U.S. hotel weekly occupancy slipped a bit in the most recent week of reporting (27 February-5 March 2022), falling to 61.2% from 62.2% the week prior. While all attention is focused on rising gas prices and the potential impact on hotel demand, this week’s decrease was due to a weaker Sunday as the previous Sunday benefited from the Presidents’ Day holiday. Excluding Sunday, occupancy for the remaining six days reached 63.2%, the highest six-day result in the country since mid-November. Average daily rate (ADR) declined 4.2% post-holiday, but the absolute level remained above where it was in the comparable week of 2019. Revenue per available room (RevPAR) also decreased (-5.7%) but remained in STR’s “Recovery” category (index to 2019 between 80 and 100).

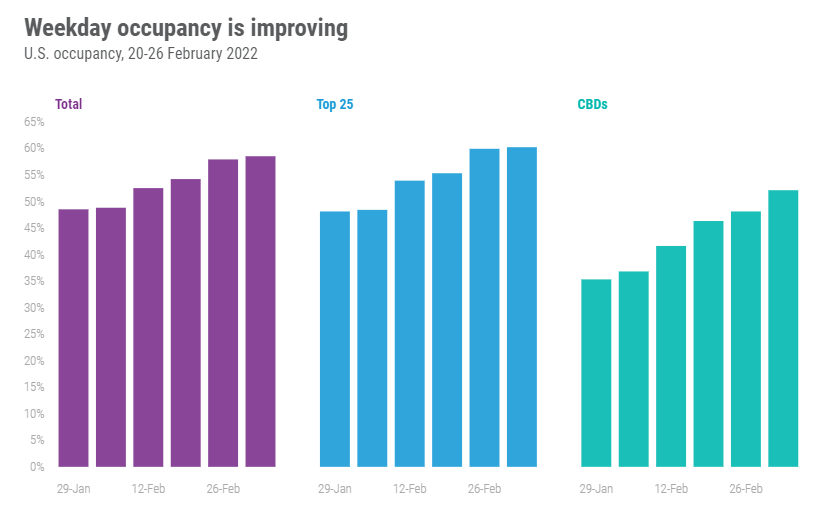

We remain encouraged by the continued improvement in the Top 25 Markets, where weekday (Monday-Wednesday) occupancy advanced for an eighth consecutive week to 60.2%. The week’s increase was a bit different, however, from previous periods. Demand for more leisure-oriented Top 25 Markets like Orlando, Miami, Los Angeles, and San Diego, to name a few, which benefited from the Presidents’ Day holiday, decline during weekdays. However, Washington DC, San Francisco, New York City, and 12 others propelled the aggregate Top 25 into the growth category. New York’s weekday occupancy rose to a nine-week high (58.4%). Another pleasant surprise was Washington, DC, where weekday occupancy increased to 52.6%, which was the market’s highest level since mid-November and only its ninth time above 52% since the presidential inauguration. And while weekday occupancy fell in Orlando, the nation’s second largest market, it remained strong at 70.7%, which was the fourth highest among the Top 25 behind Phoenix (75.1%), Miami (78.1%) and Tampa (80.3%). Overall, U.S. weekday occupancy climbed to 58.5%, a level not seen since October.

Central Business Districts (CBD) within the Top 25 Markets saw a sharp increase (more than 4 percentage points) in weekday occupancy, rising to 52.1%, a 12-week high. CBD weekday occupancy has risen by more than four percentage points in three of the past four weeks. The Washington, DC CBD posted the largest weekday occupancy gain among the CBDs (19.9 percentage points) with occupancy increasing to 54.5%, its best since October. Houston CBD saw strong growth as well with occupancy rising to 72.7%. Tampa and Miami led all CBDs this week while Minneapolis continued to see the lowest weekly occupancy (21.7%), up a half point from last week. New York’s Financial District saw its occupancy increase by more than five percentage points this week to 57%.

