Are you wondering where CBS All Access went?

It didn’t go anywhere—it just became Paramount+.

On March 4, 2021, ViacomCBS launched Paramount+, the rebranded version of CBS All Access.

With the rebrand, Paramount+ began its uphill battle to attract both consumers and brands. But was it too little too late, especially for a streaming service on its second life?

Maybe not.

With 32.8 million subscribers at the end 2021 and $55 million in ad buys, Paramount+ might be onto something.

An Investment in Content Could Be the Saving Grace for Paramount+

Paramount+ knows that its content stands out.

According to Paramount+’s Chief Programming Officer, Tanya Giles, “More than one in three new subscribers join the platform specifically to watch originals and other exclusive content.”

So, it’s doubling down.

“We’re looking for every show to be a tentpole show at this point in time while we’re building out the service,” said Nicole Clemens, President of Original Scripted Series at Paramount+.

The investment in content seems to be paying off. Not only did total sales jumped 16% in the final quarter of 2021, but it’s one of the fastest-growing streaming services in the U.S., trailing only iQiyi and HBO Max.

The rate at which Paramount+ is growing shouldn’t slow as it continues to invest in original content; its most recent hit coming from the prequel to Yellowstone. Access to live sports, including the NFL, should also accelerate growth.

While content seems to be the saving grace of Paramount+, the less expensive, ad-supported tier that became available in June 2021 made the service more accessible. Plus it opened the door to more ad inventory. A win-win for Paramount+.

What Does Paramount+ Promise Brands?

For brands, the main selling point is access to ViacomCBS’ EyeQ, a tool that gives them a way to reach a unified, cross-product digital video ecosystem as well as custom creative campaigns and unique social integrations.

“EyeQ provides advertisers the opportunity to capitalize on the consumer migration to streaming,” said John Halley, COO, Advertising Revenue & EVP, Advanced Marketing Solutions at ViacomCBS. “It’s a bridge to reach audiences that have become difficult to access through linear investments, who are watching less of the traditional platform and spending more time with OTT delivered video or social platforms.”

It’s not just about features that should get brands excited. Paramount+ has built a subscriber base that rivals more established players, making it clear that it can be a force in OTT.

As Paramount+ continues to establish itself, there’s no doubt the company will invest more in its advertising capabilities, giving brands more powerful ways to connect with subscribers.

MediaRadar Insights on Paramount+

MediaRadar began tracking* Paramount+ advertising on May 1, 2021.

Since tracking began, more than 1,700 unique brands bought $55 million worth of ads on Paramount+, thanks largely to a 132% month-over-month increase in December when 550 brands bought ads (406 brands bought ads in May).

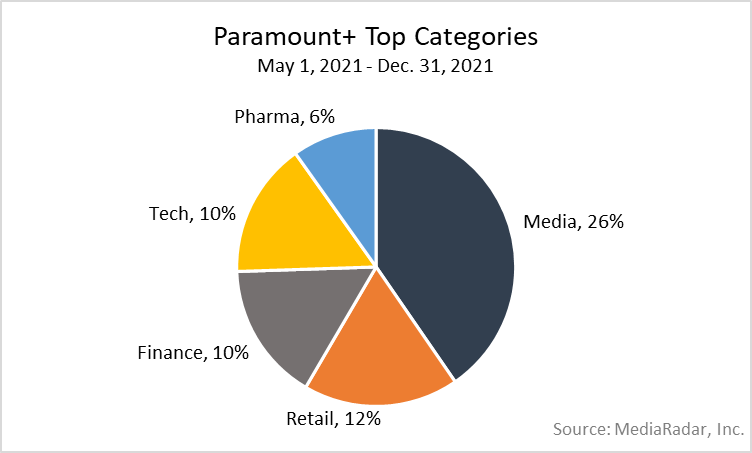

Like other streaming services, brands in Media, Retail, Finance and Tech all invest in Paramount+ ads. Additionally, Pharma accounted for 6% of buys.

Media accounted for 26% of the yearly ad spend, growing at 19% QoQ. Meanwhile, Finance, Tech and Retail accounted for 12%, 10% and 10%, respectively.

On average, ad buys increased by 15% every month. And they’ve increased by 132% from when tracking began.

Some Top Advertisers:

Ad Analysis

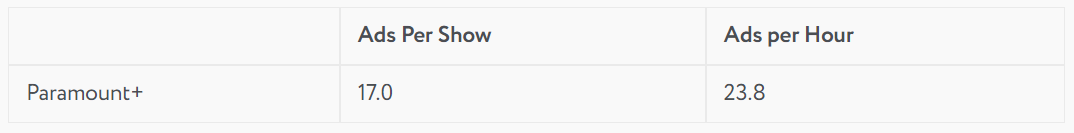

Paramount+’s one-hour shows typically carry 30 ads, while marquee programs such as Picard and Star Trek Discovery have between 15 and 18 ads, despite running 45-65 minutes.

The ad load on Paramount+ is 2x the nearest competitor, which may imply ViacomCBS is bundling more actively.

Slightly over half of Paramount+ ads are 30 seconds long, a third are 15 seconds and the remaining ones range from 5 to ten seconds.

Are Paramount+ Ads a Smart Buy in 2022?

Paramount+ shows impressive growth, but you still have to ask the question: Are Paramount+ ads a smart buy for you?

There’s not a simple answer.

On the one hand, Paramount+ attracted a respectable $55 million in ad buys from 1,700 unique brands during the 8-month tracking period. For comparison, HBO Max saw $46 million in ad buys while Discovery+ saw $29 million during their tracking periods. (We tracked HBO Max for 6 months and Discovery+ for 4 months.)

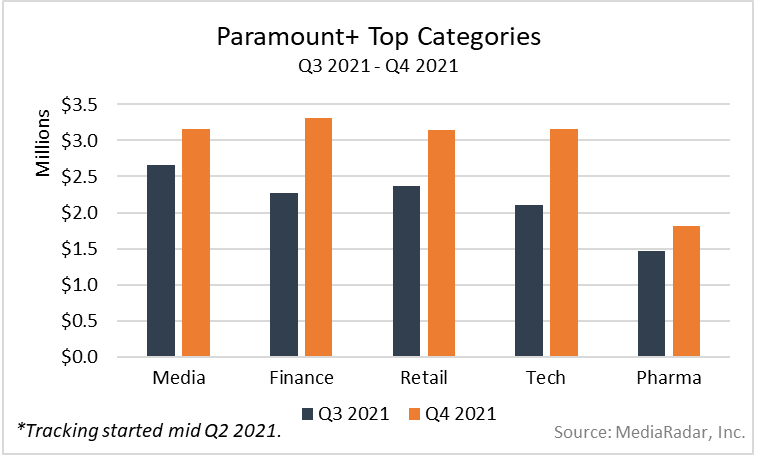

So, through this lens, it seems like Paramount+ ads are a smart buy. The fact that spending increased between Q3 and Q4 for top categories (Media, Finance, Retail, Tech, and Pharma) also points to that.

At the same time, however, the high ad load is impossible to ignore.

Paramount+ shows the most ads per hour and show (17 ads per show and 23.8 ads per hour). Hulu’s licensed content, which has the next highest ad load, shows 10.1 ads per show and 13.8 ads per hour. Peacock, the streaming service with one of the lowest ad loads, shows 4.6 and 8.7 ads per show and hour, respectively.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.