The beauty sector saw a surge in visits in recent months as consumers stocked up on makeup and skincare products to celebrate their return to school, work, and social engagements. We checked in with sector visit leaders Ulta, Bath & Body Works, and Sephora to find out how these brands are performing and what lies ahead for the beauty category.

Ulta

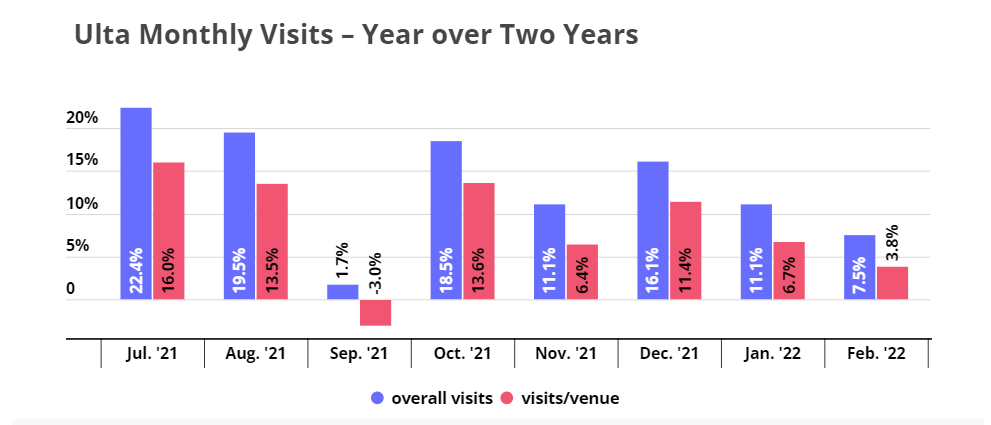

Ulta Beauty, one of the largest beauty retailers in the United States, has seen a clear visit boost since the easing of pandemic-related restrictions last summer. The brand has opened new stores at a record pace, which is feeding an impressive year-over-two-year (Yo2Y) foot traffic surge: visits in December, January, and February have been up 16.1%, 11.1%, and 7.5%, respectively, compared to the same month two months prior.

Even more impressive is the brand’s Yo2Y increase in visits per venue. Except for September ‘21, at the height of the Delta wave, monthly average visits per venue were up every month since July, with December, January, and February’s Yo2Y average visits per venue up 11.4%, 6.7%, and 3.8%, respectively. This means that the brand’s stores are now more crowded than they were two years ago, even as Ulta’s store fleet continues to grow.

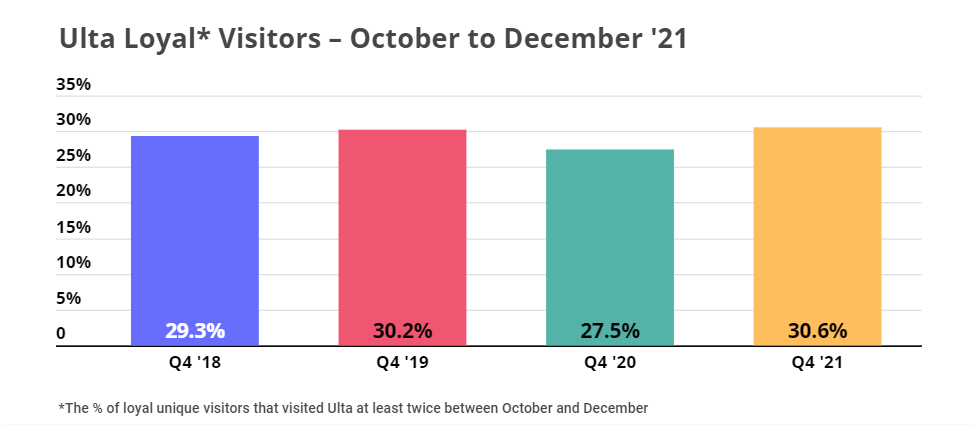

And Ulta is succeeding in maintaining loyalty levels steady even as it grows its consumer base. Since Q4 2018, loyal visitors to Ulta – the share of Ulta visitors that visited the brand at least twice during the quarter – increased from 29.3% in Q4 2018, to 30.2% in Q4 2019, to 30.6% in Q4 2021. So although Ulta offers several different channels, including a growing number of Ulta at Target shop-in-shops and the brand’s online platform, customers are still visiting the stand alone Ulta brick and mortar stores.

The rise in loyalty numbers and increase in visits per venue offer a promising sign that the year ahead has even more growth in store for Ulta.

Bath & Body Works

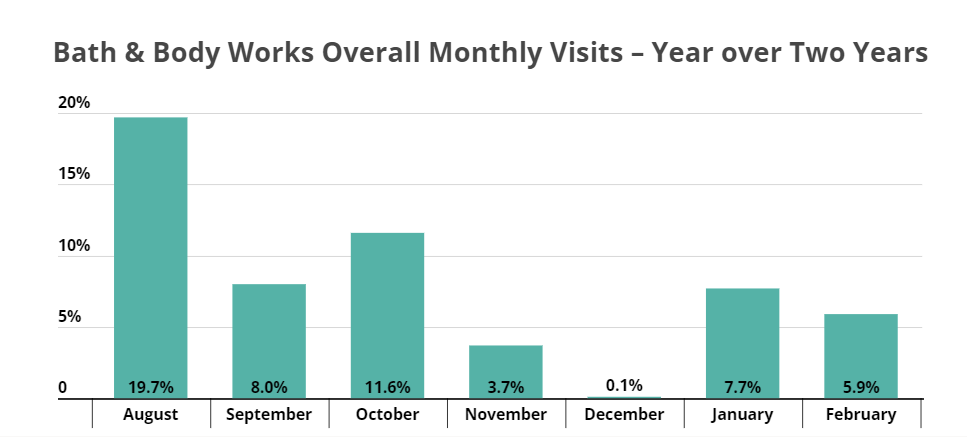

Bath & Body Works’ wide assortment of scented soaps and hand sanitizers helped the brand thrive during the early COVID days, and the company has been keeping the momentum going. The brand separated from Victoria’s Secret in August following L Brands’ split. Since the split, Bath & Body Works’ Yo2Y visits have been up every month.