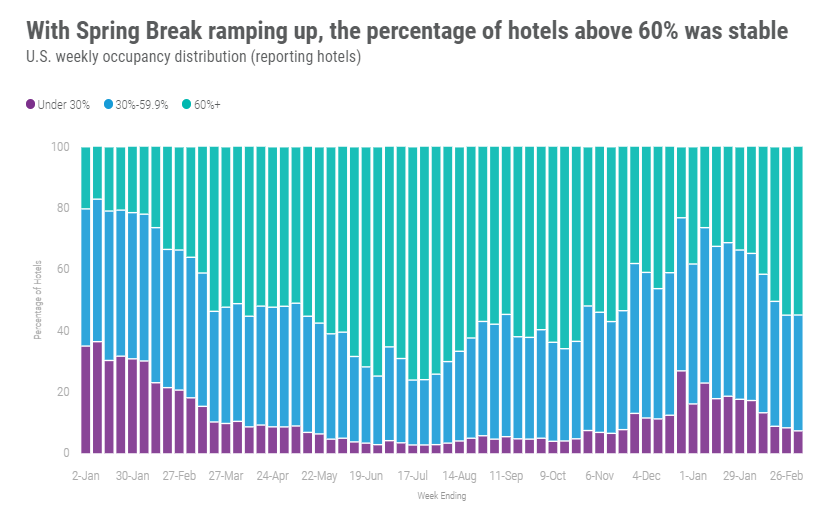

Weekend occupancy advanced 1.1 percentage points to 71.7% after falling in the previous week. Not since October has weekend occupancy been above 70% for three consecutive weeks. Daytona Beach had the highest weekend occupancy (94.1%), followed by Tampa (93.9%) and Salt Lake City (91.8%). Thirty-two markets reported occupancy at or above 80% this weekend, which was one more than the previous weekend. Only 19 markets saw weekend occupancy below 60%, the second smallest number of the past 16 weeks behind the Presidents’ Day weekend, when 16 markets were in that grouping. Top 25 Markets saw slightly better weekend occupancy (72.6%), but it was down versus the previous weekend (-0.4 percentage points) because of decreases across many markets, including New Orleans (-10.2%) post-Mardi Gras. Orlando continued to excel with weekend occupancy of 90.6%, which was the market’s third highest level since the start of the pandemic. Recall, Orlando’s highest post pandemic level was reached two weeks ago, and its second highest occurred just a week ago. On a property-level basis, 45% of U.S. hotels reported occupancy at or above 80% over the weekend.

Group demand advanced again, climbing to nearly four million room nights (or 55% of the 2019 comparable). The same was seen in the Top 25 where the comparison to 2019 was slightly higher at 56% of 2019 volume. Among Upper Upscale hotels, group volume was 66% of the 2019 comparable. When compared with 2019, this year’s volume is less concentrated in weekdays (42% vs. 48%) with more coming over weekend (33% vs. 26%),

The week-to-week ADR decline was the largest since the Christmas holiday, and the decrease was spread across all days with Sunday dropping 12%. Even with the drop, however, U.S. ADR was 5% higher than the 2019 comparable. Of the 166 STR-defined markets in the U.S., more than 80% reported ADR that was higher than the corresponding week of 2019. Adjusting for inflation, U.S. ADR was six percent lower than the 2019 level with 37% of markets above where they were in 2019.

While ADR also declined in the Top 25 Markets, the decrease was much less (-2.5%). Weekday ADR in the Top 25 was flat, while all other markets were -6%. Weekday ADR in CBDs was up strongly (+7.9%), driven by robust gains in Washington DC CBD (+33%), New Orleans CBD (+24%) and Los Angeles CBD (+16%) among others.

