Hotel performance has remained stable in most of Europe amid the war in Ukraine, and countries bordering the conflict area have seen a refugee-driven lift in occupancy.

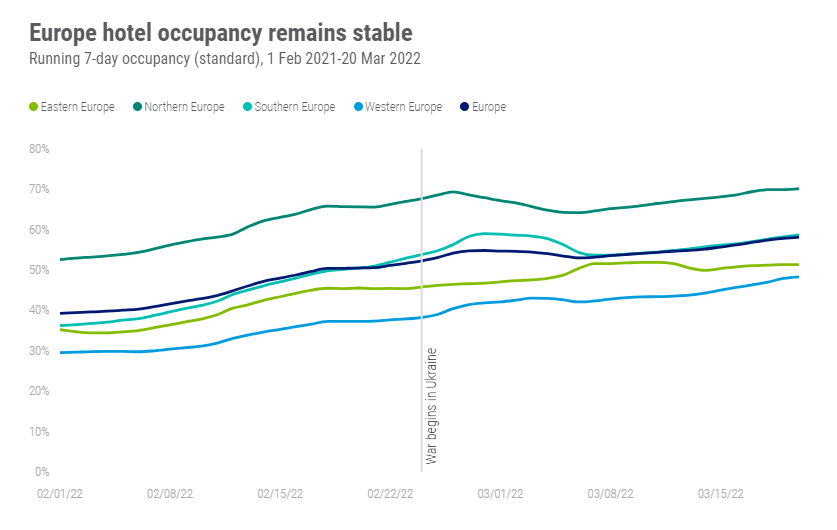

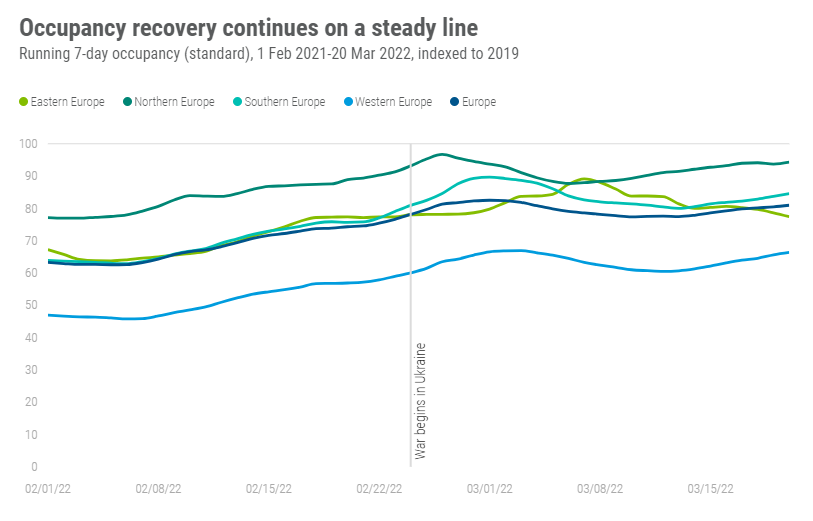

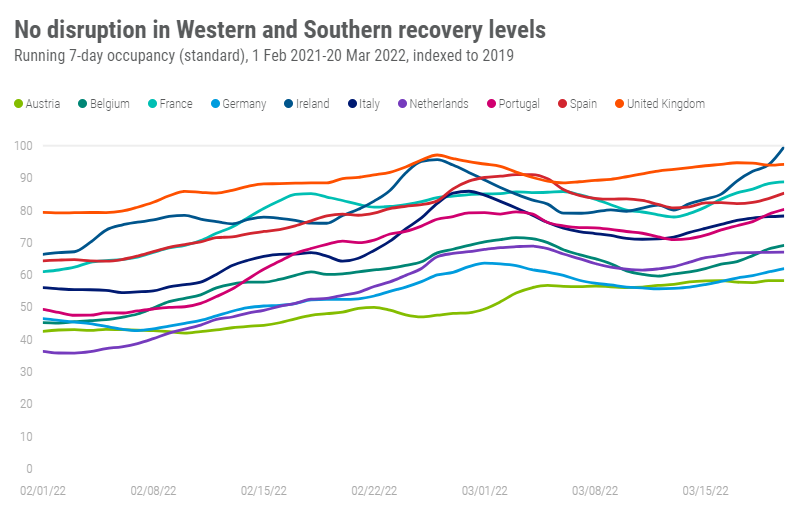

Using standard methodology, which excludes temporary closures from the pandemic, Europe’s hotel occupancy hasn’t dipped below 53% on a running 7-day basis since late February. The latest data for 20 March showed occupancy above 58%. When indexed to 2019, levels over the last few weeks have not fallen below 77% of the pre-pandemic comparables and came in above 80% on 20 March. When drilling down to the subcontinent level, Northern Europe has remained furthest ahead in both absolute occupancy and indexed levels to 2019.

