It’s been more than two decades since Netflix’s founding and more than a decade since Hulu and Amazon Video entered the picture. However, it wasn’t until the last two years that the streaming world really started getting crowded.

We can attribute a lot of that to the push from media companies into the OTT world, with the likes of Disney+, HBO Max and Paramount+ all fresh off their launches.

One media company was slower to join the movement: NBCUniversal (NBCU).

That changed in 2020 when NBCU introduced Peacock and began its quest to attract both consumers and advertisers away from other platforms.

Peacock Appeals to Consumers with Free Streaming and Lighter Ad Loads

Though the pandemic delayed certain aspects of NBCU’s grand rollout (e.g. the 2020 Summer Olympics), the media giant officially launched Peacock on April 15, 2020.

Unfortunately, an ill-timed launch wasn’t Peacock’s only challenge. It was also late to an already saturated market and its content catalog left some critics less than impressed.

So, what did it do?

Something most major streaming platforms would never do: Make much of its content available for free.

Was this a necessary move given the competition? Maybe.

Laura Martin, Senior Media Analyst at Needham & Co., said, “This is the only strategy that NBCU can really have. To launch as the 10th subscription service was not as good an idea as trying something different.”

Still, Peacock reported 54 million sign ups and 20 million monthly active accounts by the end of Q2 2021.

But has this been enough to entice advertisers?

What Does Peacock Promise Brands?

Peacock takes the same consumer-first approach with its advertising as it does with its pricing.

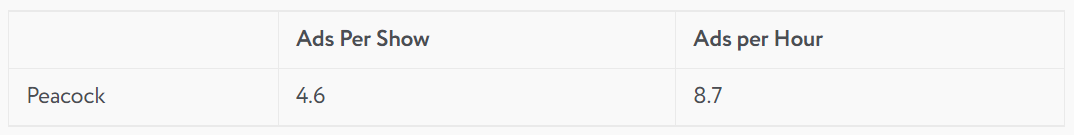

According to our research, Peacock offers one of the industry’s lowest ad loads at 4.6 ads per show and 8.7 ads per hour, respectively. For context, Hulu shows approximately 14 ads per hour, while Paramount+ typically shows approximately 24.

Peacock also maintains strict frequency caps and a suite of ad units that aim to minimize disruption. For example, Binge Ads are exclusive sponsorships that reward viewers with an ad-free episode after they watch two consecutive episodes of the same show.

Similarly, Explore Ads, which show when someone presses pause, use an overlay to highlight what’s happening on-screen while also delivering a contextually relevant ad.

Peacock offers brands an appealing option, including full-funnel metrics and access to NBCU’s full suite of talent and creative capabilities.

Brands can also take advantage of NBCU’s One Platform, which is “designed to remove the complexity of traditional media buying to help marketers reach their preferred audience on a single media plan with a single guarantee.”

MediaRadar Insights on Peacock

Since MediaRadar began tracking* Peacock advertising on May 1, 2021, the platform has had more than 800 unique advertisers.

This number of advertisers is more than HBO Max and Discovery+ but considerably less than Hulu and Paramount+. Hulu and Paramount+ had 3,319 and 1,715 advertisers, respectively.

During the tracking period, advertisers spent nearly $128 million on Peacock, with a month-over-month (MoM) average increase of 12%, but a December MoM increase of 108% from when tracking began in May.

Additionally, Q4 realized a 35% quarter-over-quarter spend growth and a 200% growth in the number of advertisers. We saw 81 advertisers on Peacock during Q4.