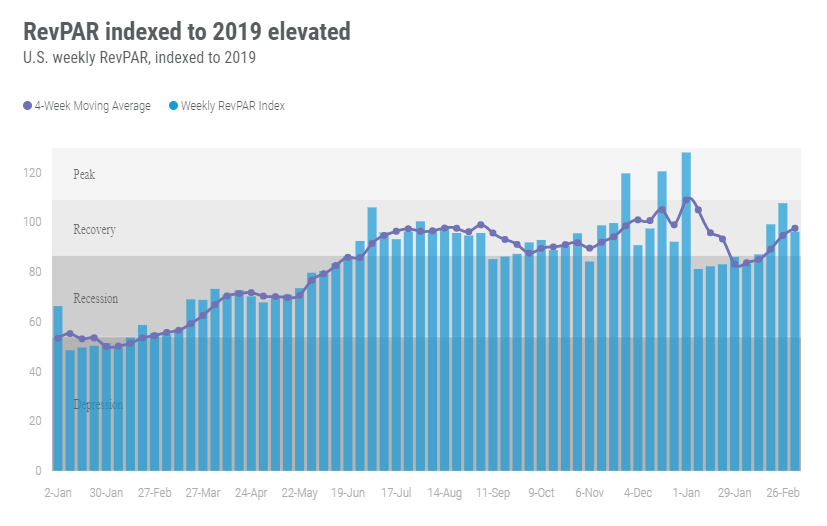

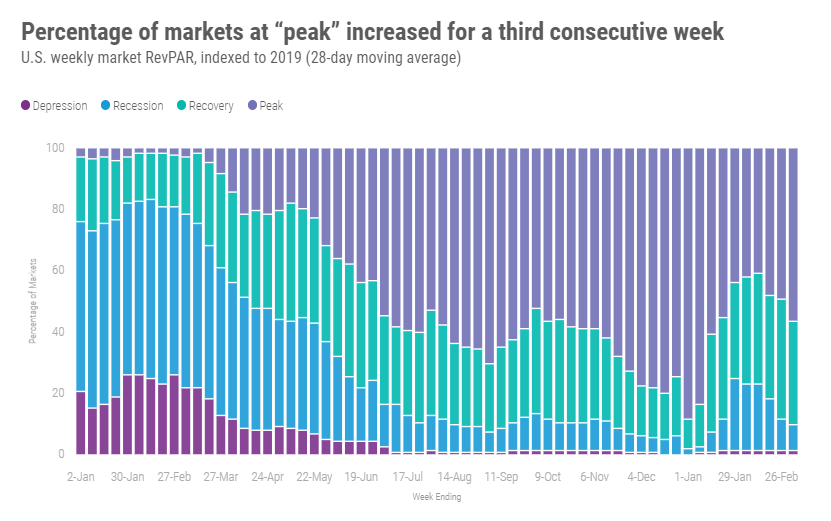

With the week-on-week fall in both occupancy and ADR, U.S. RevPAR also dropped by the largest amount since the holidays, however, the index to 2019 remained strong at 96.1 and in STR’s “Recovery” category (RevPAR indexed to 2019 between 80 and 100). The index has been in the 90s or higher for the past three weeks. For the week, 60% of markets saw “Peak” RevPAR (RevPAR indexed to 2019 above 100) with another 29% in “Recovery.” Adjusting for inflation, the U.S. index stood at 86.2 with 57% of markets at “Peak” and 34% in “Recovery.” Over the past 28 days, the U.S. index was 87—the highest of the past eight week with 57% (42% inflation-adjusted) of markets were at “Peak” and 34% (44% Inflation-adjusted) in “Recovery.” Among the Top 25, and on an inflation-adjusted basis, four markets (Los Angeles, Miami, Norfolk/Virginia Beach, and Phoenix) were at “Peak,” and 10 were in “Recovery.”

Around the Globe

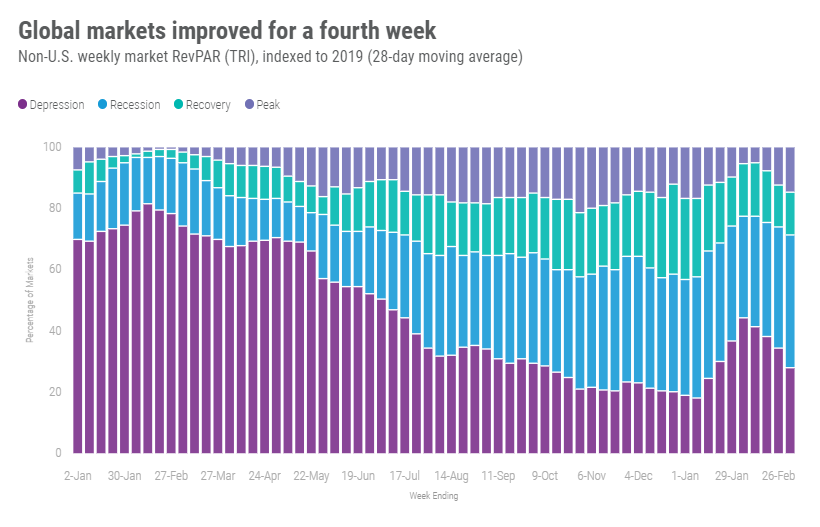

Global weekly occupancy, excluding the U.S., fell for the first time in five weeks, dropping 1.9 percentage points to 50.1%. The decrease was widespread as more than half of the 104 countries tracked on a weekly basis reported declines. The decrease was led by China, Japan, and United Kingdom, which accounted for 71% of the fall among the weekly demand losers. Weekly demand in Russia dropped 15%, down nearly 100,000 room nights from the previous week. France, Spain, and Germany were the big gainers, but even with the growth, Germany’s occupancy remained low (39.7%) with Spain climbing to 63%. Among the top 10 countries, based on supply, the United Kingdom continued to have the highest weekly occupancy (66%), followed by Spain. Despite the occupancy drop, ADR increased, 2.1% globally and 3.7% in the top 10 countries. RevPAR, however, was down due to the fall in occupancy (-1.7% globally, -1.9% top 10).

Big Picture

Uncertainty and anxiety have risen substantially over the past two weeks. For the hotel industry, gas prices and their potential impact on the recovery are top of mind. While gasoline prices have hit an all-time high on a nominal basis, they remain below the high seen in July 2008 on an inflation-adjusted basis (real). Historically, room demand has seen limited impact by increases in gasoline prices. Even though there is little correlation between real gasoline prices, room demand and RevPAR, this time could be different given the increase in all other living expenses. However, travel tends to skew to higher income individuals and families, who may be less impacted by inflation and/or gasoline prices. Additionally, pent-up demand due to the ongoing pandemic could also offset the impact.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.