We analyzed foot traffic trends for leading plus size retailers – Torrid, Lane Bryant, Ashley Stewart, and Destination XL – to find out where the brick and mortar plus size apparel category stands two years into the COVID pandemic.

Comeback from a Rough 2020

The pandemic dealt a mixed hand to the plus-size apparel sector. Ascena Retail Group, owner of plus size apparel brands Catherines and Lane Bryant, filed for bankruptcy. As a result, Catherines permanently shuttered its brick and mortar business to focus exclusively on its online store, and Lane Bryant announced the permanent closure of over 150 stores. On the menswear front, Destination XL managed to avoid bankruptcy while sustaining some heavy losses.

Towards the end of 2020, however, prospects for plus-size brick and mortar apparel stores were looking up. Sycamore Partners, which already owned Torrid, purchased Lane Bryant in December 2020, guaranteeing the brand’s continued physical presence. Destination XL reported seeing significant improvements in in-store sales by mid-March 2021. And the ultimate expression of the plus-size category’s comeback came on July 1st 2021 with Torrid’s IPO.

Strong Finish to 2021

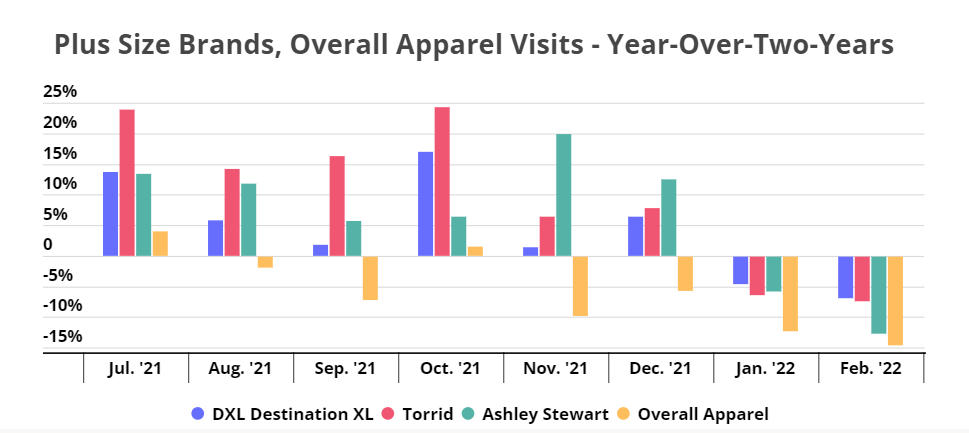

By the second half of last year, the category was on steady ground. Foot traffic data from the last six months of 2021 shows that visits to Destination XL, Torrid, and Ashley Stewart increased every month compared to the equivalent month in 2019. The three brands finished the year strong with 6.4%, 7.8%, and 12.5% monthly visit increases for Destination XL, Torrid, and Ashley Stewart, respectively, compared to December 2019. And while visits did dip slightly in the new year – likely due to the Omicron surge – Yo2Y foot traffic trends for all three retailers still outperformed the nationwide apparel average in both January and February of 2022.

Ashley Stewart, Torrid, and Destination XL target vastly different markets. Ashley Stewart’s core shoppers are African American women; Torrid appeals to a younger demographic, with a focus on women aged 25 to 40; and Destination XL carries big and tall men’s clothing. The fact that all three have succeeded in posting such strong foot traffic numbers and beating the apparel average speaks to the potential of the plus size apparel market in 2022 and beyond.

Lane Bryant’s Rightsizing Paying Off

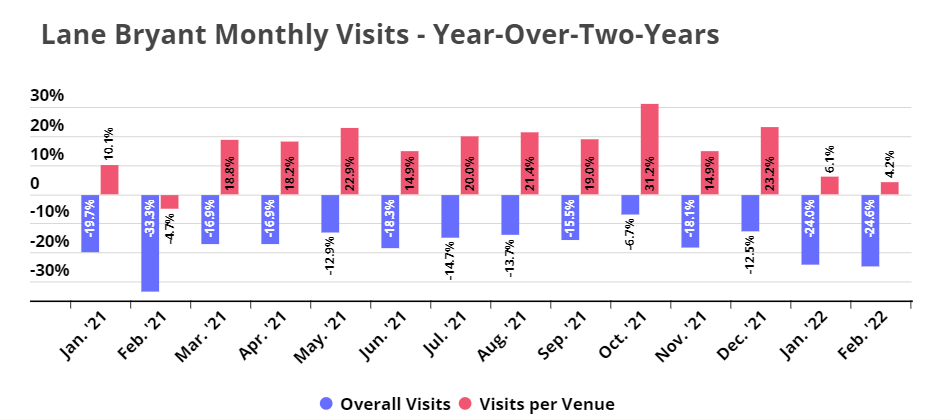

Lane Bryant saw a massive store fleet reduction in 2020 as the brand permanently closed over 150 stores. And since there were fewer Lane Bryant stores to visit, the brand’s Yo2Y foot traffic count also plummeted. But comparing the average number of visits per Lane Bryant store in 2019 and 2021 shows that this plus size pioneer’s right sizing is paying off.

Although overall foot traffic is down, Lane Bryant’s remaining locations have been getting more monthly visits on average than they were two years ago: the brand’s Yo2Y average visits per venue were up by double digits almost every month last year, capping off a strong 2021 with a 23.2% Yo2Y increase in average visits per venue.

So far, the growth is continuing into 2022, despite the Omicron-induced retail downturn, with Yo2Y visits per venue up 6.1% and 4.2% in January and February, respectively. These metrics reveal that there is still a healthy demand for physical Lane Bryant stores, and if the brand succeeds in sustaining another year of 2021-level visit per venue growth, Lane Bryant may even consider adding a couple more stores to its now diminished store fleet.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.