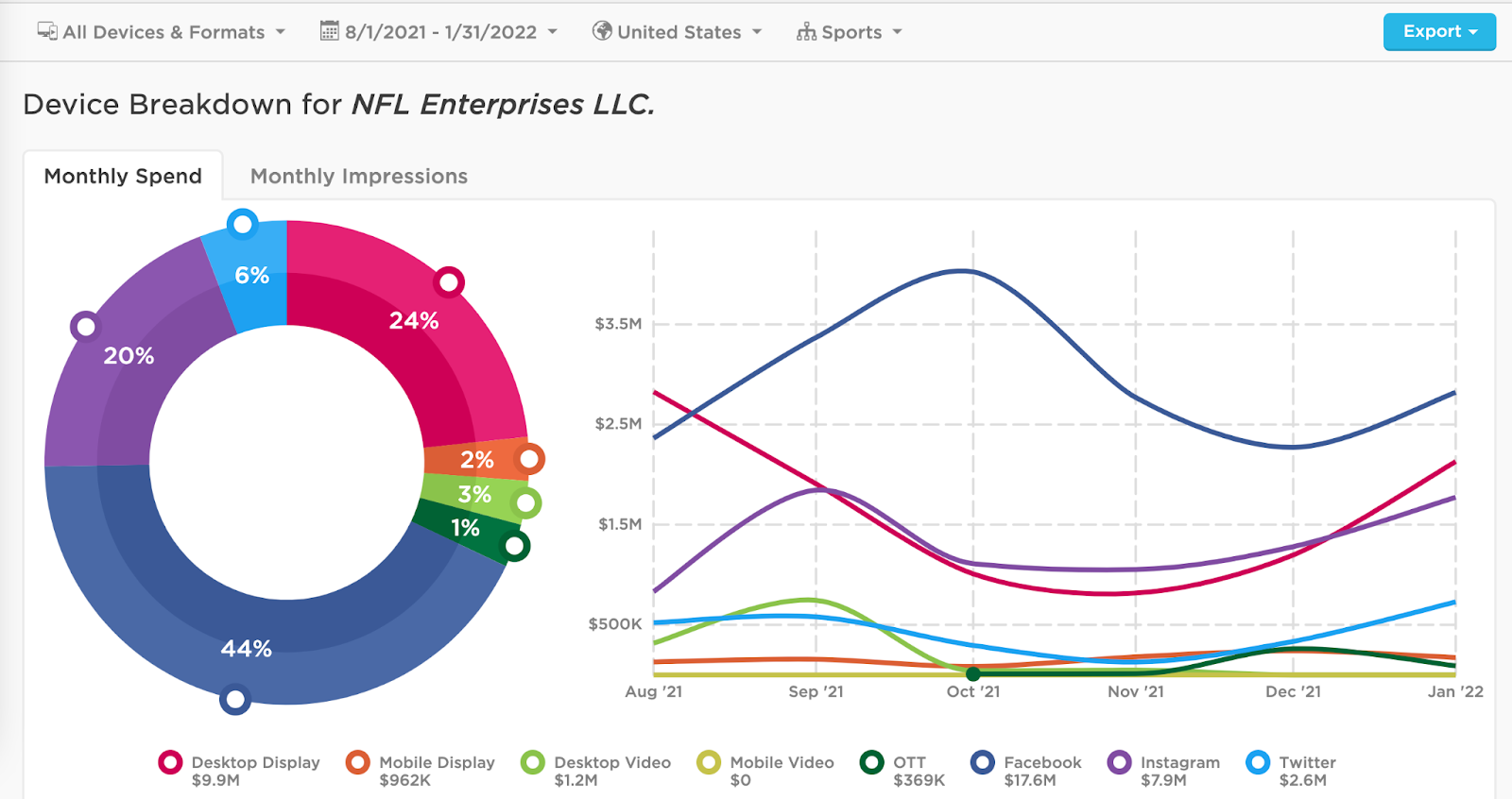

So far this season, the NFL has invested over $40.2M into its digital campaigns and amassed over 6.7B impressions.

The league’s top promotion was their Inspire Change campaign, the NFL’s year-round social justice initiative focused on breaking down barriers to opportunity and ending systemic racism, which launched at the end of 2021. In addition to in-stadium elements, the brand released video content during in-game broadcasts to amplify social justice work done by NFL players and clubs, the league itself, and social justice grant partners.

Another set of top creative during this season included promoting their pre-season games in August through the NFL Network, the league’s proprietary streaming platform where fans can watch live games and coverage through an affiliated streaming service.

This season, the NFL bet big on Facebook, with channel spending steadily increasing from pre-season until peaking towards the start of the holiday season, with over $4M spent in October 2021. Spending for Instagram, Twitter, and Desktop Display also increased in January in preparation for Super Bowl 56. In preparation for Super Bowl 56, spend activity picked up across other channels in January including Instagram with a 39.1% MoM increase, a 78% increase for Desktop Display, and 118.1% for Twitter.