Indeed, recent foot traffic data indicates that the brand is not slowing down in the new year. January and February visits were up 7.7% and 5.9%, respectively, compared to the same months in 2020.

The retailer intends on opening more stores in 2022 and plans on relaunching its aromatherapy collection with improved formulas free of sulfates, parabens, or dyes. This should cater to the rising consumer demand for “clean” wellness products. All in all, Bath & Body Works appears positioned to continue thriving in 2022.

Sephora

Sephora has been making some dramatic changes to its store fleet, with the aim of making the brand “more accessible to beauty shoppers across the country,” according to a 2021 release by the brand. These changes include growing its off-mall presence in regions such as the Pacific Northwest and states such as Florida and Texas, and opening Sephora shop-in-shops at 200 Kohl’s stores. This past February, Kohl’s announced the expansion of the partnership and the addition of 400 Sephora at Kohl’s locations, bringing the total to 600 and putting the partnership on track to meet its 850 store goal by 2023.

We have covered the Kohl’s-Sephora partnership extensively in the past, so we took this opportunity to dive into some of Sephora’s top performing venues to better understand what characterizes these locations.

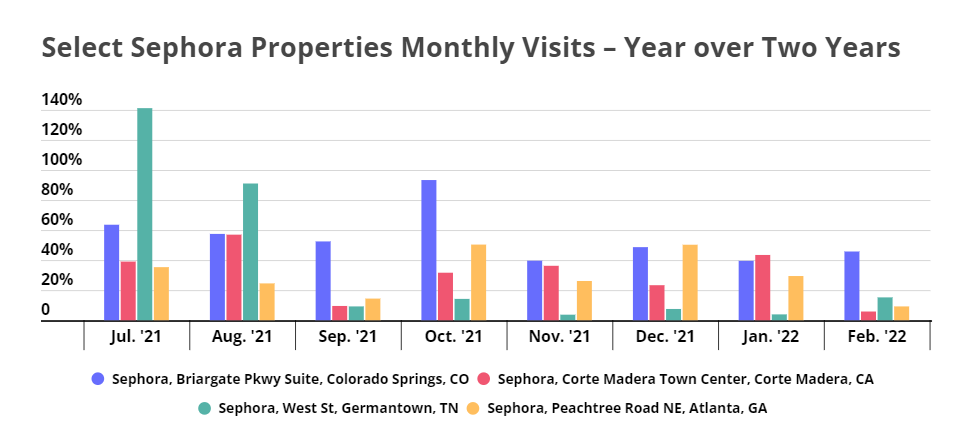

The Sephora stores in Colorado Springs, CO; Corte Madera, CA; Germantown, TN; and Atlanta, GA, have seen Yo2Y growth in visits every month since July. What do these four venues have in common?

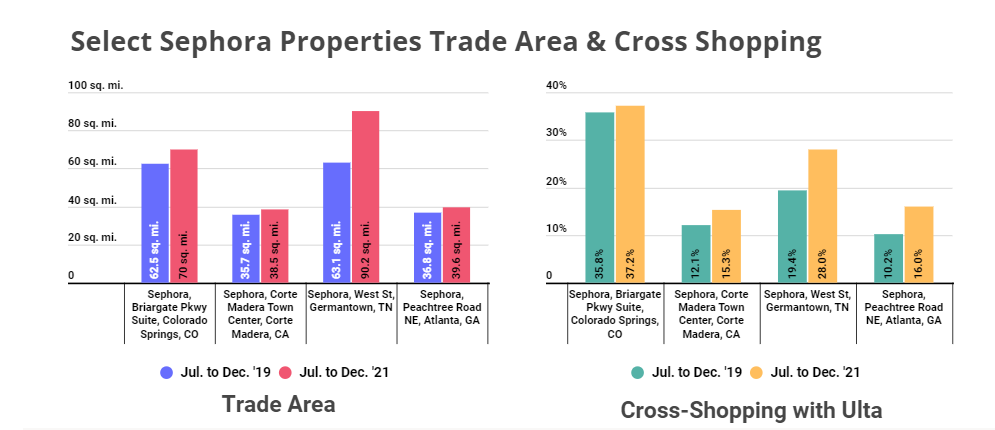

The chart on the left compares the trade areas for the four Sephora locations during the period between July and December 2021 with the period between July to December 2019. This comparison shows that all four overperforming Sephora properties have seen an increase in their trade area, meaning that these venues have succeeded in attracting shoppers from further away, which has led to an increase in overall visits.

The chart on the right compares cross-shopping trends between 2019 and 2021. The data shows that cross-shopping with Ulta – meaning the share of Sephora customers who also shop at Ulta – increased for all four locations. This indicates that Ulta’s success does not necessarily need to come at the expense of Sephora – the current demand for beauty and wellness products seems large enough to benefit all players in the space.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.