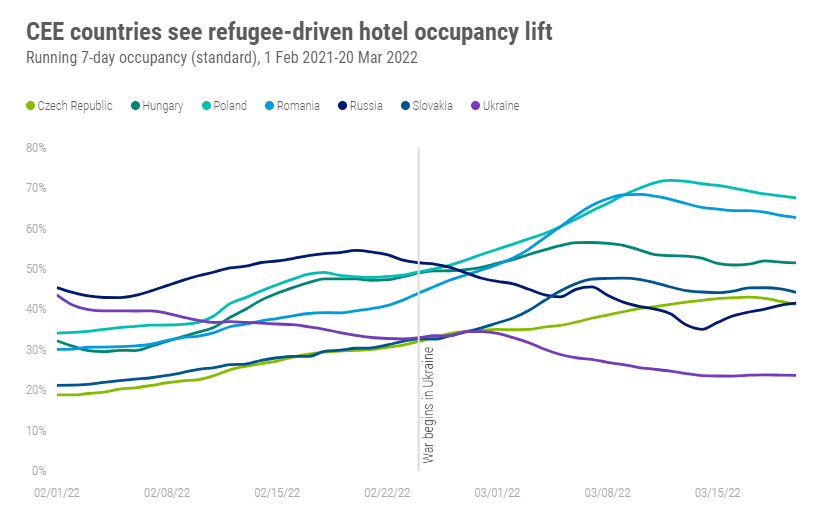

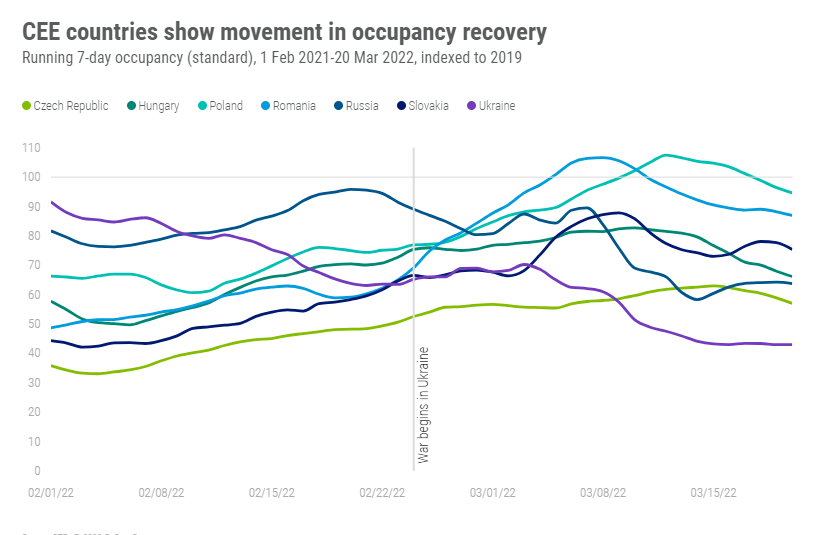

At a country-level, the obvious exception has been in Ukraine, where already low occupancy has plummeted among STR sample hotels that have continued to report data. Russia has also seen a dip in its occupancy recovery. As expected, countries neighboring Ukraine have seen a lift in occupancy with hotels housing a significant volume of refugees. Poland, for instance, went from sub-50% occupancy at the end of February to a high of 72% on 12 March. The latest data through 20 March also shows Poland at 68% on a running 7-day average. Romania has remained consistently above 60% occupancy after being well below that level prior to the war.

