While the current situation with Peloton may seem like an obvious result of the brand’s meteoric rise over the pandemic, just over a year ago it was considered fair to ponder whether physical gyms were on the path to extinction. The idea that the convenience of an at-home Peloton experience could fully replace a group workout class was without question. Yet, those of us that were slightly more bullish on the potential of brick and mortar fitness chains recognized that while connected fitness could become a bigger piece of the puzzle – omnichannel lessons from elsewhere pointed to a larger overall pie, as opposed to a zero-sum game.

The Fitness Recovery Setback

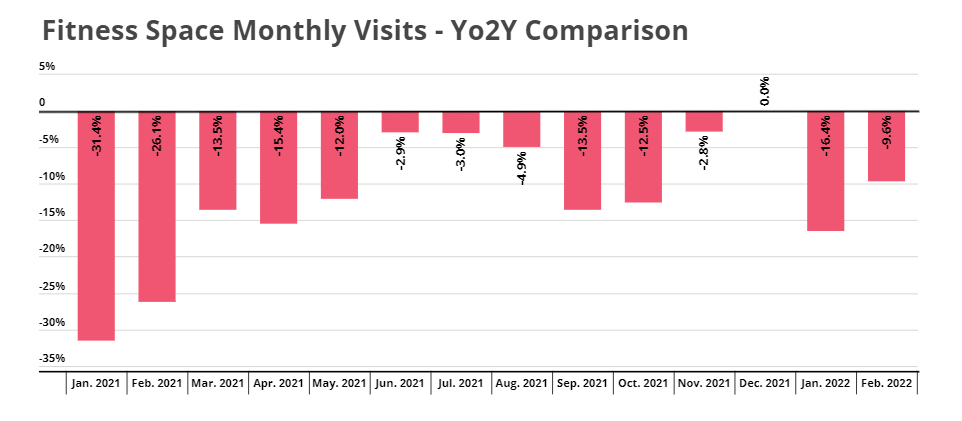

And the out-of-home fitness sector rewarded this confidence with a strong recovery. Fitness category visits were down as little as 2.8% in November of 2021 and flat in December compared to the same months two years prior. This created even more confidence heading into a critical Q1 for a segment that traditionally sees its visit peaks in the first months of the year.

However, the Omicron wave hit at precisely the wrong time for this segment impacting the positive visit trend it had been seeing. The year over two year (Yo2Y) visit gap ballooned to 16.4% in January. Yet, as Omicron cases declined, visits again started to pick back up with February seeing the visit gap drop to just 9.6%.

Understanding the Latest Sign of Resilience

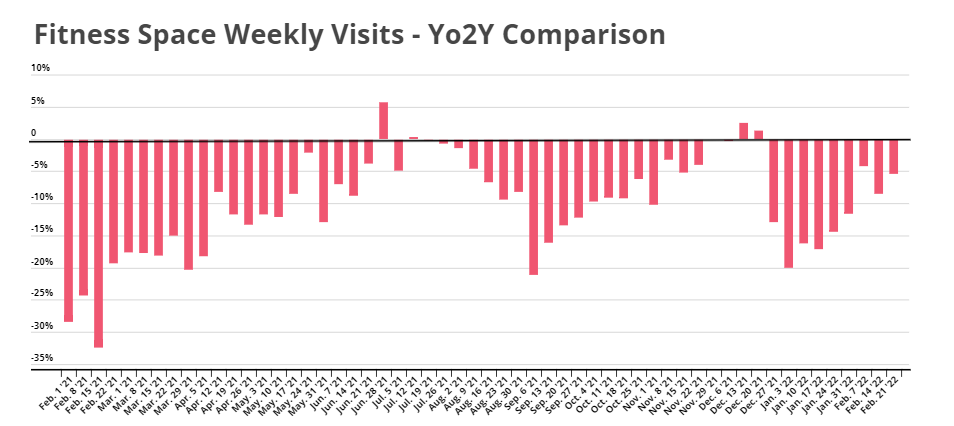

Looking at the weekly data shows the latest fitness recovery even more. Analyzing the first five full weeks of 2022 starting with the week beginning January 3rd shows an average weekly visit gap of 15.8% compared to the same weeks in 2020. Looking at the three-week period beginning with the week of February 7th shows that this decline dropped to just 5.9% on average, with the week beginning February 21st seeing just a 5.3% decline compared to the equivalent week in 2020.

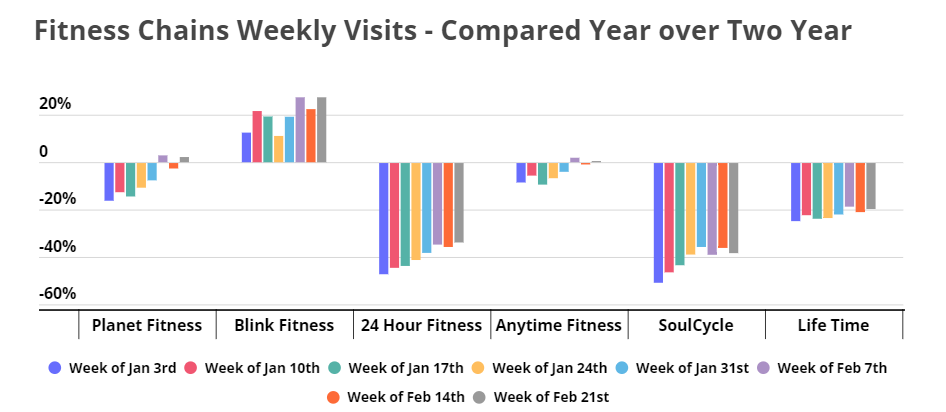

And amid this recovery, some fitness chains had already returned to Yo2Y growth. Planet Fitness saw visits up 2.9% and 2.2% the weeks beginning February 7th and 21st, while Blink Fitness saw increased growth throughout the period. Those fitness chains that were still seeing declines also saw visits trending in the right direction through the period.

The Takeaways

Like the wider brick and mortar retail sector, fitness chains saw an impressive recovery in 2021. And like retail, fitness chains drove this recovery amid a narrative that digital, convenience-oriented channels would fundamentally challenge the value they provided to customers. However, the draw of the gym visit remains strong, with February visit rates proving the resilience of demand for the sector once again following an especially challenging, Omicron-affected January.

What’s to come? Should the brick and mortar fitness sector prove capable of maintaining its current trajectory, 2022 could provide the needed environment for a full recovery. But even if challenges continue to disrupt the flow of the recovery, there is ample evidence that consumer demand will remain strong.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.