Key takeaways:

Federal deposits shrink after Covid-19 stimulus ends

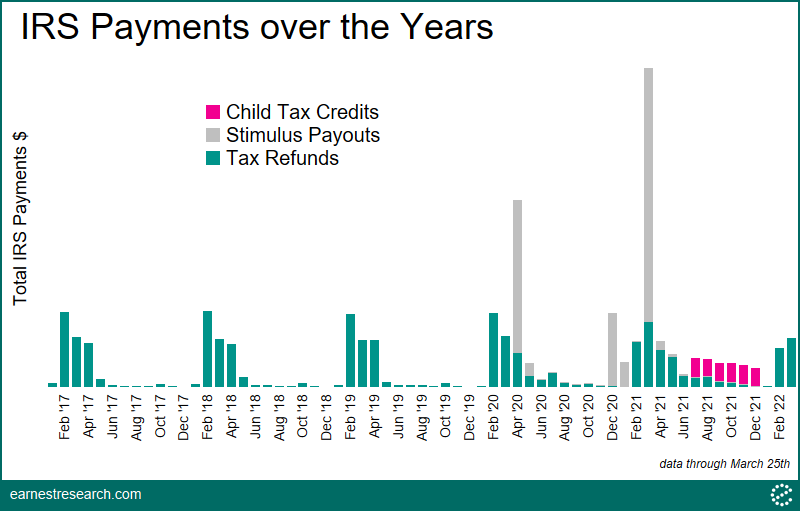

Annual federal tax refunds have been a reliable source of additional spending cash for American taxpayers. Covid-19 upended the regular February-April cadence of payments as many households received additional stimulus payouts and tax credits that almost doubled the amount normally deposited by the government. This tax season marks a return to more normal refund behavior, which could signal sales declines for retailers who benefited from consumers’ extra cash in 2020 and 2021.

Bigger tax refunds, but fewer total dollars

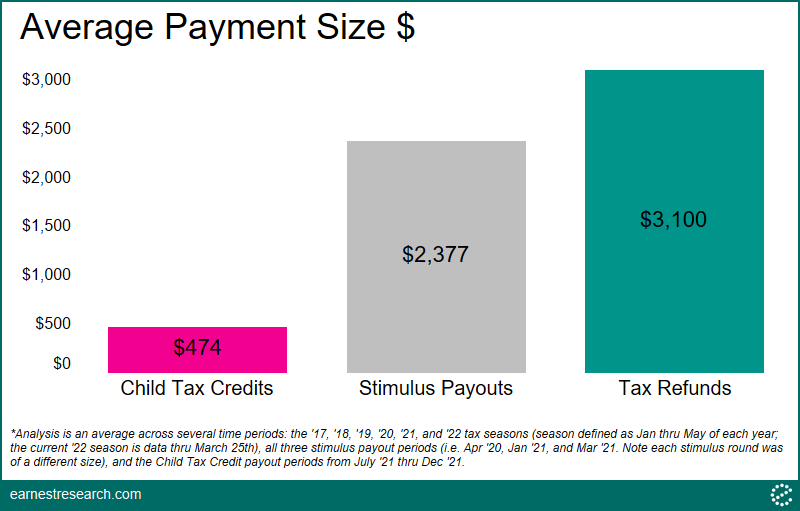

The federal tax refund between 2017 and 2022 averaged $3,100 in the data*, 30% larger than the average stimulus payment dispensed in 2020 and 2021, and only slightly higher than the combined stimulus and child tax credit. The key difference is that not all Americans receive tax refunds, while most households received stimulus. The breadth of stimulus checks pushed consumer spending beyond the normal refund bump in years past.

The impact of federal deposits could be partially offset by larger refunds, with the IRS reporting a 13% YoY increase in average refund size so far. This growth is possibly due to eligible stimulus recipients who were not included in previous payouts and will likely be getting their checks added to their refunds.