NHL Celebrates Its Return To The Ice

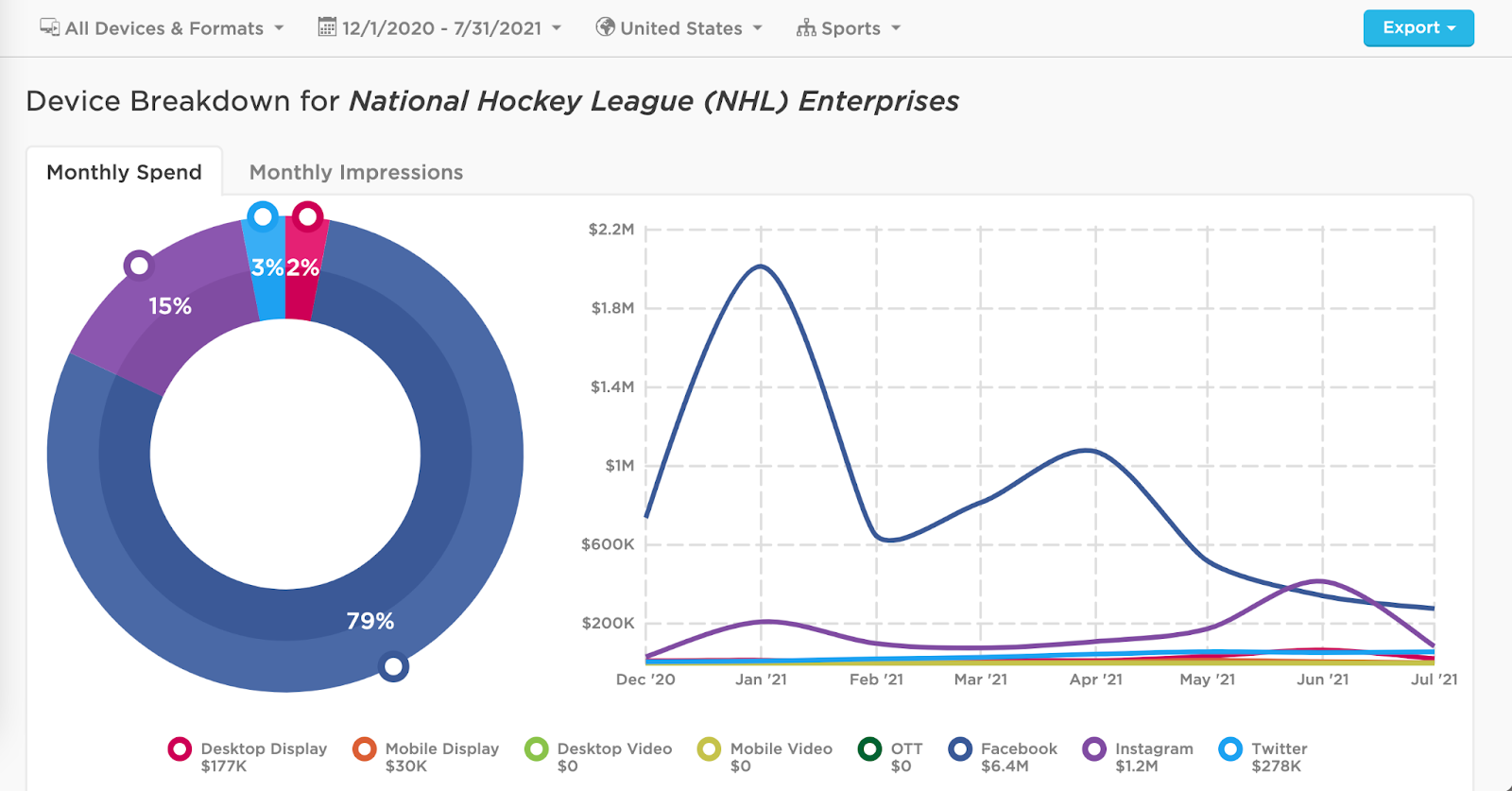

Compared to the other major leagues, the NHL spent the least on its digital ad campaigns ($8.1M) during its 2021 season. The league did not break the billion impression threshold, pulling in 882.4M in paid impressions over an 8-month period.

With their 2020 season being cut short due to the pandemic, the NHL put out creative on Facebook celebrating the return of hockey and promoting their streaming service partner, ESPN+, with a bundle offer deal for fans. Mirroring other leagues’ approaches, the NHL also ran promotions on giveaways with autographed jerseys and local partnerships in league cities.

The NHL invested most of its ad budget at the start of the season, with Facebook taking the majority spend share (79%). Instagram saw a slight uptick in advertising towards the end of the season, and no Desktop Video, Mobile Video, or OTT spend was observed during this period.

As the country begins to return to in-person events, will the big leagues also fall back into the tried-and-true content of the past, or will the pandemic usher in a new era of sports marketing?

We have a hunch it’ll probably be a mix of both. As Tom Brady bids farewell to a long and storied football career, the major leagues will also need to retire traditional tactics in favor of engaging consumers with personalized digital experiences, leveraging live events to drive cross-channel promotion, and promoting action by directing consumers to interact on a website or mobile app.

To learn more about the data behind this article and what Pathmatics has to offer, visit www.pathmatics.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.