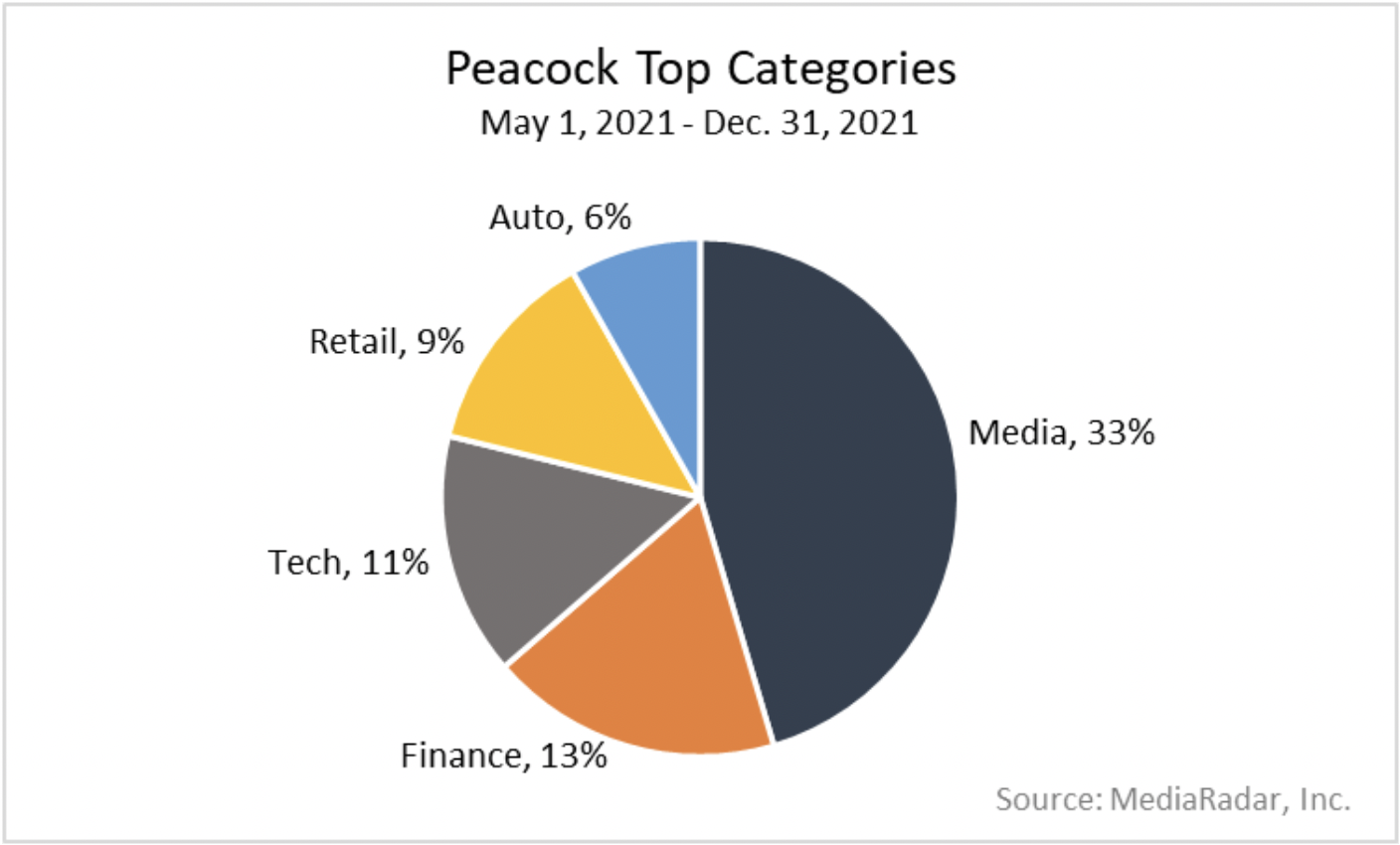

Peacock is targeting Media advertisers, like those promoting shows, movies and video games. As a result, 33% of ad buys come from Media brands.

Unlike the other streaming platforms we reviewed, the Auto industry makes up one of Peacock’s top advertising categories. While ad buys from Auto companies decreased by 47% between Q3 and the end of Q4, the number of advertisers increased by 118%.

Other top categories during Q4 were Finance, which grew at a rate of 26% after adding nearly 5x more advertisers than it had in Q3.

Tech spend was down 10% but saw a 136% increase in the number of advertisers. Finally, Retail spending increased by 92% with nearly 6x more advertisers buying in Q4.

Peacock’s Top Advertisers:

Ad Analysis

Peacock & HBO Max have the lightest ad load of the major streaming forms. This is designed to benefit consumers—but also offers advertisers more exclusive slots.

Almost all ads running on Peacock are 15 or 30 seconds in length. Specifically, two-thirds are 30 seconds, while about one-third are 15 seconds.

It’s also worth noting that Peacock seems to be pushing its original content more than other platforms. While other platforms allocate around 12-15% of total ad spots to their programming, Peacock allocates almost 30%.

Are Peacock Ads a Smart Buy in 2022?

When we look at the overall OTT landscape, we see an ecosystem that’s growing quickly, with the number of OTT users expected to amount to 3.9 million by 2026. Despite the popularity, however, total OTT ad spend was only about $1.3 billion in 2021 or 3% of total digital spend per month.

This tells us that the general population is all-in on OTT, but most advertisers are not. OTT is a great option for those looking to invest their ad dollars in an ecosystem that’s less crowded than more established ones.

That said, the growth of both the number of advertisers and ad spend at the end of 2021 indicates that brands are taking notice. Peacock received $500 million in upfronts last year—signaling a strong shift from linear TV to streaming.

In order to know if Peacock is a worthwhile investment for your brand, prospects or clients, dig into MediaRadar data to see who is shifting spend into OTT, across which platforms and to identify what type of creative strategies they are using.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.