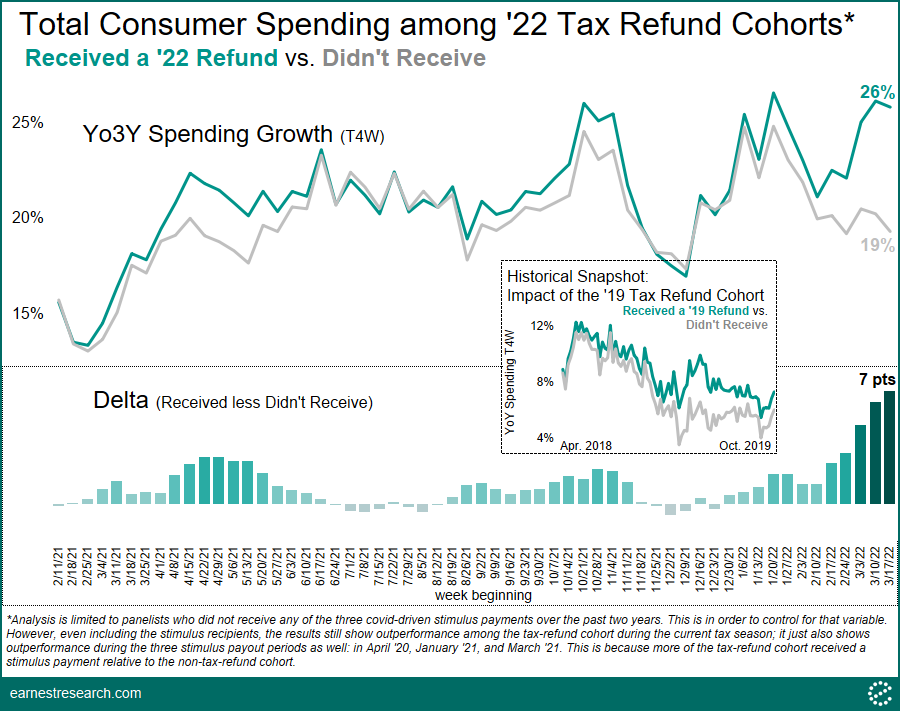

Refund recipients already outspending non-recipients

Tax refund recipients began outspending their non-recipient peers once the tax season began this year; a gap that widened to 7 points into the third week of March. Indeed, outspending from refund recipients has generally always occurred: in 2019, (i.e. before COVID and the related stimulus-related noise), tax refund recipients outspent their peers by 3 points throughout the 2019 tax season.

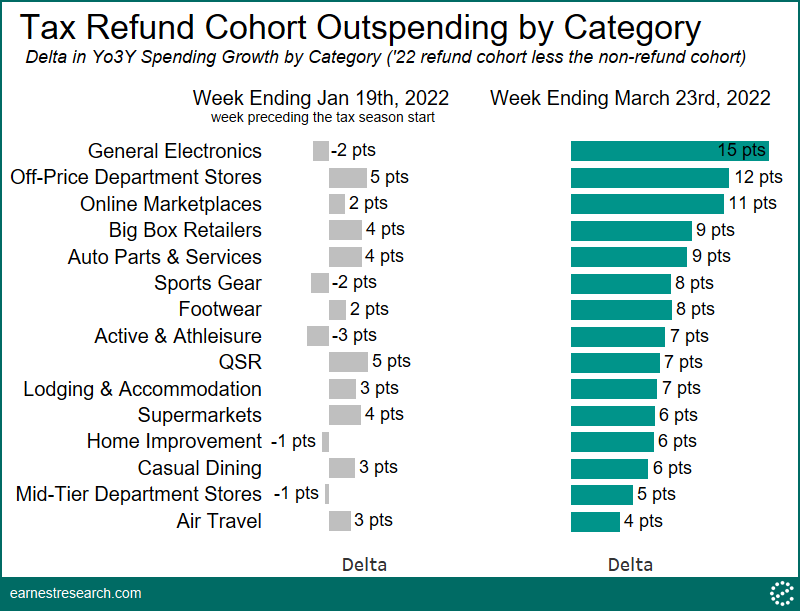

General Electronics and Off-Price Department Stores benefitting

Refund recipients spending on General Electronics outgrew non-recipients by 15 points in the trailing 4 week period ended March 23, after under performing non-recipients in the week before tax refunds began. Off-Price Department Stores (12 points), Online Marketplaces (11 points), and Big Box Retailers (9 points) similarly benefited from spending by refund recipients. The benefit to categories still recovering from quarantine lockdown restrictions is less clear–refund recipients were already outspending on QSR, Casual Dining, and Air Travel before refunds began.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.