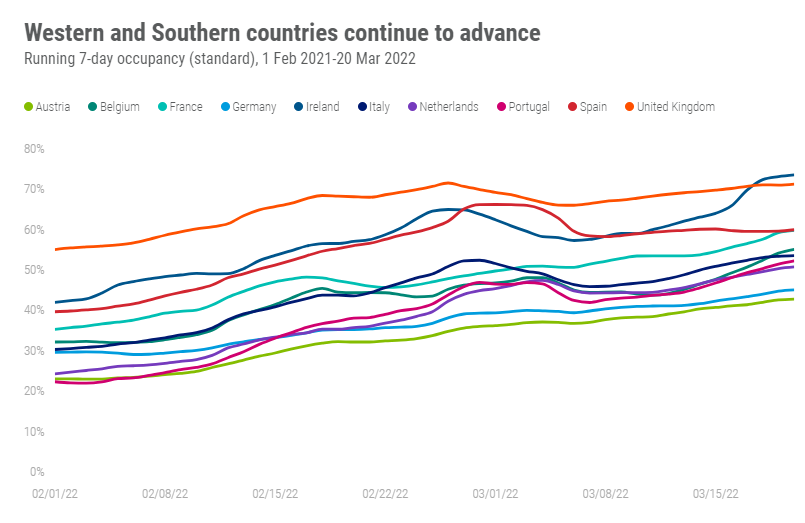

When looking at countries in Western and Southern Europe, steady improvement has remained constant over the past month with the highest occupancy levels in Ireland and the U.K. As noted in STR’s latest Market Recovery Monitor, Ireland recently saw its highest weekly level of the pandemic-era with a boost from St. Patrick’s Day celebrations and the Scotland vs. Ireland Six Nations match.

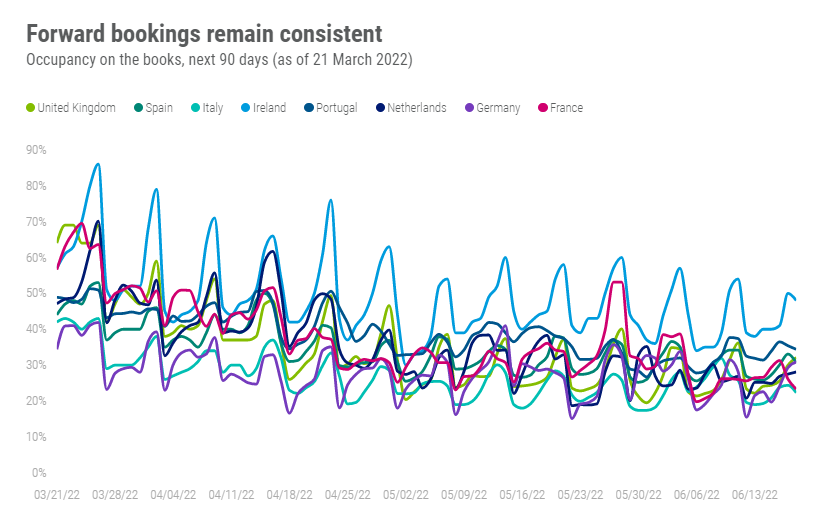

Looking ahead with Forward STAR data, patterns in occupancy on the books remain consistent around Western and Southern Europe. Ireland is reporting the highest booking levels with weekend spikes above 70% in April.

Consistent with the shorter bookings windows that have developed during the pandemic, levels gradually become lower in May and June.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.